As we detailed last night, the recent surge in the yuan has been almost unprecedented against a backdrop of dismal economic data, a still tightening Fed and an aggressively easing PBOC.

And it appears PBOC has had enough of it as MNI reports this morning that the central bank does not want a sharp appreciation by the yuan, citing a source close to the People’s Bank of China.

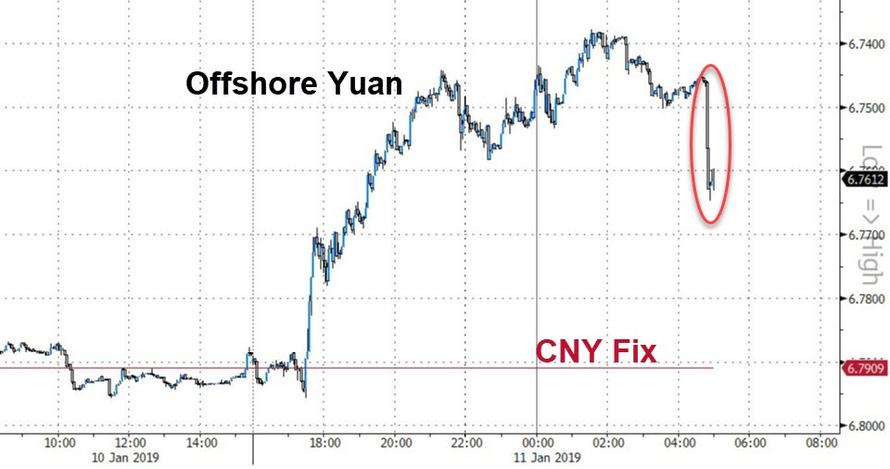

That prompted an immediate reversal of some of yesterday’s gains…

Not entirely a surprise, as Michael Every, head of Asia financial markets research at Rabobank in Hong Kong, warned:

“The yuan can hold up fine” until the Fed hikes again, trade tensions resume and China “goes all-in on stimulus,”

“It’s a ‘when’ and not an ‘if’ for when it reverses direction again and we test new lows.”

It seems when is now. Will Yuan catch down to ‘fundamentals’?

via RSS http://bit.ly/2QIu8ys Tyler Durden