US equity futures are lower, reversing earlier gains and trading near session lows in a narrow, jitter overnight session as traders prepare for a heavy slate of earnings and readings of consumer sales and small-business due later. As of 8:15am ET, stock futures were muted, down 0.1% after earlier rising 0.2% and approaching last month’s record levels after an artificial-intelligence-driven selloff and subsequent rebound over the past week. Nasdaq futures drop -0.2% with small caps outperforming as bond yields drops by 1-3bps and the USD is flat. The downbeat mood doesn’t match the bullish tone in Asia, where stocks hit fresh records while European bourses are green across the board. Pre-market, Mag 7 are mixed, Semis are bid with SMH leading IGV as TSMC sees revenue +37% YoY in Jan. Financials and Industrials are leading Cyclical outperformance with healthcare the best performing sector within Defensives. Commodities are weaker but with vol lower, it appears to be profit-taking than what we have seen YTD. Today’s macro data focus is on Retail Sales, weekly ADP, Small Biz Survey, and Import / Export prices.

In premarket trading, Mag 7 stocks are mixed (Amazon +0.7%, Nvidia +1%, Microsoft +0.6%, Tesla +0.8%, Meta +0.1%, Alphabet -0.2%, Apple -0.4%)

- Amentum (AMTM) falls 9% after the government contractor’s first-quarter revenue missed the average analyst estimate, pressured by contract transitions, divestitures and the government shutdown.

- Amkor Technology (AMKR) rises 3% after the semiconductor manufacturing company’s first-quarter revenue forecast was stronger than expected, prompting several analysts to raise their price targets.

- Clear Channel Outdoor (CCO) climbs 8% after agreeing to be acquired by investors led by Mubadala Capital in an all-cash transaction that values the billboard company at $6.2 billion, including debt.

- Coca-Cola (KO) down 4% after offering a 2026 full-year sales outlook with a bottom end of the range that came in below Wall Street estimates. Atlanta-based Coca-Cola sees organic sales growth of 4% to 5%. Analysts expected 5.01% on average.

- Credo Technology (CRDO) gains 17% after the communications equipment company’s preliminary third-quarter revenue was much stronger than expected.

- Datadog (DDOG) rises 9% after the software company’s fourth-quarter results beat expectations on key metrics.

- DuPont (DD) inches 2% higher after the chemicals company reported fourth-quarter adjusted earnings per share that beat the average analyst estimate as healthcare and water technologies segment sales grew.

- Goodyear Tire (GT) is down 9% after the company forecast that global unit volumes will be down in the first quarter, weighing on the profit outlook for the year.

- Harley-Davidson Inc. (HOG) falls 13% after the company reported an unexpected drop in motorcycle shipments, extending its struggles in the face of weak demand and punishing tariffs.

- Ichor (ICHR) gains 15% after the factory automation equipment company forecast adjusted EPS for the first quarter that beat the average analyst estimate. It also reported better-than-expected 4Q results.

- ON Semiconductor (ON) falls 3% after the chipmaker gave 1Q revenue guidance that was just shy of analyst expectations at mid-point, indicating a continued but slow recovery in demand for auto and industrial chips. Business disposals planned this year are also creating a headwind.

- Regenxbio (RGNX) shares tumble 10% after US regulators rejected its gene therapy for Hunter syndrome, underscoring the hard line the Trump administration is taking on drug approvals for rare diseases.

- Spotify (SPOT) rises 11% after the music streaming company reported a record 38 million monthly active users (MAUs) for the fourth quarter, surpassing its guidance for 32 million.

- Upwork (UPWK) shares are down 22% after the online recruitment company’s first-quarter forecast was weaker than expected.

In corporate news, BP halted share buybacks as pressure on the energy major mounts. Tesla’s head of sales for North America is leaving, exiting a position that’s seen substantial turnover in the past year. The Teamsters Union sued UPS, demanding the company shut down its planned buyout program targeting UPS Teamsters drivers.

Markets are experiencing a moment of calm after an artificial-intelligence-driven selloff and subsequent rebound over the past week. Traders are now waiting to see how this week’s data may shape expectations for the Federal Reserve’s interest-rate path.

“What’s at stake with this week’s US data is to know whether we can move from a K- to a V-shaped rebound,” said Kevin Thozet, an investment committee member at Carmignac. “There are signs that the US consumer’s morale is improving, but we’re not there yet. It’s clearly the objective of the Trump administration ahead of the midterms.”

In political news, President Macron of France said the EU needs to get tougher with Trump, who he said is pushing for the “dismemberment” of the bloc. Trump has also threatened to prevent the opening of a new bridge connecting Michigan and Ontario until the US is given compensation and ownership of half of it. The EPA plans to repeal a policy that provides the legal foundation for rules regulating greenhouse gas emissions. China’s BYD, the world’s biggest manufacturer of EVs, has joined hundreds of companies in pushing to be refunded for duties paid under Trump’s import tariffs.

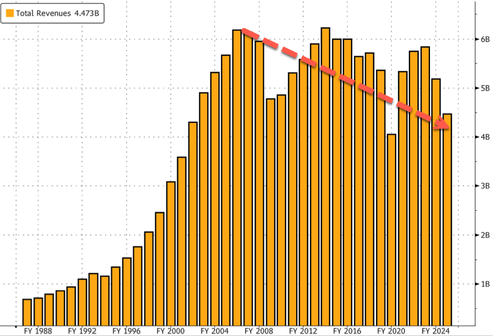

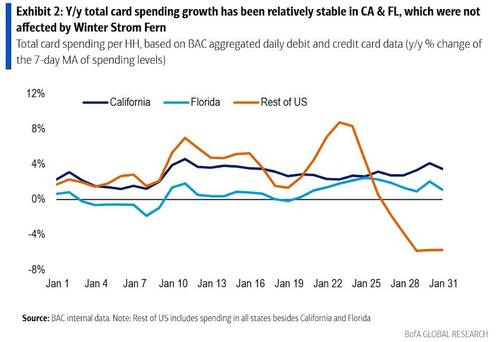

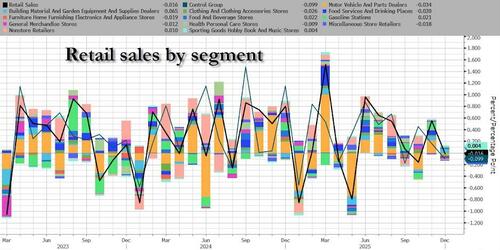

On the macro front, economists and analysts expect another solid month of retail sales in December, supported by household spending that has remained resilient despite the high cost of living and a fragile employment backdrop.

Looking at earnings, out of the 302 S&P 500 companies that have reported so far, 79% have beat analyst estimates, while 17% have missed. More US companies are posting quarterly earnings growth, suggesting a sustained broadening beyond technology heavyweights, strategists at Deutsche Bank write. S&P 500 firms are on track to register a 14.5% increase in 4Q earnings, notching a four-year high.

In Europe, the Stoxx 600 is up 0.1% and switching between small rises and falls. CAC 40 higher after results from Kering boosted luxury stocks.Here are some of the biggest movers on Tuesday:

- Thule shares gain as much as 15% for their biggest one-day gain in 10 months, after fourth-quarter results from the maker of roof and bike racks surpassed expectations.

- Kering shares gain as much as 14%, the most since March 2020, on hopes that the French luxury group is returning to a path to growth following better-than-expected fourth-quarter sales at its Gucci unit.

- Philips shares jump as much as 11%, the most in more than six months, after the Dutch medical technology firm reported better-than-expected results for the fourth quarter and provided guidance for 2026 which Bernstein analysts called “upbeat.”

- Lanxess shares rise as much as 9.8% as Goldman Sachs upgrades the German firm to neutral from sell, saying it sees less of a risk around the balance sheet and signs of positive economic momentum across the European chemicals sector.

- AstraZeneca shares rise as much as 2.3%, reversing an earlier dip, after the UK drugmaker provided upbeat sales guidance for 2026, which offset the weaker-than-expected core operating profit in the fourth quarter.

- Bellway shares rise as much as 5.4% after the UK housebuilder said it has seen a pickup in demand since the start of the important spring selling season.

- Allianz shares drop as much as 2.9%, leading a fall in European insurance stocks after US peers came under pressure on Monday over fears of artificial intelligence disruption.

- TUI shares fall as much as 7.6%, the most since June, as analysts noted slower bookings revenue from Europe’s biggest travel operator as a reflection of the challenging environment.

- BP shares drop as much as 5.7%, most since June, after the oil company suspended share buybacks to strengthen its balance sheet.

Earlier in the session, Asian stocks rose, as technology shares tracked their US peers higher on a revival of artificial intelligence enthusiasm, and Japan’s market extended gains following Prime Minister Sanae Takaichi’s election victory. The MSCI Asia Pacific Index climbed as much as much as 1.4%, set for a fresh record high and third day of gains. TSMC was among the biggest boosts to the region, with January sales surging 37% from last year. Other winners include fellow AI beneficiaries Softbank Group and Alibaba.

Stock benchmarks also rose in Hong Kong, India and Philippines while shares in South Korea closed little changed. Risk sentiment has been on the mend in Asia, as global tech shares rebound from last week’s selloff on concerns over high spending levels and business obsolescence due to AI. Investors continue to assess the unfolding earnings season and indications on the path for global monetary policy. Japanese stocks got a fresh jolt on expectations that the greater parliamentary majority for Takaichi’s party will give her a mandate to increase fiscal spending and cut the sales tax on food. Among fresh tailwinds for the AI trade, the Financial Times reported that US tech giants are set to get a reprieve from forthcoming US tariffs on imported semiconductors. Indonesian equities edged higher even as index compiler FTSE Russell said it will join MSCI in pausing its index review for the country due to the risk of adverse turnover and uncertainty in determining public float.

In FX, the Bloomberg Dollar Spot Index is also little changed, with the Norwegian krone rising on a surprise inflation jump, while Norwegian bonds are plunging.The Fed’s Bostic says he’s starting to see signs that confidence in the greenback is coming into question. The Fed’s Miran, meanwhile, said the central bank’s balance sheet should be smaller, but should be used during an economic crisis. Yen, Japanese stocks and long-end bonds all rallied on confidence that higher fiscal spending can be absorbed by markets.

In China, the yuan surged to its strongest level since May 2023 after regulators asked banks to limit their holdings of US Treasuries. The news reinforced a broader trend of diversification away from the dollar, potentially accelerating the repatriation of capital into Chinese assets.

In rates, treasuries hold small gains led by long-end tenors, outperforming European bonds ahead of December retail sales data, with January employment report ahead on Wednesday. Treasury yields are 1bp-3bp richer 3bp across the curve with 2s10s and 5s30s spreads tighter by 1bp and 1.5b. 10-year near 4.18% is 2bp richer on the day, slightly outperforming bunds and gilts. Gilts leading gains in bonds following a turbulent session of political speculation on Monday, as UK Prime Minister Keir Starmer shored up his position as UK prime minister. This week’s Treasury coupon auctions begin with $58 billion 3-year note sale at 1pm in New York: the auction has when-issued yield near 3.55%, about 6bp richer than last month’s, which stopped through by 0.1bp; supply cycle includes 10- and 30-year new issues Wednesday and Thursday. IG dollar issuance slate slate includes Bank of England 3Y and IADB 5Y FRN; Google parent Alphabet Inc. headlined Monday’s calendar with a $20 billion multi-tranche offering. Issuers paid about 2bps in new issue concessions on deals that were 5.4 times covered for the two deals.

Money markets continue to price in two Fed rate cuts for 2026, with the first move seen under the likely leadership of Kevin Warsh after Jerome Powell steps down as chair in May. Traders have been debating whether Warsh would represent a more hawkish choice for the top role than other candidates President Donald Trump considered.

Trevor Greetham, head of multi-asset investing at Royal London Asset Management, said stocks are probably being driven more by interest-rate expectations than corporate results at the moment.

“You can see that by the performance of the technology sector and what’s going on with US Treasury yields,” Greetham said. “Recently, when you’ve had rising bonds, you’ve had tech underperformance, which tells you more about the interest-rate part of the calculation.”

In commodities, gold is edging lower but sticking above $5,000/oz, oil prices choppy with Brent holding around $69/barrel.

The US economic calendar includes weekly ADP employment change (8:15am), December import/export price indexes and retail sales and 4Q employment cost index (8:30am) and November business inventories (10am). Fed speaker slate includes Hammack (12pm) and Logan (1pm)

Market Snapshot

- S&P 500 mini little changed,

- Nasdaq 100 mini little changed,

- Russell 2000 mini +0.2%

- Stoxx Europe 600 little changed,

- DAX little changed,

- CAC 40 +0.5%

- 10-year Treasury yield -2 basis points at 4.18%

- VIX +0.1 points at 17.46

- Bloomberg Dollar Index little changed at 1182.98,

- euro little changed at $1.191

- WTI crude -0.2% at $64.24/barrel

Top Overnight News

- Trump will travel to Beijing during the first week of April for a meeting with Chinese President Xi Jinping. BBG

- White House eyes data center agreements amid energy price spikes, while a draft pact seeks to help ensure data centres do not raise household electricity prices and strain water resources or undermine grid reliability.

- Trump said his pick to lead the Federal Reserve can stoke the economy to grow at a rate of 15%, an exceedingly rosy target that nonetheless underscores the pressure that Kevin Warsh will face if confirmed to the role. BBG

- The Trump administration is planning this week to repeal the Obama-era scientific finding that serves as the legal basis for federal greenhouse-gas regulation, according to U.S. officials, in the most far-reaching rollback of U.S. climate policy to date. WSJ

- Alphabet is selling sterling and Swiss franc-denominated bonds for the first time, including an ultra-rare issue of a 100-year note. This follows a bumper $20 billion debt deal in the US to fund its AI ambitions. BBG

- Indian investors put a record $2.65 billion into gold ETFs in January, slightly more than equity funds, underscoring strong demand for bullion amid geopolitical and monetary risks. BBG

- Emmanuel Macron warned that the EU must stand up to Donald Trump. In an interview with newspapers including Le Monde and the FT, Macron said he anticipates a clash with the US over digital regulation. BBG

- TSM (TSMC) January sales grew at their fastest clip in months, a sign of sustained global AI spending even as concerns persist about an industry bubble. The contract chipmaker for Nvidia Corp. reported a 37% rise in January revenue to NT$401.3 billion ($12.7 billion), above the 30% revenue growth TSMC expects for the full year. BBG

- Keir Starmer has managed to shore up his position for now, but low approval ratings and electoral and party challenges put his leadership at risk — even as the UK economy strengthens. BBG

- The Fed’s Stephen Miran advocated a smaller Fed balance sheet while maintaining the option for large-scale asset purchases during crises. BBG

- US Department of Health and Human Services is to cut USD 600mln in public health grants to blue states: BBG

Trade/Tariffs

- India is reportedly in talks with France, Netherlands, Brazil and Canada over a deal on critical minerals.

- Japanese Trade Minister Akazawa said plan to visit US between February 11th to 14th to discuss Japan’s investment plan.

- US President Trump posted Canada is building a massive bridge between Ontario and Michigan which Canada will own and built it with virtually no US content, adds ” I will not allow this bridge to open until the United States is fully compensated…”.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly higher as the region took impetus from the gains on Wall Street, where the S&P 500 approached closer towards its record levels, and the Nasdaq outperformed as the tech rebound persisted. ASX 200 marginally gained amid continued outperformance in tech, but with advances in the index limited by underperformance in the top-weighted financial sector and weakness in some defensives. Nikkei 225 rallied to a fresh record high near the 58,000 level amid the Takaichi trade and expectations of incoming stimulus, while SoftBank was among the biggest gainers due to its heavy semiconductor exposure. Hang Seng and Shanghai Comp lagged behind their regional counterparts in somewhat mixed trade, with the Hong Kong benchmark led higher by pharmaceuticals, while the mainland was flat amid little fresh drivers.

Top Asian News

- China NPC Standing Committee will hold 21st session on February 25th-26th in Beijing.

- Japanese Finance Minister Katayama said discussions on using entire surplus are planned, but no position has been taken. Indicates that a proposed cut in food sales tax would serve as a temporary solution ahead of the implementation of a new tax credit system.

- China released a white paper on Hong Kong’s practice of safeguarding national security, according to Xinhua.

- TSMC (2330 TT) January (TWD) rev. rose 37% Y/Y to 401.3bln (prev. 335.0bln M/M).

- TSMC (2330 TT / TSM) board has approved the issuance of corporate bonds in Taiwan, of up to TWD 60bln in size.

European bourses (STOXX 600 +0.1%) are mostly firmer, but with slight underperformance in the FTSE 100 (-0.4%), which has been pressured by post-earning losses in BP (-5%) and as precious metals move lower. European sectors are mixed. Chemicals leads followed by Consumer Products whilst Travel & Leisure is found towards the bottom of the pile. For Luxury, Kering (+10%) is boosted by strong earnings, where the Co. highlighted it expects to return to growth and improve margins in 2026. Travel & Leisure has been pressured by TUI (-6%), which highlighted weaker markets and airline trading.

Top European News

- UK Cabinet Office has asked all Ministers not to follow Wes Streeting in publishing their messages with Peter Mandelson.

- Mail on Sunday’s Hodges reported that his understanding is that UK PM Starmer “is planning some sort of fresh attempt to limit what gets published over the Mandelson saga.”.

- French President Macron said the bloc should not be lulled into a false sense of security that tensions with the US over Greenland, technology and trade are over. said:Reiterated called for the EU to raise common debt to raise in AI and quantum computing, energy transition and defence.

FX

- DXY is flat and trades within a 96.79-97.00 range, taking a breather following the losses seen in the prior session. USD-specific newsflow has been lacking this morning, but will pick up later following the release of US Retail Sales and the Employment Cost Index; Fed speak is also due. On the trade front, Politico reported that US President Trump and Chinese President Xi’s summit is reportedly set for the first week of April – though the White House clarified that nothing is set in stone. ING opines that the index could trade within a 96.50-97.50 range over the next few days.

- JPY is the outperformer this morning, in the aftermath of the LDP landslide victory on Sunday. As mentioned in the coverage on Monday, investors are seemingly deriving confidence from the renewed political stability, and trust recent vows by PM Takaichi that she aims to adhere to fiscal responsibility. Moreover, on the monetary policy side of things, markets are increasing their bets of faster BoJ normalisation. JGB pressure also subsided overnight (albeit were already within recent ranges), and the continued strength in the Nikkei will also push JPY bears away. ING, citing local brokers, expects JPY 10tln to enter Japanese equities over the next 3 months – which could see USD/JPY break below 155.00. The pair currently trades around 155.30, and within a 155.08-156.29 range.

- G10s are mixed against the USD; as mentioned, JPY outperforms (+0.3%) whilst the Aussie is the slight laggard, as precious metals pull back a touch. The GBP remains on the backfoot, despite comments from PM Starmer who reiterated that he is to remain in his position – pushing back calls for him to resign. EUR is currently flat; earlier, ECB’s de Guindos failed to move the single currency, as his comments were largely in fitting with the Bank’s latest policy announcement. He stated that the ECB would need to be very vigilant if Chinese exports to Europe increase, via Econostream.

- NOK is stronger this morning after the region’s inflation metrics topped expectations. In brief, Core Y/Y printed at 3.4% (exp. 3%), with the headline metrics also printing above forecasts. Norges Bank has longed reiterated the line that “the policy rate will be reduced further in the course of the year”. Some had seen a cut as early as March/May, whilst SEB saw a cut in June pre-release; following the data the firm said, “we will not change our forecast for a June cut based on this one inflation release, but risks for a later cut have increased”. EUR/NOK is currently lower by 0.4%, and trades at the lower end of a 11.3468-11.4254 range.

Fixed Income

- Benchmarks bounce this morning with JGBs firmer overnight, having picked up off post-election lows, USTs rebounding from the pressure after the China diversification report. JGBs firmer by near 30 ticks at best, back to the week’s 131.60 opening level.

- Gilts have also rebounded, as the immediate pressure on PM Starmer eased slightly after the Cabinet backed him yesterday and no fresh revelations emerged overnight. As such, the benchmark gapped higher by 23 ticks before climbing to a 90.88 peak, firmer by 37 ticks on the day. However, Starmer’s situation remains fraught into the end-February by-election, May local elections and amidst that any fresh revelations about his dealings with Mandelson. On that point, the Mail on Sunday’s Hodges reports that Starmer appears to be planning to limit what is published re. Mandelson, and the Cabinet Office have asked Ministers not to publish their personal messages with Mandelson, after Wes Streeting made his available. No move to the 2031 Gilt auction, which was strong.

- Limited newsflow for EGBs thus far. As such, the benchmark is firmer given the bias from above, but with magnitudes more modest as EGBs were not hit directly by the China-UST report or the Starmer situation on Monday. Bunds moved a touch lower heading into a 2031 Bobl outing, which overall follows an improving trend of German outings, but still remains soft; EGBs remain firmer by a handful of ticks.

- Back to USTs, the benchmark is firmer by a handful of ticks at a 112-10 high, looking to last week’s 112-16+ peak. The docket is headlined by data (weekly ADP, Retail Sales & ECI) before Wednesday’s Payrolls & Friday’s CPI; additionally, 3yr supply is scheduled just after 2026 voters Hammack and Logan.

- Germany sells EUR 3.811bln vs exp. EUR 5bln 2.50% 2031 Bobl: b/c 1.65x (prev. 1.41x), average yield 2.40% (prev. 2.47%), retention 23.8% (prev. 23.38%)

- UK sold GBP 3.75bln 4.125% 2031 Gilt: b/c 3.94x (prev. 3.50x), average yield 4.001% (prev. 3.980%), tail 0.2bps (prev. 0.2bps).

- Netherlands sold EUR 1.845bln vs exp. EUR 1.5–2bln 3.25% 2044 Green DSL: average yield 3.388% (prev. 3.176%).

- Alphabet (GOOGL) launches its first GBP debt sale with a 100-year note. To also sell GBP-denominated 3-year, 6-year, 15-year and 32-year bonds.

- Japan sold JPY 250bln 10yr I/L JGB; b/c 3.38x, (prev. 3.46x), yield at lowest accepted price 0.458% (prev. 0.113%). Lowest accepted price 96.05 (prev. 99.00).

- Alphabet (GOOGL) launches its first CHF debt sale, according to Bloomberg.

Commodities

- Crude benchmarks have held onto the majority of Monday’s gains, with WTI holding above USD 64/bbl while Brent regains the USD 69/bbl mark. Geopolitical risk premium continues to be priced into the oil market, despite US-Iran tensions easing somewhat following their indirect talks in Oman.

- Nat gas futures have continued to pull back from the surge higher following the Arctic storm, due to warmer weather forecasts in the US. Henry Hub futures continue to near USD 3/MMBtu while Dutch TTF holds below EUR 35/MWh.

- Spot gold continues to hold above the USD 5k/oz, with Monday’s session managing to close above the level for the first time since the selloff on January 30th. The yellow metal sold off modestly at the start of the APAC session but has since clawed back earlier losses and is only seeing modest losses of 0.2%, at the time of writing.

- 3M LME Copper trades muted and in tight ranges, as the Chinese New Year holiday looms. Buying of the red metal is expected to be light going into, and throughout, the holiday period, with buying expected to resume when the festive period ends.

- Bank of China (3988 HK) is to increase margin requirements for gold deferred contracts, effective from the 11th of February.

- Venezuela’s largest refinery, Amuay, is out of service after a power blackout, according sources.

Central Banks

- US President Trump said he doesn’t know if the Powell probe is worth holding up Warsh, adds Powell is incompetent, but the question is if he’s corrupt.

- Fed’s Miran (Voter, Dove) said no significant tariff-driven inflation seen so far, and interest rates should be much lower than current levels.

- US President Trump said in a Fox Business taped interview that the US economy can grow at 15% if Fed nominee Walsh does a job that he’s capable of.

- BoJ is to submit nominee to replace board member Noguchi on February 25th.

- ECB’s de Guindos said the ECB would need to be very vigilant if Chinese exports to Europe increases, describes the economy as more resilient and inflation is moving towards target, via Econostream. Reiterates the current level of rates are appropriate. Recent euro strength is fully consistent with the assumptions included in the ECB’s projections.

- Monetary Authority of Singapore chief economist said monetary policy stance remains appropriate.

Geopolitics: Ukraine

- Russia’s Kremlin announce that they have no clear date for the next round of discussion with Ukraine.

Geopolitics: Middle East

- Iran warns of destructive influence on diplomacy ahead of Israeli’s PM Netanyahu’s trip to the US.

- White House officials said US President Trump does not support Israel annexing the West Bank, adds stable West Bank is key to Israel’s security and align with the administration’s peace goals.

Geopolitics: Other

- EU Defence Commissioner Kubilius said the EU needs to take responsibility for its defence and that replacing US strategic enablers with European ones should be a priority.

- China holds 2026 work conference on Taiwan affairs, while Chairman of the Chinese People’s Political Consultative Conference Wang Huning said will resolutely crack down on Taiwan independence, according to Xinhua.

- China’s embassy in London said it has consistently opposed UK interference in China’s internal affairs, including the BNO issue. said:Urges British side to follow the general trend and cease political interference, while it accused Britain of resorting to tricks and described its behaviour as contemptible.

- Philippines ambassador to Washington said China seems ready to find ways to ease South China Sea tensions through cooperation.

- US military said it carried out a strike on a vessel in the eastern Pacific, killing two and leaving one survivor.

- US Interior Secretary Burgum said Greenland deal is moving forward with progress.

US Event Calendar

- 6:00 am: United States Jan NFIB Small Business

- 8:30 am: United States Dec Import Price Index MoM, est. 0.1%

- 8:30 am: United States 4Q Employment Cost Index, est. 0.8%, prior 0.8%

- 8:30 am: United States Dec Retail Sales Advance MoM, est. 0.4%, prior 0.6%

- 8:30 am: United States Dec Retail Sales Ex Auto MoM, est. 0.4%, prior 0.5%

- 12:00 pm: United States Fed’s Hammack Speaks on Banking and Economic Outlook

- 1:00 pm: United States Fed’s Logan Speaks at Asset Management Derivatives Forum

DB’s Jim Reid concludes the overnight wrap

A rare moment of peace descended yesterday: not a single new disruptive AI model has appeared since at least last Thursday! The lull gave me just enough time to investigate who “Bad Bunny” is, having been entirely unaware of their existence before the Super Bowl halftime show. After a few clips from the most streamed global artist of 2025 it’s safe to say I won’t listen again. Talking of rabbits, the market bounce continued yesterday, with the S&P 500 (+0.47%) closing just shy of its record high, while in Europe the STOXX 600 (+0.70%) hit another record high. Tech stocks led the way, posting a strong rebound from their recent slump, and the S&P 500’s software component (+3.36%) had its best daily performance since May last year, with little sign of the concern that affected markets last week. The rebound also supported other asset classes including gold (+1.88%) but overall it was a fairly quiet day on the news front. Treasury yields saw a modest decline following some unusual labour market comments from NEC Director Kevin Hassett ahead of tomorrow’s jobs report.

Hassett said on CNBC that markets should expect “slightly lower jobs numbers”, but that this “shouldn’t trigger any panic.” While this was more a comment on the general jobs trend amid slowing population growth and rising productivity, it still created some fears over a weaker number for the delayed January jobs report tomorrow, particularly after the JOLTS survey last Thursday showed December job openings at their lowest since 2020. Treasuries saw a modest rally following Hassett’s interview, with 2yr yields closing -1.3bps lower at 3.49% and 10yr yields -0.5bps at 4.20%. They are -0.8bps and -1.5bps lower again this morning.

Yields had been higher earlier, and 30yrs still closed +0.7bps at 4.86% following a Bloomberg report that Chinese regulators had directed financial institutions to limit purchases of US Treasuries. So that limited the performance of bonds but like the rest of the curve, 30yrs are rallying (-1.5bps) this morning. The dollar is flat this morning but yesterday fell -0.77%, posting its second-worst day of 2026 so far.

By contrast, US equities had a strong day, with the S&P 500 (+0.47%) closing just 0.2% from its all-time high. Technology stocks led the gains after last week’s struggles, with Oracle (+9.64%) the second best-performer in the S&P500 though its shares are still down over -50% from their September peak. The Mag-7 were up +1.10% led by Microsoft (+3.11%) and Nvidia (+2.50%). And the equal-weighted version of the S&P 500 (+0.07%) reached a new record, even as its advance was limited by losses in defensive sectors including healthcare (-0.86%) and consumer staples (-0.86%).

Earlier on, UK politics was back in the headlines, with gilts coming under fresh pressure amidst a further round of questions about PM Starmer’s position. Gilts had struggled from the open, given the weekend news that Starmer’s chief of staff had resigned. The selloff then reached its peak after Labour’s leader in Scotland publicly called on Starmer to resign, with investors concerned that a new PM may be more likely to ease the fiscal rules and borrow more. At the intraday peak, 10yr gilt yields were up by over +8bps, but this move faded back to just +1.2bps higher after the entire cabinet publicly came out in support of Starmer. Similarly, the 30yr gilt yield was +9bps intraday, before closing up just +1.0bps. Still, UK assets in general underperformed, with the FTSE100 (+0.16%) eking out only a marginal gain.

There was stronger performance elsewhere in Europe, with multiple indices like the STOXX 600 (+0.70%), FTSE MIB (+2.06%), and DAX (+1.19%) all posting strong gains. Sovereign bonds also rallied, with yields on 10yr bunds (-0.1bps), OAT (-0.4bps) and BTPs (-1.6bps) falling back. Those moves came as markets slightly dialled up the chances of another ECB rate cut this year from 22% to 29%. While ECB President Lagarde said little new on policy compared to last week’s press conference, Bundesbank President Nagel said that while there was no current need for the ECB to react to below target inflation, they could adjust policy in either direction.

Earlier on, we also heard that Banque du France Governor Villeroy will be stepping down from his position on June 1, before the end of his term in October 2027. Villeroy said his decision to step down was a “personal” one but it means that President Macron will now get to nominate the next Governor for a new six-year term, rather than the pick being left until after the French Presidential election due next spring. It also adds to the upcoming changes of some of the key figures on the ECB Governing Council, including Vice President de Guindos who is finishing his term in May.

Elsewhere in markets, Brent crude oil prices rose +1.45% to $69.04/bbl after the US Maritime Administration warned US ships to stay “as far as possible” from Iranian territory. So that added to fears about a potential escalation, with oil prices continuing to fluctuate on various headlines. Meanwhile, silver (+7.15%) and gold prices (+1.88%) also rebounded, with gold closing at $5,058/oz. This morning Brent and Gold are back down just under half a percent with Silver down -2.5%.

Japanese equities continue their climb this morning with the Nikkei (+2.34%) and Topix (+1.89%) extending record levels in the wake of Prime Minister Sanae Takaichi’s landslide victory in the Lower House. JGBs are remarkably calm with 10 and 30yr yields -3 to -4bps lower. The Yen continues to edge higher (+0.3%) to 155.30 having been as low as 157.73 near the open yesterday as markets first reacted to the likely record election victory. So all calm for now. Elsewhere, the Hang Seng (+0.54%) and the KOSPI (+0.53%) are both higher with other markets flatish, including US and European futures.

To the day ahead now, data includes US January NFIB small business optimism, Q4 employment cost index, December retail sales, import price index, export price index, November business inventories. We’ll also hear the Fed’s Hammack and Logan speak. Earnings include Coca-Cola, AstraZeneca, and Barclays. Finally, the US will hold a 3yr Treasury auction