Submitted by Jeffrey Snider via Alhambra Investment Partners,

A eurodollar futures contract affords the buyer the opportunity to obtain a $1 million eurodollar deposit for a three-month term at the expiration and execution of the contract. The rate to be paid for that deposit is 100 points minus 3-month LIBOR for spot settlement on the 3rd Wednesday of the contract month. If 3-month LIBOR on June 20, 2018 is, for the sake of argument, 1%, then the June 2018 contract itself will price 99.00 at that expiration. You are essentially buying into a discounted view of future money rates.

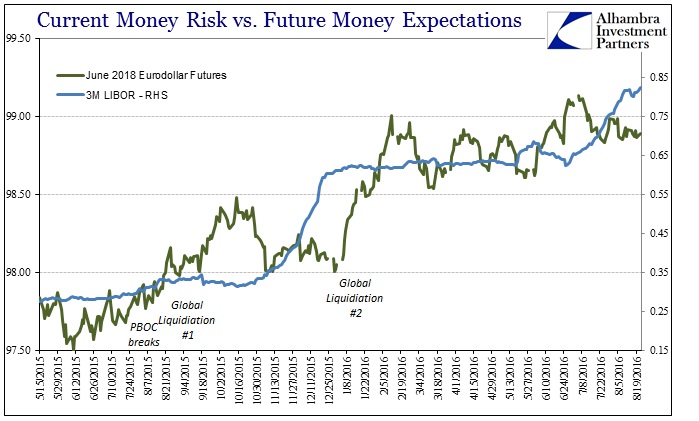

Because we are dealing with prices and views on rates into the future, there are different perhaps seemingly conflicted sets of risks and parameters. This is especially true when examining the current offerings in LIBOR. If eurodollar futures are predicated upon future LIBOR rates, why do they seem to move opposite to current LIBOR? The London rate has been rising for more than a year and a half going back, importantly, to December 2014. Yet, during that time eurodollar futures all over the curve have been rising (in price), too. That seems to be conflicting information as one would expect the current price of LIBOR to get discounted into the futures price.

After all, if LIBOR is rising today as a result of “normalization” of interest rates after so many years of ZIRP, it stands to reason that such a benign (that is, rising rates not predicated upon rising risks, rather as a matter of intentional policy changes) increase would be passed along into the futures market. If 3-month LIBOR was to hit 90 bps as a matter of normalization, then the June 2018 futures price, you would think, would take that 90 bps as a starting point.

The current June 2018 price is around 98.80, meaning there is very little time value (just less than two years) reflected in that price given 3-month LIBOR is currently fixed above 83 bps. In fact, eurodollar futures have been rising as LIBOR has been rising, suggesting that normalization is not the primary discounting mechanism.

Since LIBOR is a reflection of money rates at different maturities as of right now, where eurodollar futures are a reflection of money rates as of that future point, these two related rates do not necessarily need to be directly translatable. When rising risk rather than benignity is indicated, rising LIBOR (current) alongside rising eurodollar futures prices (future) is easily interpreted as the former leading to the latter. In other words, where rising LIBOR right now would suggest increasing credit or (more so) liquidity risks, rising eurodollar futures suggest the ultimate economic damage those risks are expected to unleash if left unchecked.

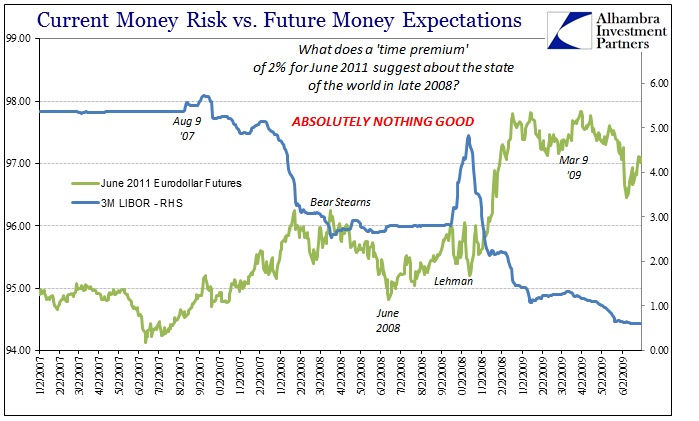

We need only, as ever, reflect back to money behavior in 2007 and 2008 to calibrate these interpretations as perfectly consistent. Eurodollar futures in general (I will use the June 2011 contract as a general proxy for the whole curve, but keep in mind there are other dimensions to consider especially calendar spreads as an element of risk measurement; i.e., flatness of the curve) fell in price in the middle of 2007 as it appeared the initial risks of subprime had passed. In June 2007, however, eurodollar futures began to rise (in price) again, confounding the FOMC to no end.

On August 9, 2007, LIBOR rates jumped signaling the start of the crisis – which, as eurodollar futures prices suggested, meant overall a sharp decline in rates as well as crunching of the time premium of money before it was all over. We can easily observe both “waves” of the 2007-08 crisis in eurodollar futures as LIBOR declined sharply over time (apart from the sharp spikes where “dollar” pressure was most acute in first near-panic and then full panic). On first blush, it seems as if contrary to our current condition, LIBOR and eurodollar futures were acting as they “should”, moving in opposite directions – rising eurodollar futures prices, which Bill Dudley swore must have been at “disequilibrium” because the Fed had no intentions in mid-2007 of reducing rates (as if it were up to the Fed), and then falling LIBOR that eurodollar futures had described all along.

Dudley got it all wrong as eurodollar futures got it all right; LIBOR rates by 2009 were near zero, a probability that eurodollar futures were increasingly pricing going all the way back to June 2007. From the perspective of the TED spread, rising liquidity risk through the period meant translation into the greater possibility for lower rates (as a reflection of economy as much as policy) after it was all over. Eurodollar futures were trying to assess the possible damage from the whole affair, meaning that these highly dramatic liquidity events were risking a permanent reduction in “dollar” capacity (as we have since observed).

As you can see from the TED spread overlay, eurodollar futures prices remained highly elevated even though liquidity risks by the middle of 2009 had fallen back to “normal” – by then the damage was done. Remaining priced near and above 97 (June 2011 contract), the futures market was projecting that the economic problems the panic had created would linger for a long, long time, meaning that the overall probability spectrum of a futures price for June 2011 was skewed to the low side and to an extreme even though by then markets seemed to be recovering.

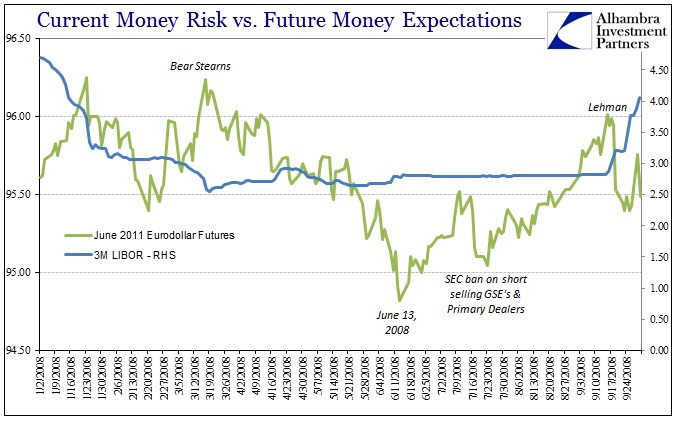

It took a second wave of financial disruption for such pessimism to become just that permanent. From the failure of Bear Stearns (technically its “merger”) in the middle of March 2008 until June 13 that year, eurodollar futures did decline in price as liquidity risks seemed to fall and normalize. (SIDE NOTE: to this day I have no idea what the significance of June 13, 2008 was and I have looked thoroughly; it may just be the vagaries of market imagination; see below). This was the period of “cautious optimism” perfectly punctuated right near its end when Chairmen Bernanke told an audience of bankers in Massachusetts on June 9 that, “although activity during the current quarter is likely to be weak, the risk that the economy has entered a substantial downturn appears to have diminished over the past month or so.” Falling eurodollar futures prices suggested an increasing probability that he was correct, as did the TED spread, though neither would last more than a few days after Bernanke’s words.

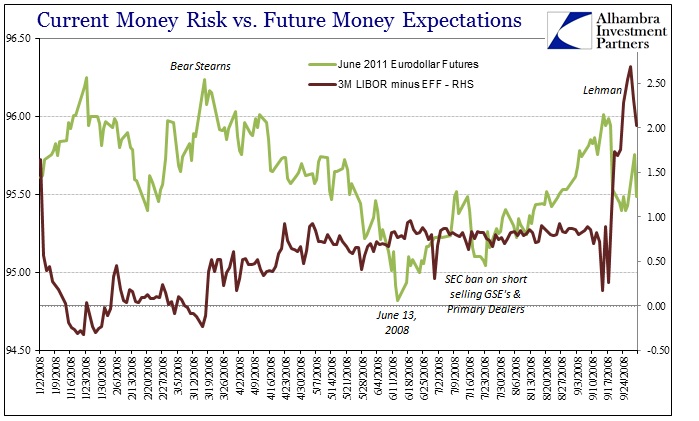

Other indications, however, showed this was impossible, meaning that eurodollar futures deal in probabilities not certainties (and reminds us to be mindful of all these various related dimensions), and thus the extraordinary efforts of monetary policy were for a time given the benefit of the doubt. It was still doubt as, for instance, the spread of 3-month LIBOR over effective federal funds never came close to normalizing, and in fact only got worse throughout the spring of 2008 where eurodollar futures were being sold. The fact that LIBOR was steady was misleading, as TED would eventually show that summer.

It may have been that this stubborn geographical divide in the “dollar” finally hit home by early June and that money markets finally woke up to the realization that what had happened from August 2007 until Bear Stearns was not the whole play, only its opening Act. From June 13 until Lehman, the TED spread was rising again along with eurodollar futures prices even though 3-month LIBOR remained almost perfectly steady (12-month LIBOR and the spread over EFF, however, were both more consistent with rising TED and eurodollar futures).

That means that what we find in these periods of uncertainty and “tightening” especially in the global, wholesale “dollar” framework (including repo and collateral conditions which do get translated into TED through the T-bill rate) is rising risk and then futures translation of those possible risks into probabilities for what might happen should those risks become real. In that sense, the greater the risk, the greater the potential damage; rising LIBOR or really TED, rising eurodollar futures.

That, of course, leads us in the direction of the past two years in money behavior. The key in that paraphrasing is risk rather than normalization. If LIBOR was reflective of intentional monetary policy, and thus steeper curves and nominal rates throughout credit and funding, we would, again, expect eurodollar futures to sell off.

As with the 2008 period, though, it needs to be pointed out to not nearly the same extreme, the dramatic, general increase in eurodollar futures prices are perfectly consistent with rising LIBOR even though they would be contradictory under the normalization scenario. The TED spread confirms risk not policy as the underlying mechanism, while the eurodollar futures price reveals the growing pessimism about what that could mean for the intermediate and long terms in real economic conditions.

Once again FOMC policy is at odds with what is taking place in deeper and far more intellectually-sound money markets. Referring back to August 9, 2007, eurodollar futures were absolutely right about what these risks were as I wrote a few weeks ago:

It is that single day that explains why real GDP is $16.5 trillion instead of $21 trillion; why nominal disposable personal income is $14 trillion rather than $18 trillion; why global trade is figured by the OECD to be $22 trillion this year, $9 trillion less than it should have been if the prior growth trend had been maintained; and so on and so on in economic account after economic account all over the world. In other words, had the Great Recession actually been a recession we wouldn’t be thinking about August 9 for the tenth time.

With LIBOR, TED, and eurodollar futures where they are now and how they all got that way over the past two years, does 2a7 money market reform or even Janet Yellen’s stubborn optimism really seem so convincing? After all, eurodollar futures in particular were absolutely correct about what all that money mess truly meant for the future of the world economy as risks turned frighteningly real in ways the Fed (or any central bank) still doesn’t comprehend.

via http://ift.tt/2crT7HS Tyler Durden