Authored by Kevin Muir via The Macro Tourist,

Today’s post will be about Japanese yen vol, but I am sure to bore some readers with that topic, so I am starting with something a little more interesting.

As many of you know, I am a little bit of a bitcoin skeptic. At the end of the day, I have trouble investing in the ledger in the sky.

Call me old-fashioned, call me a troglodyte, call me a bitter gold bug, call me whatever you want, I just can’t bring myself to get long bits in the cloud. And before you send me messages how I don’t understand it, don’t forget I was mining bitcoin before most of Wall Street had ever heard of it. So I am much more than just some trade-a-saurus that refuses to get with the times, I am the knob who passed on bitcoin at $5.

Yet I have the privilege of counting Tony Greer from TG Macro as one of my pals, and his enthusiasm about using crypto currencies for micro-payments has piqued my interest. From Tony’s great letter the other day:

For selfish reasons, this is the article that gets me most excited about bitcoin and the blockchain. The streamlining of media distribution is going to kick the door open for individuals to compete with publishing powerhouses and main stream periodicals.

Publishing content on Amazon, iTunes, even YouTube is extremely costly for the author/artist. Youtubers can’t earn money until they get 10,000 views. Apple and Amazon take between 30% and 75% for the right to their distribution networks. Since media consumption has gone digital, it’s been difficult to charge on a PER ARTICLE basis because of high transaction costs making it prohibitively expensive. All that’s about to change. The blockchain is going to allow thousands of transactions to be processed at low to no cost, it will preserve a record of all those transactions along with all the content, it provides transparency for the artist/author and consumer, and one day, it will make the Morning Navigator available to every single reader in the world for $1 per copy.

Take a moment to read the article Tony linked to. Yeah, I know. You would never expect me to be linking to an article in BitCoin Magazine, but life’s funny.

I have no real counterargument to the idea of using cryptos for micropayments. There is a real need for the ability to easily transfer small amounts of money. Given that it is simply a change in a ledger at a bank, it should be virtually free. Yet the banks, VISA and Mastercard, have for too long enjoyed oligopoly pricing, and just like the music industry fifteen years ago, they will not willingly lower their fees until it is too late.

The other day I was out with some bankers who were explaining Ben Davies’ newest project. Many of you will remember Ben as the CIO of Hinde Capital, but a year or so ago he left to devote his time to GLINT. Having a look at the prototype, I realized this product very well might change the way we think about global currencies and how we transact. I will not bother shilling their service (if you are interested click on the link to get to their website), but needless to say, existing financial institutions should be worried about the emergence of GLINT, Goldmoney, and all the other fintech startups that are nipping at their heels.

Up until now, the biggest beneficiaries of the move to digital cash have been VISA and Mastercard. And although I understand all the reasons why their point of presence will make de-throning them difficult, I just can’t help but wonder how long before their margins are threatened.

It’s not like their stocks are down and out…

I am not advocating investing in bitcoin, GLINT, or any other fintech startup. As I have shown, I am not smart enough to tell you who is going to win. But I am beginning to wonder if the easier trade is to short VISA and Mastercard. For too long they have enjoyed oligopoly style rents, and I just think that the real takeaway from all this new technology is that their day in the sun might soon well be over…

* * *

Japanese Yen Volatility

Between 1999 and 2012, the Bank of Japan increased their balance sheet threefold, raising it from 10% of GDP to 30%. Many a pundit screamed about Japan’s irresponsible monetary policy, but then the 2008 Great Financial Crisis hit, and suddenly the BoJ’s policies didn’t seem that extreme. The Fed embarked on a massive quantitative easing program, followed by most of the rest of the developed world. Next thing you knew, the Bank of Japan’s bloated balance sheet seemed like just one of many.

Post GFC, the rate at which these other Central Banks were expanding their balance sheet put extreme stress on the Japanese economy as the BoJ’s relatively tame quantitative easing policy was overwhelmed by the rest of the world. Global deflation was exported to Japan. And just when things couldn’t get worse, Japan was hit by the tsunami / nuclear disaster. Paradoxically, this caused a spike in the USDJPY rate down to 75, with the Yen hitting an all-time high value against the US dollar.

This proved the final straw for the Japanese people, and Prime Minister Abe was elected on a platform of breaking the back of deflation through innovative extreme policies. And just like that, Abeconomics was born.

Since then the Bank of Japan balance sheet has swelled from 30% of GDP to 95%!

It’s too easy to take this for granted. The blue tickets just seem to keep coming, and coming, and coming. Pretty soon, it all seems so normal.

But it isn’t. Not even close. This is bat-shit-crazy monetary expansion. Forget about arguing whether it is appropriate or needed. It doesn’t matter. The markets don’t give a hoot about your opinion. Nor does the BoJ. Heck, they barely even care what Yellen or Trump thinks. They are going to do what they think best for their people, and that means inflating the shit out of their currency.

What I find amazing is how complacent the markets have become about all of this. Sure when Abeconomics first came to pass there were tons of worrisome hedge fund presentations about the inevitability of disaster. But since then Kyle Bass and all the other Japan skeptics have moved on to China, or to the most recent hedge-fund-herding-theme-of-the-day. Yet at one point a few years back a reporter asked Kyle if he could put on one trade for the next decade and couldn’t touch it, what would it be? Bass answered gold denominated in Yen. I have this sneaking suspicion our favourite Texas hedge fund manager’s call was way more prescient than even he imagines (I just hope Kyle hasn’t taken it all off to bet on the China collapse.)

It’s not like the market hasn’t figured the short Japanese Yen trade out. Shorting Yen is one of the go-to carry trades for macro traders everywhere.

I am not adding much value by reiterating climbing aboard this trade. It’s a crowded trade, and most importantly, not that original.

The trouble with crowded trades is that the exit doors are always too small. And even the BoJ is worried about the possibility of a speculative unwind in the Japanese foreign exchange market.

It was with great interest that I read an article in the Nikkei Asian Review titled “Japan looking to tamp down leverage in forex trades”.

Japan is considering lowering the maximum leverage permissible in foreign exchange trading on grounds that both retail and institutional investors are facing greater risks should the market face sudden fluctuations.

Foreign exchange margin trading in Japan amounts to roughly 5 quadrillion yen ($44.2 trillion) annually. The lower cap would reduce the risk of a crisis originating in Japan, but will likely be met by resistance from industry players.

The Financial Services Agency has begun discussions with the Financial Futures Association of Japan on changing the rule. The leading proposal would reduce the maximum leverage ratio from 25 to 10. The cabinet could issue an order as early as next year to place the new ceiling into effect.

I don’t necessarily think this regulatory change will be something that causes the whole Yen carry trade to unwind, but it’s one piece of a puzzle that definitely seems precariously perched. The BoJ wants the yen to decline, just not too fast. The trouble is that markets don’t always let Central Bankers devalue currencies in a nice calm manner.

I have long held the view that most market pundits are expecting the next crisis to look just like the last. They are all shorting credit because that’s what worked last time. And it’s also why for the longest time, VIX was consistently trading at a higher price than realized volatility. Long equity volatility was the real big winner last time, so everyone loads up on VXX because after all, we all know the next 2008 style crash is right around the corner.

Well, I might not know much, but I know that the next crisis will not be the same as the last one. It never is.

So while everyone is busy loading up on VIX calls, or buying CDX protection, I am more interested in thinking about where the global financial system is most unbalanced.

And I can’t believe there is anything more frightening than the manic increase in the BoJ’s balance sheet. I don’t know if it is going to end in a stomach churning roller-coaster-style free fall where the BoJ loses control of their money supply and the Yen spikes to 200, or if some other event will cause a massive short covering rally of Yen that forces a rally back to 95 or even 85 before the BoJ steps in, and prints an even stupider amount. But I am convinced it is not stable.

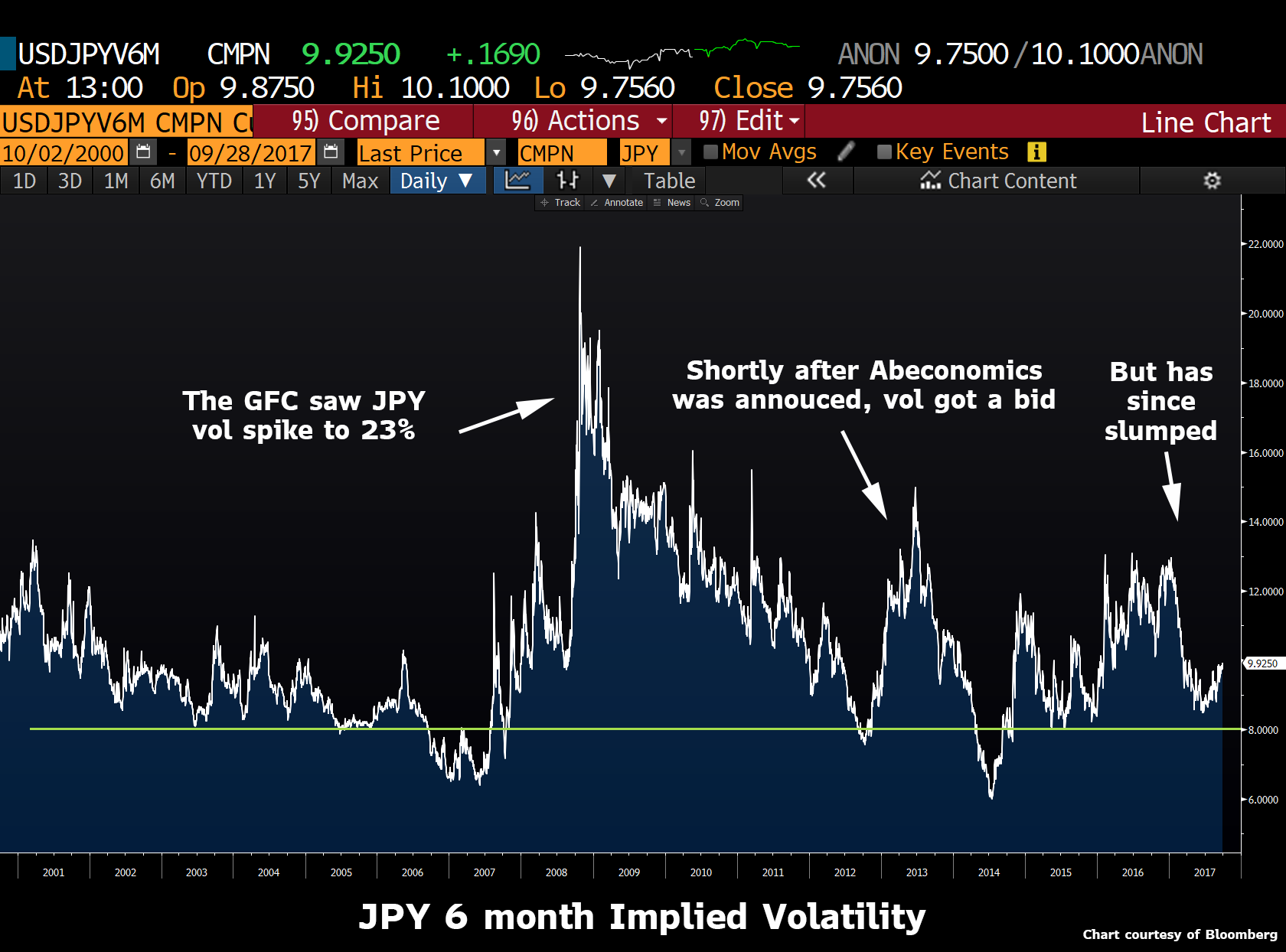

You would think that given the massive money printing the market would have bid up the price of protection, but Japanese implied volatility is remarkably low. I have plotted the 6-month over-the-counter implied volatility level of the Yen over the past few years.

Of course, the 2008 crash caused a pick up in volatility, so the move to 22% does not seem unreasonable. And the ensuing move back to 8% makes sense. Then with the introduction of Abeconomics, the rally to 14% is easy to justify. But it’s the drifting back down to sub 10% that I think mispriced.

There is no way that the Yen has the same risk as the 2001-2006 period. It just ain’t so. Kuroda has taken Japan down a monetary path that is unprecedented. To think that this will road will not be filled with huge obstacles is naive. Yet here at 10% for six-month Yen vol, we are only a couple vol points away from the lower end of the range of the past couple of decades.

I am buying long-term Japanese yen volatility. No, I don’t trade OTC, so I am going to the CME and buying straddles, strangles, and every other long vol option spread I can think of. I wish there is was some way to just buy a VXX type ETF of the Yen, but there simply isn’t demand for this type of product. The inability to easily buy a hedge is precisely why it stands a much better chance of being the real risk you should be worried about.

Japanese yen volatility is too cheap given the dangers involved in this crazy monetary experiment. Just because all the hedge fund wise guys have forgotten about the trade doesn’t mean you have to.

Panics don’t occur when everyone is looking for them. I am not sure about the trigger, and heck, I am not even sure about the direction.

But I do know that you don’t print 65% of your GDP in 5 years and not affect markets.

There will be consequences, we just don’t know what they are yet. Get your insurance while you can, not when you have to…

via http://ift.tt/2xIt7yg Tyler Durden