After a solid 3Y auction, and a subpar 10Y sale, today the Treasury concluded refunding week by selling $19BN in 30Y paper in another strong auction, pricing at a yield of 3.022%, down from January’s 3.035% and “on the screws” with the 3.022% When Issued. This was the lowest stop out on the 30Y since July 2018.

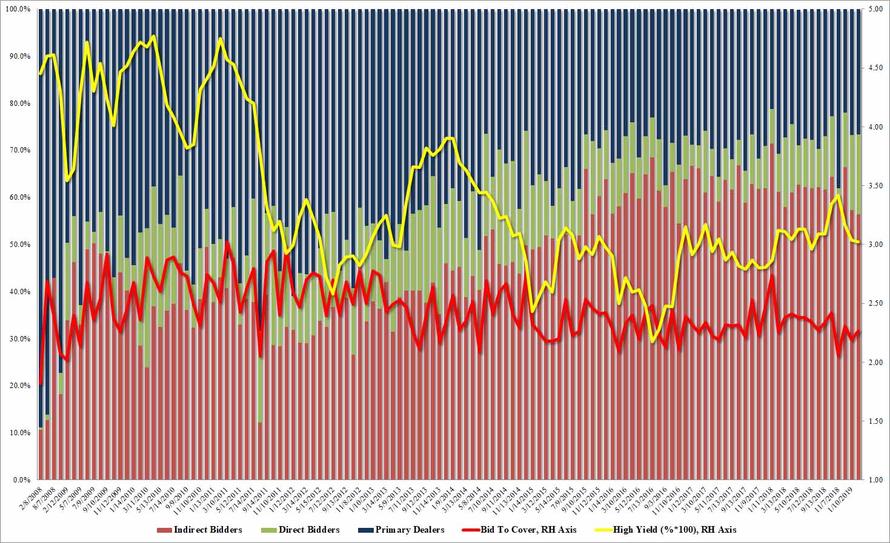

The internals were also solid, with the Bid to Cover rising modestly from 2.19 to 2.27, right on top of the 6 month average. Other metrics were virtually unchanged from January, with Indirects taking down 56.4% of the auction, down modestly from 57.3% last month and below the recent average of 61.9%. Directs, meanwhile, rose modestly from 15.9% in Jan to 17.0%, the highest since December 2014 and as expected, well above the 6M average of 10.4% leaving Dealers holding 26.6% of the auction, just below the recent average of 27.7%.

Overall, a solid auction with which to close out the week, with stable demand despite today’s sharp drop in yields across the curve as investors continue to press the deflation/economic contraction narrative for the foreseeable future.

via ZeroHedge News http://bit.ly/2IbSMZl Tyler Durden