Authored by Mark Jeftovic via BombThrower.com,

The Politics Of Institutionalized Predation.

“I become stronger as you become weaker, I absorb strength as yours flows into me. I become capable of this because I do not experience your pain, I don’t care about your loss, and I feel no regret about using, abusing, and devouring you.”

— Page 63, An Age For Lucifer

Consider the following:

“This book explores a strange new spirituality about to enter into competition with other established religions. My purpose here is to convince you that its emergence is probable, if not inevitable. I begin this exploration with an unproven assumption based on Darwinian evolutionary principles: a new predator will appear on our planet, an evolutionary prototype designed to prey on humans. Another assumption then follows: this predator will evolve gradually and incrementally from humanity, just as we apparently evolved from lower forms to prey on them. A further assumption suggests that these predators have already appeared as evolutionary prototypes, as new humans with advanced methods of survival and new forms of spiritual expression and religious organization designed to support and advance their predation.“

— Robert C Tucker, An Age For Lucifer: Predatory Spirituality & The Quest for Godhood

The book in question was Robert C Tucker’s “An Age For Lucifer: Predatory Spirituality and the Quest For Godhood“. I first wrote about it in a Bombthrower piece: The WEF Isn’t a Cabal, It’s A Cult, and I can’t remember how I came into possession of it in the first place. I remember owning it for years and never reading it, because frankly, it scared me.

At first I thought it was some kind of manual for psychopathy – how to rise above your self-limiting human emotions to attain power and fame (even Godhood?) through the energetic predation of those around you.

But once I found out that its author wasn’t some High Priest of the Left Hand Path, but rather, a former counsellor and director of COMA, the Council On Mind Abuse, based in Canada – it started to take on a different light.

COMA worked with “adult survivors and child victims of ritual abuse“, and Tucker spent much of his adult life interviewing Satanists and Luciferians (yes, there is a distinction, as Tucker would elucidate in this book).

The Winged God Lucifer, with a human child on his knee…

It was an anthropological study, born out of a thought experiment:

What if all the ritualistic abuse we are seeing isn’t random criminality but an expression of an overarching, organizing principle that viewed mere humans as psychic fodder, to be devoured for the benefit of those in the know?

In his talks with Satanists and sociopaths Tucker repeatedly detected a whiff of something, he never put a name to it, but referred to it as “the thing that points beyond itself”.

COMA eventually went bankrupt, being on the receiving end of relentless lawfare from the Church of Scientology. Tucker died of a heart attack in Mexico in 2003.

In my original Bombthrower piece, I picked up the thread on “The Thing That Points Beyond Itself”, positing the very real, not metaphorical, existence of larger, transpersonal entities such as egregores, morphogenic fields, Vadim Zeland’s “Pendulums”, memetics and mass thought forms in general.

The WEF Isn’t A Cabal. It’s a cult

As the world tries to wrap its head around the millions of new and partially unredacted Epstein documents, it becomes very difficult to unsee the dynamics of what has been revealed to be playing out at the highest echelons of institutional power, for decades at least.

The Thing That Points Beyond Itself

An egregore isn’t an analogy or mythical. It’s what a shared belief system becomes when it fuses with incentives and institutions and starts behaving like an organism. It recruits, it feeds, it protects itself. The Epstein network isn’t the egregore. It’s one of its organs.

As the names keep dropping, it’s hard not to get a sense that absolutely anybody who had achieved fame, influence, power or renown was mixed up in an organized cabal of depravity and moral turpitude.

It feels like every TED Talk you ever nodded in agreement to, every Grammy award-winning singer you vibed to, every politician you voted for, and every business leader whose companies you bought shares in, they were all laughing behind your back, because it was a Big Club and you ain’t in it.

The Club is in the global domination game, and its accoutrements include fraud, racketeering, blackmail, and ritualized abuse of women and children.

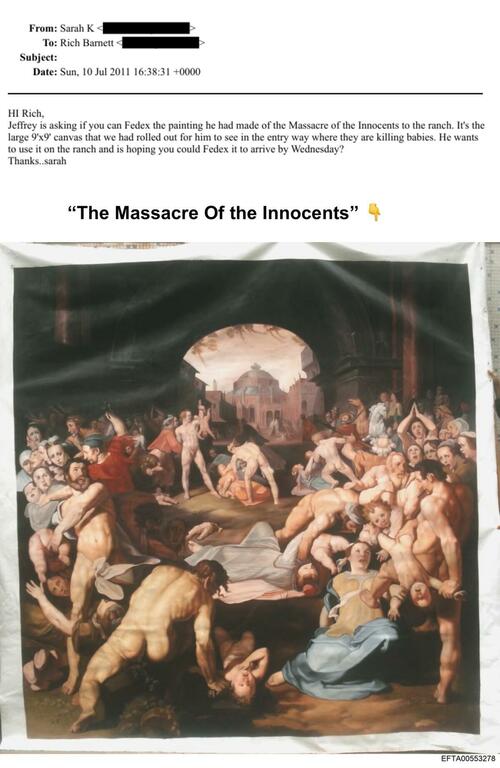

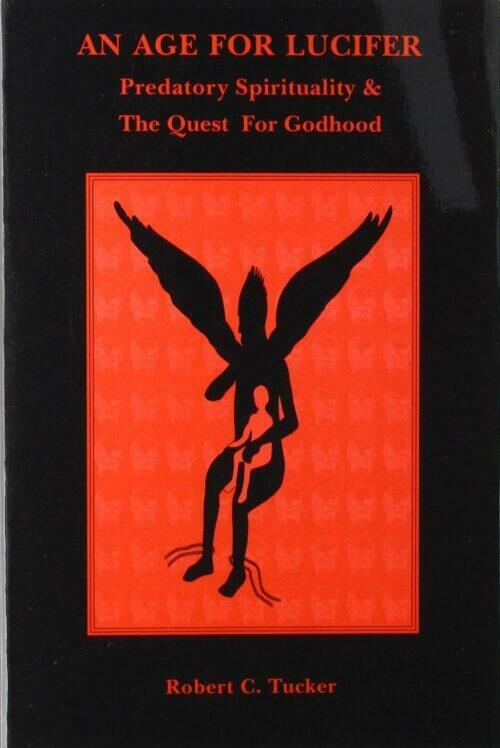

FedEx: “when you absolutely, positively need a wall-sized mural of infant massacre for a ritual happening Wednesday at 2pm”

But what is weird about The Club is the seeming preponderance of pedophiles and sexual predators. Doesn’t anybody nice ever rise into positions of authority?

The Club has to be impelled by something, be it an incentive structure or dynamic that attracts both sociopaths and easily manipulable bunglers.

But it goes beyond that.

The Falsification of Hanlon’s Razor

Hanlon’s Razor used to be the bedrock of my thinking. It’s a derivation of Occam’s Razor. Loosely stated, it advises us:

“Never ascribe to conspiracy what can be explained by stupidity.”

When you look at the types of people ensconced in government, bureaucracy, and academia, this fits. Nowhere in the private sector could you find such a monotonous array of one-dimensional apparatchiks. Any enterprise run by such institutionalized mediocrity would have zero competitive edge and go bankrupt.

However, what I should also have taken to heart, more than I did, was something James Dale Davidson and Lord Rees-Mogg observed over twenty years ago in their seminal work The Sovereign Individual:

“Too little attention has been paid to the fact that electoral politics lures disordered, Messianic personalities into positions of power.”

My base case used to be that the political class were, by definition, failures and rejects. They washed out of the private sector, then drifted into statecraft out of necessity.

I thought that belief in a vast, overarching conspiracy of powerful elites who controlled everything was Loserthink. It ingrained a sense of helplessness in the believer, which made them ambivalent and docile.

Now I realize that I’m the loser – at least in the eyes of everyone in The Club, because there is now no doubt, except to the willfully ignorant – that The Club exists, and the entire political ruling class, the corporate oligarchs, the TED-class influencers and CNN talking heads and panelist experts, are all in it.

Seeing now that The Club exists, and whatever is behind it pulls the levers of power, narrative, and money itself, doesn’t make me feel helpless after all.

It makes me angry. As it likely does for a lot of people.

But The Club is driven by something, that sits behind it.

Not much Podesta in the Epstein files, but lots, and lots of pizza

What’s Behind the Three-M’s?

In numerous writings I have said that the main affliction facing humanity today was what I privately term the “3M’s of Elite Insularism”, those in the The Club are Malthusian, misanthropic, and Marxists.

But I now suspect those are mere symptoms of how The Thing That Points Beyond Itself presents, and that thing is…

In Gore Vidal’s 1954 novel Messiah, a Death Cult named “Caveism” sweeps the Western world in under 36 months.

A Luciferian Death Cult

Throughout his book, the term Tucker uses to refer to his posited predatory spirituality is Luciferianism, and he said that it

“reinforces and encourages four basic energies — devouring, possession, violence and disguise — which in turn, assist the Luciferian to transform consciousness, animate hidden potential, and ultimately attain godhood.”

Devouring is the core process – it is the act of ingesting various types of energy for oneself, whether it be wealth, property or life energy itself – it’s all fair game to the elites in The Club, because they view it all as theirs by divine right.

“Luciferians believe that core identity can be devoured only when it is broken like an egg or nutshell. Once broken, the victim’s identity yields powerful energies. “

Page 71.

(Serious adrenechrome vibes…)

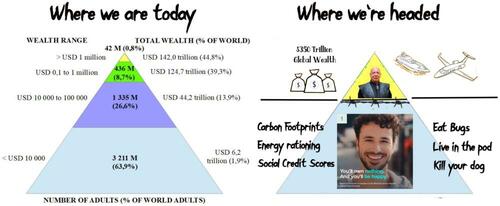

The elites, The Club, view themselves as a kind of breakaway civilization – but not in the sense that I have been calling The Great Bifurcation for years. My sense of that was a split into separate streams of humanity, a la the Eloi and Morlocks posited in The Time Machine, by that irascible communist H.G. Wells.

But The Club isn’t splitting off from the mass of humanity, they’re using the masses as fuel for stage separation like a booster rocket. Ready to jettison our spent husks as our psychic energy is consumed to propel them into the stars and Godhood itself.

For the rest of us to go along with this, we have to submit to this and want to provide ourselves as energetic fuel to be consumed by our betters.

This involves the promotion of what Tucker calls “Self-Annihilating Traditions” and we see it in various forms of psychic driving and mass influence operations that induce an intellectual and instinctive lethargy at both the individual and mass levels:

“The actual experience of being devoured emotionally, cognitively, or spiritually usually occurs gradually over time. The devouring itself is never obvious to the victim; if it was, then defenses would be mobilized.”

Any suffering the victims do experience is attributed to other causes – I think of them as “institutional scapegoats”.

“Suicidal Empathy” is phrase that has arisen from those skeptical of the value prop of allowing oneself to be psychically, economically and even physically devoured to the benefit of The Club, ostensibly in service to the higher calling of the collective.

We have to be conditioned to desire an end to our own existence as a moral imperative unto itself – hence the relentless climate crisis, mankind-as-a-cancer narrative, the institutionalization of euthanasia, abortion and the incentivizing of medical pseudo-science that induces violent psychosis on a mass scale.

Like the Anti-Life Equation posited in DC Comics New Gods series, most humans have to be conditioned to want to die.

DC Comics: New Gods #6 (1972), written and illustrated by Jack Kirby

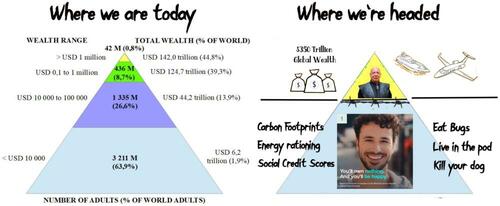

…so that the “capstone class”, as I’ve called them in the past, can use us as booster fuel into godhood.

Tucker’s book was tabled as a thought experiment, and that’s where it sat for me, until now.

When you map the model onto the world we actually inhabit the point ceases to be that some new predator-class spirituality might emerge.

It is here now, and the point is that we inhabit a system that is optimized for it.

Class structure, now and future

Somewhere along the line, a prototype evolved inside the species, and learned to prey on its own kind. As I outlined in another (very long) piece, this has likely been going on for a long, long time.

(That piece happened to mention Clinton Foundation insider Ira Magaziner, his role shaping the governance regime of the Internet, and his presence in the Epstein black book; the latest Epstein file dump shows, despite protestations that no relationship existed, that Magaziner and Epstein were indeed in contact beyond the stated claims. Ira is still CEO of the Clinton Health Access Initiative. His son is congressman Seth Magaziner, D-RI).

Back to The Club: over the centuries, they’ve built a social and spiritual architecture that normalizes the predation, and advances it – taking special efforts to co-opt anything that appears that could challenge it. Tucker called it “predatory spirituality.” We have other names. The behaviour is the same.

And where would such a class (The Club) take up residence, if they were real?

They would not live at the margins, nor burrow into the powerless underclass.

The Club would move inexorably toward the apex. They would infiltrate the institutions that confer immunity, walk the corridors of power where favours become law.

They would acquire control of the media organs where spin defines reality, and they would reside above the law, where consequences are for other people, the little people.

Predatory spirituality takes up residence where power emanates, because that is where it can feed without being seen, or at the very least with immunity.

Civil War, SplinterNet and Guillotines

(a.k.a. where we are headed…)

Epstein is not important because he was uniquely depraved. He is important because he is the icon, the symbol that points beyond itself.

The machinations of his network give us a glimpse of the operating system. It’s a case study in how leverage, ritual, and institutional protection intertwine. Once you accept that, the question is no longer “How could this happen?” The question becomes “How long has this been going on?” and “Who or what hasn’t been corrupted by it?”

In the follow-up piece, I’m going to widen the lens. Because when institutional legitimacy breaks down, alternative structures step into the vacuum.

Despite what The Club would want for the rabble, when it comes right down to it, people actually don’t want to be psychically, economically and spiritually devoured for the benefit of an insular, overlord class.

For years I have written the age of centralization and the linear geometry of the Industrial Age was heading toward collapse. It was, and still is, too early to tell what comes next – but whatever it is, owing the emerging architecture of the Network Age, it won’t be a top-down hierarchy, lorded over by (Luciferian) priests of the temple.

Whenever people ask me for a succinct descriptor of what I see coming, my answer was and remains: Snow Crash.

As the collapse in institutional legitimacy accelerates, non-state groupings will step into the vacuum and provide the functional scaffolding that civil governments are no longer willing, or able to provide.

Sometimes they look like protection rackets. Sometimes they look like special economic zones, franchise sovereignties or city-states.

Sometimes they look like cartels with drones. Sometimes they look like transnational corporations with private intelligence services.

The end result is the same. Fragmentation. Competing authorities. SplinterNets (and consensus reality shattered).

That’s where this leads.

Epilogue

My next piece explores a strange new social construct about to enter into competition with other established sovereignties. My purpose here is to convince you that its emergence is probable, if not inevitable. I begin this exploration with an unproven assumption based on game theory and simple incentives: a new class of irregular sovereigns will appear on our planet, an evolutionary prototype designed to oppose Luciferian predation. Another assumption then follows: these factions will evolve gradually and incrementally from largely compromised nation states, just as we apparently evolved from previous obsolete governance structures. A further assumption suggests that these groups have already appeared as evolutionary prototypes, as guerrillas with advanced methods of resiliency and new forms of communications and asymmetric tactics designed to support and advance their insurgency.

Watch this space.

Get on the Bombthrower mailing list to get the next instalment, follow me on X, we’re also getting ready to relaunch Ready.ca – a boot camp for politically homeless Canadians (and others).