It’s a sea of green across global markets, which resumed their rally overnight with European stock and US equity futures following Asian peers higher, shrugging off softer numbers from tech giant Intel and weaker German IFO data, buoyed by strong earnings and optimism from some positive trade-related comments by U.S. officials ahead of next week’s meeting, while tech shares rallied. Gold and oil climbed, while the dollar hit session lows following news Trump advisor Roger Stone was arrested for witness tampering.

European markets opened higher, led by automakers and tech stocks which rose 1.5% and 1%, respectively. Europe’s STOXX 600 index hit its highest since Dec. 4, up 0.8% on the day. Trade optimism received a fresh boost of optimism after Bloomberg reported that a Chinese delegation including deputy ministers will arrive in Washington on Monday to prepare for high-level trade talks led by Vice Premier Liu He.

The euro gained even as German business sentiment measured by the IFO Survey fell for the 5th month in a row to 99.1 its weakest level in almost three years, while the expectations component tumbled to the lowest level since 2012; confirming a recession in Europe’s biggest economy is closer than most expect; core European sovereign bonds stabilized after rallying for most of the week.

On Thursday, the euro fell to its lowest in six weeks following Thursday’s European Central Bank meeting in which Mario Draghi painted an increasingly downbeat picture of the European economy.

Europe’s gains came as stocks rose overnight in Asia and the United States on the back of strong earnings from U.S. tech firms. The MSCI All-Country World Index was up 0.3% on the day, but the gauge was set to break a four-week winning streak as weak economic data and cautious soundings from central banks pulled the index half a percent down on the week. Chipmaker and software stocks led the way in Asia, shrugging off weaker 2019 forecasts from Intel, which fell in pre-market trading.

Global stocks are poised for their first weekly drop of 2019, with investors questioning the validity of the post-Christmas rally as the earnings season rolls on. Traders are grasping at straws for hints at progress on trade ahead of discussions next week in Washington, while also assessing the economic impact of the 35-day government shutdown that’s hampering the normal flow of official data: “I’m reasonably positive,” Axel Merk, chief investment officer at Merk Investments LLC in San Francisco, told Bloomberg TV. “I don’t think we have an imminent recession which is usually one of the key ingredients to a real bear market, but it’s prudent to diversify.”

Markets reversed losses from earlier in the week even though according to the latest Reuters polls of hundreds of economists from around the world, a synchronized global economic slowdown is underway and any escalation in the U.S.-China trade war would trigger a sharper downturn, and despite a downgrade of US stocks to Neutral by Citi.

Offsetting the economic gloom, in a note to clients, UBS Global Wealth Management’s CIO Mark Haefele said that rhetoric on U.S.-China trade has become more positive, and that Beijing has taken steps to stimulate its economy.

“While economic and earnings growth is slowing, we believe it is unlikely that growth will drop far below trend,” he said. “At the same time, there are reasons to be cautious about policymakers’ ability to follow through on their rhetoric.”

Chinese Vice Premier Liu He will visit the United States on Jan. 30 and 31 for the next round of trade negotiations with Washington. The two sides are “miles and miles” from resolving trade issues but there is a fair chance they will get a deal, U.S. Commerce Secretary Wilbur Ross said on Thursday.

In US political news, President Trump said he wants a prorated down payment on the wall in any short-term government funding bill and that if Senate Majority Leader McConnell and Minority Leader Schumer can reach an agreement on government funding, he would support it. However, US House Speaker Pelosi said the idea of including a down payment on wall is a non-starter and Democrats were said to not support any kind of border wall funds which was made clear to McConnell, while Pelosi was later reported to postpone a press conference concerning counter offer to President Trump.

In central bank news, ECB dove Benoit Coeure said he sees a lot of political uncertainty and that economic slowdown is a surprise to the ECB, adds jury still out on how persistent slowdown will be and that rate guidance may have to be adjusted at some point. While, ECB’s Villeroy (Dovish) stated they remain committed to keeping interest rates low and ECB will probably downgrade the GDP forecast in March. Finally ECB’s Vasiliauskas (Hawkish) stated that there is no reason to change ECB guidance at the moment.

In currencies, the dollar fell 0.2%, hitting session lows shortly after news that Trump advisor Roger Stone had been arrested by the FBI. The euro rebounded 0.36% at $1.1345, recovering from a six-week low hit in the wake of ECB President Mario Draghi’s downbeat comments on Thursday. The ECB’s post-meeting statement for the first time since April 2017 alluded to “downside risks” to growth.

The British pound was also higher, rising 0.2 percent to $1.3076 after brushing a two-month high of $1.3140, lifted after The Sun reported on Thursday that Northern Ireland’s Democratic Unionist Party has privately decided to back May’s Brexit deal next week if it includes a clear time limit to the Irish backstop.

10-year U.S. Treasurys yields were slightly higher at 2.729% after dropping to a one-week low as pessimism over global growth supported safe-haven government debt.

In commodities, Brent (-0.1%) and WTI (+0.2%) prices are mixed and off of session highs, just under USD 62/bbl and USD 54/bbl respectively; in spite of yesterday’s unexpected EIA crude inventory build of 7.97mln vs. Exp. -0.042mln draw. Elsewhere, Russia was China’s largest crude oil supplier for December and 2018; with Russia being the largest crude supplier to China for the third year in a row. Gold (+0.3%) is marginally higher on the weakness in dollar, in spite of the positive risk sentiment reducing safe haven demand for the yellow metal. Copper prices are benefiting from market sentiment, whilst palladium has lost over 8% since reaching a high of just under USD 1400/oz last week.

Today’s publication of durable goods orders and new home sales is postponed by government shutdown. AbbVie and Colgate-Palmolive are reporting earnings.

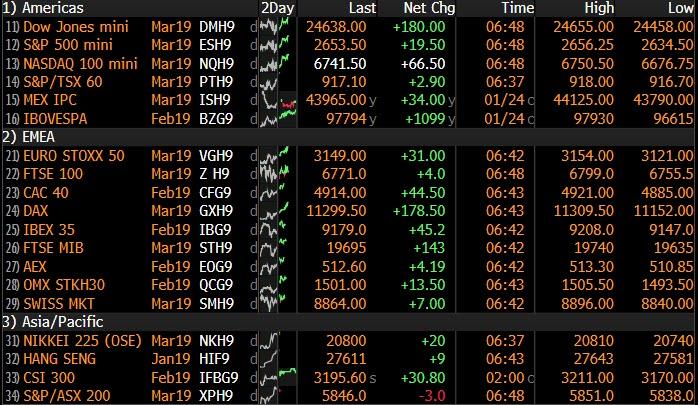

Market Snapshot

- S&P 500 futures up 0.6% to 2,650.75

- STOXX Europe 600 up 0.7% to 358.16

- MXAP up 1% to 154.44

- MXAPJ up 1.2% to 503.03

- Nikkei up 1% to 20,773.56

- Topix up 0.9% to 1,566.10

- Hang Seng Index up 1.7% to 27,569.19

- Shanghai Composite up 0.4% to 2,601.72

- Sensex down 0.6% to 35,985.79

- Australia S&P/ASX 200 up 0.7% to 5,905.61

- Kospi up 1.5% to 2,177.73

- German 10Y yield rose 0.8 bps to 0.188%

- Euro up 0.2% to $1.1330

- Italian 10Y yield fell 9.1 bps to 2.303%

- Spanish 10Y yield fell 2.0 bps to 1.22%

- Brent futures little changed at $61.13/bbl

- Gold spot up 0.2% to $1,283.61

- U.S. Dollar Index down 0.2% to 96.43

Top Overnight News

- A Chinese delegation including deputy ministers will arrive in Washington on Monday to prepare for high-level trade talks led by Vice Premier Liu He, according to people briefed on the matter

- Commerce Secretary Wilbur Ross said the U.S. and China are eager to end their trade war, but the outcome will hinge on whether Beijing will deepen economic reforms and further open up its markets. “We’re miles and miles from getting a resolution,” he said in an interview on CNBC on Thursday

- U.K. Chancellor of the Exchequer Philip Hammond warned that leaving the European Union without a deal would betray voters who were promised a “more prosperous future” if they chose Brexit. EU ties itself in knots on Irish border amid Brexit tension

- Senators began a new effort to end the 34-day partial government shutdown after blocking two rival spending bills. The White House signaled President Donald Trump was open to a plan to reopen agencies for three weeks, but at a price

- The Greek parliament’s historic vote on the agreement with the Republic of Macedonia over the latter’s name, was pushed to Friday, with not enough time for all listed lawmakers to speak Thursday

- Oil rose for a third day as a deepening crisis in Venezuela that threatens to complicate OPEC’s task of balancing world oil supplies outweighed a surprise jump in U.S. crude inventories

- Bank of England Governor Mark Carney said threats of jail for bankers are just a bluff and the real weapon to improve behavior is hitting pay packets

- U.K. Chancellor of the Exchequer Philip Hammond suggested he could quit the government in protest if the U.K. plunges out of the European Union with no-deal in nine weeks’ time

- Benoit Coeure and Francois Villeroy de Galhau — two of the top contenders to become the next ECB president — said they don’t know if the institution will be able to raise interest rates this year

A jubilant tone was observed across the Asia-Pac majors heading into the weekend, which followed the mostly positive performance of their global peers amid firmer US PMI data and a dovish tone from the ECB. ASX 200 (+0.7%) and Nikkei 225 (+1.0%) were buoyed by broad gains across the sectors and with Japanese exporters supported by favourable currency flows, although not all was rosy as healthcare lagged in Australia and steep losses in AMP Capital. Elsewhere, Hang Seng (+1.6%) and Shanghai Comp. (+0.4%) advanced as the 2nd phase of the PBoC’s RRR cut took effect and with outperformance seen in tech names including Tencent after regulators approved 2 of the Co.’s mobile phone games. However, gains in the mainland were initially capped after the PBoC‘s continued inaction resulted to a net weekly drain of CNY 770bln, in which it cited high liquidity levels due to the RRR cut. Finally, 10yr JGBs remained close to this week’s best levels after the prior day’s extended gains and with the BoJ also present in the market for government bonds with 5yr-10yr maturities, although prices have slightly eased with demand for bonds subdued by the risk appetite.

Top Asian News

- Goldman, Morgan Stanley Are Said to Ask to Cancel Jardine Trades

- Sinopec Says It Lost $688m on ‘Misjudged’ Oil Prices

- It’s Happy Friday Mode for Asia Traders as Stock Rally Lives On

- Yuan- Free FX Strategies for Betting on China. Or Against It

Major European indices are in the green [Euro Stoxx 50 +1.1%], the FTSE 100 (+0.4%) is the underperforming index given the impact of yesterday’s dovish ECB, alongside overnight sterling strength following reports that the DUP may agree to PM may’s deal if the Irish backstop has a time limit. The index is also weighed on by poor performance in Vodafone (-2.2%) who missed on their Q3 service revenue. Sectors are in the green, with underperformance in telecom names given the aforementioned earnings from Vodafone. Other notable movers include Telia (-3.3%) who are at the bottom of the Stoxx 600 after the Co. missed on Q4 revenue and adjusted EBITDA. Similarly, Givaudan (-3.3%) are near the bottom of the Stoxx 600 following a miss on Q4 revenue and adjusted EBITA.

Top European News

- ECB Presidential Contenders Wary on Chance of 2019 Rate Hike

- German Business Confidence Deteriorates Amid Heightened Risks

- Maersk Ready to Move Ahead With Drilling Unit IPO, CEO Says

- EU Ties Itself in Knots on Irish Border Amid Brexit Tension

- Russia Central Bank to Boost FX Buying as Ruble Steadies

In FX, the Dollar and overall index retraced some of yesterday’s trade and ECB-induced gains in which DXY reached highs just shy of 96.700. The index fell back below its 50 DMA at 96.549 and through the 96.500 level to currently hover nearer the bottom of a 96.300-530 range, with a 96.680 Fib also keeping the upside capped. Meanwhile, the US government shutdown is set to notch its 35th day after the US Senate blocked two competing proposals (although this was expected) and as a result today’s US building permits, durable goods and new home sales data will be postponed.

- EUR – Staging a recovery from post-ECB lows, when EUR/USD briefly lost the 1.1300 handle. Back above the level now, the single currency was largely unreactive to unsurprising narratives from ECB’s Coeure and Villeroy, while the release of an overall downbeat German ifo survey and downgrades in the ECB SPF also did little to wobble the Euro. EUR/USD now close to the top of a 1.1300-50 range ahead of a Fib level at 1.1351. In terms of option expiries, the pair sees EUR 1.96bln scattered around 1.1300-25, EUR 1.5bln between 1.1350-60 and EUR 2.8bln between 1.1375-1.1400.

- CAD – Rising oil prices and an easing buck sent USD/CAD back below its 50 DMA at 1.3350 to an intraday low of 1.3311 ahead of the psychological 1.3300 level with reported bids around the figure. A marginal pullback in energy sent USD/CAD back up to around the middle of a 1.3311-3361 band ahead of the Canadian budget balance release later today.

- GBP –Tumultuous day for the Pound after a Sun article provided Cable with the fuel to sky rocket past the 1.3100 handle to a high just shy of 1.3140, well above the December low of 1.2477. The article reported that PM’s coalition party, the DUP, are willing to back her Brexit deal if the Premier can get an expiry date to the backstop, though is widely expected to be rejected by the EC. Nonetheless, the idea of unity in the government aided the Pound to set fresh yearly highs vs. the buck. However, Cable has pared back most of the overnight gains, albeit holding just above its 200 DMA (1.3055-60) and closer to the bottom of 1.3057-3139 parameters.

- JPY – Choppy session thus far, but overall back on a decline amid the broad upturn in risk appetite around the market after USD/JPY rose above its 30 DMA at 109.79 to reach intraday highs of 109.91 (vs. low of 109.52) ahead of USD 1.2bln of option expiries at the 110.00 strike for the NY cut.

In commodities, Brent (-0.1%) and WTI (+0.2%) prices are mixed and off of session highs, just under USD 62/bbl and USD 54/bbl respectively; in spite of yesterday’s unexpected EIA crude inventory build of 7.97mln vs. Exp. -0.042mln draw. Elsewhere, Russia was China’s largest crude oil supplier for December and 2018; with Russia being the largest crude supplier to China for the third year in a row. Looking ahead we have the Baker Hughes rig count, where last week total rigs decreased by 25 to 1050. Gold (+0.3%) is marginally higher on the weakness in dollar, in spite of the positive risk sentiment reducing safe haven demand for the yellow metal. Copper prices are benefiting from market sentiment, whilst palladium has lost over 8% since reaching a high of just under USD 1400/oz last week.

US Event Calendar

- 8:30am: Durable goods orders data postponed by govt shutdown

- 10am: New home sales data postponed by govt shutdown

DB’s Jim Reid concludes the overnight wrap

As I finish this off I’m on the earliest train out of Davos and back to Zurich before travelling home. We had a DB drinks reception for our clients last night and one said to me that in 11 years of coming here the best advice would be to trade in the opposite direction to the main theme of the conference over the next 12 months. If you believe that then you should trade if favour of a return to globalisation trends in 2019 as the conference was generally concerned about its immediate path. Our CEO overheard this and said that on the main panel he was on, the head of the WTO was the contrarian. He said that 2019 will end up being around the lowest tariff year on record and an improvement on 2018. Clearly this relies on China and US either sorting out their differences or at least announcing a truce. However, it’s a reminder that although global trade has come off the peak, tariffs are still historically low outside of the main dispute. Personally, I think globalisation is in reverse but whether it’s a soft landing or not depends on policy. All to play for.

Back to the real (financial) world and yesterday lived up to the billing of being a busy day in markets with much weaker-than-expected European PMIs initially setting the tone. Draghi and the ECB then played for time – given March is where they get their latest staff forecasts – but acknowledged that risks were now to the downside. Elsewhere, Wilbur Ross downplayed expectations that a US-China trade deal is any closer, US jobless claims hit the lowest since around the time man first walked on the moon, and it was also a day where the government shutdown looked likely to continue for some time yet, even if there have been overnight attempts to find a deal to temporarily open government. So plenty to discuss.

However, by the end of play the main US equity indices hadn’t moved much as the S&P 500 eked out a +0.14% gain while the DOW dropped -0.09%. More positively, tech stocks rallied with the NASDAQ up +0.68%. The Philadelphia Semiconductor index advanced +5.73% on the back of strong earnings from Texas Instruments, Lam Research, and Xilinx. The STOXX 600 pared gains of as much as +0.49%, heading into negative territory after the ECB before closing +0.22%. Rates fell across the continent, as 10y Bunds and OATs finished -4.4bps and -5.0bps lower. BTPs outperformed, with yields down -9.3bps, to 2.66% and to the lowest level since last July. Treasuries rallied as well, with 10-year yields ending -2.5bps lower while the dollar rallied +0.45%.

The euro experienced sharp moves amid the data and ECB meeting. First, the single currency weakened around -0.44% following the soft PMI data (details below). It then held its level around 1.1340 as the ECB policy statement kept policy unchanged, which maintained forward guidance (“interest rates to remain at their present levels at least through the summer”) and said reinvestments will continue for an extended time beyond the first rate hike.

The euro then took another leg lower to 1.1307 after Draghi said the risks to the outlook have “moved to the downside.” However, this shift was ultimately viewed as somewhat incremental and the euro retraced all its moves to return to flat on the session as the press conference continued. Draghi confirmed that the Council decision was unanimous on changing the outlook but that the Council “didn’t discuss policy implications”. There was apparently “unanimity” among the council supporting the view that the “likelihood of recession is low”, but DB’s Mark Wall thinks the Governing Council is divided on the outlook, between one camp who expect uncertainties (Brexit, trade, etc.) to be resolved positively and another who is more worried about European domestic demand. The tension between these two views will probably not be resolved until the ECB publishes new staff forecast at its March meeting. Mark’s full thoughts are available here.

On other policy questions, there was also no decision made on TLTRO, although it was mentioned by several officials and clearly talked about, while the positive side effects were talked up by Draghi later on. That perhaps leaves the option open for March but didn’t provide any insight beyond that. The issue of negative rates and their impact on banks was also posed to Draghi, however, it was mostly a repeat of the line he used in December. Draghi specifically said that “we have to see how the continuation of negative rates will affect this balance” in response to a question on if the ECB would have to do something about it. Again a non-committal answer.

As highlighted earlier, in the midst of Draghi speaking, headlines also hit the wires from across the pond and specifically comments from US Trade Secretary Ross. He said that the US and China were “miles and miles” away from a resolution, which caused a kneejerk reaction in markets but then followed by saying that there is a “fair chance” that the two countries would arrive at a trade deal. He also added that it was “unlikely” that next week’s meetings between the two sides would result in a final solution. Crystal clear then. Later on, Director of the National Economic Council Larry Kudlow said that President Trump was optimistic about talks with China, so no shortage of noise on the trade front.

President Trump himself tweeted later in the session about the ongoing government shutdown, saying “We will not Cave!” and escalating the tension. The senate voted on two bills to reopen government, but neither received enough support to pass. Overnight, the debate has seemingly moved on as to whether government could reopen for three weeks if Mr Trump received a down payment for the wall. Pelosi has already poured cold water on the idea but it perhaps shows that negotiations aren’t completely breaking down. In the background, the Washington Post reported that White House Chief of Staff Mick Mulvaney has asked all executive departments and agencies for lists of their highest-impact programs which could be negatively affected if the shutdown continues into March or April. Probably always good to prepare for the worst, but such a long shutdown, if realised, would have serious implications for the US economy.

In Asia this morning, technology stocks are leading markets higher, with the Nikkei (+1.06%), Hang Seng (+1,34%), Shanghai Comp (+0.57%) and Kospi (+1.49%) all moving upwards. Other significant news overnight has come from the UK, where sterling rose 0.5% against the dollar to its highest level in over two months, after the Sun reported that the DUP would be prepared to back Prime Minister May’s Brexit deal if there were a time limit to the Irish backstop. The news comes ahead of Tuesday’s debate in the House of Commons, where Parliament will have the opportunity to vote on a variety of amendments put forward by MPs to May’s Brexit plan.

Back to the details of the PMIs, which actually ended up requiring a bit of digging through such was the disparity between sectors and countries. However, the bottom line is that momentum is certainly weaker. The composite reading for the Euro Area for instance came in at 50.7 compared to expectations for 51.4. That’s also down 0.4pts from the soft December reading and is the lowest now since July 2013. The data is also consistent with GDP growth of just +0.1% qoq, which paints downside risks to the consensus forecast for 2019 growth of around 1.3% (DB 1.2%). In terms of sectors, manufacturing slumped more, by 0.9pts to 50.5 (vs. 51.4 expected) while the services reading fell 0.4pts to 50.8 (vs. 51.5 expected). As you can see though both were much softer than expected.

What was interesting was the split between Germany and France. In France the services reading tumbled further by 1.5pts to 47.5 (vs. 50.5 expected) and to the lowest in nearly 5 years. The manufacturing reading bounced back in contrast to 51.2 (vs. 50.0 expected) from 49.7, however, the extent of the drop in the services reading left the composite at 47.9 versus 48.7 in December. So rather worryingly there was little sign of a rebound after recent protests. In Germany the pain was reserved for the manufacturing sector, which tumbled to 49.9 from 51.5. That’s the first sub-50 reading since November 2014. The services reading did, however, rise 1.4pts to 53.1, which left the composite at 52.1 and up 0.5pts from December. Our economists also highlight that the implied non-core PMI numbers aren’t pretty with the implied non-core composite down 1pt equally, shared by the manufacturing and services sectors. Manufacturing PMIs for Italy and Spain will print next Friday alongside the final readings across the globe.

The associated statement with the PMIs highlighted “ongoing auto sector weakness, Brexit worries, trade wars and the protests in France” as reasons dampening growth in both sectors but also that the survey responses “indicate that a deeper malaise has set in at the start of the year” and that “companies are concerned about a wider economic slowdown gathering momentum, with rising political and economic uncertainty increasingly affecting risk appetite and demand”. With the manufacturing reading for the Euro Area and Germany now down in 12 of the last 13 months, a quick refresh of our equity versus PMI regression analysis shows that the STOXX and DAX are still around 14% and 17% ‘cheap’ respectively and that implied PMIs are actually more like 46.0 for the Euro Area and 43.7 for Germany based on equity markets. France looks 16% ‘cheap’ by the same measure. So despite the decline in PMIs, equity markets have oversold by this basic measure in Europe. However, for there to be a sustainable rebound, the PMIs need to find a base. Something they have struggled to do for over a year now.

In the US, initial jobless claims fell to 199k, the lowest level since 1969, as the US labour market continues to strengthen. Continuing claims fell from 1,737k to 1,713k, near the cyclical and multi-decade lows. The US PMIs, while not as significant as the European vintages, showed some improvement with the manufacturing index up to 54.9 from 53.8. The services reading fell 0.2pts to 54.2, while the composite print ticked up to 54.5 from 54.4. The Kansas City Fed’s manufacturing index rose to 5 from 3, though the anecdotal details suggested some concerns over both tariffs and the government shutdown. Altogether, the PMIs and KC Fed index did not move the needle for our expectations of next Friday’s ISM manufacturing report.

Finally, the day ahead will feature the January IFO survey in Germany this morning along with the January CBI reported sales survey in the UK. The US session is meant to feature the December durable and capital goods orders data, as well as the January new home sales print, however, the government shutdown will delay that once more. The earnings calendar features AbbVie and Colgate-Palmolive, as well as Ericsson in Europe.

via ZeroHedge News http://bit.ly/2FNp6j9 Tyler Durden