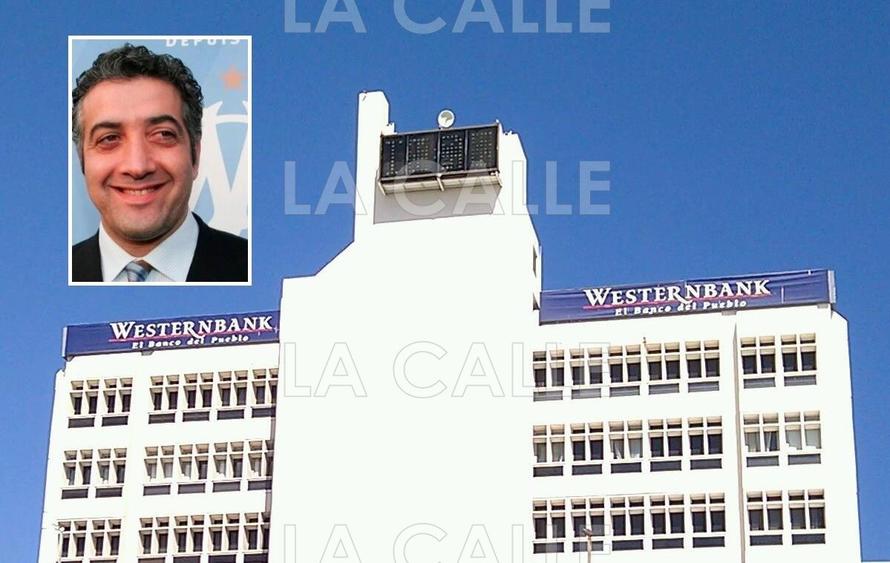

A pharmaceutical executive whose lavish Miami lifestyle included fancy automobiles, private jets, yachts, and luxury homes, was found guilty of federal fraud charges in connection with a $100 million scheme more than a decade ago that triggered the 2010 collapse of Westernbank, one of Puerto Rico’s most prominent banks at the time, reported the US Department of Justice Office of Public Affairs.

Jack Kachkar, 55, was convicted earlier this month of eight counts of wire fraud affecting a significant financial institution following a 21-day trial before U.S. District Judge Donald L. Graham in Miami. Kachkar is expected to serve decades behind bars; the sentencing will be held on April 30.

“Jack Kachkar’s fraud caused substantial harm to the 1,500 employees of Westernbank and the people of Puerto Rico,” said U.S. Attorney Fajardo Orshan. “The U.S. Attorney’s Office remains committed to the prosecution of those individuals and corporations that use Miami and other South Florida communities as their base to operate multinational fraud schemes.”

“Today’s verdict holds the defendant accountable for orchestrating fraudulent schemes that resulted in more than $100 million in losses to insured institutions and the FDIC as receiver,” said Inspector General Lerner. “The FDIC Office of Inspector General remains committed to investigate cases of deception and swindles that undermine the integrity of financial institutions, and we will continue to work with our law enforcement partners to bring to justice those who commit such offenses.”

“IRS Criminal Investigation will always pursue investigations like this where Mr. Kachkar, for his own personal benefit, orchestrated such a large scheme at the expense of one of Puerto Rico’s largest banks and its 1,500 employees,” said IRS-CI Special Agent in Charge Palma. “This investigation shows that the appearance of success can be a mask for a tangled financial web of lies, and we are proud to be part of the prosecution team that is bringing Mr. Kachkar to justice.”

“HSI San Juan will continue working with our local, state and federal partners to investigate and prosecute these types of cases as well as those involving violations to the more than 400 federal statutes that we investigate, “ said HSI Special Agent in Charge Arvelo. “This man was responsible for one of the largest fraud schemes ever recorded in the banking business in Puerto Rico and he will pay the consequences.”

“This defendant’s greed was powerful enough to destroy a bank, taking with it the jobs of approximately 1,500 hard working citizens of Puerto Rico,” said FBI Special Agent in Charge Leff. “The FBI thanks the US Attorney’s Office for sending an equally strong message that most fraud schemes will eventually lead to a prison cell.”

According to the trial evidence, from 2005 to 2007, Kachkar was the CEO of-of Inyx Inc., a publicly traded specialty pharmaceutical products and technologies company. The fraud began in early 2005, Kachkar entered into a series of loan agreements with Westernbank in exchange for collateral in assets of Inyx and its subsidiaries. Under the loan agreements, the bank advanced money based on Inyx’s customer invoices from “actual and bona fide” sales to Inyx customer.

However, the evidence showed that Kachkar organized a scheme to defraud Westernbank by creating dozens of fake customer invoices worth tens of millions of dollars.

During the course of the scheme, Kachkar falsified and deceived Westernbank loan officers about imminent repayments from its international lenders to continue the scheme of pumping more credit into Inyx.

Kachkar distorted additional collateral to Westernbank executives, including numerous mines in Mexico and Canada worth hundreds of millions of dollars. The evidence showed that the additional collateral was worth a fraction of that presented by Kachkar.

Westernbank lent about $142 million, primarily based on false and fraudulent customer invoices to Kachkar over the two years. The evidence showed he diverted tens of millions of dollars for his benefit, including “a private jet, luxury homes in Key Biscayne and Brickell, Miami, luxury cars, luxury hotel stays, and extravagant jewelry and clothing expenditures,” said the DOJ.

At the end of the scheme, in the summer of 2007, Westernbank declared a default on the Inyx loans, ultimately suffered losses of more than $100 million. Shortly after, the losses triggered a series of catastrophic events leading to Westernbank’s collapse.

via ZeroHedge News http://bit.ly/2SGaBDD Tyler Durden