Last Wednesday, as the US stock market was roaring higher on its way to a 10% rebound from the December 24 bear market lows, we laid out the latest calculation from Nomura’s cross-asset strategist, Charlie McElligott, who showed that it was only a matter of days before the same CTAs who were blamed for the sharp selloff in mid-December, were forced out of their from “max short” level and started covering, in the process sending markets even higher.

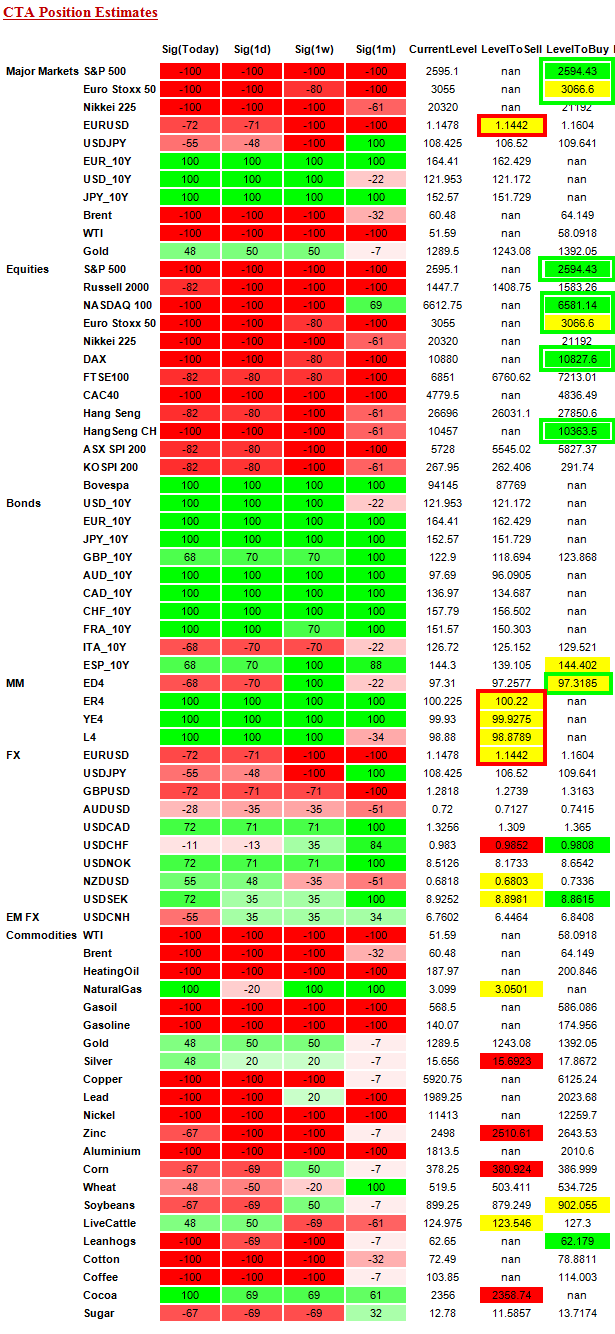

Now, in his latest update, McElligott has further refined his analysis and notes that whereas CTAs for the key equity indexes, the S&P, Stoxx and Nikkei are all still in the “Max Short” bucket, all that may be about to reverse, as the first “Buy to Cover” level is just a few points higher in the S&P, or at 2,594, less than 10 points away. Here are some more details from the Nomura analyst on where the max pain levels for algo shorts are, and where the market will almost certainly rise to before retesting if the short squeeze can push it even higher, or if a new wave of selling will emerge as Morgan Stanley predicted earlier:

- SPX at 2594, Nasdaq at 6581, Eurostoxx at 3066, DAX at 10827, Hang Seng CH at 10363—all would see current “Max Short” covered down to just “-82% Short” if today closes above those levels

As McElligott adds, late last week saw Russell, FTSE, Hang Seng, ASX and KOSPI all trigger modest short-covers from their prior “Max Short” positioning at the start of the week. Finally, also nearing inflections is EURUSD nearing sell trigger to again go “Max Short” at 1.1442

Stepping away from the algos, McElligott next looks at equity hedge and mutual fund positioning, and notes that these players both “grabbed” meaningfully back-into US Stocks last week, increasing their “beta to SPX” WoW. According to Nomura’s calculations, Mutual Funds’ “beta to SPX” rose to the 62nd %ile from 59% last week, but more glaringly, “buying the dip” was sharply higher from just 27th %ile 1m ago. At the same time, long/short hedge fund “beta to SPX” also jumped last week to 52nd %ile from 41st %ile, although remains significantly lower from last month’s Santa Rally positioning blow-up (was 81st %ile 1m ago).

Another notable observation is that Long/Short equity HFs are also again increasing their “net exposure” through forced-reduction of their short books, which were obviously “grossed-up” in Dec as the market melted “and are now being painfully squeezed-out to start 2019” – in a repeat of the violent short squeeze observed in Q4, and in factor space are outperforming “Crowded / Popular / Momentum Longs” by 2x’s – 3x’s YTD.

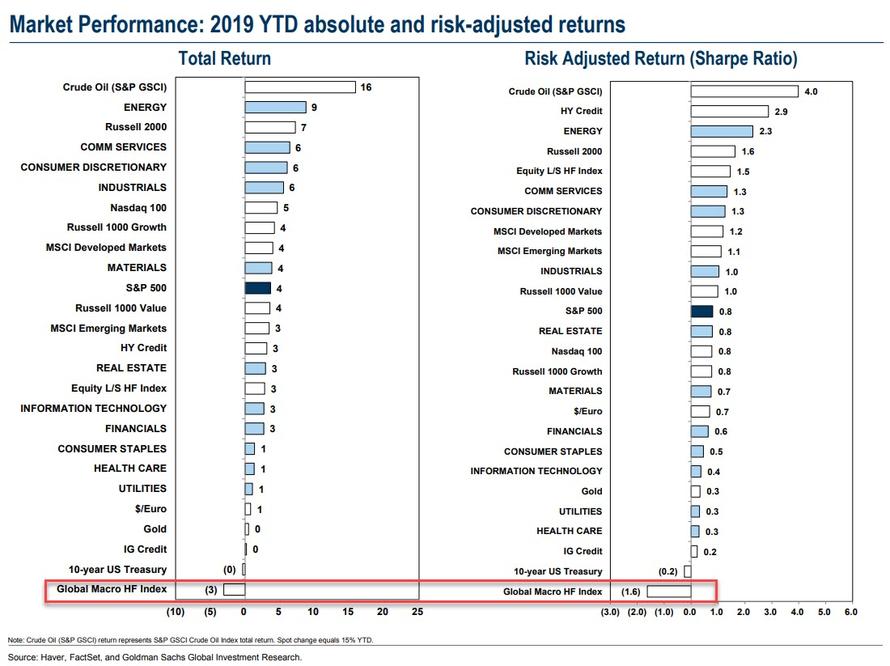

Meanwhile, in stark contrast to US Equities Mutual- and Hedge- Funds, McElligott finds that Macro Funds have not yet participated in this US Equities bounce, dramatically reducing their ‘beta to SPX’ last week down to just 8th %ile from 33%ile the week prior; not only that but global macro HFs are currently the worst performing asset class, according to Goldman.

That, to the Nomura strategist, speaks to that desire of many macro traders to fade the equity rally.

Last, and perhaps most important, is that according to Nomura’s QIS Risk Parity model, balance and risk-parity funds have seen ongoing additions to global Bonds over the past month (+$21B vs 1m ago, almost entirely in JGB 10s and small UST 10s) versus reductions in Credit (particularly US IG -$18.9B vs 1m ago) and Global Equities (-$4.9B vs 1m ago, with -$4.2B of the overall from US Equities reduction).

As McElligott concludes, “as 2019 develops, it will be key to track these “counter-cyclical” longer-term adjustments to Risk Parity positioning into this “slower growth, lower inflation” view, as our 2Y lookback increasingly “picks-up” the 2018 volatility regime, while the prior 2017 “halcyon days” realized volatility environment within the two-year window decreases with each passing day.“

via RSS http://bit.ly/2TN6tib Tyler Durden