Authored by Jim Quinn via The Burning Platform blog,

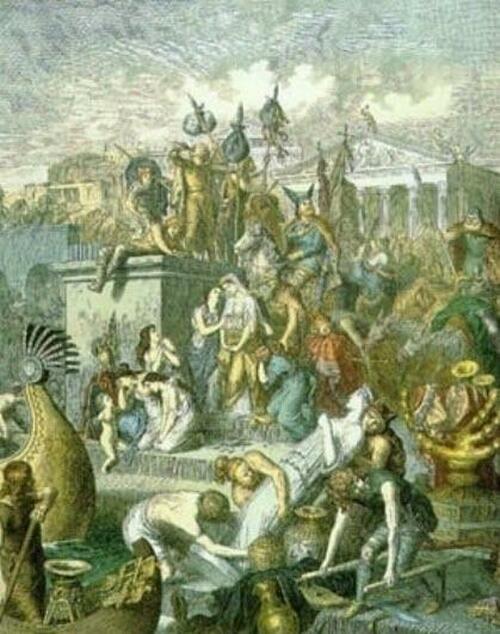

“The story of its ruin is simple and obvious; and, instead of inquiring why the Roman Empire was destroyed, we should rather be surprised that it had subsisted so long. The victorious legions, who, in distant wars, acquired the vices of strangers and mercenaries, first oppressed the freedom of the republic, and afterwards violated the majesty of the purple. The emperors, anxious for their personal safety and the public peace, were reduced to the base expedient of corrupting the discipline which rendered them alike formidable to their sovereign and to the enemy; the vigor of the military government was relaxed, and finally dissolved, by the partial institutions of Constantine; and the Roman world was overwhelmed by a deluge of Barbarians.” — Edward Gibbon. The Decline and Fall of the Roman Empire, Chapter 38 “General Observations on the Fall of the Roman Empire in the West”

“After a diligent inquiry, I can discern four principal causes of the ruin of Rome, which continued to operate in a period of more than a thousand years. I. The injuries of time and nature. II. The hostile attacks of the Barbarians and Christians. III. The use and abuse of the materials. And, IV. The domestic quarrels of the Romans.” — Edward Gibbon. The Decline and Fall of the Roman Empire, Chapter 71 “Four Causes of Decay and Destruction.”

The moniker of my website originated from a quote by David Walker, then Comptroller General of the U.S., in 2007. I wholeheartedly endorsed Walker’s viewpoint and become politically active in trying to get Ron Paul elected as president in 2008 and 2012. It was a fruitless effort, as the uni-party in Washington DC, controlled by the dark forces of the Deep State, do not allow men and women who truly want to reduce the size and scope of government to ever get elected. His warning sixteen years ago is a perfect example of being right but being early. When talking about the decline of empires, you are really deliberating about a process, not an event. The Roman Empire did not fall on a specific day due to a specific cause. It collapsed in stages over hundreds of years due to numerous reasons, each triggering events which compounded upon each other and ultimately led to the final collapse.

Walker said, “The US government is on a “burning platform” of unsustainable policies and practices with fiscal deficits, chronic healthcare underfunding, immigration and overseas military commitments threatening a crisis if action is not taken soon.” He believed we were resting on the laurels of being the sole superpower, as our empire built on debt was slowly and methodically crumbling. He cited three reasons for the fall of the Roman Republic that resonated in 2007 regarding the American Empire (formerly a republic):

-

There has been a decline in moral values and political civility at home. Examples include the devaluation of life, greater self-centerdness by individuals and increased partisanship and ideological divides in Congress.

-

We now have an overextended military around the world. While the US military is unmatched as to its capabilities, it is under stress and stretched very thin.

-

There is fiscal irresponsibility by the central government. Our debt ratios are set to increase dramatically when the baby boomers retire.

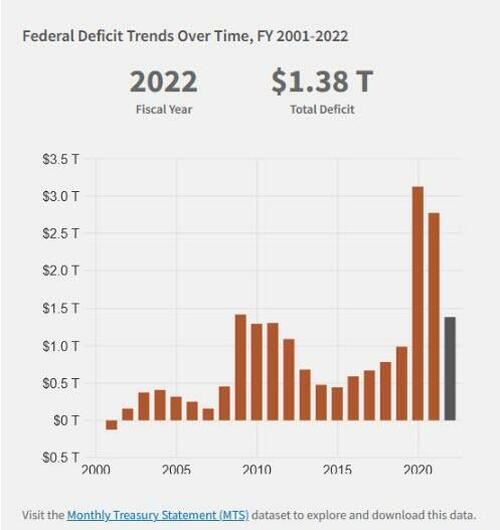

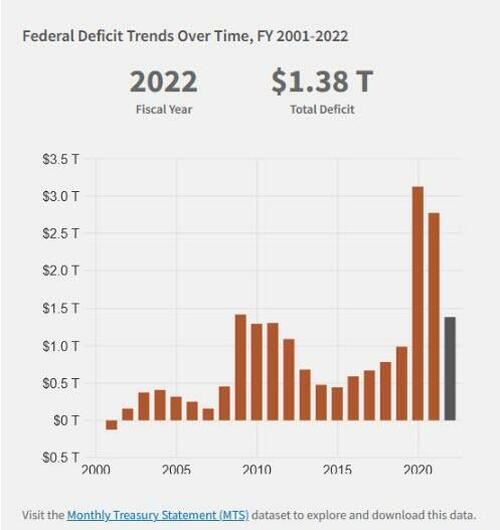

It’s almost humorous Walker was issuing these dire warnings when the 2007 annual deficit was $160 billion. At our current rate of debt accumulation, it takes only one month to reach $160 billion. In 2020 and 2021 it only took 20 days to accumulate $160 billion. The national debt in 2007 was $9 trillion, up from $5.6 trillion in 2000. Today it stands at $31.8 trillion. Interest on the national debt will approach $900 billion this year, exceeding defense spending.

Walker warned about our debt ratios skyrocketing when the baby boomers retired. Well, the debt to GDP ratio has doubled from 62% in 2007 to 124% today, and most boomers can’t even afford to retire. U.S. unfunded liabilities total $188 trillion. Personal debts total $25 trillion, with $1.8 trillion of student loan debt and $1.3 trillion of credit card debt. The fiscal irresponsibility of our government and its citizens is breathtaking, unsustainable, and ultimately fatal to our empire. Walker may have been early, but he certainly was not wrong.

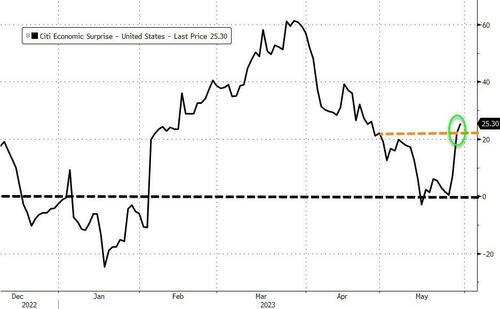

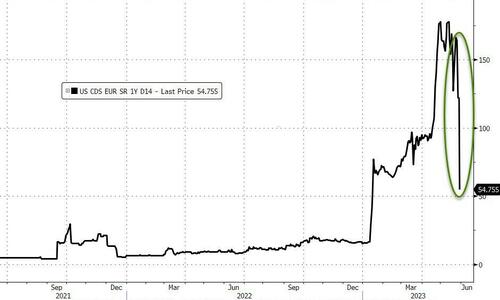

The current Kabuki theater farce regarding the raising of the debt limit is a perfect example of how spineless politicians blatantly deceive the public, with the full support of the regime media, in proclaiming spending cuts and fiscal responsibility, when the CBO projections show the national debt growing to more than $50 trillion in the next ten years, as most of the spending is on automatic pilot. And this is before the coming recession/depression provokes the usual political response of fiscal stimulus, which will drive the debt higher.

Threats of government default, hysterical articles in the regime media, and last-minute deals are nothing but a show for the ignorant masses, while the true globalist agenda of one world order, where the peasants will own nothing and be happy, is rolled out at an accelerated pace. They know the fiscal sustainability of the western world is dire, therefore they are acting in a reckless manner, which imperils the world with a potential global war.

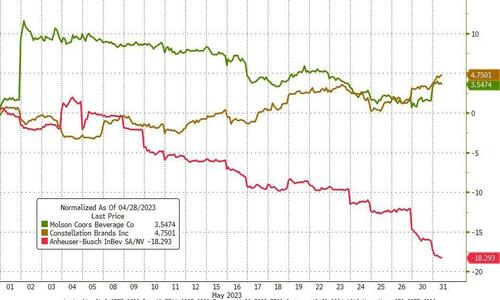

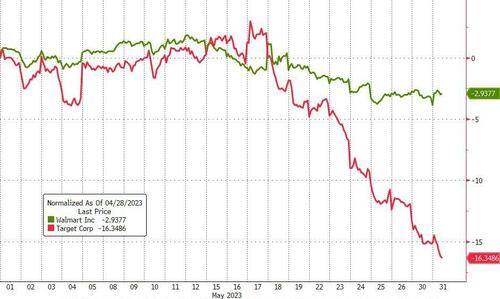

Walker’s first point about the decline in moral values and political incivility has reached civil war instigating levels of degradation, deviancy, and treasonous political activity. Not in Walker’s wildest dreams did he envision the grooming and trafficking of children, drag queen story hour for toddlers, pushing children to be mutilated and propagandized into believing they are the opposite sex, promoting deviancy, and having this degenerate behavior jammed down our throats by the government, corporations, and the media.

Destroying our culture, promoting abnormality and sloth, tearing the fabric of our society to shreds, encouraging lawlessness, looting and murder, and persecuting normal white Americans who dissent, is actively promoted, and funded by Soros, Gates, and the rest of the Davos – WEF globalist psychopaths. The devaluation of our lives was never more evident than during the covid plandemic, where the annual flu was weaponized to lockdown the world, create havoc and chaos, institute totalitarian measures to abscond with our liberties and freedoms, destroy the lives of vaxx dissenters, and ultimately destroy the lives of millions who obeyed and were injected with the untested, gene altering, spike producing, Big Pharma enriching concoction.

To put a Roman Empire slant on it, what has been wrought by Clinton, Obama, Comey, Wray, Brennan, Clapper, Pelosi, and their gaggle of treasonous co-conspirators since 2016 has marked our current day crossing of the Rubicon. Politics has always been a dirty game, but the machinations to bring down a duly elected sitting president, which continue to this day under the direction of Biden’s handlers, is reminiscent of the plots, coups, and murders as the Roman empire descended into corruption, madness, and deviant behavior.

The Durham report documented the unequivocal facts regarding the relentless coup attempt against Trump, but the complete coverup by the regime media and the toothless non-existent prosecution of the criminal Deep State characters involved in this treasonous act proves there no longer is a representative government looking out for the citizens of this country. We are a corporate fascist oligarchy, ruled by the few, for the few. We are nothing more than serfs, peasants, and useless eaters to the ruling class, as they continue to pillage and plunder what remains of the Treasury.

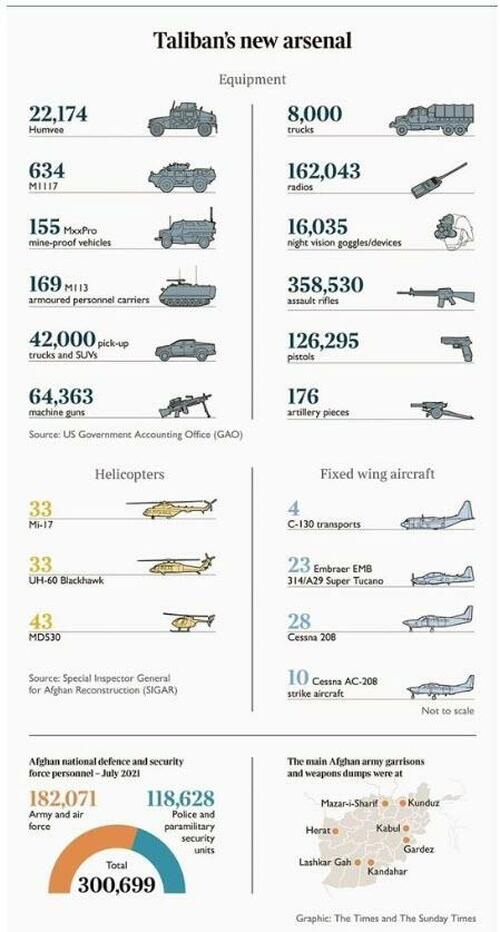

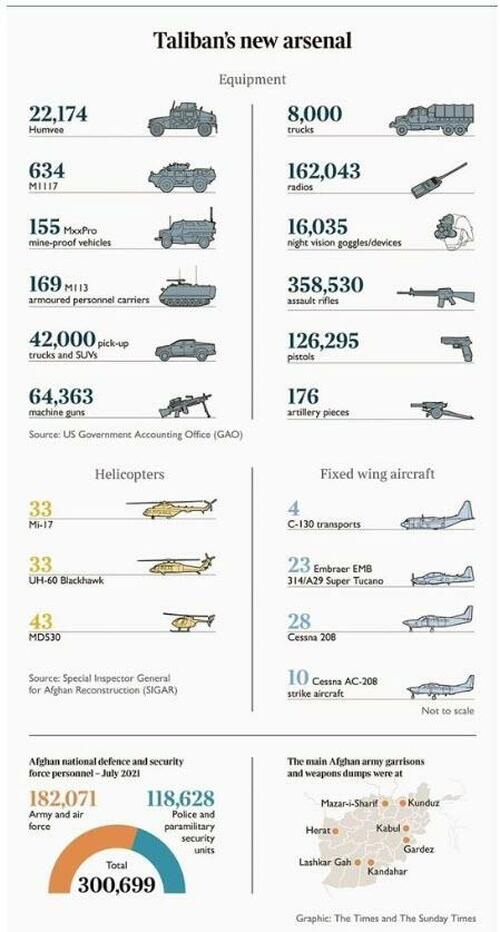

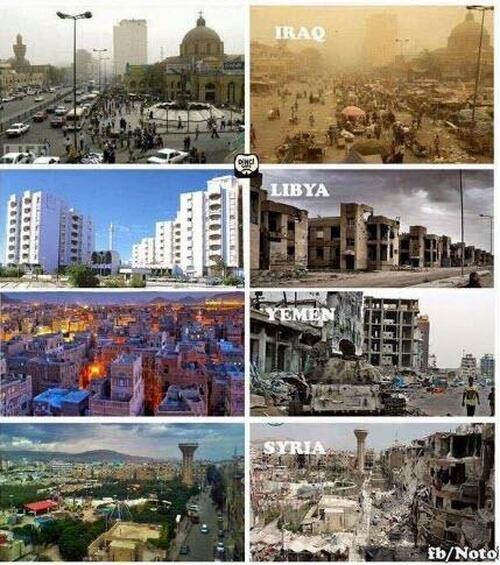

Walker thought our military was stretched thin in 2007, as the neo-cons had us fighting a two-front war in Iraq and Afghanistan to enrich the military industrial complex, based on false WMD claims and a fruitless effort to find our CIA created global terrorist mastermind – Osama bin Laden. Little did he know that twenty years after invading Afghanistan to destroy the Taliban, we would conduct a disastrous retreat and hand the country back to the Taliban, with a gift of about $10 billion in military hardware.

“The past was alterable. The past never had been altered. Oceania was at war with Eastasia. Oceania had always been at war with Eastasia.” ― George Orwell, 1984

The defense budget in 2007, while fighting two wars, was $700 billion. Today the budget approaches $900 billion when we are supposedly not at war with anyone. With the Deep State firmly in control of both political parties, the arms dealers will always be swimming is your tax dollars, whether they are shipping their murderous wares to Zelensky, Israel, Taiwan, or any other country fighting our current mortal enemies – Russia, China, Syria, and Iran.

Mr. Walker was naïve in his assessment about the U.S. military’s strength. Winning wars to protect America has never been the goal. War is big business and keeps the politicians on both sides of the aisle satiated with political donations (aka bribes). The ruling class had no issue using a few hundred thousand poor patriotic useless eaters as cannon fodder in Iraq and Afghanistan to further enrich themselves. But it is much easier to create chaos and war in other countries and let their poor suckers die for a forlorn false cause, while providing weapons to both sides. I wonder if Walker was blindsided by Obama’s creation of wars in both Libya and Syria in 2011.

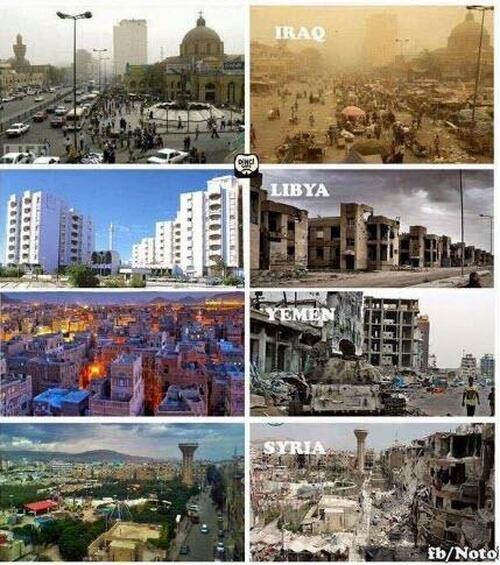

We killed Ghaddafi and left Libya a smoking chaotic ruin, with Islamic terrorists running rampant. Obama created ISIS so we had a reason to destroy Syria and Assad. Russia obliterated ISIS and has successfully kept Assad in power, infuriating the neocons and provoking the next move on the global chessboard. All the NPC Ukrainian Flag waving dolts who believe everything the regime media regurgitates, as instructed by their masters, are clueless as to why Biden and his neocon handlers are pushing us towards a direct conflict with Russia. Obama, Clinton, Victoria Nuland, John Brennan, McCain, Graham, and a slew of other Deep State lackeys overthrew the democratically elected president of Ukraine in 2014, because he was friendly towards Russia, initiating a domino effect in the Ukraine which has left us at the doorstep of World War III.

The Roman economy was basically a rapine economy. Like all slave-owning societies, Rome had no middle class, a debased currency, and no export production – it lived by conquests, slave trade, and plundering the conquered provinces. Such economies can exist only as long as they expand; when the expansion ends, downfall is inevitable. See any resemblance to the American economy? When the Fed stops printing, it all comes crashing down. By the third century their currency was worthless, and a barter economy sprung to life.

By 451 AD the empire was bankrupt, taxes were 40% to 60%, and there was nothing left in the coffers to pay the military or keep the infrastructure from crumbling. The barbarians applied the final blow with the sacking of Rome, and the Dark Ages were born. Slavery and serfdom were the fate of Roman peasants. The collapse of Mediterranean trade meant the collapse of papyrus imports, and the means of writing disappeared. Literacy dissipated. The Roman civilization was kept alive only in churches and monasteries, which could afford parchment and vellum. What will the bankruptcy of the American empire entail and how will the city dwelling welfare recipients’ fare? My guess is not very well.

Just as the Romans became fat and happy, enjoying the fruits of efforts, innovation and sacrifices put forth by prior generations, Americans have grown to believe they are the richest, freest, and most powerful nation on earth. They believe it is their privilege to rule the world. Just as the Romans hired mercenary armies to fight their wars because it was beneath their citizens to defend their vast empire, the U.S. used paid mercenaries (Blackwater) in Iraq and Afghanistan to fight their wars. Now we just outsource the dying to Ukrainians, Libyans, Syrians, and Somalis, while providing them the weapons, technology, and logistics to wage endless war on our behalf.

Next up will be the Taiwanese, as we provoke China into our next war. As documented earlier, the fiscal trajectory of our empire is on a course towards Armageddon, and the tens of billions in weapons being handed to the most corrupt nation on earth – Ukraine – is simply insane. Biden acts like a Roman emperor dictator (with dementia) during the final stages of Rome’s collapse, while the feckless politicians in the House & Senate sit idly by, cheering on our descent into national bankruptcy.

The final collapse of the Western Roman Empire was mainly triggered by the weakness of its late-stage emperors, failure of its civil administrators, disease, epidemics, and the unceasing invasion of its lands by the barbarian Visigoths and Vandals. Military failure and monetary weakness were the final nails in the coffin. The parallels with the American empire’s late stages are uncanny.

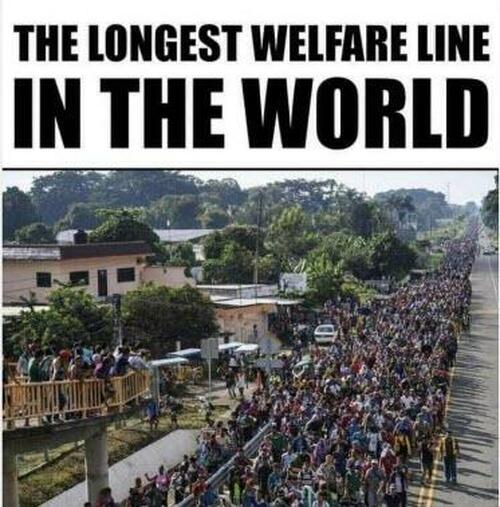

Can anyone conceive of a weaker emperor than Dementia Joe Biden? He is a low IQ, lying, corrupt to his core, bumbling, child sniffing fool, acting on behest of the Deep State and their globalist cabal. His administration is crawling with deviants, dopes, and those seeking the destruction of our country. The barbarian hordes are streaming across our southern border and being ushered into communities across the country by government sanctioned flights and bus rides. These mostly male Hispanics, Haitians, Somalis, Muslim terrorists, and Chinese nationals are not going to strengthen our country, but contribute greatly to its fall. But at least the ruling class will have maids and gardeners, while Big-Agra will have cheap labor to pick their crops.

Edward Gibbon’s discernment that the number one cause for the ruin of Rome was “The injuries of time and nature”, is more profound than it might seem. Its ability to be sustained for almost one thousand years is remarkable, but as with all large entities it succumbed to entropy, currency debasement, deviancy, corruptibility of its ruling class, and apathy of its citizenry. Everything trends towards disorder, chaos, and ultimately collapse. Pleasure without pain, glory without sacrifice, indolence without work, degeneracy disguised as creativity, and treason portrayed as politics, led to a slow spiraling disintegration of their society and culture over the course of centuries.

These exact same characteristics are rearing their ugly head in the late stages of the American Empire decline. It is fascinating that Roman historian Tacitus was documenting traits of a declining nation state during the first century, while it took until the fifth century for the Western Roman Empire to finally collapse. The timing of the downfall is always in doubt, as grains of sand are added to the pile until entropy wins and all comes crashing down.

“You have not tasted servitude. There is no land beyond us and even the sea is no safe refuge when we are threatened by the Roman fleet. We are the last people on earth, and the last to be free: our very remoteness in a land known only to rumor has protected us up till this day. Today the furthest bounds of Britain lie open—and everything unknown is given an inflated worth. But now there is no people beyond us, nothing but tides and rocks and, more deadly than these, the Romans. It is no use trying to escape their arrogance by submission or good behavior. They have pillaged the world: when the land has nothing left for men who ravage everything, they scour the sea. If an enemy is rich, they are greedy, if he is poor, they crave glory. Neither East nor West can sate their appetite. They are the only people on earth to covet wealth and poverty with equal craving. They plunder, they butcher, they ravish, and call it by the lying name of ’empire’. They make a desolation and call it ‘peace” ― Tacitus

It’s as if Tacitus lived among us today. His description fits perfectly in describing the psychopaths controlling the U.S. Empire, along with most of the western world, as they rape, pillage, plunder, and desolate foreign lands in the name of freedom and call it peace keeping. The U.S. Empire is willing to fight Putin until the last Ukrainian is dead on the battlefield. How noble. Slaughter and seizing natural resources under false pretenses (WMD) are hailed as spreading democracy to third world countries.

It took the Roman Empire about 1,000 years to fall. The British Empire fell in approximately 300 years. The United States has been around for 234 as a nation, but only an empire since 1946, a mere 77 years. Has the advancement of technology, speed of communications, monetary manipulations, and level of military firepower coalesced into accelerating the demise of empires? It certainly appears so, as the American Empire is on course to fall by the end of this Fourth Turning, within the next ten years.

It is commonly believed the Dark Ages began with the fall of the Roman Empire. Of course, the definition of the Dark Ages has been debated for centuries, with the time frame sometimes set from 500 AD to 1000 AD, and sometimes until 1500 AD. They overlapped with the Middle Ages and some scholars contend they weren’t even that dark. I find it interesting as we enter a new Dark Ages, the regime media is busy writing articles contending the previous Dark Ages weren’t so bad after all.

The level of gaslighting produced on a daily basis by the propaganda peddlers doing their assigned task of keeping the masses ignorant and confused, is beyond the comprehension of average Americans trying to make a living and trusting their government. In reality, the Dark Ages coincided with the cultural decay and decadence of Rome in its late stages, as the vices of gluttony, lust and greed became the root of their civilization and functioned as chains enslaving and weighing down their culture.

During the glory days of the Roman Empire, they achieved tremendous advancements in the areas of science, literature, philosophy, government, and architecture. The fall of the empire left a vacuum in these areas for centuries. The death of a culture is not an easy event to recover from. Record keeping during the Dark Ages was minimal, leaving historians in the dark as to what happened. After the fall, feudalism emerged, and the Catholic Church gained increasing power.

The intermingling of the church and state contributed to the lack of cultural advancement. The uneducated peasants were fearful and superstitious, living lives of subsistence and want. The Renaissance Age of enlightenment, which followed the Dark Ages, provided the inverse paradigm to the Dark Ages. Italian scholar Petrarch, who lived in the 14th century referred to the time period as ”those men of intellectual prowess as living cloaked in darkness”.

I would contend we have already entered a new Dark Ages, based upon the collapse of our culture, ignorance of the masses, failure of our educational system, celebration of deviancy, lack of civility, and lawlessness in our cities. Most Americans would scoff at the notion we have already entered a new dark age. Everyone (including the desperately “poor” illegal aliens swarming across our border) has a super-computer phone in their hands 24/7. Every piece of knowledge ever conceived is available at our fingertips through the internet.

We spend tens of thousands of dollars per student per year in our public schools to educate our children. Our universities are world renowned. We are the wealthiest nation in history. We have tens of thousands of laws, regulations, and rules, to keep us safe. And supposedly, the American dream is attainable by everyone born in this country. Sounds like we should be living in a new age of enlightenment. But nothing could be further from the truth. Mistaking technological advancement and passage of laws with cultural and societal advancement is a complete fallacy, as described by Albert Einstein and Aldous Huxley almost a century ago:

“Technological progress has merely provided us with more efficient means for going backwards.” ― Aldous Huxley, Ends and Means

In case you haven’t noticed, our culture has descended into the gutter, societal norms which kept the country relatively cohesive since its inception are being attacked and obliterated by deviants and degenerates, and any semblance of a unified vision of what America stands for is actively being destroyed by the globalist Davos crowd seeking to implement their Great Reset agenda of technocratic control over the lowly peasants, while they feast, plunder and pillage the planet – the true psychopath barbarian billionaire horde.

The perversion of normalcy into glorifying pedophiles, drag queens, transgender freaks, drug addict felons, race hustlers, and organizations promoting lawlessness, looting, and killing, while persecuting and prosecuting normal, hard-working, civilized white people has left the country on the brink of chaos. Technology has done nothing but make us dumber, distracted and easily manipulated by the Bernaysian masters of manipulation.

Multiple generations have now been socially indoctrinated by government schools to obey, emote, believe, and fear whatever (Covid) and whoever (Putin) they are commanded to fear. What they are not taught is how to think critically, question everything, and make their own decisions based upon actual facts. Test scores in reading, writing and math are at all-time lows. The solution is to continually lower the standards and never hold anyone accountable for results.

We are a nation of morons led by a cadre of psychopaths. Children are encouraged by their parents and doctors to cut off their breasts and penises due to peer pressure and deviants controlling the schools and media. Groomers make toddlers watch transgender freaks perform sex acts on stage. Library books for 8-year-olds describe anal sex, masturbation, and other perverted acts.

Statues portraying our history are torn down by mobs, while what passes for art and architecture today is perverted, frivolous and inconsequential. There are no masterpieces of literature created in our rotting society. The only thing that matters is monetizing content and number of eyeballs. Quality is non-existent, overridden by quantity and replaceability. Movies and television programs are created by untalented hacks, responding to focus groups, and required to insert the required racial and homosexually woke storylines into every program.

There are no Godfathers or Casablancas being produced. There are no novelists writing masterpieces on par with Steinbeck or Hemingway. But we do have Cardi B belting out her best-selling song WAP (acronym for Wet-Ass Pussy) and Sports Illustrated with transgender and obese swimsuit models. Based on TV commercials, 90% of Americans are either black, in an interracial relationship, gay, or transgender. We are an epically unserious society. Anyone observing America and most of the western world in an impartial manner would have to conclude we are already living in a new Dark Age of ignorance, superstition, and degradation, even before the final collapse of empire.

While doing research on the Dark Ages I was surprised to stumble across some climate related information which puts the current hysterical climate change narrative in perspective. The current war on CO2, cow farts, petroleum powered vehicles, farmers, and human beings living in peace, is nothing more than an agenda to depopulate the planet, make our lives miserable, and further enrich those controlling the narrative, flying on private jets, vacationing on enormous yachts, and living in 50 room mansions in the Hamptons.

The green agenda is built on taxing you more, with zero impact on climate, while virtue signaling success. Meanwhile, the sun and power within our earth’s core will dictate our climate, despite all fruitless manmade efforts to have an impact. George Carlin’s The Planet is Fine diatribe captures the hypocrisy of humans thinking they matter at all when it comes to the planet.

“The planet is fine; the people are fucked! The planet isn’t going anywhere; we are! We’re going away! Pack your shit, folks! We’re going away and we won’t leave much of a trace either, thank God for that.” – George Carlin

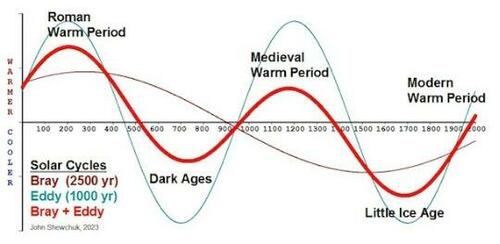

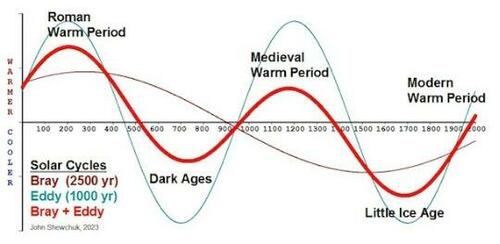

As you can discern, Rome flourished during a warming period and the Dark Ages coincided with a cooling period. Neither was due to human activity, petroleum products, not recycling enough, or cow farts. It was due to solar and volcanic activity, which may have gone hand in hand in creating the dynamics that made the Dark Ages dark. The Little Ice Age coincided with the Maunder Minimum from 1645 to 1715 when sunspots were at a minimum. Major volcanic eruptions in the 13th century, dimming sunlight across the planet also contributed to the cooling of the planet.

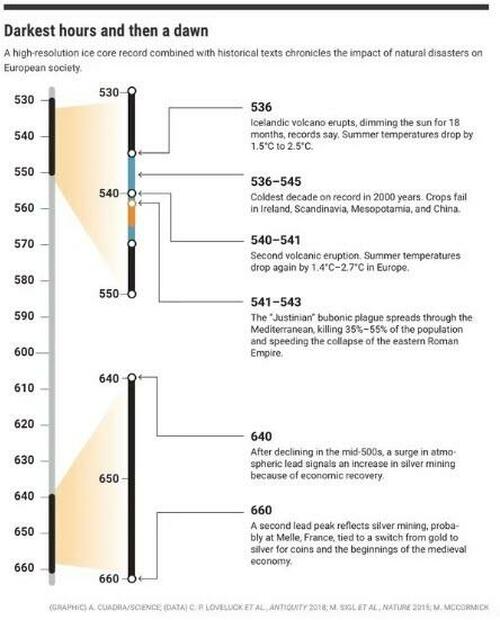

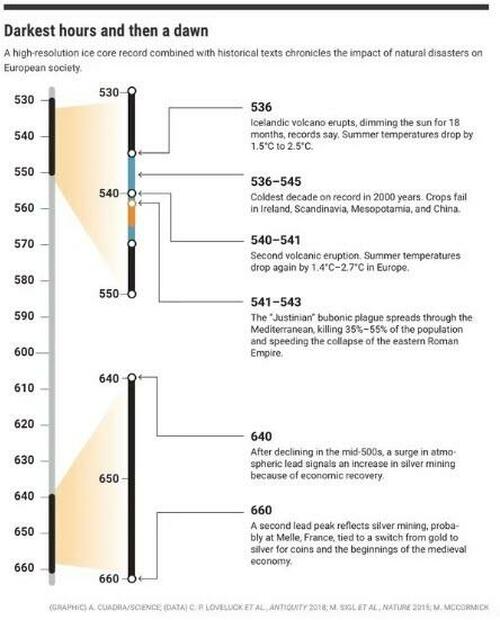

It seems recent studies of ice cores by real scientists confirm the period around 536 AD may have been the worst time to live on our planet in history. A cataclysmic volcanic eruption in Iceland in 536 AD spewed ash across the Northern Hemisphere, producing a mysterious fog plunging Europe, the Middle East, and parts of Asia into darkness, day and night—for 18 months. Snow fell during the summer in China. Two other massive eruptions followed, in 540 and 547. The repeated blows, followed by Bubonic plague, plunged Europe into economic stagnation that lasted until 640.

Humans will always be at the mercy of Mother Nature, the sun, and the volcanic activity within the bowels of our planet. Taxes, recycling, and electric cars won’t have one iota of impact on the future of the planet. The impact of little or no sun over the course of years led to crop failures, famine and plague, bathing sixth-century Europe in darkness and despair. Crops cannot grow without sun. Hunger and lack of vitamin D left the populations susceptible to disease. The bubonic plague killed half the inhabitants of the Eastern Roman Empire during these dark days, hastening its collapse.

With no wheat, there was no bread, a staple of the diet in those days. The people of Europe were occupied with survival, living a brutish existence, leaving little time for cultural advancement. The trials and tribulations documented throughout history are determined by a combination of controllable human actions and uncontrollable natural causes.

Under dark skies, St Augustine brings a message of Christian hope to 6th-century King Ethelbert of Kent. Photograph: Popperfoto/Getty Images

Our helplessness at the hands of nature happens every day across the globe, with the 2004 Indian Ocean earthquake and tsunami and the 2011 Japanese earthquake and tsunami deadly reminders of our vulnerability and powerlessness. We already know Schwab, Soros, Gates, Tedros, and the rest of the Great Reset New World Order cabal are actively attempting to bring down the American Empire and replace it with a global oligarchy, where we own nothing, and they own it all. Using climate change as their cudgel, they are already conducting a war on farmers, purposely restricting the output of food for the masses.

Combined with rampant raging central bank created inflation across the world, wars being conducted in breadbasket regions of the globe, and extreme drought conditions in key agricultural regions, the landscape is already in the danger zone. With Mexico’s Popocatépetl volcano showing signs of a major eruption, and hundreds of other dormant volcanoes around the world capable of eruptions on par with the 536 AD eruption, it’s only a matter of when, not if. Many scientists postulate the Sun has entered into the modern Grand Solar Minimum (2022–2053) that will lead to a significant reduction of solar magnetic field and activity like during Maunder minimum, leading to noticeable reduction of terrestrial temperature. We have zero control or influence over these events.

Quotes from Tacitus nearly 2,000 years ago are proof human nature never changes and the cycles of history repeat themselves across empires. Biden’s illegal executive orders, disregard of the Constitution, and blatant corruption, along with the regime media suppressing legitimate dissent about Fauci’s lies, Pfizer’s falsification of trial data, and the FDA colluding with Twitter to censor doctors, fit perfectly into Tacitus’ view of the world.

“The more corrupt the state, the more numerous the laws.” ― Tacitus

“If you would know who controls you see who you may not criticize.” ― Tacitus

The traitorous acts of Obama, Biden, Clinton, Comey, Brennan and the entire FBI and CIA complex in conducting a coup against a duly elected president and then covering up their treason with the full cooperation of the regime media was and still is an audacious crime. These crimes are fully detailed in the Durham Report and on Hunter Biden’s laptop, but no one will go to jail, because half the country supports the crime the other half is apathetic and uninterested, and our elected leaders are in on it. Two thousand years and nothing changes.

“Crime, once exposed, has no refuge but in audacity.” ― Tacitus

“The worst crimes were dared by a few, willed by more and tolerated by all.” ― Tacitus

The American Empire is displaying all the worst attributes of Rome in its death throes, as the oligarchy grows more audacious, knowing they are illegitimate, but unconcerned with being brought to justice because they control the executive, judicial, and legislative branches of government. They fear no one and dare the peasants to try and stop them. The oligarchs provoke crisis, chaos, fear, and strife. They hide in the shadows, functioning as an invisible governing power, manipulating the minds of the masses, in their psychotic belief they can control and rule the world because they are superior in intellect, integrity, and ability to envision the future.

This relatively small circle of psychopaths, who have gotten the empire into this mess, grow ever more powerful as they lead us on a path to disaster. Their hubris and an arrogant disregard for the wishes of the people, belief in their own invincibility, and not fearing any retribution for their crimes of treason, leave them at the top of a crumbling empire – so they will have the farthest to fall.

Everything about our empire is unsustainable. Ultimately it will collapse financially under the weight of its unpayable debts. With psychopaths running the show who believe they can win a two front war against Russia and China, we will be lucky if our empire isn’t just a pile of smoldering ruins when they are done with it. There is absolutely no way to vote ourselves out of this because the Deep State counts the votes.

The dissenters are not united enough to shoot our way out of this. You can run, but you can’t hide from the impact of the coming collapse. The unknown ingredient to this toxic mixture of death is nature’s influence. If a volcanic eruption, or several volcanic eruptions on par with the 536 AD occurrence, were to happen concurrently with economic collapse, the earth’s population of 8 billion would be drastically reduced in short order.

At this point, the best we could hope for is a relatively non-violent collapse where the critical thinking self-reliant people would migrate to rural regions and learn to live off the land again. The simple life of thriving day to day based on your own efforts, along with the efforts of your small homogeneous community, is the likely destiny for millions. No one is coming to save us. We’ll have to save ourselves. We happened to be born at a juncture of history where a Fourth Turning crisis ended an empire. We didn’t choose our fate, but we need to prepare and make the best of our situation.

I find nothing more appropriate to visually represent our clownworld empire falling than a picture of a dwarf clown, smoking a cigarette while holding a bouquet of wilted flowers in the pouring rain in front of a defunct circus tent. If the clown shoe fits, wear it. The season is turning.

A time to be born, a time to die

A time to plant, a time to reap

A time to kill, a time to heal

A time to laugh, a time to weep

To everything turn, turn, turn

There is a season turn, turn, turn

And a time to every purpose under Heaven

– The Byrds

“The Fourth Turning could mark the end of modernity. The Western saecular rhythm – which began in the mid-fifteenth century with the Renaissance – could come to an abrupt terminus. The seventh modern saeculum would be the last. This too could come from total war, terrible but not final. There could be a complete collapse of science, culture, politics, and society. Such a dire result would probably happen only when a dominant nation (like today’s America) lets a Fourth Turning ekpyrosis engulf the planet. But this outcome is well within the reach of foreseeable technology and malevolence.” – Strauss & Howe – The Fourth Turning

* * *

It is Jim’s sincere desire to provide readers of his site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit this site, he asks that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can’t do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions.

To donate via Stripe, click here.