Perhaps it was the stress of stuffing his ex-wife’s air vents with dead fish, or simply the consistent inability to generate any alpha in his Janus Unconstrained Fund ever since departing Pimco in Oct 2014 in a scandal that rocked the asset management industry and led to a infamous schism between Gross and his former right hand man, Mohamed el-Erian, but whatever the ultimate reason, moments ago Janus announced that Bill Gross, who will be 75 in April, is finally retiring.

Gross, 74, had run the Janus Henderson Global Unconstrained Bond Fund since late 2014, however his annualized returns of less than 1% at Janus “failed to live up to his stellar long-term record from the Pimco era” as Bloomberg diplomatically put it.

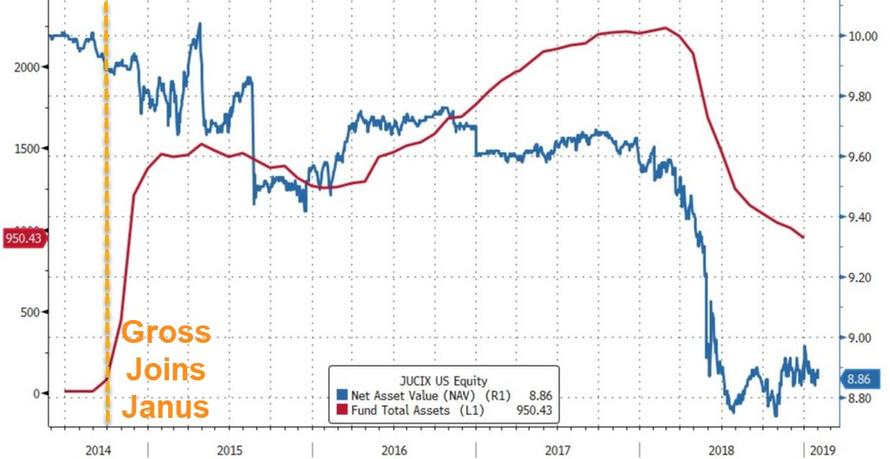

And speaking of reasons, Bloomberg is quick to point out that Gross’ Janus Henderson Global Unconstrained Bond Fund had another $60 million of redemptions in December, dropping assets to under $1 billion, and marking the 10th consecutive month of outflows.

In 2018, the unconstrained fund lost almost 4%, sparking a waterfall of investor redemptions that drove assets below $1 billion from the peak of $2.24 billion early in the year. Gross, who in September 2018 reduced his own stake in the fund, had blamed losses during the year’s first half partly on a misplaced bet that rates on U.S. Treasuries and German bunds would converge, apparently failing to account for hedging costs as we explained previously.

The billionaire money manager started his latest chapter with fanfare, compared by Janus Chief Executive Officer Dick Weil to Super Bowl-winning quarterback Peyton Manning, “that game-changing level of talent.” Gross poured $700 million of his personal fortune into the unconstrained fund, but he failed to attract much outside money and his performance relative to peers deteriorated each year.

“The sort of underperformance we’re seeing is challenging and disappointing to him more than any of us,” Weil, whose firm is now based in London, said in a Bloomberg Television interview last August.

In the statement Monday, Weil said: “Bill is one of the greatest investors of all time and it has been my honor to work alongside him. I want to personally thank him for his contributions to the firm.”

When Gross joined Janus, he knew time was limited to prove he retained his market mastery.

And sadly for the investing legend,his time has now run out, which is disappointing because At Pimco, Gross racked up one of the longest winning streaks of any money manager. The Pimco Total Return Fund, which he founded in 1987, became the world’s biggest mutual fund as assets swelled to almost $300 billion at its 2013 peak, generating annualized returns of 7.8 percent from inception through his last day.

As Bloomberg notes, Gross drove himself obsessively. A former devoted long-distance runner, he once raced from San Francisco to Carmel, California, and became hospitalized with kidney damage.

Pimco’s assets swelled after the 2008 financial crisis, when the Total Return Fund and other accounts produced gains even as stocks plunged. But a few years later, his performance wobbled. Total Return lagged peers in 2011 and again in 2013, exacerbating friction between Gross and colleagues. In early 2014, CEO and Co-CIO Mohamed El-Erian quit.

Gross sought to weed out managers he suspected of disloyalty, spurring executives at Pimco’s parent, German insurer Allianz to intervene. Gross eventually jumped ship before he could be thrown overboard. On Sept. 26, 2014, he left a handwritten note announcing his resignation as of 6:29 a.m. Pacific time — one minute before New York markets opened. Investors withdrew hundreds of billions of dollars, little of which followed Gross to Janus Capital, as the firm was known before its 2017 merger with Henderson Group.

* * *

“No other fund manager made more money for people than Bill Gross,” Morningstar Inc. said in January 2010, when it named him fixed-income manager of the decade.

Alas, not even Gross had any idea how to navigate the “new normal” in which not fundamentals or logic, but central banks were in charge of everything.

The full release is below:

* * *

Janus Henderson Investors (NYSE: JHG, ASX: JHG) announced today that William H. Gross (Bill) has decided to retire from the firm and focus on managing his personal assets and private charitable foundation.

Mr. Gross, 74, has been a pioneer in fixed income investing for more than 40 years. He co-founded PIMCO in 1971 and served as managing director and its chief investment officer. He joined Janus Henderson in 2014 (then Janus Capital) to manage the Janus Henderson Global Unconstrained Bond funds and related strategies, including a successful institutional Total Return strategy.

Dick Weil, Chief Executive Officer of Janus Henderson, said: “I have known Bill for the past 23 years. Bill is one of the greatest investors of all time and it has been my honor to work alongside him. I want to personally thank him for his contributions to the firm.”

Bill Gross said, “I’ve had a wonderful ride for over 40 years in my career – trying at all times to put client interests first while inventing and reinventing active bond management along the way. So many friends and associates at my two firms to thank – nothing is possible without a team working together with a common interest. I’ve been fortunate to have had that. And thank you to all of my past clients for their trust and support. I learned early on that without a client, there can be no franchise. I’m off – leaving this port for another destination with high hopes, sunny skies and smooth seas!”

Mr. Gross also oversees the $390 million-asset William, Jeff and Jennifer Gross Family Foundation, which donated $21,450,000 to 28 non-profits in 2018, including Doctors Without Borders and the Children’s Hospital of Orange County. Mr. Gross intends to be active in visiting prospective charitable organizations, as well as managing his personal assets. Including proceeds from his world-renown stamp collection, Mr. Gross has made philanthropic donations totaling $800 million in the past 20 years.

“I look forward to continuing to work with my son Jeff and daughter Jennifer in identifying and supporting worthy and important causes that are creating better lives locally and around the world,” said Mr. Gross.

While the Unconstrained strategy Mr. Gross manages has underperformed its 3-month Libor benchmark since Mr. Gross joined Janus Henderson in late 2014, nominal performance has been positive over the time period. In addition, and in-line with Mr. Gross’s career success as a bond investor, his currently existing Total Return strategy has outperformed its U.S. Aggregate benchmark by 89 basis points, net of fees, through 12/31/2018.

As a result of Mr. Gross’s decision to retire, portfolio management responsibilities for the Global Unconstrained Bond funds and related strategies will be assumed by the Global Macro Fixed Income team that has been supporting Mr. Gross for the past four years. This team reflects the capabilities of Kapstream, acquired by Janus Henderson in 2015, and has been in place to facilitate an orderly transition of the strategies at such time as Mr. Gross chose to retire. Nick Maroutsos, co-head of Global Bonds and portfolio manager at Janus Henderson, will become portfolio manager of the Global Unconstrained Bond funds effective February 15, 2019 to assist with the transition associated with Mr. Gross’s planned departure on March 1, 2019. Mr. Gross will work closely with Mr. Maroutsos and the team to ensure a smooth and seamless transition.

Effective February 15th, 2019, the Global Unconstrained Bond funds domiciled in the United States and Ireland will be renamed Absolute Return Income Opportunities, which better reflects the strategy name of existing Kapstream portfolios managed in a similar fashion. There will be no change to the funds’ investment objective or guidelines.

via ZeroHedge News http://bit.ly/2UDggI3 Tyler Durden