Authored by Michael Wilson, Head of Morgan Stanley US equity strategy

Assume you started a two-month sabbatical on December 3 and just returned to work this past week. If you took your sabbatical seriously and truly disconnected, you might assume nothing much had happened, with asset prices very close to levels two months ago. Of course, asset markets have been anything but stable over this stretch, with the worst December since 1931 followed by the best January since 1987. Nevertheless, here we are back at those early December levels, which raises the question, Has anything really changed?

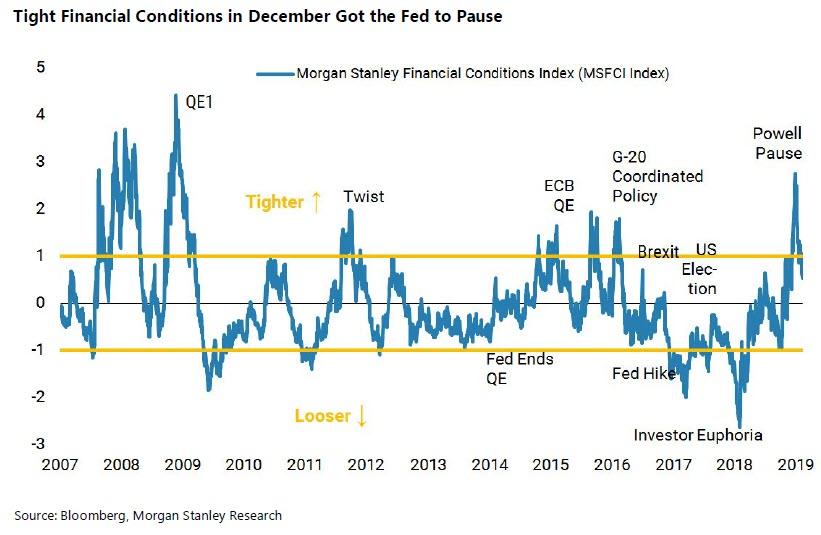

To explain the collapse and subsequent rebound in asset prices, I hear many embracing the narrative that the sell-off was simply a Fed-induced policy error, exacerbated by poor year-end liquidity and performance pressure on asset managers. Thus, with the spike in our financial conditions index severe enough to get the Fed to reverse its policy course, these same folks are suggesting investors have a “green light” to take more risk and markets should be off to the races. After all, everyone knows you don’t fight the Fed or price momentum, right?

While the Fed’s more dovish pivot is a real change and made us more constructive in early January, I’ve also been arguing for the past few weeks that it’s not off to the races from here.

- First, asset prices are up a lot in the past month and no longer exceedingly cheap.

- Second, while the price level (and valuation) is roughly the same as in early December, the price trend is now pointing up. This new uptrend has turned sentiment bullish again – and that’s bearish.

- Third, the Fed is still tightening policy. While rate hikes are on pause, the Fed continues to shrink its balance sheet by US$50 billion per month. Now, with financial conditions having loosened significantly since that December spike, there is much less pressure on the Fed to stop or even taper QT.

Most important, however, is the fact that earnings growth expectations have deteriorated materially over the past few months. Strangely, I see much less acknowledgement of this growth deterioration with everyone so focused on the Fed and stock price trends. A big part of our equity strategy discipline is listening to what the market is telling us, and we acknowledge that the recent surge in price and breadth is a positive signal about the future. However, earnings revisions have been some of the worst we’ve ever observed in terms of breadth and velocity. Virtually every sector and region of the world is seeing downward revisions, making it difficult to explain them away as a temporary function of trade tensions and/or the government shutdown in the US.

We have been calling for an earnings recession in the US since last summer, when the consensus was still forecasting close to 11% S&P 500 EPS growth for 2019. Starting in early December, this same consensus began to fall sharply, and 1Q19 S&P 500 earnings are now expected to be down more than 1% year on year. Given the severity and breadth of the revisions to date, I would not be surprised if 2Q and 3Q S&P 500 EPS growth also turn out to be negative on a year-on-year basis. Therefore, I believe that the recent move in stocks is much more about the Fed pivot and less about stocks telling us the trough is now.

Whether stocks can advance sustainably from here will be determined by the depth and timing of this trough in earnings growth. At this point, I think it’s too early to determine either. Some have argued that this looks very similar to early 2016 with China stimulating, the Fed pausing, earnings revisions plummeting and stocks rallying. While that’s true, 1Q16 was the fourth quarter in a row of negative year-on-year growth whereas 1Q19 is the first negative growth quarter. This makes the comparisons for the next several quarters much more difficult today versus 1Q16, thereby increasing the chance for both a deeper and later trough in growth than what is currently forecast. Our best estimate at this point is for a trough in S&P 500 EPS growth in 2Q19 or 3Q19 somewhere between -5-10%Y. If we’re right, we should get a better opportunity to add to equity risk over the next few weeks/months. In S&P 500 terms, we think that is closer to 2500 than 2700. With equity markets having gone nowhere since the end of 2017, entry points have been critical to generating positive returns. We think that will continue to be the case, so price levels matter more than trend.

Enjoy your Sunday

via ZeroHedge News http://bit.ly/2E1jL5p Tyler Durden