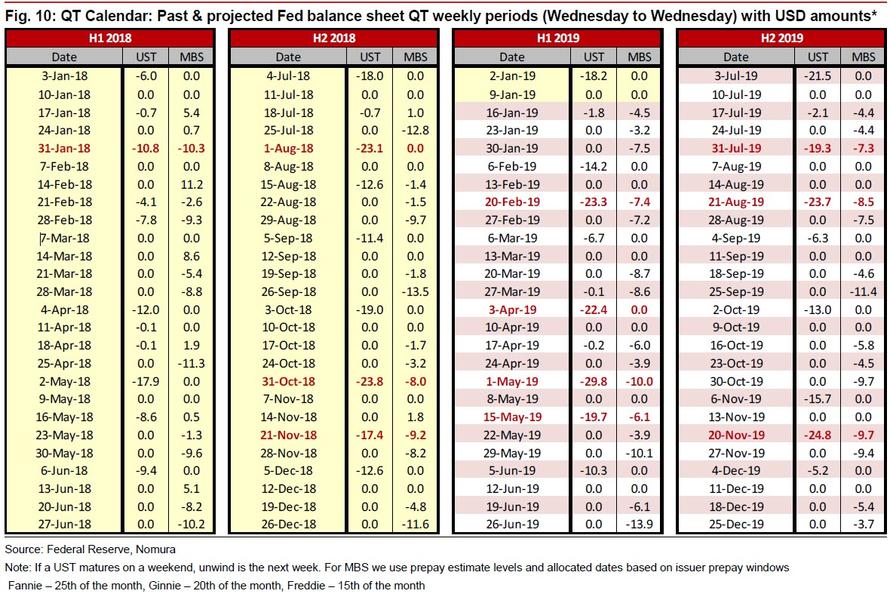

Over the weekend, we showed the one chart that every trader should have “taped to their screen“, namely Nomura’s latest recap of the key Fed balance sheet roll-off dates, or those days in which there is a tangible decline in system liquidity as billions in Fed holdings of Treasurys and MBS mature, and the resultant proceeds as the Treasury repays the Fed in cold, hard cash are subsequently destroyed by the Federal Reserve which, as part of Quantiative Tightening, is now in the process of shrinking the money currently in the system.

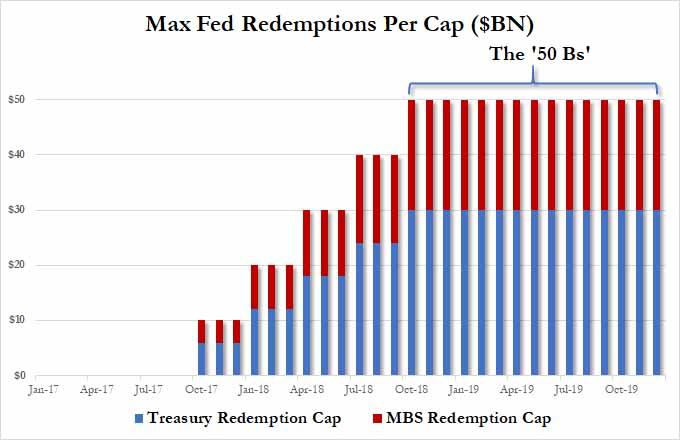

Well, it now appears that the chart above may have to be substantially truncated, because according to a d anticipated. That is, assuming the bank’s top policy makers follow through on speculation reported Friday morning by the Wall Street Journal report, the Fed might acquiesce to President Trump’s demands that they “stop with the 50 Bs” – a reference to the central bank’s monthly peak balance sheet runoff, which as we explained previously is really 36.2 Bs…

… sooner than many investors had anticipated.

Just a few weeks after Fed Chair Jerome Powell backtracked on his claim, articulated during the press conference that followed the December Fed meeting, that the runoff of the Fed’s balance sheet was on “autopilot”, the WSJ said Friday that the central bank’s top policy makers are seriously considering maintaining a larger balance sheet than what the central bank had initially anticipated when it stopped reinvesting the proceeds from expiring holdings.

Federal Reserve officials are close to deciding they will maintain a larger portfolio of Treasury securities than they’d expected when they began shrinking those holdings two years ago, putting an end to the central bank’s portfolio wind-down closer into sight.

Officials are still resolving details of their strategy and how to communicate it to the public, according to their recent public comments and interviews. With interest rate increases on hold for now, planning for the bond portfolio could take center stage at a two-day policy meeting of the central bank’s Federal Open Market Committee next week.

Yet nothing is certain yet, as Kansas City Fed President Esther George in a Jan. 15 interview: “A lot of the heavy lifting has been done. We’re waiting for the committee to be satisfied that they have reached sufficient understanding of what all the moving pieces are.”

Curiously, when the balance sheet unwind began, few – and certainly not Chicago Fed president Charles Evans – expected it would become such an important issue in the eyes of the market… which is of course bizarre considering it was the expansion of said balance sheet from under $1 trillion to its peak of $4.5 trillion that was the key catalyst behind the market’s rebound from the “generational low” in 2009.

The Fed began gradually shrinking its mortgage and Treasurys portfolio in 2017 by allowing securities to mature without reinvesting the proceeds into other assets. At the time officials said the slow unwind would fade into the background – the equivalent of watching paint dry.

As a result, the Fed expected the process to take up to four years to play out, with many expecting it to conclude some time in 2020. When the runoff began in October 2017, various officials estimated the portfolio—then around $4.5 trillion – could shrink to anywhere between $1.5 trillion and $3 trillion. New York Fed President John Williams went one better in April 2017, when he was the San Francisco Fed’s president, and said that runoff could last five years. Powell himself gave a tentaive ETA of 2020/2021.

“In about three or four years, we’ll be down to a new normal,” said Fed Chairman Jerome Powell at his Senate confirmation hearing in Nov. 2017.

But according to WSJ, the Fed now expects the runoff to end much sooner, though the paper hedged that many policy makers still “don’t understand why the market has placed so much emphasis on the balance sheet lately.” When Esther George surprised markets by calling for a pause on rate hikes, she added that it’s “unclear” whether the balance sheet shrinkage had accomplished much in the way of removing accommodation.

Apparently to the residents of the Marriner Eccles building, inflating the balance sheet is a major market stimulative effect, but its shrinkage should somehow be ignored by the market. And these are the people who set the price of money for the world’s biggest economy…

Whether Powell offers a similar take during the press conference after next week’s meeting will depend on the conversations that take place during the meeting. According to WSJ, the internal debate over the proper size of the balance sheet has focused on the necessary level of reserves in the banking system. Some believe that holding a large amount in reserve would help the Fed better control volatility in short-term credit markets.

Regardless of where the runoff ends, Lorie Logan, one of the officials responsible for managing the portfolio and an executive at the New York Fed, said in a speech last May that she saw “virtually no chance of going back to the precrisis balance sheet size”, which of course is logical: by 2020 there will be roughly $2 trillion in currency in circulation (and rising) which will be the new floor of the Fed’s balance sheet. Ultimately, the Fed hopes to dump practically all of the MBS it accumulated during QE and shift toward a portfolio consisting almost exclusively of Treasurys.

“The conversation is really about the relative amount of reserves,” she said.

This is a concept that many analysts believe isn’t well-understood by investors.

The idea that the Fed won’t return to its precrisis balance sheet size isn’t well appreciated by some stock investors, creating one potential source of market confusion, said Tom Porcelli, chief U.S. economist at RBC Capital Markets. “Equity investors think the runoff is going to continue in perpetuity,” he said.

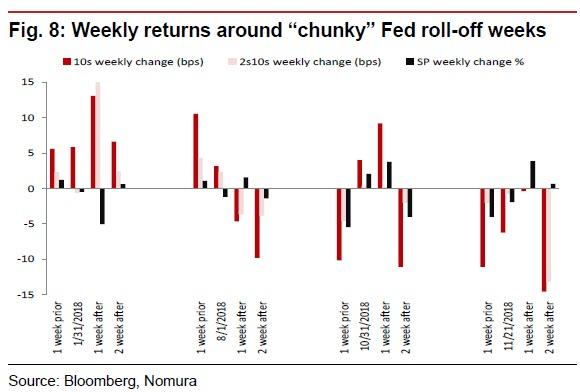

Well, no. As we discussed last week, investors are only doing what they did during QE and POMO days, only in reverse, and on days when the Fed withdraws liquidity, the market drops, in what JPM’s Marko Kolanovic explained recently has become a self-fulfilling prophecy.

Ultimately, the WSJ report could just be a trial balloon to see how markets – and maybe the president – react to signs of a more dovish take to shrinking the balance sheet. If it works, that should tell markets – and the Fed – everything they need to know. and so far, futures are solidly in the green…

via ZeroHedge News http://bit.ly/2HvJpDb Tyler Durden