After a furious, post “Mnuchin Massacre” rally that has seen the S&P index rise +10.44% over the last 11 sessions, the best such stretch since October 2011, every major US stock index is approaching a tipping point according to Nomura quants who caution that with the S&P500 near 2,600 and the Russell 2000 at ~1,450, we are near levels at which CTAs are forced to cut their loss-making short futures positions, and further note that they have already identified that mechanical buying back of futures by trend-followers is been gradually induced.

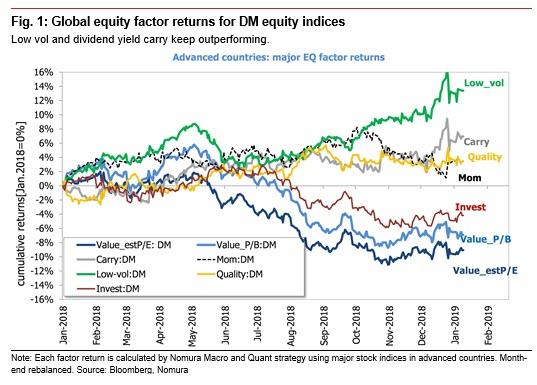

To be sure, the positive drivers such as progress in US-China trade talks and the Fed’s dovish shift have significantly accelerated a recovery in sentiment, but in global stock markets, the current pattern in major DM equity market factor returns shows investors calmly remain in a conservative stance on risk-taking (rather than this being a superficial rebound). In fact, their preference has been tilted toward defensive-oriented factors such as low volatility (i.e., buying low-vol, selling high-vol names) or dividend-yield carry factors (i.e., buying higher dividend yield stocks and selling low dividend yield stocks). The cautious view is still very persistent under the surface.

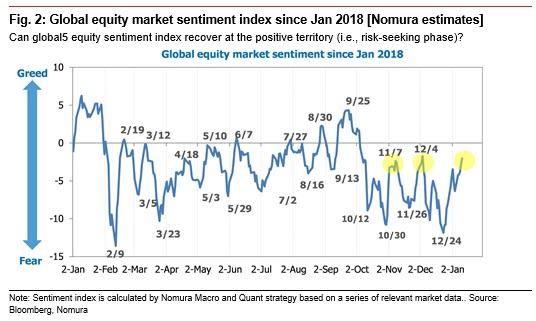

However, a more notable observation for the viability of the recent rally is that according to Nomura, “we have reached a reality check in identifying the sustainability of the current risk rally” with the bank adding that its estimate of global stock market sentiment is aligned with the peaks seen last November and December. Note that in all prior cases, sentiment softened from around these market levels.

Even if the improvement continues, Nomura warns that additional positive events or drivers related to solid fundamentals would be necessary to push sentiment further into positive territory (i.e., a risk-seeking phase). Otherwise, one needs to be aware that systematic buy-back pressure on trend-chasing algo investors like CTAs and Risk Parity funds only will accelerate the upward momentum of the equity market.

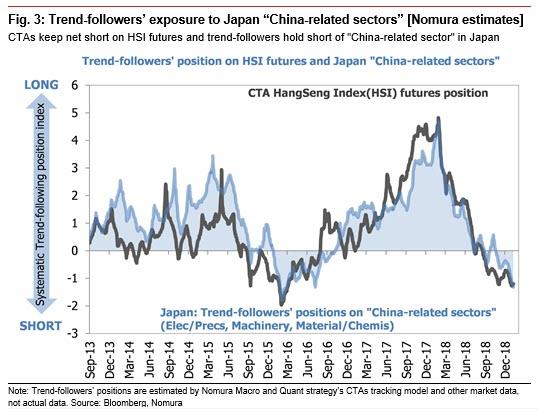

One other key wildcard is what happens with China: while Nomura believes that the future momentum of the Chinese economy seems overlooked at the moment, it is one of the “reality check” factors. Removing US economic uncertainty is not enough, in Nomura’s view, but at the same time “we need to confirm if China’s economic recovery is likely.”

On that point, some short-term investors are slightly sceptical; CTAs are still short Hang Seng Index futures and trend-followers in the Japanese market are also short China-related sectors. That’s why the bank’s quant team said it will watch closely such speculative investors’ China-bearish positions as well as China stock market sentiment in an effort to confirm the sustainability of the global stock price rebound.

Finally, in light of today’s furious dollar rally and return-reversal, Nomura cautions that CTAs continue to unwind their aggregate USD long positions which may suggest today’s snapback rally is just new CTAs loading up longs. That said, unless DXY rapidly recovers above 96.0, USD is more likely to be exposed to mechanical selling pressures across major pairs, in Nomura’s view.

via RSS http://bit.ly/2QFaTpe Tyler Durden