Authored by Kevin Muir via The Macro Tourist blog,

$11,589.01.

That’s the US dollar amount of American stocks the Swiss National Bank owns on behalf of every man, woman and child in Switzerland. Let that sink in.

A Central Bank has taken on itself to expand its balance sheet and invest in the proceeds, not in gold, nor sovereign debt – heck not even in corporate bonds. Nope, the SNB has taken it upon itself to “invest” that money in another country’s most risky part of the capital structure – equity.

And don’t think it’s a small number. It’s almost $100 billion US dollars.

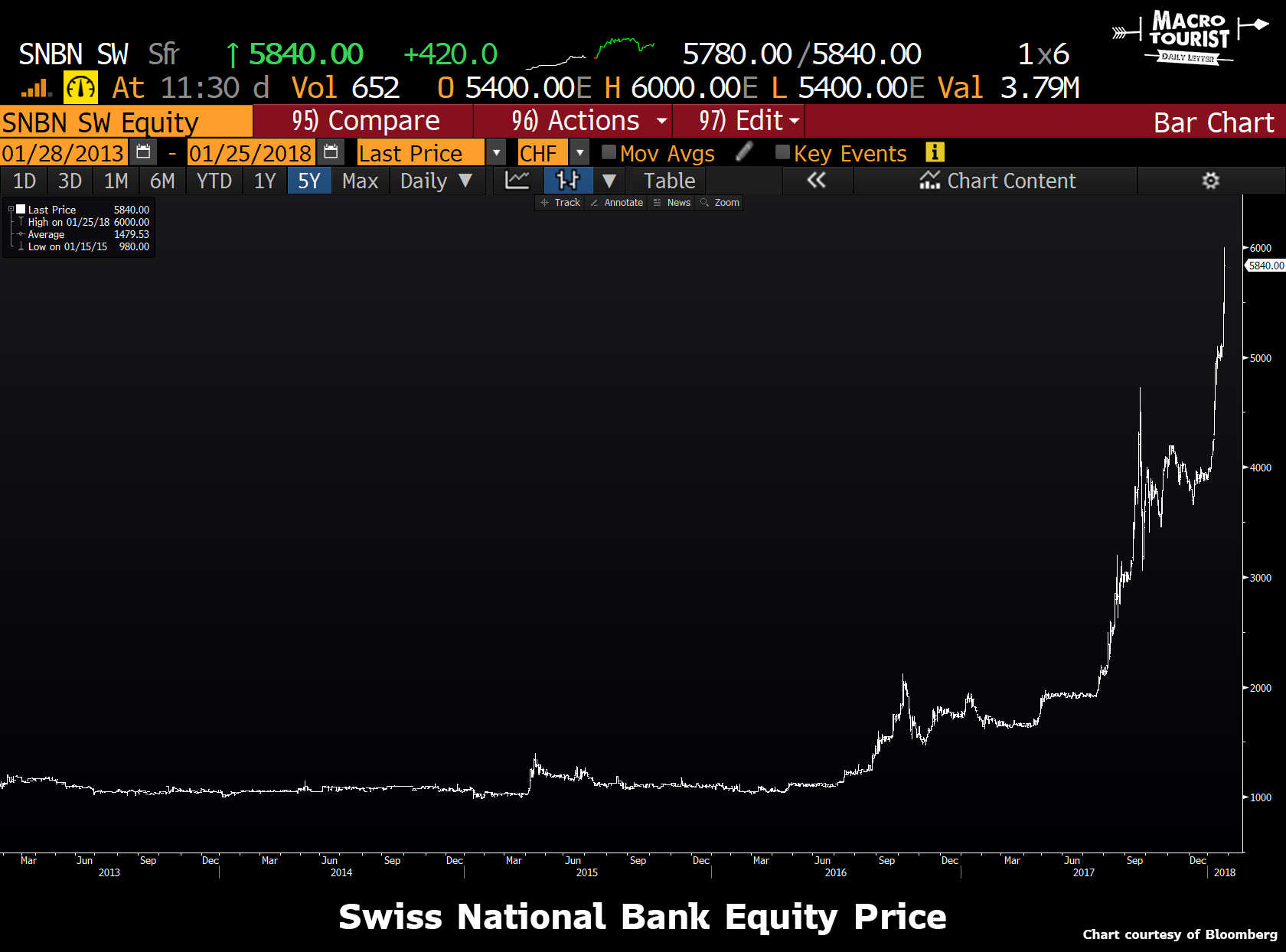

In a strange twist of fate, the Swiss National Bank is not only Switzerland’s Central Bank, but also a publicly traded security. I know, it makes little sense, but in this day and age, what does? Anyways, the financial community is all abuzz with SNB’s rocket ship chart formation.

The SNB’s equity price market capitalization is only 584 million CHF, so when you consider that the S&P 500 is up almost 6% since the start of the year, and that the SNB owns $100 billion of stocks which are up $6 billion USD during the last two months, maybe it makes sense to take a punt of buying some SNB equity. Now, who really knows how to value this security? Those gains should accrue to Swiss citizens as opposed to SNB equity holders, but it’s easy to understand the excitement.

The real problem

It’s all fun and good to speculate on the SNB equity price, but I am more interested in what the SNB’s behaviour means for the global markets going forward.

The real problem is that a Central Bank just monetized their balance sheet against another country’s equity market, and instead of getting punished for this reckless behaviour, the markets are celebrating the Swiss good fortune. And I ask you – have you ever seen Central Bankers not behave like a bunch of antelopes on the Serengeti? It is an amazingly disturbing precedent.

The Swiss National Bank has gone down a rabbit hole from which it will be extremely difficult to surface. Not only does every Swiss citizen own indirectly through the Central Bank more than $10k of US stocks, but their total assets per capita is over $94,000 each!

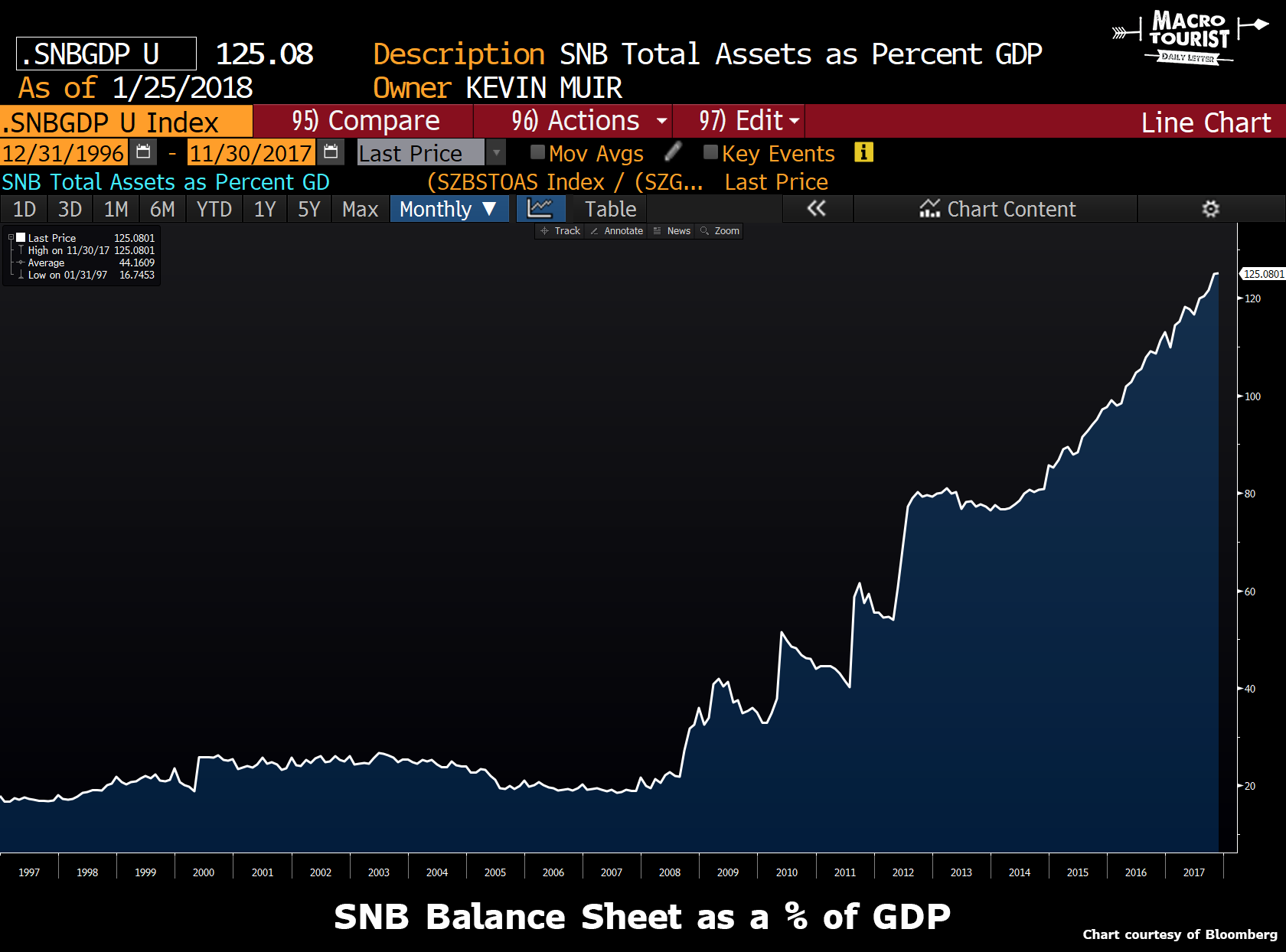

Since the 2007 Great Financial Crisis, the SNB has taken the size of their balance sheet from 20% of GDP all the way to 125%!

And look at the period from 2014 to today. From 80% to 125%. And that was during a period of relative calm in both the markets and the economy.

What’s going to happen when the global economy rolls over?

This sort of balance sheet expansion, and especially with the corresponding move out the risk curve, is complete madness.

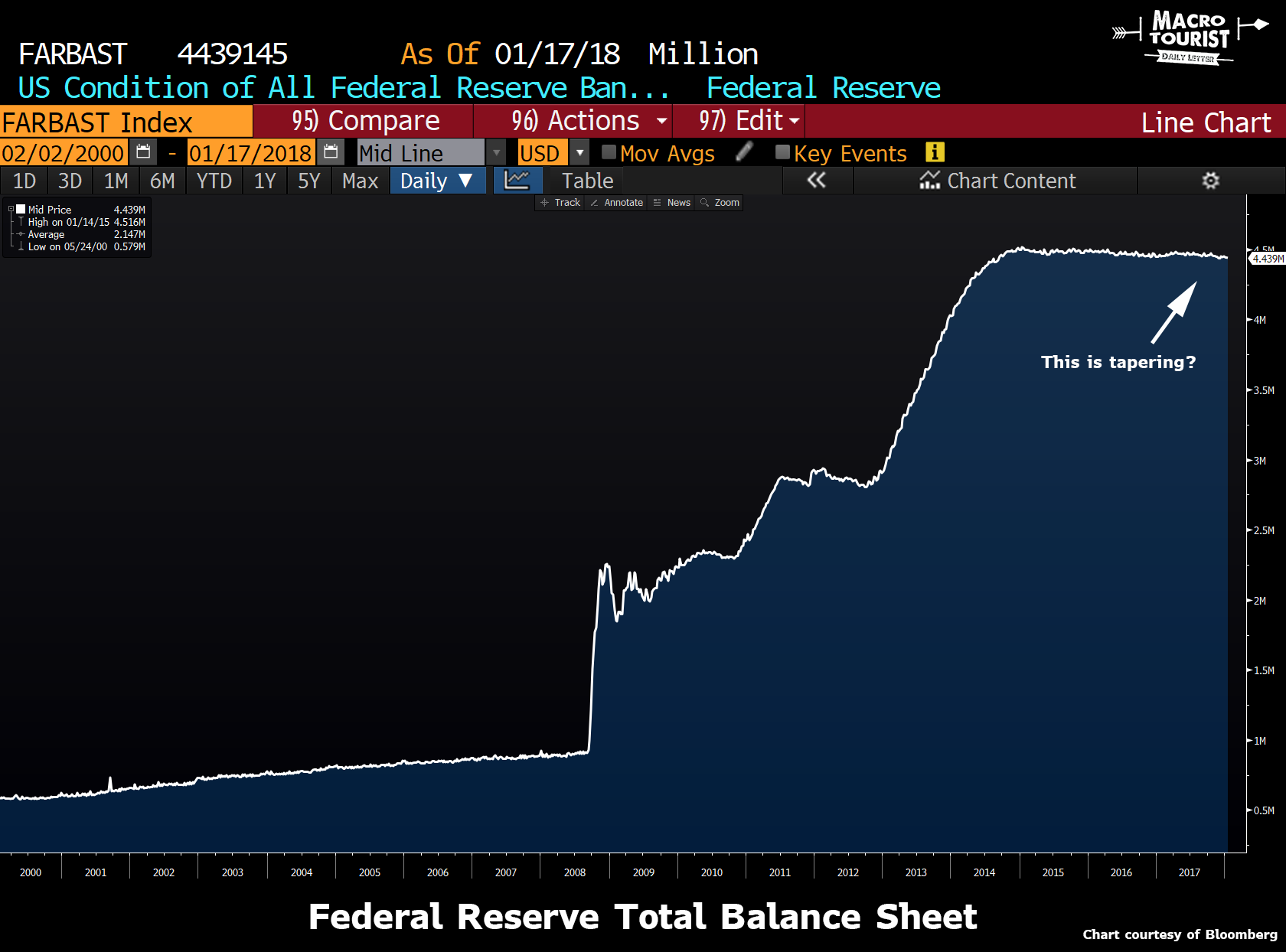

I know many market strategists are issuing warnings about markets due to forecasted global Central Bank asset tapering. I sure hope they are correct that this insanity ends soon. But I worry that we are being naive.

Have you looked at the Federal Reserve’s balance sheet lately? I know they are on a schedule to taper, but it’s at a glacial pace.

I worry that right now, Central Banks are being rewarded for keeping their balance sheets as big and risky as they can stomach. It appears to be a trade with no cost, and in fact, helps out by both keeping their currency weak, and in the meantime, making some money. It encourages them to be extremely slow easing off the accelerator.

The idiocy of Central Banks taking this sort of risk is beyond description, but no sense arguing about it – it is what it is. But make no mistake, it’s like wearing jeans, a denim shirt, and a jean jacket at the same time (the Canadian tuxedo), it just shouldn’t be done (unless you are Ryan Gosling and then somehow the ladies seem to like it – go figure…)

I don’t have any conclusions to draw from this diatribe. I don’t think you should take this as some sort of apocalyptic warning about a coming crash. In fact, it’s probably just the opposite. If this sort of Central Bank insanity continues at this pace even though the global economy is firmly in the green, then it only affirms my belief that Bill Fleckenstein was correct when he said, “the bubbles will continue until the bond market takes away the keys.”

PS: If the Federal Reserve decided to invest $11,589 in the US stock market per American citizen, they would need to buy $3.75 trillion of stocks… That would mean they would have to almost double the already inflated balance sheet. That’s the level of absurdity from the Swiss National Bank.

via RSS http://ift.tt/2Bu6U7u Tyler Durden