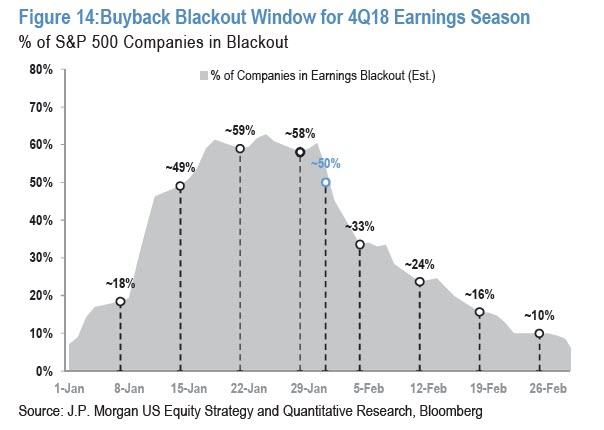

The coming week will not only be the heaviest in terms of number of S&P500 companies reporting Q4 earnings, it will also see the peak of the current buyback blackout window. As JPMorgan shows in the chart below, in the week of Jan 29, roughly 60% of all companies will be prohibited from repurchasing their stock, a potential downside risk as should a negative catalyst emerge – say US-China Trade talks fail to impress – there will be far fewer companies able to provide a natural shock absorber to a rapid drop.

That’s the bad news. The good news is that one the blackout period is over, and starting next week, only a third of the S&P will be prevented from repurchasing stock, companies will be able to return to doing what they have done best in the past decade – buyback their own stocks, reducing their shares outstanding, and artificially boosting their EPS, stock price and equity-linked management compensation.

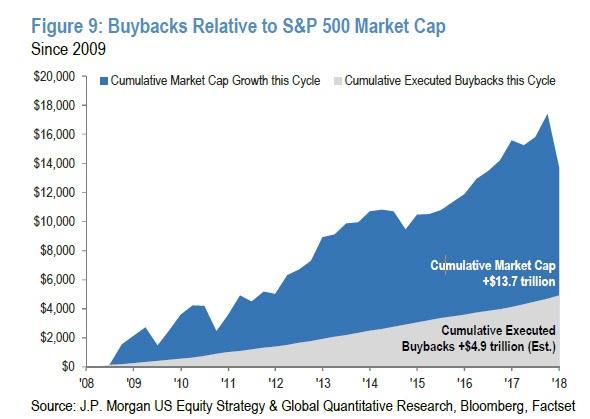

Indeed, as JPMorgan’s Dubravko Lakos-Bujas writes, buybacks have been a key theme through this cycle with S&P 500 companies returning ~$5 trillion to shareholders since 2009…

… and contributing ~2% to annual EPS growth.

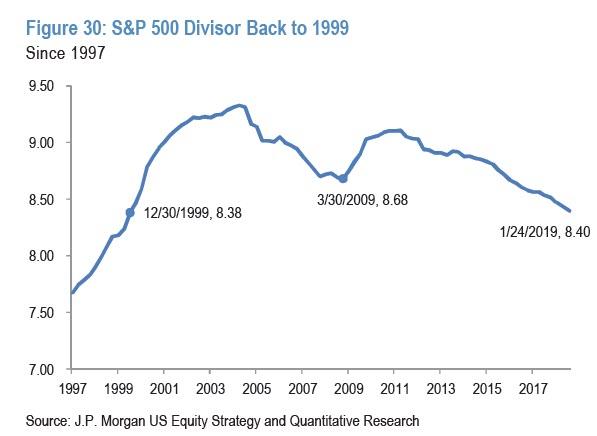

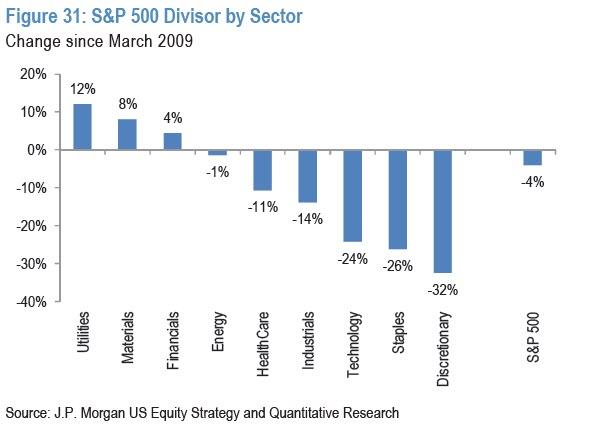

As a result, the S&P 500 divisor has fallen to 1999 levels as billions in shares have been taken out of circulation…

… with the discretionary sector enjoying the biggest decline in outstanding shares since March 2009.

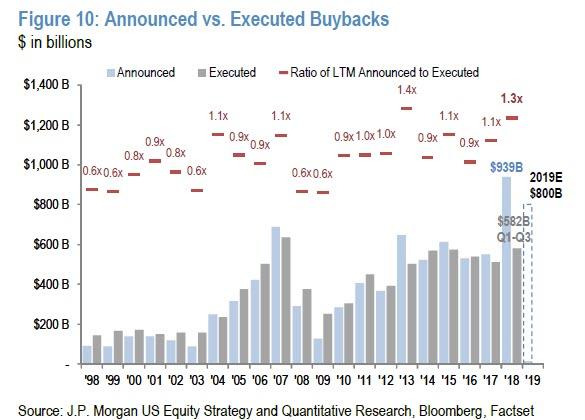

As we discussed previously, 2018 was notable for not only being the worst year for global capital markets since the financial crisis, it was also the year which saw record buyback announcements of $938 billion, led by Technology ($350b) and Financial ($194b) companies alone which announced as much as all S&P 500 companies in 2017 (~$550b).

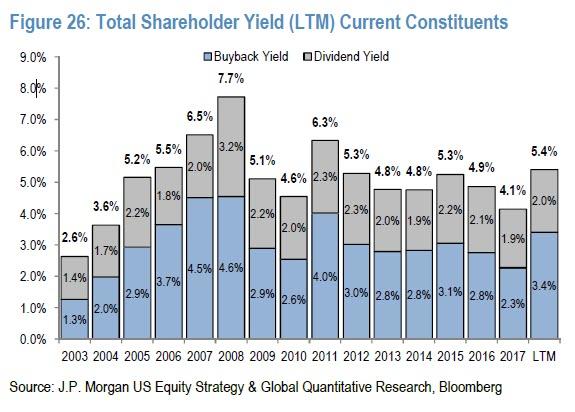

The even better news for bulls, is that in 2019, JPM expects S&P 500 companies to execute ~$800 billion in buybacks and return an additional ~$500b via dividends, inline with 2018 shareholder return, and adds that “Despite higher shareholder payouts, S&P 500 companies continue to reinvest as evidenced by double-digit growth in capex and R&D.”

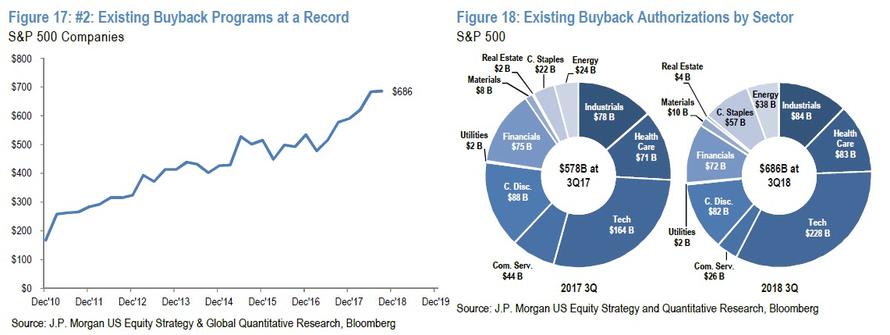

Narrowing the lookback window, the JPM strategist notes that despite the recent market volatility, buyback activity has been very strong during 4Q18 (including December) and the bank expects it to remain robust in 2019 given profit growth (30% EPS growth 2017-19), lower valuation (~1x lower than average and ~4x lower than cycle peak), and a record high ~$700b available to execute under existing authorizations.

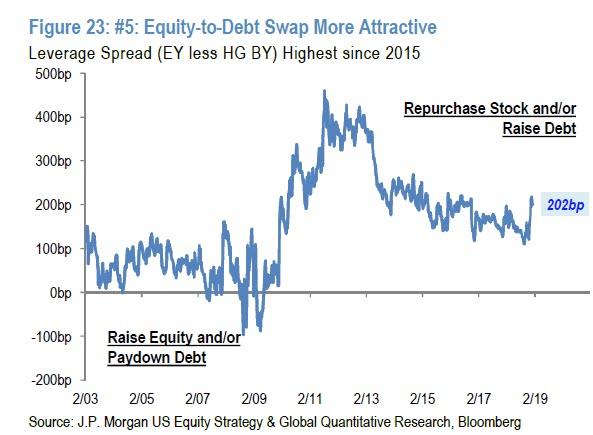

Looking ahead, JPM expects technology companies to continue aggressively buying back shares given stronger growth, higher margins, lower capital requirement, and still high overseas balance (~$180b repatriated with ~$585b remaining). For Financials, the bank expects another strong year on continued release of excess capital/reserves and again anticipate a seasonal pickup in announcement activity mid-year when capital plans are approved by regulators, however, this will likel taper in 2020.

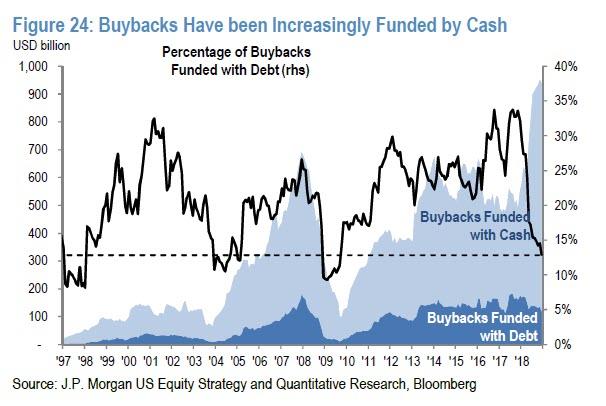

Another interesting observation from JPM: whereas historically, buybacks were largely funded with new debt, the bank finds that buyback executions in 2018 were some of the “highest quality of this cycle” as they were predominantly funded by cash rather than debt, a trend the bank expects to persist into 2019.

Based on JPM estimates, debt funding of buybacks peaked at ~34% in 2017 before falling to a cycle low of ~14% in recent months, and notes that if volatility remains elevated, corporates are likely to opt for buybacks over M&A and dividend growth. This would result in further de-equitization and even lower S&P 500 divisor, which is already at a 20yr low.

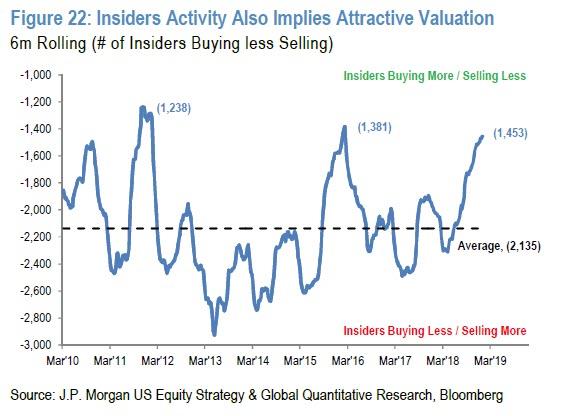

While leverage spread is attractive at ~200bp (earnings yield less HG bond yield, see Figure 7), JPM believes buybacks will remain primarily funded by cash flow (~$2tn) and balance sheet cash (still elevated at ~$1.6tn ex-Financials).

Also, S&P 500 companies have repatriated ~$340b or ~27% in foreign held funds thus far with an additional ~$1 trillion still held abroad.

And while JPM clearly remains optimistic on near record buyback activity in 2019, noting that “despite high market volatility, buyback announcements and recent insider activity imply corporate sentiment remains healthy”, if last year was any indication not even almost $1 trillion in announce buybacks could prevent the broader market from tumbling.

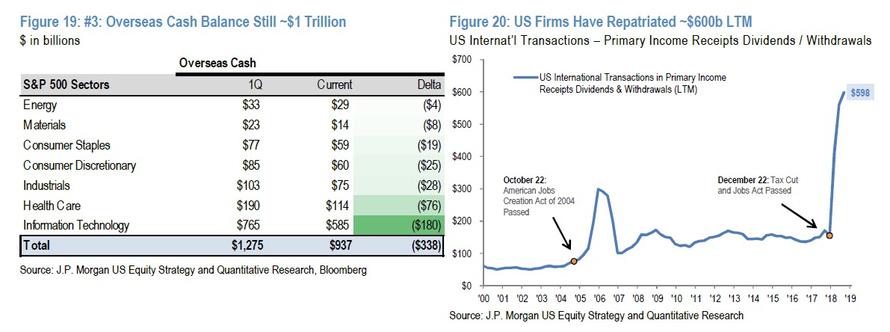

JPMorgan makes one final point, looking at Insider Activity, namely that “the recent insider activity implies that corporates are still optimistic about the current cycle. In fact, the current near record level of insider bullishness is similar to the prior two intra-cycle resets (i.e. 2011 and 2015-16) in which insiders sold fewer shares and stepped up purchases on lower valuation.

via ZeroHedge News http://bit.ly/2FRQo7Q Tyler Durden