The Fed capitulation appears to have been seen early by gold and the market is now implying a 13.5bps rate-cut in 2019… as stocks soar…

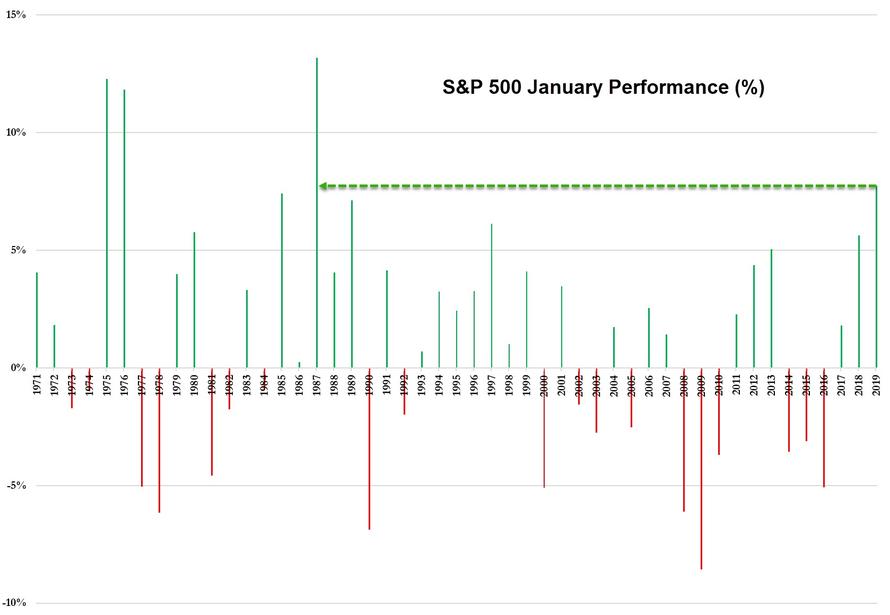

After the worst December in 100 years, the S&P just experienced its best January since 1987…

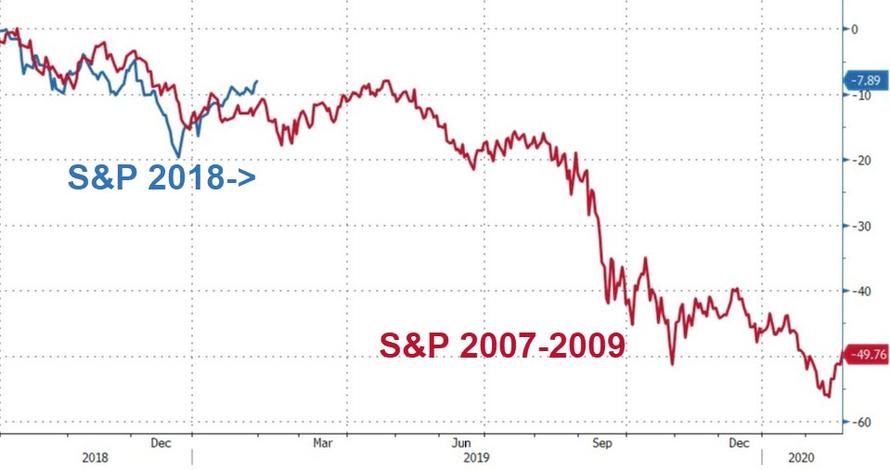

Is this really what you wanted Mr.Powell? This is how it ends…

Chinese stocks were very mixed in January with tech-heavy indices hit hardest (CHINEXT red) and the major industrials outperforming on stimulus, trade-talk optimism…

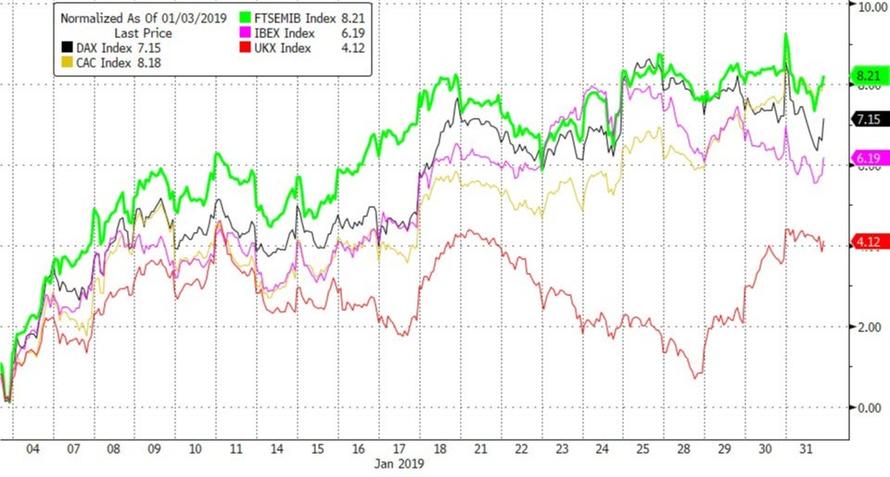

German retail sales collapse and Italy enters recession and Italian stocks soar to its best January since 2011!!

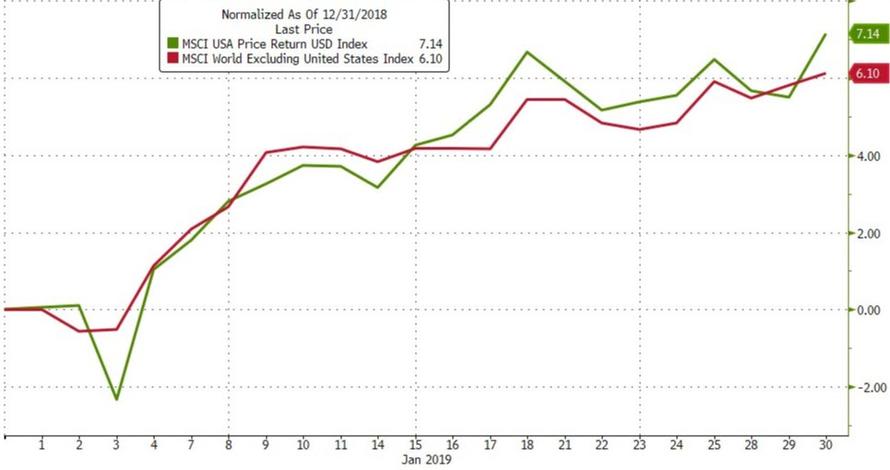

US markets and non-US markets are joined at the Central-bank-driven hip…

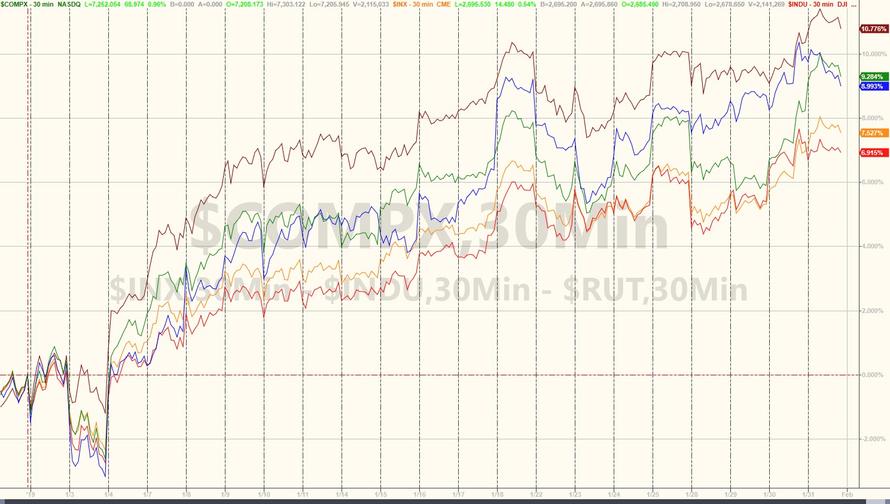

US equity markets were also exuberant in January (especially the last few days). Small Caps led the majors, soaring over 10% – the best month since Oct 2011 and the best January since 1987…

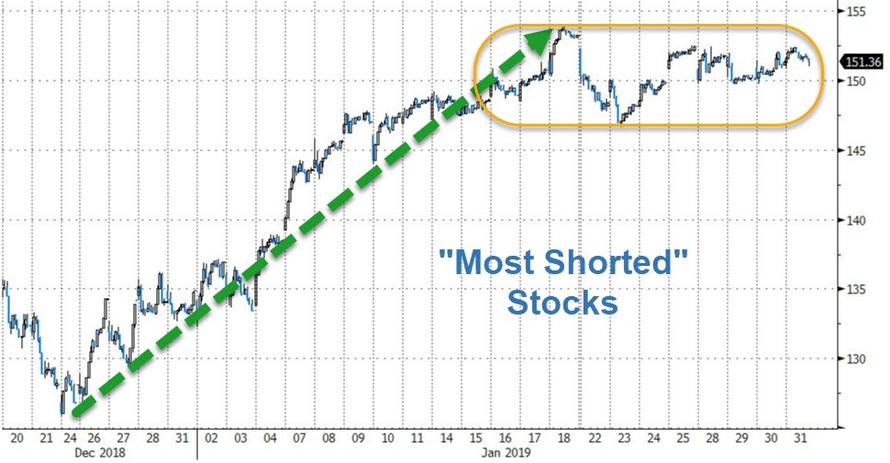

All on the heels of the biggest monthly short-squeeze since September 2010…

FANG Stocks soared over 31% off the lows…

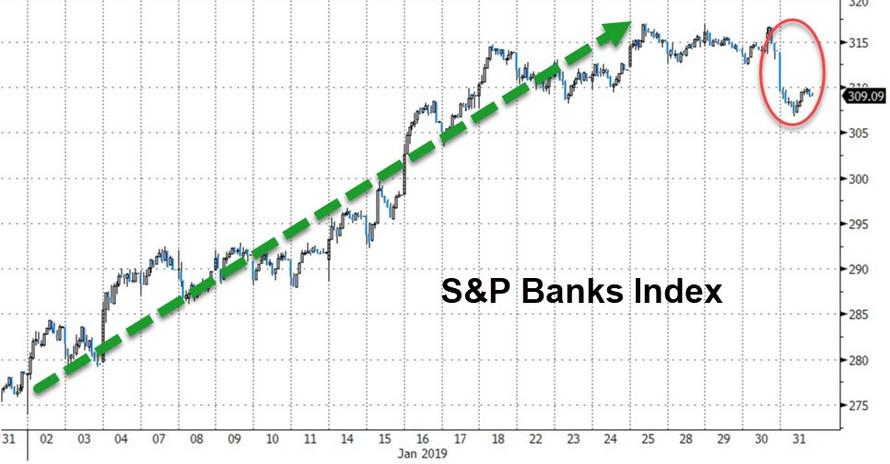

A big January for banks also…

On the week, thanks to Powell’s fold and Lighthizer’s trade comments, we are back in the green…

GE was today’s big winner…

Credit spreads and VIX collapsed in January… (with credit dramatically outperforming in the last week or so…

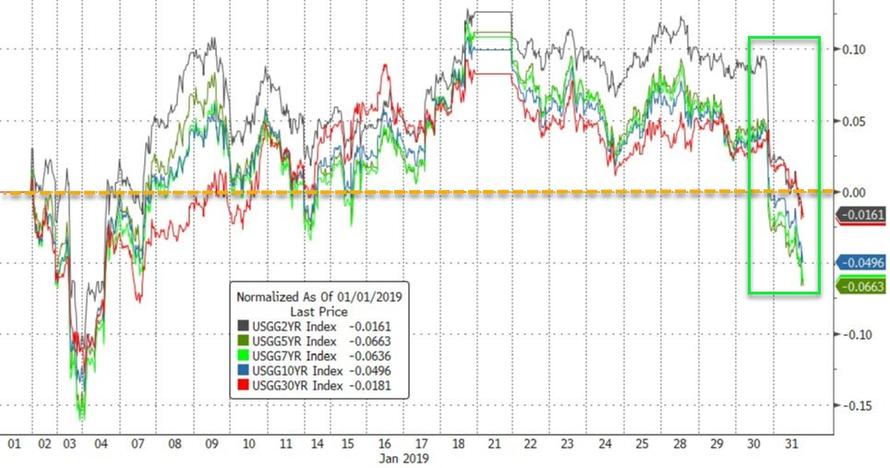

The last few days have seen Treasury yields tumble – accelerating after Powell – leaving all yields lower in January…

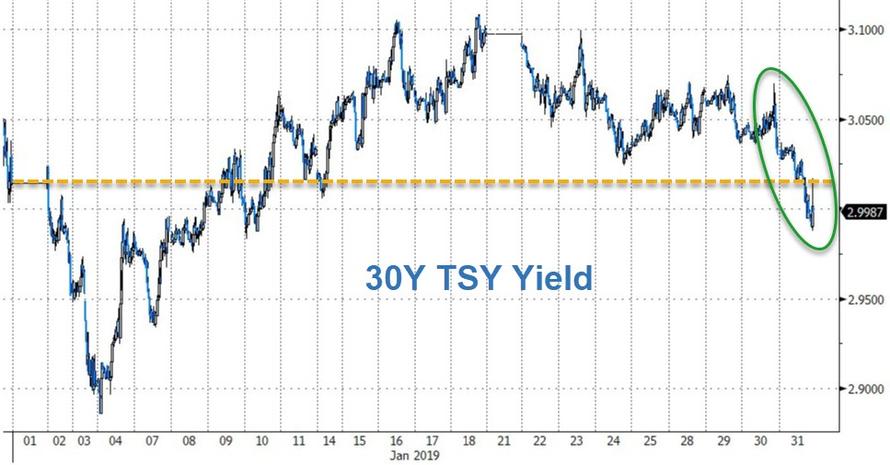

30 TSY yields tumbled back below 3.00%…

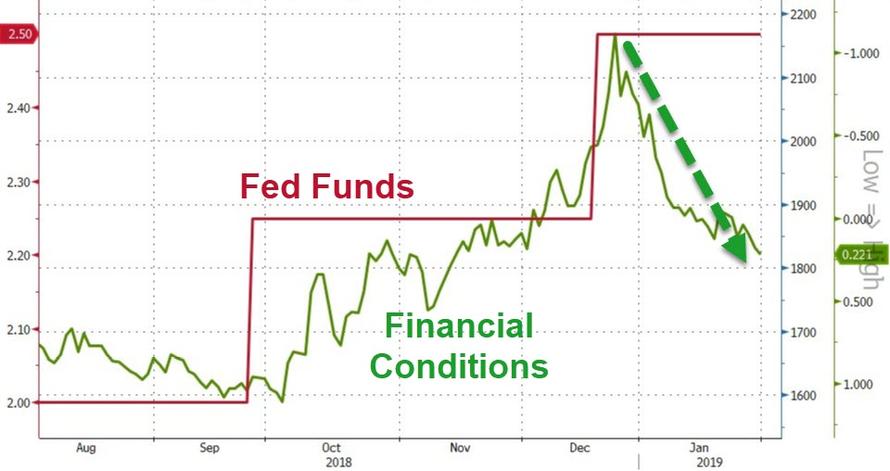

Financials Conditions have eased dramatically – erasing the last hike’s tightening…

The Dollar dropped for the 3rd month in a row (biggest monthly drop in a year) slammed to 4-month lows after The Fed yesterday…

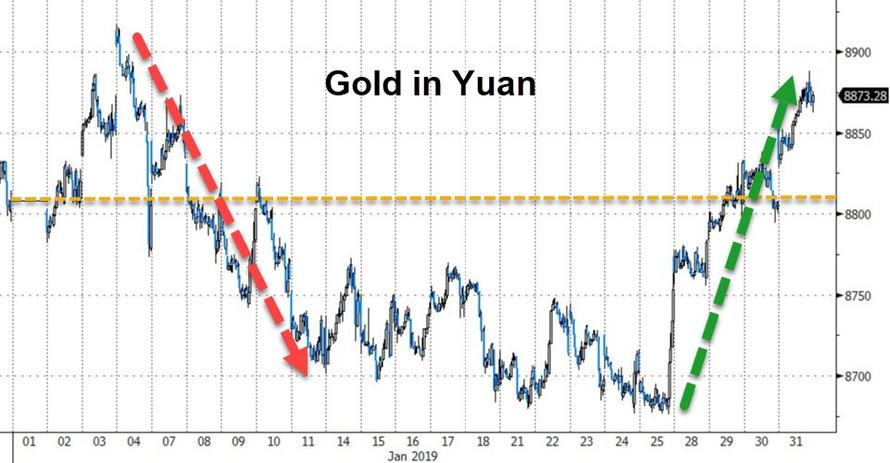

Yuan surged in January as the dollar slipped…

Despite dollar weakness, cryptos slipped again in January…

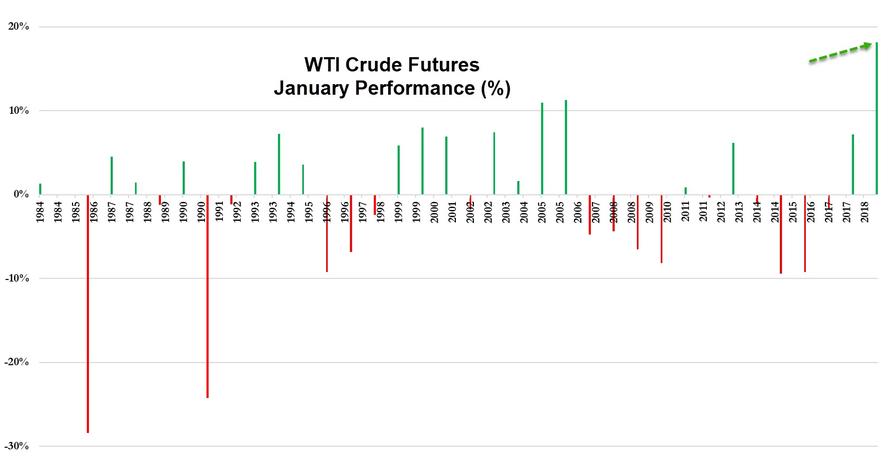

All major commodities made good gains in January, led by WTI…

WTI Crude soared over 18% in January (its best month since April 2016)…

This was WTI’s best January ever…

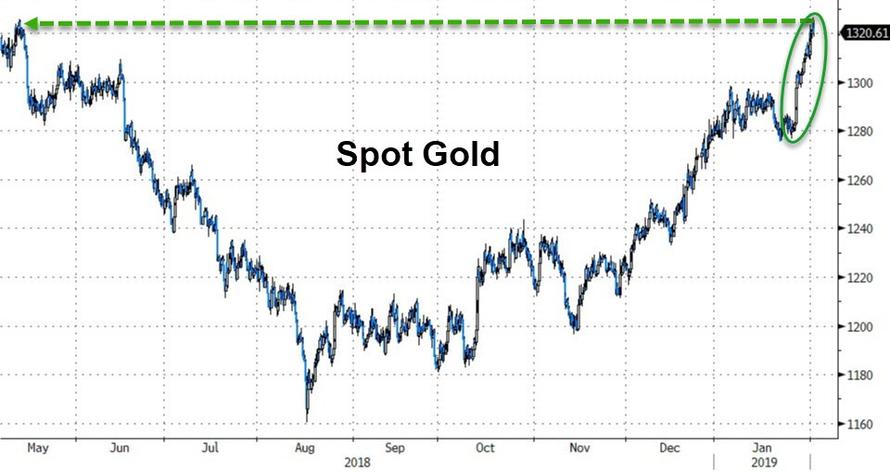

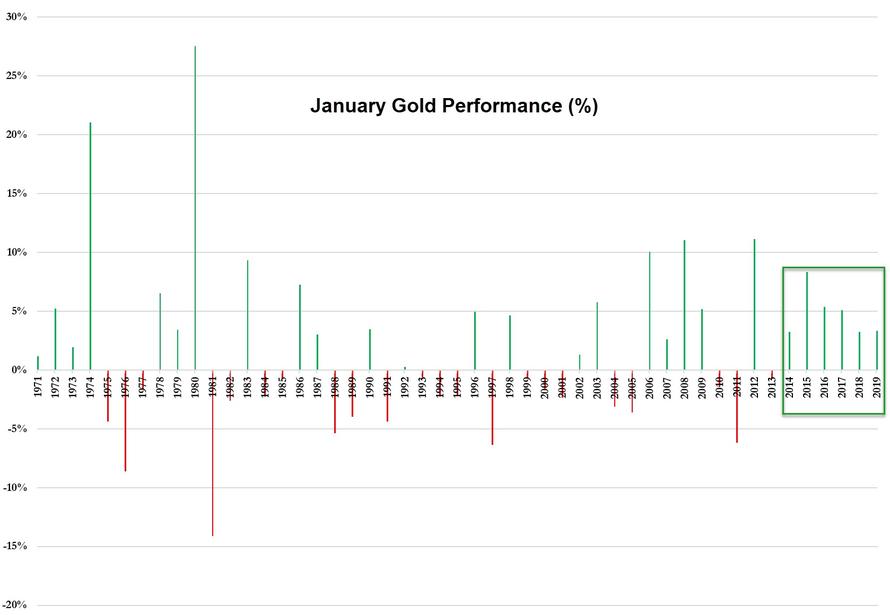

Gold had a great month too…

Ending the sixth straight January with gains…

While gold soared against the dollar, it barely broke-even in January against the Yuan…

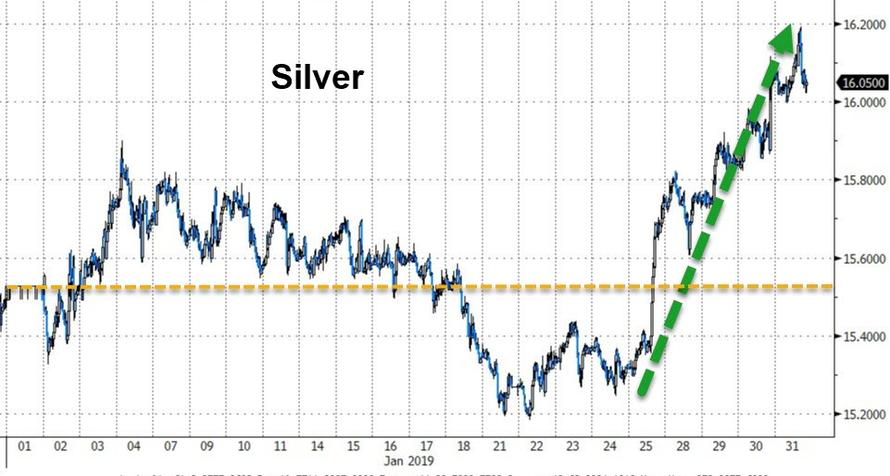

Silver also had a solid January (the 7th year of the last 8 with a positive January)

In other commodity news, Nickel just posted its best January in more than two decades.

As Bloomberg notes, the metal, used in stainless steel and electric vehicles, surged 17 percent in the month amid bets that demand will rise as a production deficit deepens. Prices extended gains this week after Vale SA’s dam disaster fueled speculation that shutdowns at some of the company’s iron ore sites could extend to its nickel operations, tightening supplies further.

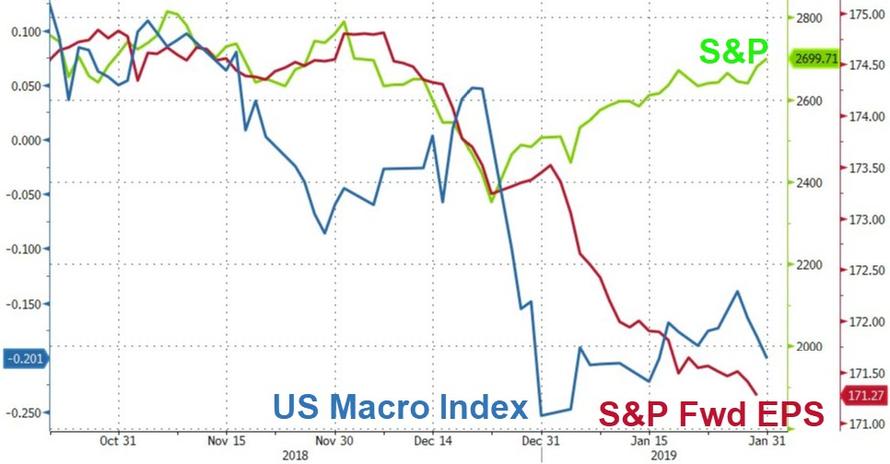

Finally, amid all the exuberance in January, the month saw the biggest drop in forward earnings expectation in three years…

But all stocks care about is how easy Powell can be…

“You Are Here”…

* * *

“You have meddled with the primary forces of nature, Mr Powell, and we won’t have it! Is that clear? … And you will atone.”

via ZeroHedge News http://bit.ly/2Rwzb5a Tyler Durden