Yesterday we provided an extensive preview of why there is a substantial risk the Fed will disappoint the market today when it fails to deliver a message as dovish as what the market now expects, both on the future of the Fed’s rate hike trajectory but more importantly on the future of the Fed’s balance sheet rolloff.

Picking up on what the Fed may or may not say in both its statement and during Powell’s press conference, Goldman writes that two issues will be the focus: guidance on the funds rate and guidance on the balance sheet. Here are the details.

Regarding the first, Guidance on the funds rate, Goldman writes that the December FOMC statement softened the sentence on future rate hikes by adding the word “some,” and by replacing “expects” with “judges,” to read, “The Committee judges that some further gradual increases in the target range for the federal funds rate will be consistent with” its policy objectives. The December minutes further softened this language to “will most likely be consistent with,” and Goldman expects this change to carry over to the January statement.

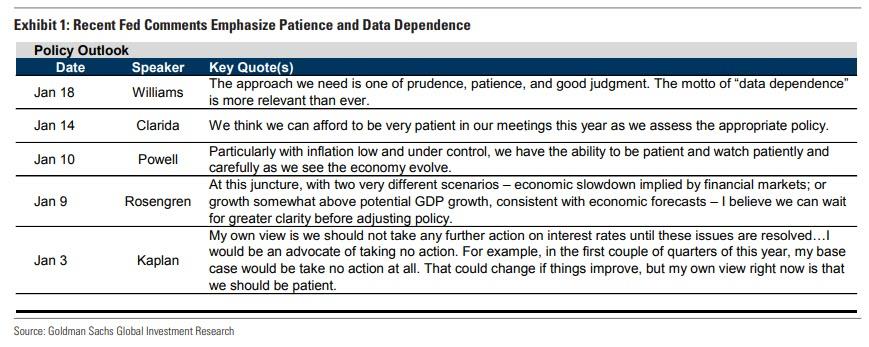

Furthermore, recent speeches by Fed officials have emphasized that the Committee can be patient for now and that decisions about further changes in the policy stance are data dependent. Both themes will likely be incorporated into the statement by noting that the Committee will “patiently continue to monitor incoming data.”

Some market participants expect the Committee to go further and remove the current hiking bias from its statement altogether. This is not Goldman’s expectation, but it is possible. The December minutes reported that “several” participants argued for the removal of the hiking bias at that meeting, and recent Fed commentary summarized in the Chatterbox has sometimes emphasized data dependence without indicating a continued hiking bias. A more dovish alternative to the baseline for the statement could fully emphasize data dependence with language such as “in making changes to the stance of policy, the Committee will be guided by the implications of incoming data for the economic outlook.”

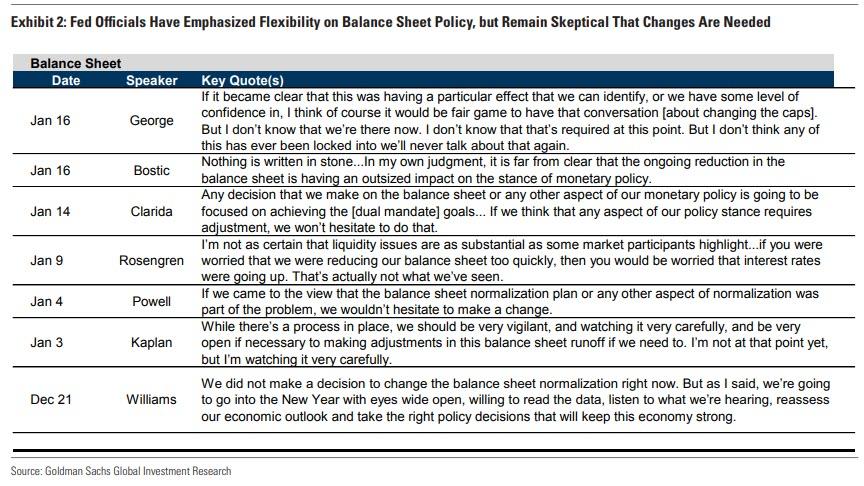

Regarding the second, and arguably much more important, guidance on the Fed’s Balance Sheet, Goldman does not expect the FOMC to make formal changes to its plan for balance sheet runoff at the January meeting, though it could make changes at later meetings. Investors are focused on two potential changes:

- First, the FOMC could revise the June 2017 addendum to the Policy Normalization Principles and Plans, which currently says that “a material deterioration in the economic outlook” leading to “a sizable reduction” in the funds rate would be required to resume reinvestment before runoff has run its course. To Goldman, even a scenario of limited rate cuts alongside continued balance sheet reduction—using the two tools simultaneously but at cross purposes—seems unlikely, and the FOMC might eventually lower the bar for ending runoff in the event of a slowdown in the economy. However, Fed officials will likely worry that making such a change now would risk unintentionally suggesting that rate cuts are on the near-term agenda.

- Second, the FOMC could eventually taper its run-off by gradually reducing the monthly roll-off caps as the level of reserves approaches its longer-run level. The intent would be to reduce the risk of unintentionally shrinking the balance sheet past the point of reserve scarcity. The December minutes noted that some FOMC participants commented on this option at that meeting. While tapering is possible at some point this year, the minutes suggested this discussion is still in an early stage and it is unlikely that the Committee will make a change next week. Instead, Goldman expects Chairman Powell to simply reiterate at his press conference that balance sheet policy is flexible in principle. Fed officials have emphasized flexibility in their recent comments on balance sheet policy, but most have also said that they do not believe changes are currently needed.

In addition to the above revisions, Goldman also expects the Fed to make the following changes to its statement:

- Economic activity downgraded to “solid”: Available data since the December FOMC meeting point to a deceleration in growth. Many Fed officials have acknowledged the likelihood of slower growth in 2019, and several have also mentioned the negative impacts of the prolonged government shutdown, with New York Fed President John Williams saying it could “pull growth down by up to a half percentage [point], or maybe even a percentage point, if it continues.” We expect the statement to characterize

- economic activity as “solid,” compared to “strong” in December. However, with the lack of hard data due to the ongoing shutdown—and Goldman’s Q4 GDP tracking estimate of 2.5% still above potential—it is possible that the statement continues to characterize growth as “strong.” The statement will likely describe business fixed investment as having “increased moderately,” and to continue to describe growth in consumer spending as “strong.

- Unchanged labor market language: The statement will continue to describe job gains as “strong, on average, in recent months” following a 312k rise in payrolls in December. While the unemployment rate increased 0.16pp to 3.86% in December, the statement will continue to say that the unemployment rate “remained low,” consistent with the language used recently following similar changes.

- No change to inflation: Goldman’s economists expect no change in the statement’s inflation description. While inflation breakevens have come down, household inflation expectations as measured by the University of Michigan’s 5-10 year expectations increased to 2.6% in the most recent survey, matching a two-year high.

- No mention of government shutdown: Although several Fed officials have mentioned the negative growth implications of the shutdown, Goldman does not expect the statement to mention it. During the last prolonged shutdown in 2013, meeting transcripts show that then-Governor Powell argued against a proposed mention of the shutdown and the Fed ultimately did not include any mention in the statement.

Putting all of the above together, this is what Goldman believes the Fed’s statement (blacklined) will look like:

The revisions above are consistent with what Deutsche Bank economists also expect: they note that the most meaningful alteration will be to the forward guidance language. Indeed at the December meeting the statement noted that the “Committee judges that some further gradual increases” in rates would be consistent with the Fed’s dual mandate; here DB believes that this statement is now too strong given intermeeting developments and expect the language to be softened by noting that the Fed expect “further gradual adjustments” in policy will be consistent with the Fed’s objectives.

As for Powell’s press conference, Deutsche Bank economists expect a similar message to be reiterated with the unspoken takeaway likely to be that June is the earliest possible date for another rate increase. The balance sheet topic is likely to be a talking point although DB doesn’t expect any major announcements, which risks hurting dovish market sentiment.

via ZeroHedge News http://bit.ly/2Wv6Wrt Tyler Durden