Authored by Mark Orsley, Head of Macro Strategy at PrismFP,

-

Fed confirming all the economic and market signals that we are in late, late cycle close to “R”

-

Equities continue to shrug off poor earnings/guidance and breakout from the Trump Megaphone – equities tend not to rally at the end of the cycle

-

Trade War (TW) resolution can extend the cycle but there are signs that TW has gone on too long – now bleeding into domestic demand

-

Bias towards end of cycle trades like 5s30sn steepeners and Dollar shorts – use equity breakout to lighten up on longs

I am sure by now you have read enough “Fed was dovish” pieces so will spare you the recap.

For clients that I have had a chance to meet with since I started at Prism a little over a month ago, my thesis has been entirely about the end of the cycle. Readers may recall this list I provided back on Jan 10th as simple evidence:

Late cycle indicators:

-

Growth moderates (you could argue we are more than moderating, but check)

-

Credit tightens (for sure have seen that)

-

Earnings peak and start to decline (yes and being guided down now – see Apple, MSM, Samsung, LG, Delta, Skyworks, Macy’s, Kohl’s, American Airlines, Constellation Brands, Lindt, Goodyear, Ford, Stanley Black & Decker, Intel, and Nvidia for example )

-

Interest rates rise accelerates (had that in Sept– the decline in rates now is actually a recession indicator)

-

Confidence peaks (both business and consumer surveys have rolled over)

-

Inflation rises (also already had that – the recent easing of inflation expectations is another recession indicator)

As you can see from that Econ 101 list of late cycle indictors, every box is checked, and rates and inflation are basically pointing to the dreaded “R” word that nobody wants to talk about or use (so I will only use “R” to keep everyone calm). Yesterday the Fed essentially verified the late cycle possibly entering an “R” by confirming that rate hikes have been shelved and the balance sheet unwind could be slowed. Classic late cycle central bank behavior that typically leads to an “R.”

If you don’t believe that fundamental analysis (not sure how you can argue different and don’t bring up NFP because that is THE most lagging indicator), let’s see what the markets are telling us. After all, clearly the markets are driving Fed policy which drives the economic cycle. The two indicators I have been watching for further confirmation of this late cycle into “R” is (1) the 5s30s curve and (2) the US Dollar. It is therefore not surprising to me that 5s30s steepened a perky 5.5bps and the broad Dollar index depreciated 50bps (vs. EM like ZAR and BRL, the USD was 1% to 2% weaker) yesterday. Both charts speak to a continuation of those moves.

US 5s30s has an insanely bullish (steeper) narrative. First there is a descending wedge which typically gets resolved to the upside. Secondly, the pattern forming at this base is either a bullish “cup and handle” or “head and shoulder.” Call it what you want but if/when we get the weekly close above 56bps, the target will be 100bps…

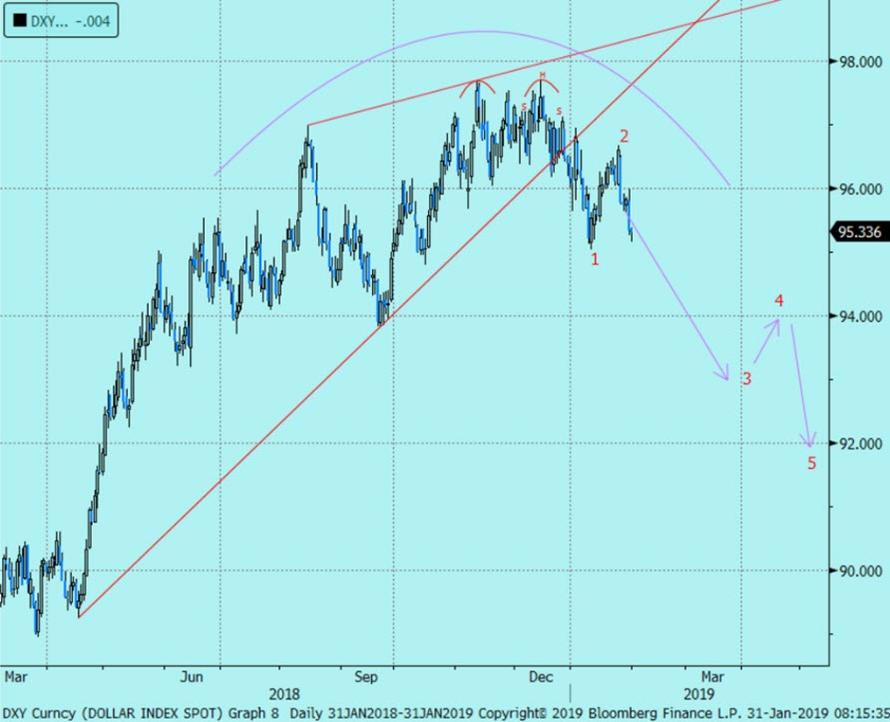

As I showed in Monday’s note, the DXY setup was ripe for a depreciation. I projected an Elliott Wave count lower and that is now in full motion. Notice the DXY chart was an ascending wedge breakdown. Doesn’t that look eerily similar to the inverse of 5s30s?? Basically this Dollar move is foreshadowing the coming move in the curve…

Equities celebrated the lower Dollar and lower rates due to a friendlier Powell than he was in December with a strong rally. NASDAQ broke out and negated the ”Trump Megaphone” we have been watching. As I warned on Monday, the market was shrugging off earnings misses/lower guidance and that was not to be dismissed. That indicates that investors de-risked in December and were champing at the bit to re-risk. A dovish Fed was vital and they delivered.

I just have one question: can someone name a time when equities sustained a rally in the late cycle entering “R” period??? I haven’t found one and I can show you all the analogs that say no if you care to see.

Now there is one thing that can extend the late cycle and avoid the “R” and that is trade war reconciliation. Clearly trade wars have dragged down global growth and thus a resolution would reverse much of that. However, it will not take growth back to the good ole days as QT continues (note Powell didn’t end BS unwind yesterday) and the fiscal impulse continue to fade to zero by mid-year.

Thus a TW resolution simply puts the cycle back to early late cycle, and away from late cycle entering “R.” If there is no resolution, we are talking not only “R” but serious repercussions to the credit markets (recall my note on Jan. 23rd showing the Corp bond maturity tsunami). I am trying not to be dramatic, but it would be a DISASTER. Through conversations with clients, the most underappreciated risk is the amount of debt (both Corp and Sov) that needs to be rolled this year. Any wobbles in the economy/markets would make that extremely difficult and cause a credit crunch which would add to the economic problems.

There is actually risk that trade wars are going on too long. Much of the data weakness around the world is export and manufacturing led (a good indication it’s due to TW). We need to watch if domestic demand is starting to suffer. Anyone see German retail sales this morning?? Anyone?? I will save you from hitting ECO; the German consumer hit a brick wall. We can thus surmise, along with other EU consumer data points, that TW have taken Europe into the abyss.

So far there are no clear signals that TW has bled into US domestic demand but there are some signs developing. Take a look at the Consumer Confidence data on Tuesday, the amount of people saying there are “fewer jobs,” and rising loan delinquencies as examples. These all point to the percolating risks that the US consumer is starting to feel the TW. Thus markets will surely celebrate a TW deal, but it may very well be the case that it is too late. That is the largest risk in my mind.

Bottom line: I continue to like end of cycle trades like 5s30s steepener and Dollar shorts. I am not wildly bullish equities even given this breakout and would use rallies to lighten up on longs. If TW get resolved, use that rally to get completely flat to short. No matter what, the economic cycle is ending, it is just a matter of how long the TW resolution euphoria extends it. Furthermore, it can be entirely possible that TW have dragged on too long and the global economy is too far gone for a deal to save it.

Sorry if that comes across too doom and gloom for you on this frigid day, but the above narrative is entirely supported

by economic facts not conjecture.

via ZeroHedge News http://bit.ly/2GbQeYp Tyler Durden