With much of the market action in recent weeks taking place during the overnight session, it is not a surprise that with China on a week-long Lunar New Year holiday, markets have been rather lethargic, with European bourses and US futures drifting without direction, if slightly lower following Friday’s inconclusive trade talks between the US and China as the dollar traded higher pressuring gold, while Treasury yields were slightly higher.

After a whirlwind week, that included a deluge of earnings, dovish Federal Reserve comments and U.S.-China trade talks in Washington, there is a notable lack of drivers for markets on Monday, particularly in Asia, where China is off and other markets will be shut for days.

US President Trump commented on Saturday that he expects to reach a trade agreement with China soon, while there were also reports that President Trump may meet with Chinese President Xi in Da Nang, Vietnam at the end of February. In related news, China state-owned Cofco Group said it purchased an additional 1 million tons of US soybeans

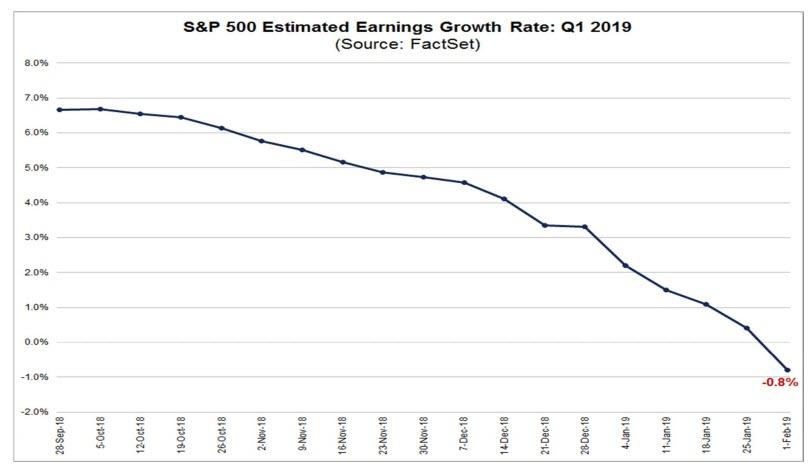

Investors may again look for direction from a corporate earnings season that’s been mixed so far and where Q1 earnings are now expected to post the first Y/Y decline in 3 years.

In Europe, the French CAC 40 and Germany’s DAX underperformed peers with autos weighing while oil and healthcare companies were the biggest gainers in the Stoxx 600 Index, offsetting declines in carmakers. The energy sector was the marked outperformer as Brent hovered around $63/bbl. In terms of laggards, material names are subdued following weak performances in some base metals during Asia-Pac trade. On the tech and consumer front, Japanese-listed Sony and Panasonic became the latest companies to issue a profit warning, following on from NDIVIA, Apple and Samsung, also citing a slowdown in China, however European tech names largely shrugged this off. The sector is kept afloat by DAX-listed Wirecard (+13.5%) after shares rebounded with a vengeance after an internal investigation into alleged criminal misconduct showed no conclusive findings. Elsewhere, UK-listed gambling names kicked off the week at the top of the Stoxx 600 following a number of positive broker moves at Jefferies, albeit William Hill (+0.4%) and Paddy Power Betfair (+0.4%) have since trimmed gains. Italian FTSE MIB manages small gains of +0.3%, while SMI’s Julius Baer (-4.6%) rested at the foot of the Swiss index amid disappointing earnings in which its CEO highlighted that a cost-to-income ratio of 68% is unlikely this year.

In Asia, trading was subdued as much of the region was closed headed into Lunar New Year holidays and following the indecisive performance in the US last Friday amid mixed employment data. Australia’s ASX 200 (+0.5%) was led higher by energy names and with optimism also seen in the largest weighted financials sector despite the looming Banking Royal Commission final report on the industry which was released after the close and referred 24 misconduct to regulators but did not suggest criminal charges. Nikkei 225 (+0.5%) was underpinned by favourable currency moves and a slew of earnings, but with Sony and Honda among the few notable underperformers after Sony reduced its revenue outlook and Honda posted a 34% drop in 9-month net. Elsewhere, Hang Seng (+0.2%) traded indecisive amid the absence of mainland participants all week and early closure in Hong Kong, while Chinese PMI data over the weekend was somewhat inconclusive in which Caixin Services PMI topped estimates but Caixin Composite PMI weakened from prior.

US equity futures were unchanged after the Dow, S&P 500 and Nasdaq all edged higher on Friday after better-than-expected U.S. jobs report overshadowed a disappointing sales forecast from Amazon. U.S. President Donald Trump told CBS that trade talks with Beijing are “doing very well” and sounded confident an agreement with North Korea was on the horizon. Brent crude set a fresh 2019 high as output fell.

In rates, BTPs rebounded from an early slump brushing off weekend warnings from ECB’s Visco. Gilts reverse a weak open to trade roughly flat, curve small steeper, helping Bunds off the lows. Money markets are betting that ECB policy makers will raise the benchmark deposit rate in only June 2020, compared with earlier expectations for a liftoff this year. That is spurring a rally in everything from benchmark German bonds to Belgian and Spanish debt securities. US Treasury futures grind sideways, 10Y yield steady just under 2.70%. Portuguese bonds look set to extend their peer- beating performance into 2019, after providing investors with the best returns among peripheral euro-area debt markets last year, according to Citigroup.

The currency market felt China’s absence due to the Lunar New Year holiday, with low volumes and tight ranges in the major currencies. The dollar advanced against most Group-of-10 peers while the yen led losses as better-than-expected U.S. data Friday made for a risk-on bias. Some highlights via Bloomberg:

- The Bloomberg Dollar Spot Index headed for its longest winning streak in almost two weeks, boosted by a weaker yen, as solid U.S. economic data Friday set the tone at the start of the week

- The euro was steady against the dollar, trading near 1.1450 after turo-zone February Sentix investor confidence fell to -3.7 vs est. -1.3

- The pound touched a session low after IHS Markit’s gauge for the construction sector fell to 50.6 in January, from 52.8 in December, a markedly worse reading than the 52.5 forecast by economists; The British economy was dealt a blow from Nissan Motor over the weekend, which is ditching commitments to build a new vehicle model in the U.K., the latest company to make contingency plans against a no-deal Brexit scenario

- Australia’s dollar fell against most of its Group-of-10 peers as an unexpected slide in building approvals raised the prospect that the central bank may adopt a more dovish tone this week.

- Yen declined for a second day as local stocks rallied in risk-on sentiment, though trading was subdued as Lunar New Year holidays start in China

- Canadian dollar led gains amid an advance in oil prices

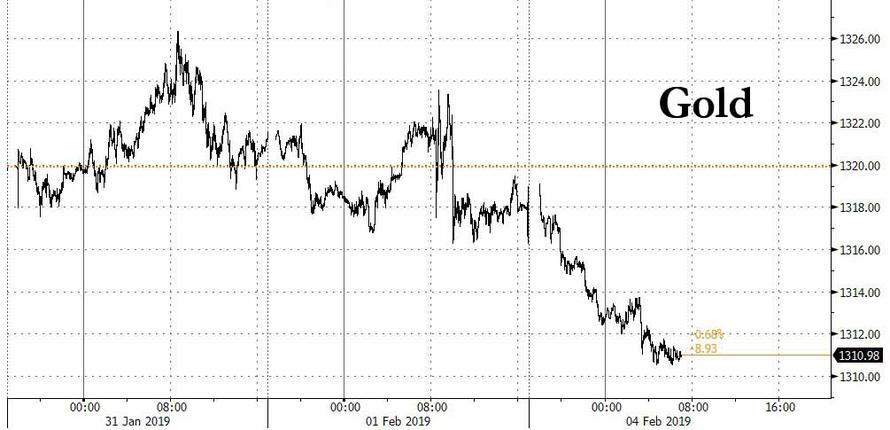

The stronger dollar pressured gold which dropped 0.5% after hitting an 8 month high late last week.

Elsewhere, Venezuelans marched in dueling protests Saturday, with the two men who both claim to be the nation’s leader each exhorting followers to hold firm. The country’s outlook is being followed by oil traders given the country’s share of global exports. Emerging-market currencies and shares fell.

In other geopolitical news, President Putin said the US breached the INF arms treaty and that Russian will also suspend the treaty, while he is said to agree with Defense Ministry proposal to begin development of a mid-range supersonic missile. Turkey President Erdogan said Turkey and Syria have begun low level discussions.

In the latest Brexit news, PM May said she will seek a pragmatic solution regarding Brexit when she returns to Brussels and said she will be armed with a fresh mandate and new ideas. Additionally, UK PM May could be planning for a general election in June, according to reports; reports were later downplayed by Boris Johnson, according to Sky News. UK PM May has also invoked the support of Jeremy Corbyn to insist the EU must offer concessions on her Brexit deal, as she states that she will “battle for Britain” when she travels to Brussels to re-open negotiations. At the same time, UK Business Secretary Clark reportedly urged PM May to rule out a no-deal Brexit and told PM May that Nissan’s decision to cancel production of a new model in its Sunderland factory was a warning sign of what could occur to the UK car industry in the event of failing to reach an agreement.

Looking ahead, notable earnings include Alphabet (market cap of USD 780bln) and Gilead report Q4 earnings while economic data include durable goods, factory orders.

Market Snapshot

- S&P 500 futures up 0.1% to 2,706.00

- STOXX Europe 600 down 0.06% to 359.48

- MXAP up 0.1% to 156.40

- MXAPJ down 0.07% to 511.08

- Nikkei up 0.5% to 20,883.77

- Topix up 1.1% to 1,581.33

- Hang Seng Index up 0.2% to 27,990.21

- Shanghai Composite up 1.3% to 2,618.23

- Sensex up 0.4% to 36,602.03

- Australia S&P/ASX 200 up 0.5% to 5,891.20

- Kospi down 0.06% to 2,203.46

- German 10Y yield unchanged at 0.167%

- Euro down 0.09% to $1.1446

- Italian 10Y yield rose 15.6 bps to 2.389%

- Spanish 10Y yield rose 0.9 bps to 1.232%

- Brent Futures up 1.2% to $63.51/bbl

- Gold spot down 0.5% to $1,311.22

- U.S. Dollar Index up 0.2% to 95.73

Top Overnight News from Bloomberg

- Money-market traders are braced for $134b of Treasury bills to be sold between Monday and Wednesday, followed by an additional dose on Thursday via the 4- and 8-week auctions

- Two-thirds of Americans oppose President Donald Trump declaring a national emergency if Congress doesn’t offer up the funds he wants to build a wall on the U.S.-Mexican border, a CBS News poll released Sunday shows

- Australian building approvals suffered the biggest annual back-to-back drop in almost a decade as a housing slump deepens. Falling unemployment is propping up households and allowing the economy to absorb a property slump, meaning the central bank can afford to stay on the sidelines — for now

- Venezuelan President Nicolas Maduro went on Spanish television to denounce foreign meddling as U.S. President Trump signaled he’s confident a transition of power to opposition leader Juan Guaido is under way

- Oil held near a two-month high after data showed U.S. production growth slowing at a time when OPEC cuts and American sanctions on Venezuela have already eased concerns over a supply glut

- Wall Street firms are preparing to lobby China for changes that would make it easier to bet against its stock market through a trading link from Hong Kong

- Federal Reserve Bank of Minneapolis President Neel Kashkari said Fed Chairman Jerome Powell is “coming around” to the view to wait until wages and inflation rise before raising interest rates again, and that the Fed’s latest pause will help keep a “fundamentally healthy” economy on track

- Money-market traders are braced for $134b of Treasury bills to be sold between Monday and Wednesday, followed by an additional dose on Thursday via the 4- and 8-week auctions

- ECB Governing Council member Ewald Nowotny doesn’t expect recession in Europe despite a lot of economic uncertainty, especially around the situation in Germany

Asian equity markets began the week positively but with gains only marginal amid the mass closures in the region for the Lunar New Year and following the indecisive performance on Wall St last Friday amid mixed employment data. ASX 200 (+0.5%) was led higher by energy names and with optimism also seen in the largest weighted financials sector despite the looming Banking Royal Commission final report on the industry which was released after the close and referred 24 misconduct to regulators but did not suggest criminal charges. Nikkei 225 (+0.5%) was underpinned by favourable currency moves and a slew of earnings, but with Sony and Honda among the few notable underperformers after Sony reduced its revenue outlook and Honda posted a 34% drop in 9-month net. Elsewhere, Hang Seng (+0.2%) traded indecisive amid the absence of mainland participants all week and early closure in Hong Kong, while Chinese PMI data over the weekend was somewhat inconclusive in which Caixin Services PMI topped estimates but Caixin Composite PMI weakened from prior. Finally, 10yr JGBs were lower with demand subdued by the gains in riskier assets and as prices tracked the post-NFP declines in T-notes, although losses were contained by the BoJ presence in the market for a respectable JPY 1tln of JGBs.

Top Asian News

- Philippine Stocks Fall as Central Bank Tempers Rate Outlook

- Putin Joins Trump in Finding Ways to Ease Deripaska’s Pain

- Euro Hedging Cost for European Elections Drops to One-Year Low

- Japan to Ask Citizens for Ideas to Fix the Government’s Finances

A lacklustre start of the week for European equities as the region failed to sustain the momentum seen in Asia. Major indices drifted lower from the open (Euro Stoxx 50 -0.4%) but remain mixed. The energy sector is the marked outperformer amid the price action in the complex in which Brent hovered around USD 63/bbl. In terms of laggards, material names are subdued following weak performances in some base metals during Asia-Pac trade. On the tech front, Japanese-listed Panasonic became the latest company to issue a profit warning, following on from NDIVIA, Apple and Samsung, also citing a slowdown in China, however European tech names largely shrugged this off. The sector is kept afloat by DAX-listed Wirecard (+13.5%) after shares rebounded with a vengeance after an internal investigation into alleged criminal misconduct showed no conclusive findings. Elsewhere, UK-listed gambling names kicked off the week at the top of the Stoxx 600 following a number of positive broker moves at Jefferies, albeit William Hill (+0.4%) and Paddy Power Betfair (+0.4%) have since trimmed gains. Finally, SMI’s Julius Baer (-4.6%) rests at the foot of the Swiss index amid disappointing earnings wherein its CEO highlighted that a cost-to-income ratio of 68% is unlikely this year. Looking ahead State-side, notable earnings include Alphabet (market cap of USD 780bln) reporting after US hours.

Top European News

- Panalpina Investor Rebuffs DSV’s $4 Billion Takeover Offer

- Danske Bankers Needn’t Fear Bonus Cuts Amid Estonian Scandal

- Electric Vehicles Meet a Strong Challenge From Gas in Spain

- Warmer Shift in Europe Brings Mixes for Gas and Power Traders

- Italy’s Staggering Debts Are Europe’s Systematic Problem

In currencies, for the DXY it was a relatively quiet start to the week, with trade in Asia dampened to an extent by China’s Lunar New Year holidays, but the Dollar continues on a firmer footing in wake of last Friday’s bumper US payroll number that was only partially nullified by less frothy earnings, a rise in the jobless rate and a downgrade to the previous month’s NFP tally. The index is holding towards the upper end of a tight 95.771-571 range, but further off its pre-data low and key chart support ahead of 95.000.

- JPY/AUD – The major laggards, partly due to the aforementioned general Greenback bid, but the former also underperforming as the Nikkei climbed and some stops were triggered at 109.85. However, option related offers appear to have capped the headline pair around 109.90 vs 109.45 at the low, with 2 bn expiries running off between 110.00-10, while techs will also be aware that a 61.8% Fib sits just above the big figure at 110.03. Meanwhile, the Aud has retreated further from recent circa 0.7295 peaks following another sharp decline in Aussie building approvals overnight, and is currently nearer the base of 0.7255-25 parameters. Note, expiry interest may also keep Aud/Usd depressed given 1.6 bn at 0.7240-50 for the NY cut.

- CHF/GBP – The next weakest G10 links, as the Franc edges down through 0.9950 support and probes below 0.9970, while the Pound is still suffering from Brexit fatigue and uncertainty in the main. Cable is hovering a few pips off the 200 DMA (1.3045) vs 1.3095 at best, with additional pressure coming via another sizeable UK PMI miss, as construction tumbled to 50.6 from 52.8 and vs an expected 52.4.

The commodity complex remains on an upwards trajectory after consolidating during Asia-Pac hours. WTI (+0.1%) and Brent (+0.5%) are choppy and off highs as the former still resides above USD 55/bbl while the latter hovers around USD 63/bbl. Recent gains are attributed to a number of factors leading to a tighter market. As output curbs come into effect, OPEC’s oil supply fell by the most in two years in January; according to a Reuters’ survey. Meanwhile, Russia’s production fell from a record 11.45mln BPD in December to 11.38mln BPD in January, around 35k BPD from October 2018 (the baselines for the global oil accord), albeit, Moscow missed the output cut target last month according to Energy Ministry data. Furthermore, adverse weather in Libya resulted in crude and condensate exports declining to a six-month low with the country’s largest oil field still halted. Prices are also underpinned as US sanctions on Venezuela sharply limits oil transactions between the OPEC member and other countries, but to a lesser extent compared to the Iranian sanctions last year; according to experts citing US Treasury data. Furthermore, oil exports from the country fell to a ten-month low with exports to US and China both declining. Metals are relatively mixed with spot gold (-0.5%) unwinding some risk premium as risk aversion wanes following Friday’s above-forecast US jobs report and optimistic China-US trade developments. Meanwhile copper was lacklustre as the red metal’s largest buyer is away on a week-long holiday. On the flip side, iron ore prices surged as demand concerns continue to weigh on the base metal amid the collapse of Vale’s dam.

It’s a quiet start to the week for data with the only releases of note being the February Sentix investor confidence reading and December PPI for the Euro Area, preliminary January CPI for Italy and final November factory orders, durable and capital goods orders revisions in the US. Elsewhere, German Chancellor Merkel travels to Japan for meetings with PM Abe, while the earnings highlight is Alphabet.

US event calendar

- 10am: Factory Orders, est. 0.3%, prior -2.1%; Ex Trans, prior 0.3%

- 10am: Durable Goods Orders, est. 1.5%, prior 0.8%; Durables Ex Transportation, est. 0.1%, prior -0.3%

- 10am: Cap Goods Orders Nondef Ex Air, est. 0.1%, prior -0.6%

DB’s Jim Reid concludes the overnight wrap

Tomorrow marks the first year anniversary of Powell becoming Chair of the Federal Reserve and interestingly today is his birthday! After eight meetings at the helm it was interesting that last week’s was the first where the S&P 500 rose on FOMC announcement day. After a year of being mostly on the hawkish side it seems he has performed a 180 degree pivot in 2019. As a reminder our long-standing concerns on US growth in 2020 were a lot to do with the risk of a 2s10s inversion at some point in 2019. We believe that the yield curve is a reliable predictor of the cycle with the normal lag between inversion and recession being 12-18 months (see our Yield Curve 101 note for more). However with the Fed’s U-turn the probability of an inversion has fallen or at least when it occurs might have been delayed. This doesn’t change our bullish view on Q1 (in fact it reinforces it) but it might at some point question our more bearish H2 forecast. However still plenty of time to review this and there are other risks to consider. A recession in Europe is one such risk and on Friday our German economists published a rather gloomy view on their domestic economy showing a number of key indicators drifting into recessionary territory. See their report here.

Back to the US and in our yield curve note we did zone in on the only lengthy delay between inversion and recession in the last 70 plus years. This was in the late 1960s where in the face of rising inflation but a falling stock market, the Fed made what could be described as a policy error by keeping policy too loose especially in the face of higher government spending on the Vietnam War and on the start of Medicare/Medicaid. Basically the yield curve first inverted in December 1965, inflation spiked in early 1966 (with the US at full employment) and continued rising and the S&P 500 fell over 20% from January 1966 peaks. The Fed seemed more concerned by the stock market and stayed on hold in 1966 and even cut rates in early 1967 as growth, fiscal spending and inflation went higher. This likely prolonged the cycle and re-steepened the curve but reinforced higher inflation and by the end of 1967 the Fed were forced to reverse course and start a hiking cycle. The curve then re-inverted and by the end of the decade the recession arrived four years after the first inversion. We make this point to show that cycles can be manipulated by policy makers that deviate policy away from what may have been a more appropriate course.

Anyway from the 1960s and back to the last year of the two thousand and tens. After a busy week last week that included the dovish FOMC and a strong payrolls (see below) this week looks set to be relatively quiet although we do have Mr Trump’s delayed State of the Union address tomorrow night and another busy week of corporate earnings. We also have a backlog of post-shutdown US data to get through though and tomorrow’s global services PMIs are one of the highlights of the week. Outside of that we have the latest BoE meeting on Thursday with Brexit and US-China trade headlines unlikely to stray too far from the spotlight. On Brexit it was interesting to see one opinion poll (Opinium/Observer) put the ruling Tory party 7 points ahead over the weekend. I can’t help thinking that whether it’s good or bad for the country, having a stance where you try to force concessions from Brussels to get a deal, polls well in the country from a core group of voters. This is a dilemma for MPs and party strategists across the board.

With regards to politics on the other side of the Atlantic, the State of the Union address will likely see border security as a hot topic with the reopening of government pretty much halfway through the 21 days by the time he speaks. We’ll soon return to focus on the threat of a fresh shutdown if progress isn’t made this week.

Earnings will continue to be in focus given some big moves for companies in this season. Interestingly DB’s Binky Chadha reported at the back end of last week that US Q4 earnings have seen the lowest beats in 7 years (see link here) but that the rally and price surges for some individual beats reflected that the market had more than priced this in. This week 98 S&P 500 companies are due to report. The highlights include Alphabet today, Walt-Disney on Tuesday, General Motors on Wednesday, and Twitter on Thursday. In Europe the highlights include BP on Tuesday, GlaxoSmithKline, Daimler and BNP Paribas on Wednesday, and Total, L’Oreal and Sanofi on Thursday. In Asia SoftBank reports tomorrow, Toyota on Wednesday and Nippon on Thursday.

In addition to the January ISM non-manufacturing release the market will also likely keep a close eye on the final January services and composite PMI revisions in Japan, Europe and the US tomorrow. Friday’s final manufacturing revisions in Europe confirmed an even weaker manufacturing print for Germany (49.7 vs. 49.9 flash) while Italy came in weaker than expected at 47.8 (vs. 48.8 expected). It’ll be worth keeping an eye on the remaining data for the non-core. The full day by day week ahead is at the end today as per normal on a Monday. A reminder that it’s Lunar New Year and China will be closed while markets in Hong Kong, Singapore, Taiwan, South Korea, Malaysia and Vietnam are also closed for either all or part of the week.

Over the weekend we’ve had the remaining January Caixin PMIs in China with the services reading surprising slightly to the upside at 53.6 (vs. 53.4 expected). That is however down 0.3pts from December and together with the soft manufacturing reading it puts the composite at 50.9 and the lowest since October. As for markets this morning, trading volumes are much lower than average unsurprisingly given the holidays however the Nikkei (+0.42%) and Hang Seng (+0.21%) are both posting modest gains. Sentiment has also been given a lift by President Trump’s comment that trade talks are “doing very well” following an interview with CBS over the weekend. Futures in the US are also slightly up while oil is little changed along with most bond markets.

Briefly recapping Friday and the past week now. After a dovish Fed last week Friday’s strong US data added fuel to the fire with the US nonfarm payrolls report and the ISM manufacturing survey both beating expectations. The headline message is that US growth still looks quite strong currently and inflation pressures are not announcing themselves at the moment. The headline January jobs number was 304k (versus 165k expected), and while the December figure was revised down by 90k, the overall trend is still very healthy. Indeed, the 12-month moving average job growth is 223k, the best pace since April 2016. The month-on-month average hourly earnings print was a touch soft at 0.1%, though the year-on-year figure met expectations at 3.2%. The unemployment rate surprisingly rose to 4.0% from 3.9% and the U-6 underemployment shot up to 8.1% from 7.6%. However, these surprising moves were driven by an increase in the labour force participation rate and by distortions from the government shutdown, so our economists downplayed their importance. The ISM printed at 56.6 from 54.1, with a robust rise in the new orders index to 58.2 from 51.1. The prices paid index fell to 49.6 from 54.9, the lowest level since February 2016.

Equity markets mostly ignored the data on Friday but with the S&P 500 ending the week +1.57% higher (+0.09% on Friday). Other major indexes also advanced, with the DOW and NASDAQ up +1.57% and +1.32% (+0.26% and -0.45% Friday), respectively. The STOXX 600 gained a more-modest +0.52% (+0.29% Friday). The real action was in treasuries, where two-year yields ended the week -9.6bps lower (despite a +6.7bps rise on Friday after the data). Ten-year yields in the US and Germany fell -7.4bps and -2.7bps (+5.5bps and +1.7bps Friday), respectively. Italian BTP yields rose +12.5bps (+14.2bps) after data showed the country formally entered a recession last quarter. Corporate credit continued to rally, with HY cash spreads in the US and Europe tightening -5.9bps and -9.8bps on the week (-8.1bps and -2.1bps Friday).

It’s a quiet start to the week for data with the only releases of note being the February Sentix investor confidence reading and December PPI for the Euro Area, preliminary January CPI for Italy and final November factory orders, durable and capital goods orders revisions in the US. Elsewhere, German Chancellor Merkel travels to Japan for meetings with PM Abe, while the earnings highlight is Alphabet.

via ZeroHedge News http://bit.ly/2RBK85B Tyler Durden