Plunging PMIs, “miles and miles” to go on US-China trade talks, and no end in sight for the shutdown… so wheel Larry Kudlow out on TV to talk up everything and rescue stocks…

Chinese markets bounced back to unch on the week overnight…

UK’s FTSE continues to tumble as Spain outperformed despite ugly PMIs across eurozone…

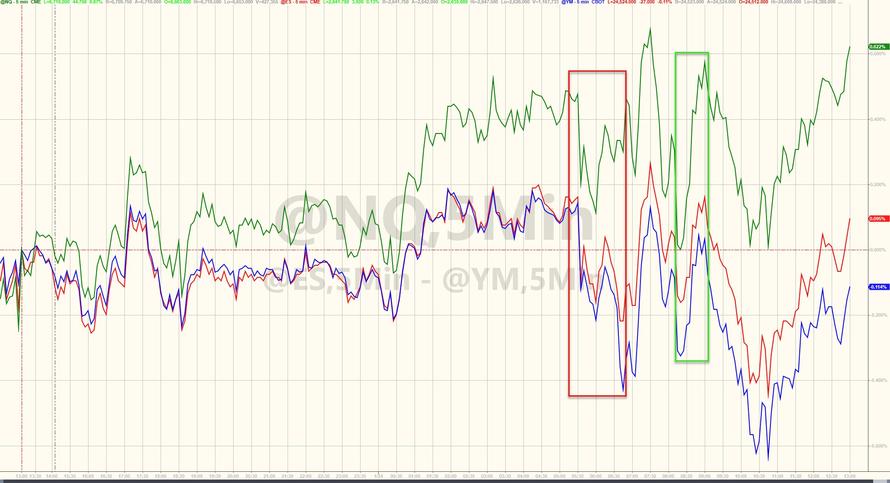

US markets were a rollercoaster of trade and shutdown headlines – Wilbur Ross admitted “miles and miles” to go until we have a trade deal with China and stocks puked. Algos ramped us into the US open, then dipped on weak PMIs, then The White House unleashed Larry Kudlow to save the world and he did briefly but we retested lows after that before the machines went back to work to rescue stocks from their 50-day moving averages…

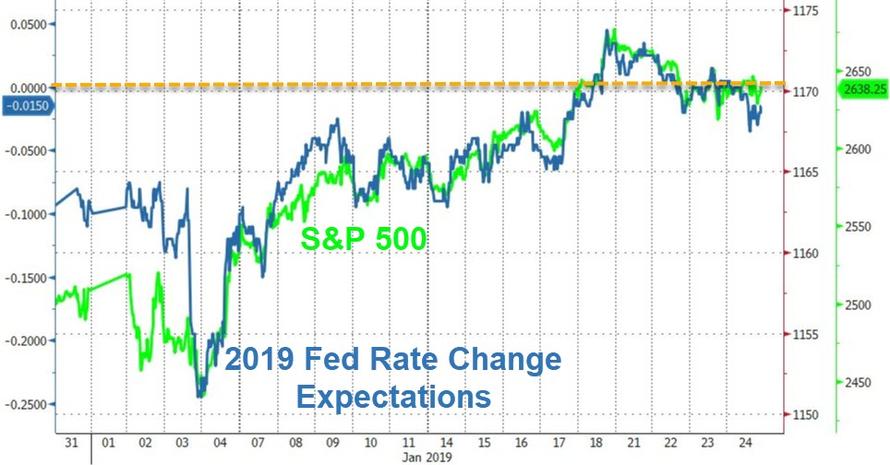

And here’s the fun-durr-mental reason they’re buying stocks…

While stocks bounced back, bonds were bid all day..

And yields ended near the lows of the day…

Big dump (Ross) and Pump (Kudlow) in the dollar today…

Noisy day in yuan today…

Litecoin jumped on the day and Bitcoin drifted modestly higher but remains down on the week…

Another chaotic day in crude markets but copper continues to trade lower (despite a bounce in china stocks)…

WTI dropped immediately after the DOE data (as it should) but then was panic-bid higher…

Finally, “hope” hits its lowest since Trump was elected…

And spot the difference – Fed Rate change expectations for 2019 and the S&P 500…

“Data Dependence” at its best!

via ZeroHedge News http://bit.ly/2sJ568D Tyler Durden