Authored by Sven Henrich via NorthmanTrader.com,

Complacency

Complacency is back and comes in the form of recession denial in the face of global slowing data. We didn’t see the slowdown coming but we are confident it will not produce a recession so the narrative goes. Not even a risk of a recession. You’re hearing it from the Fed, the White House, the IMF and every Wall Street firm, the ECB and the BOJ, the chorus is sung with uniformity. No recession.

Not only is there no recession the slowdown creates a bullish paradox is the message. Because of the slowdown central banks will remain accommodative and hence the global debt construct will not be further burdened by higher rates and the party can keep on going. So fear not, buy stocks.

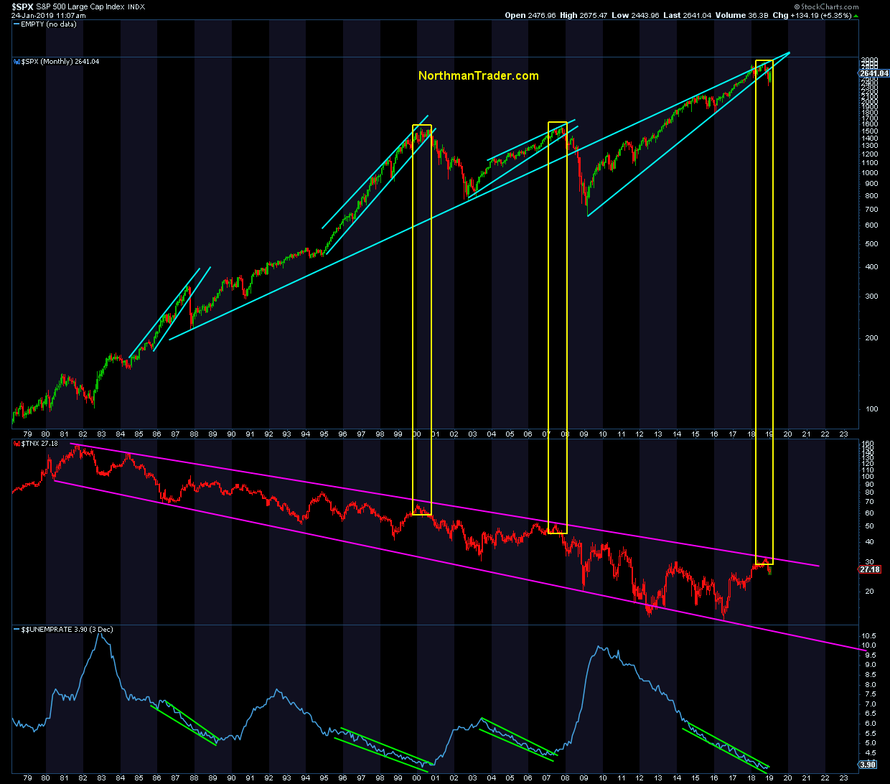

But how can anyone be sure that the slowdown in data will not produce a recession? After all recessions come not only on inversions of yield curves, but historically they are coming at the end of business cycles with low unemployment rates and waning confidence.

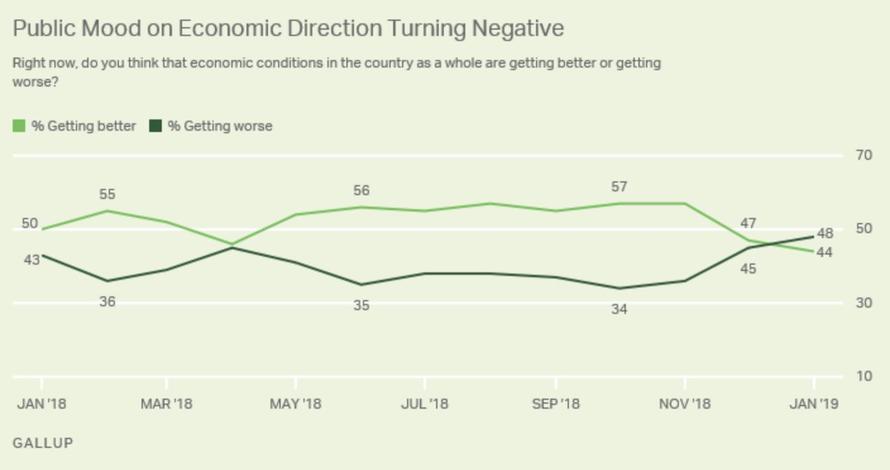

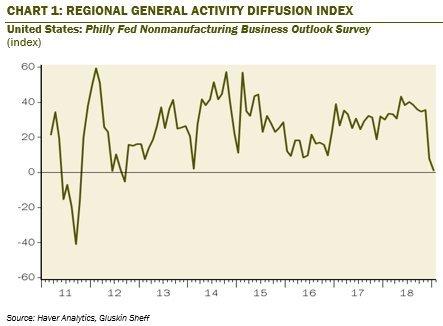

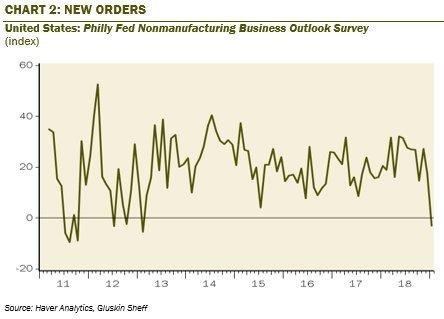

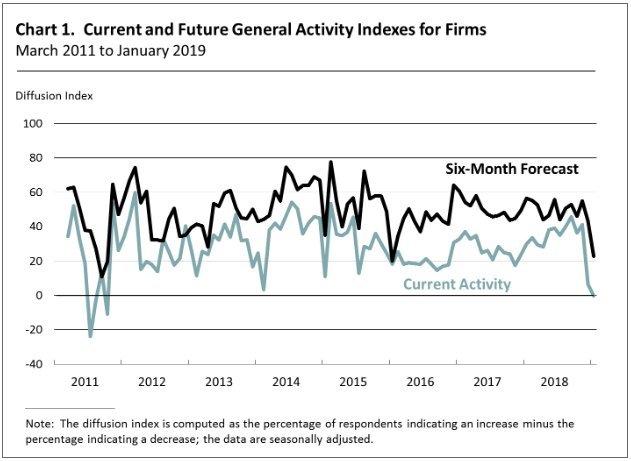

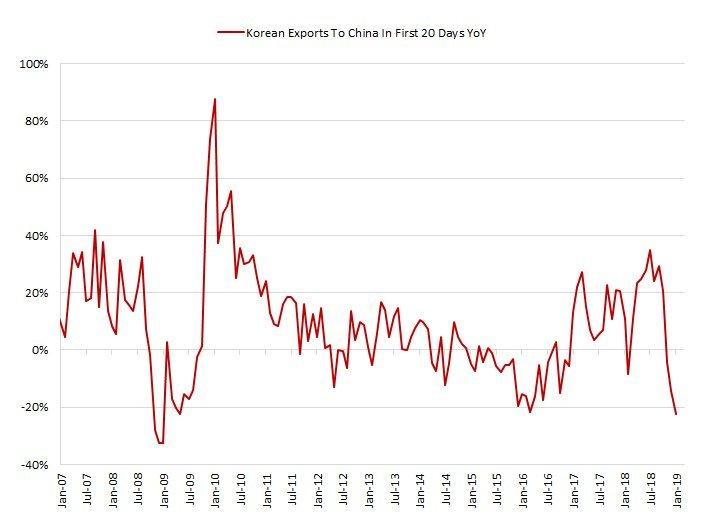

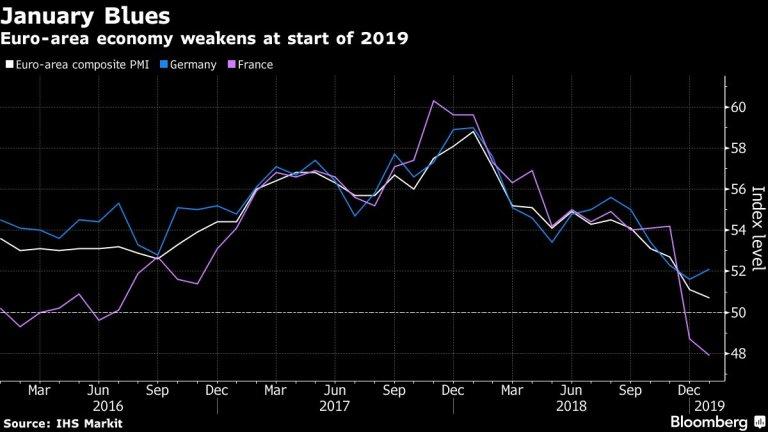

The moment when optimism gets replaced by rising pessimism, which is exactly what we are seeing now:

I don’t know when a recession hits, but someone has to explain to me how you can keep positive earnings growth going with a marked global slowdown in everything everywhere.

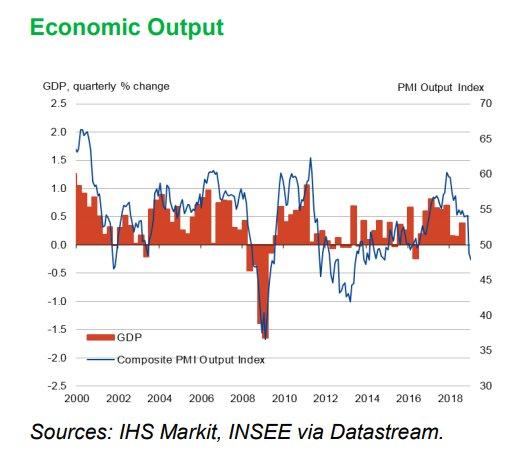

And I mean everything and everywhere. See the global examples below.

France:

Germany:

US:

Korea:

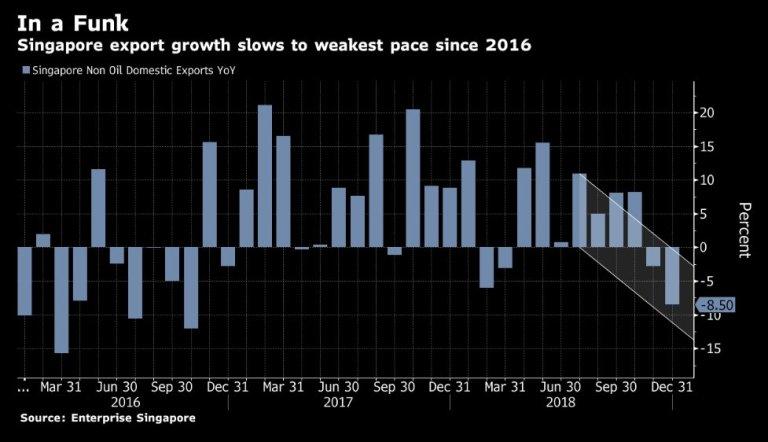

Singapore:

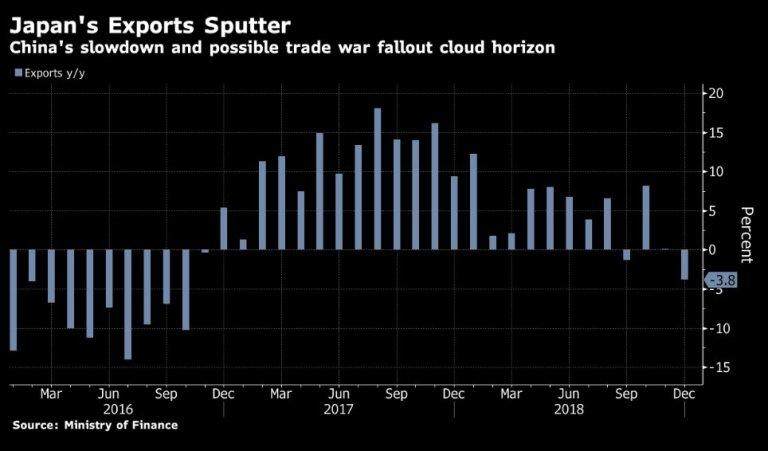

Japan:

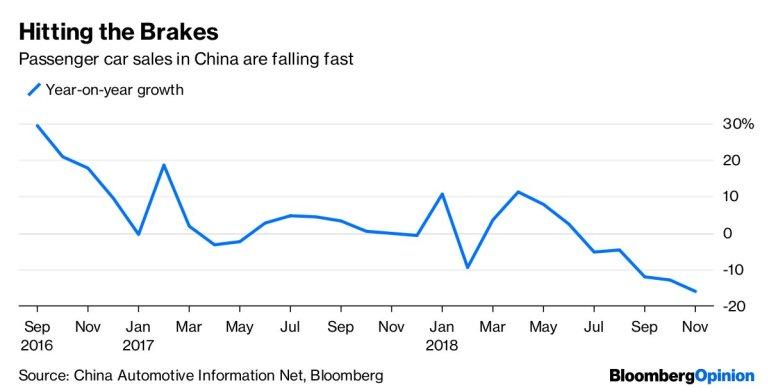

China:

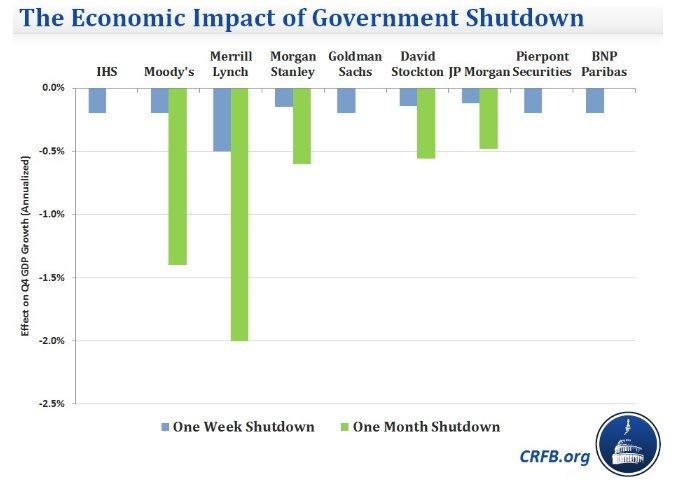

US government shutdown impacting Q1 GDP? No worries, it’s just temporary right?

Yesterday White House economic advisor Hassett acknowledged Q1 GDP may hit zero on an extended shutdown. How does one maintain positive earnings growth if Q1 GDP growth goes to zero? We’re not there yet, but there’s also no obvious sign as of yet as to when the shutdown ends.

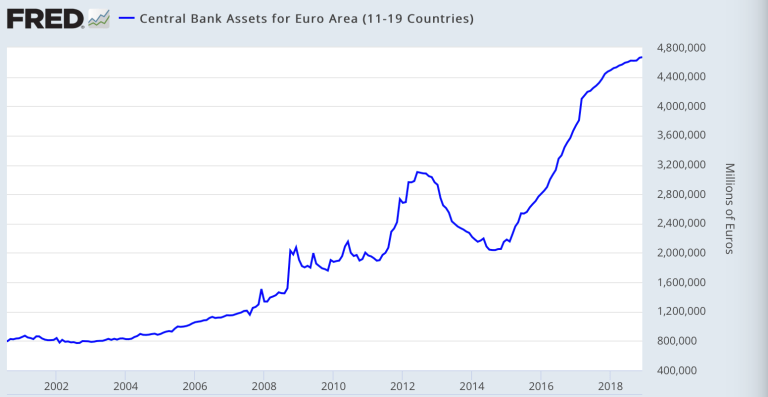

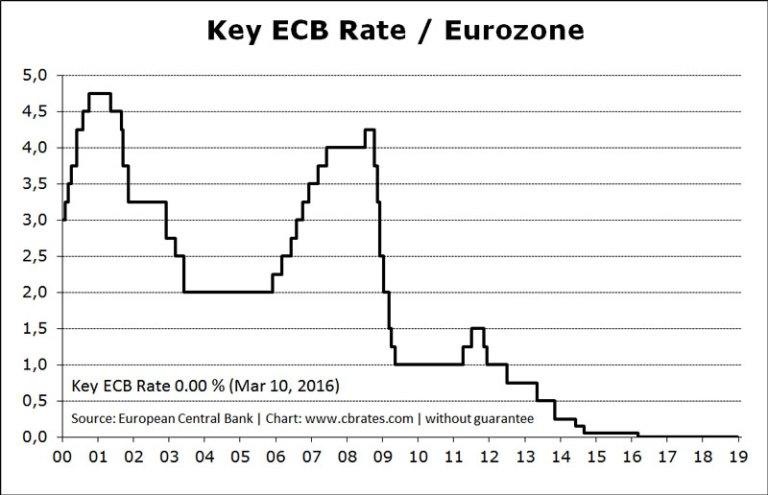

Europe is slowing before our very eyes with the ECB on negative rates still and with a balance sheet that has ballooned to 42% of Eurozone GDP.

Imagine a recession actually does unfold into all this. A recession with negative rates still in place? That’s never happened before. But that’s what you risk if 10 years after an economic expansion you still run negative rates. A colossal and historical mistake by the ECB if indeed a recession unfolds.

No wonder everybody wants to be in recession denial. To warn of a recession is to reduce confidence risking bringing a recession about. To publicly deny risk of a recession is an effort to keep confidence propped up.

But it’s not an effort borne out of knowledge or confidence, because nobody can know the when.

Remember in 2018 all the talk was of global synchronized growth. The data above tells a story of global synchronized slowing. Those that expressed confidence in global synchronized growth are now trying to project confidence in a soft landing.

Maybe. But for that to happen there needs to be evidence of recent slowing trends to turn around. So far they haven’t. And to simply assume that they will may be an exercise in complacency. After all the underlying signal of all of these charts: Earnings estimates may be way too high.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

via ZeroHedge News http://bit.ly/2FMEJqS Tyler Durden