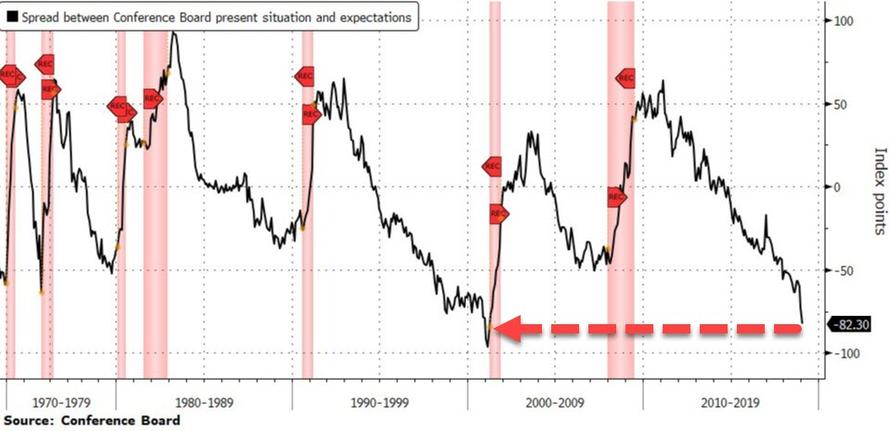

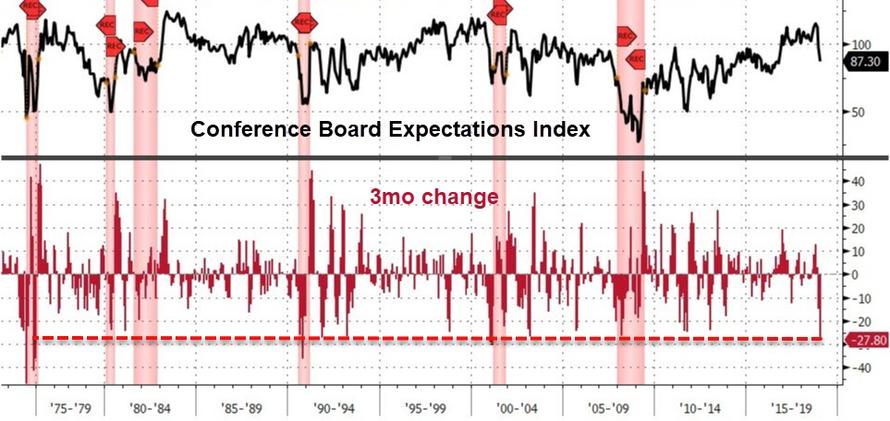

Having earlier in the week indicated his grave concern that a recession looms, signaled by Conference Board sentiment extremes…noting the spread between the Conference Board’s current sentiment and expectations is the widest since March 2001, the first month of the U.S. recession that year.

Which DoubleLine’s CEO Jeff Gundlach warned…

The most recessionary signal at present is consumer future expectations relative to current conditions. It’s one of the worst readings ever.

— Jeffrey Gundlach (@TruthGundlach) January 29, 2019

The bond guru told Reuters in an interview tonight that fragile equity markets forced Fed Chair Jerome Powell to pledge on Wednesday that the U.S. central bank will be patient with future interest rate hikes

“He’s caving to the stock market. The stock market scared him,” in late 2018.

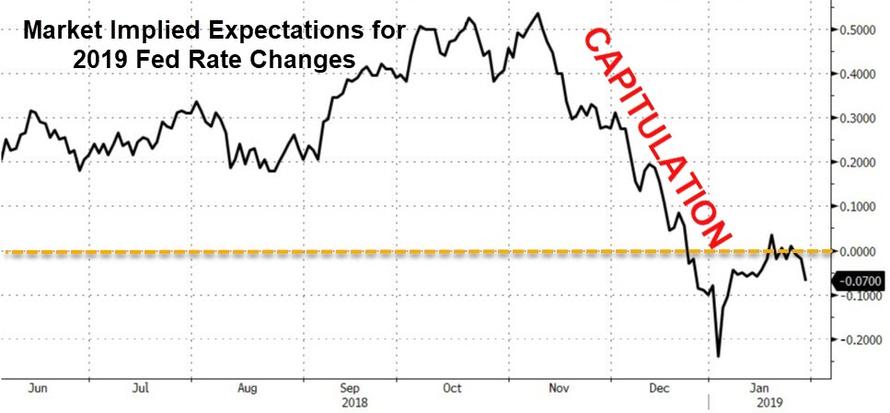

And while Powell umm’d and agh’d through his press conference, truly unable to draw the line between optimistic economic outlooks and his unprecedented reversal of policy (which plunged market expectations from a 50bps hike in 2019 to a 25bps cut in a few weeks)…

Gundlach explained that this is laying the ground work for QE4…

“Even though they won’t say so, this shows that Quantitative Tightening will be slowed down,” Gundlach said.

“And if need be, the Fed will expand the balance sheet. QE (Quantitative Easing) is the ‘unnamed’ other policy tool he referenced in case lowering the Fed funds rate proves not to be enough to strengthen the economy/markets.”

Which explains the plunge in the dollar and surge in stocks, bonds, and gold…

The DoubleLine boss went on to warn, the consumer future expectations data is “flat-out bright red bells ringing.”

One of the “morning binge-party after effects” from Wednesday’s strong stock-market rally is “not knowing what the plan really is,” Gundlach said.

“Powell is basically saying, I am going back into a foxhole and then decide what the next move is. Powell said ‘I don’t want to say anything and I don’t want to get pinned down as I did before.’ Because it got embarrassing.”

And in the meantime, macro data and earning expectations contonue to tumble against a Powell-Put levitated stock market…

via ZeroHedge News http://bit.ly/2FXG1PT Tyler Durden