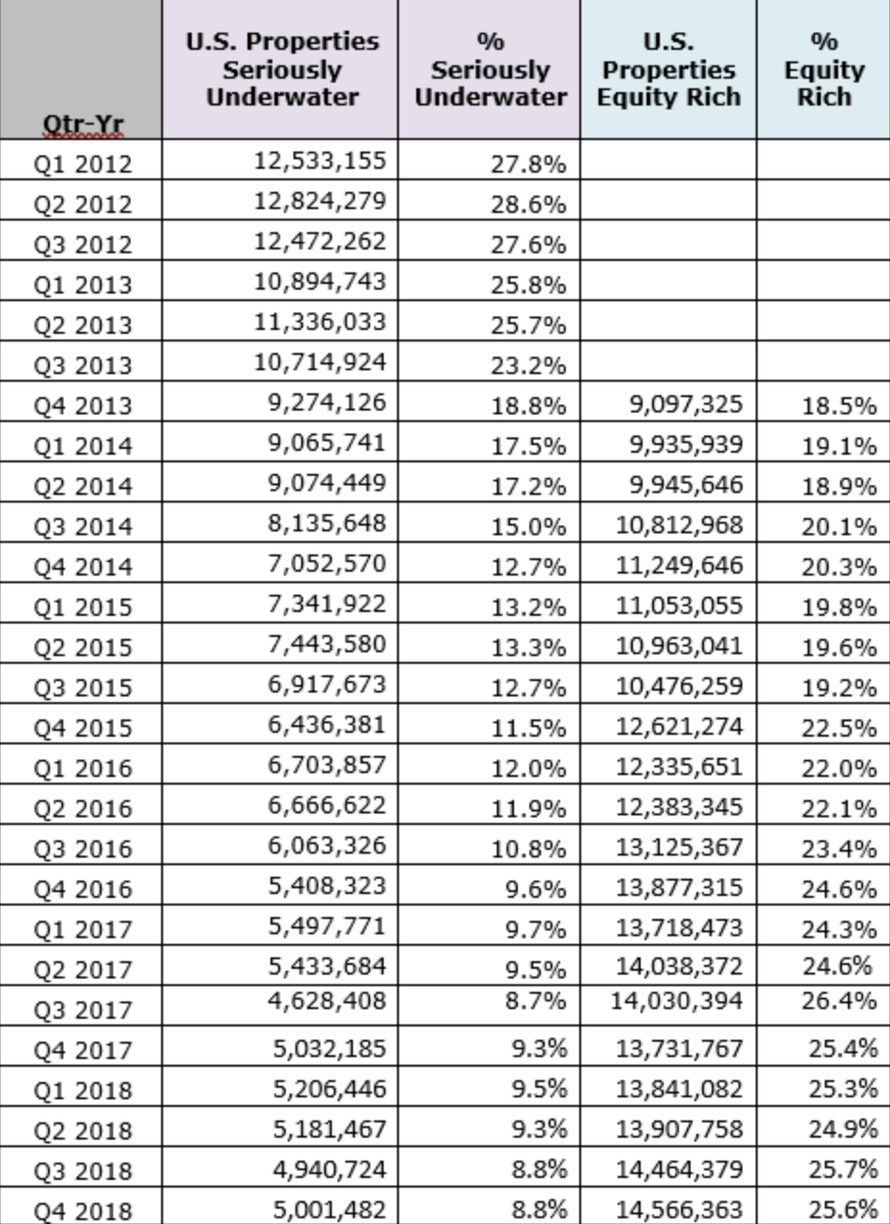

Roughly 12 years after the US housing market meltdown entered its most acute phase in 2007, a shocking number of American homes are still “seriously underwater”, according to the latest US real-estate market report from ATTOM.

And with the housing market embroiled in its worst slump since the recovery began, many of those who have continued paying their mortgages month after month, even though they owe more than the value of their homes, likely won’t find any respite from this situation – at least not any time soon.

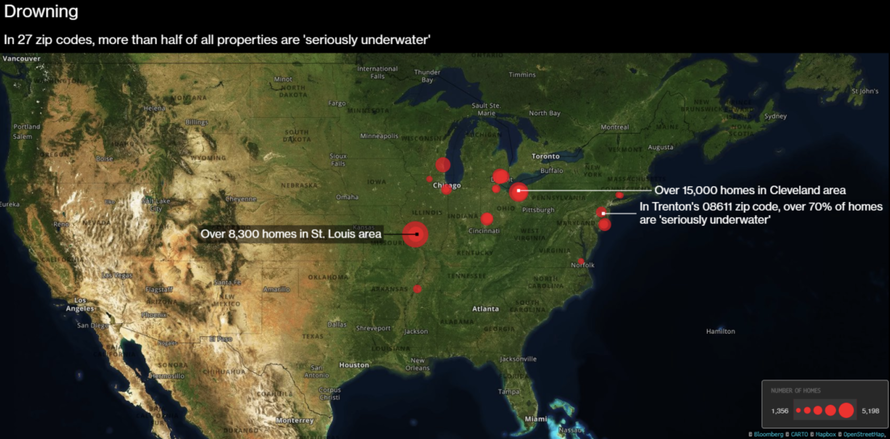

Per ATTOM‘s data, the states with the highest share of mortgages that were seriously underwater included Louisiana (20.8%), Mississippi (16.9%), Arkansas (15.9%), Illinois (15.6%) and Iowa (15.2%). And among all of the 7,590 zip codes with at least 2,500 properties examined in the report by ATTOM, there were a total of 27 where more than half of all properties with a mortgage remained seriously underwater, including zip codes in Chicago, Cleveland, Saint Louis, Atlantic City, Virginia Beach and Detroit.

(Map courtesy of Bloomberg)

Of these, the zip codes with the highest share of seriously underwater homes were: 08611 in Trenton, New Jersey (70.3%); 63137 in Saint Louis, Missouri (64.8%); 60426 in Harvey, Illinois (62.3%); 38106 in Memphis, Tennessee (60.5%); and 61104 in Rockford, Illinois (59.6%).

Meanwhile, sates with the highest share of equity rich properties – where the combined estimated amount of loans secured by the property was 50% or less of the property’s estimated market value – included California (43.6%); Hawaii (39.3%); New York (34.2%); Washington (34.2%); and Oregon (32.9%).

via ZeroHedge News http://bit.ly/2BDw9av Tyler Durden