Authored by Lance Roberts via RealInvestmentAdvice.com,

Bill Dudley, who is now a senior research scholar at Princeton University’s Center for Economic Policy Studies and previously served as president of the New York Fed and was vice-chairman of the Federal Open Market Committee, recently penned an interesting piece from Bloomberg stating:

“Financial types have long had a preoccupation: What will the Federal Reserve do with all the fixed income securities it purchased to help the U.S. economy recover from the last recession? The Fed’s efforts to shrink its holdings have been blamed for various ills, including December’s stock-market swoon. And any new nuance of policy — such as last week’s statement on “balance sheet normalization” — is seen as a really big deal.

I’m amazed and baffled by this. It gets much more attention than it deserves.”

I find this interesting.

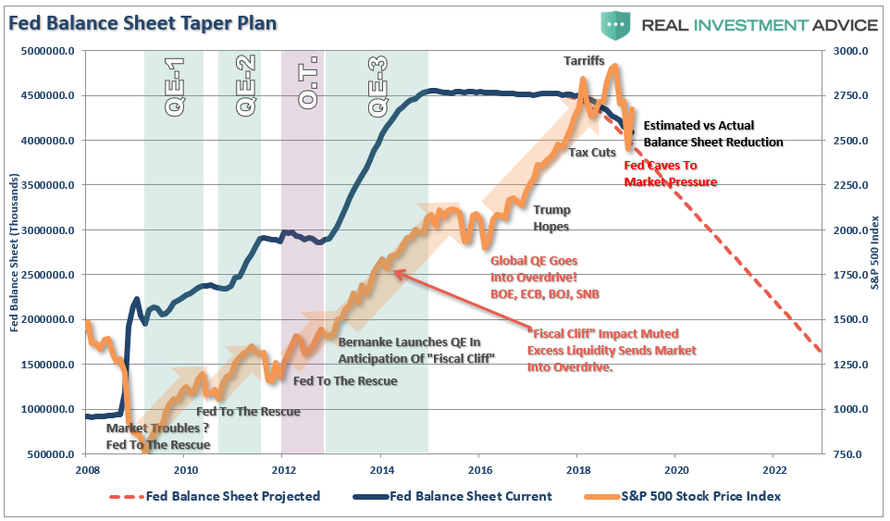

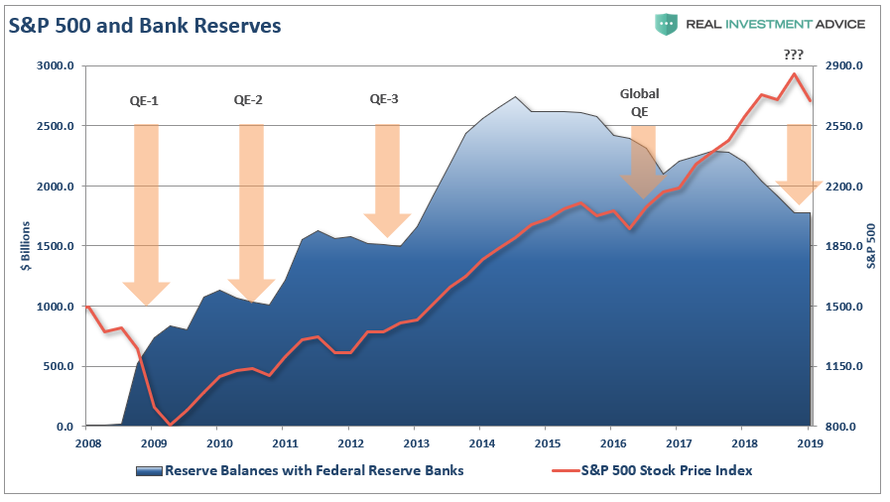

A quick look a the chart below will explain why “financial types” have a preoccupation with the balance sheet.

The preoccupation came to light in 2010 when Ben Bernanke added the “third mandate” to the Fed – the creation of the “wealth effect.”

“This approach eased financial conditions in the past and, so far, looks to be effective again. Stock prices rose and long-term interest rates fell when investors began to anticipate this additional action. Easier financial conditions will promote economic growth. For example, lower mortgage rates will make housing more affordable and allow more homeowners to refinance. Lower corporate bond rates will encourage investment. And higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending. Increased spending will lead to higher incomes and profits that, in a virtuous circle, will further support economic expansion.”

– Ben Bernanke, Washington Post Op-Ed, November, 2010.

In his opening paragraph, Bill attempts to dismiss the linkage between the balance sheet and the financial markets.

“Yes, it’s true that stock prices declined at a time when the Fed was allowing its holdings of Treasury and mortgage-backed securities to run off at a rate of up to $50 billion a month. But the balance sheet contraction had been underway for more than a year, without any modifications or mid-course corrections. Thus, this should have been fully discounted.”

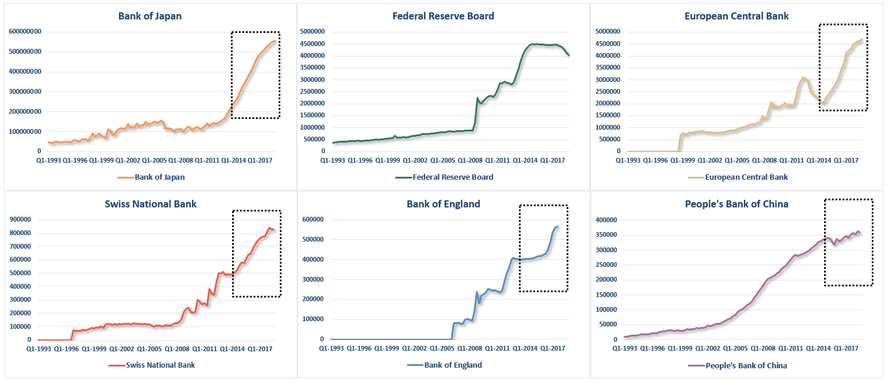

While this is a true statement, what Bill forgot to mention was that Global Central banks had stepped in to flood the system with liquidity. As you can see in the chart below, while the Fed had stopped expanding their balance sheet, everyone else went into over-drive.

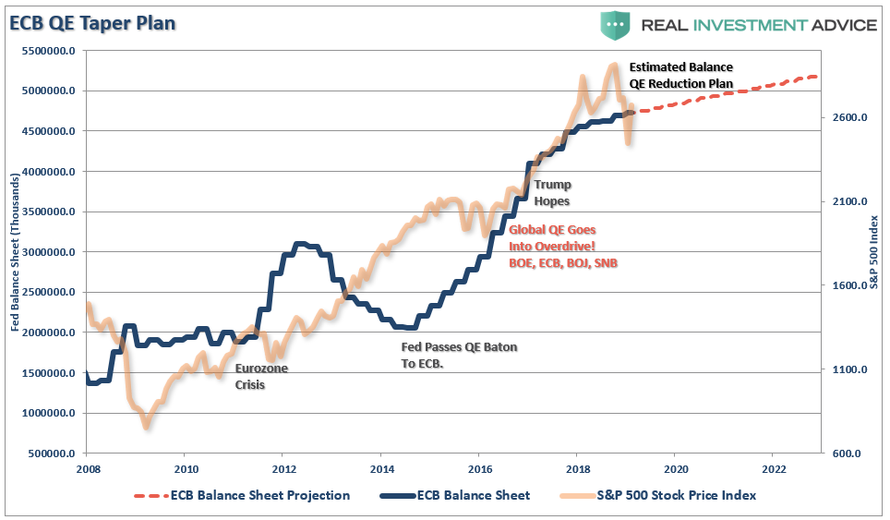

The chart below shows the ECB’s balance sheet and trajectory. Yes, they are slowing “QE” but it is still growing currently.

It’s All About Yield

But Bill then moves to the impacts on yields:

“Moreover, if anything, the run-off of the Fed’s balance sheet had a smaller-than-expected impact on the yields of those securities. Longer-term Treasury yields remained low, and the spread between them and the yields on agency mortgage-backed securities didn’t change much. It’s hard to see how the normalization of the Fed’s balance sheet tightened financial conditions in a way that would have weighed significantly on stock prices.”

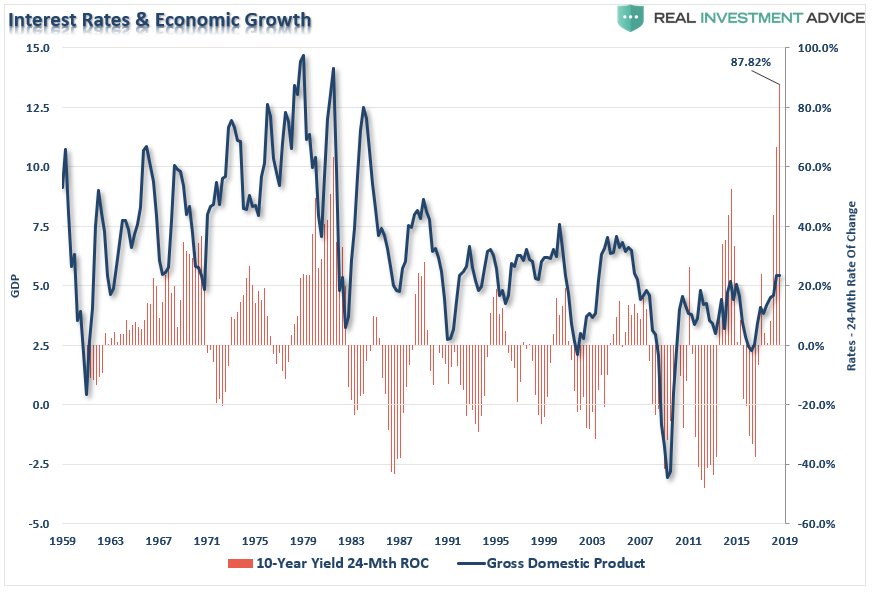

Yes, it is true that nominal yields may not have changed much in total, but what Bill missed was the impact of the “rate of change” on the economy. As I noted back in October:

“On Thursday and Friday, stocks crumbled as the reality that higher rates and tighter financial conditions will begin to negatively impact growth data. With housing and auto sales already a casualty of higher rates, it won’t be long before it filters through the rest of the economy.

The chart below shows nominal GDP versus the 24-month rate of change (ROC) of the 10-year Treasury yield. Not surprisingly, since 1959, every single spike in rates killed the economic growth narrative.”

As we have written about many times previously, the linkage between interest rates, the economy, and the markets is extremely tight. As the Fed began reducing their balance sheet the roll-off caused rates to jump to more than 3%.

In turn, higher rates which directly impacted consumers, led to an almost immediate downturn in economic activity. Specifically, in September of last year, we wrote:

“Rising interest rates, like tariffs, are a ‘tax’ on corporations and consumers as borrowing costs rise. When combined with a stronger dollar, which negatively impacts exporters (exports make up roughly 40% of total corporate profits), the catalysts are in place for a problem to emerge.

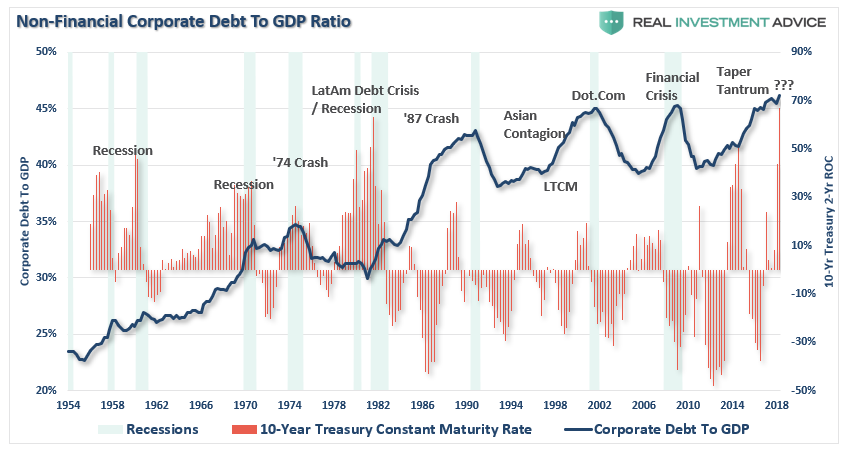

The chart below compares total non-financial corporate debt to GDP to the 2-year annual rate of change for the 10-year Treasury. As you can see sharply increasing rates have typically preceded either market or economic events.”

Of course, it was the following month the market begin to peel apart.

As Bill noted, part of the reason for the correction in the market was indeed the realization of what we had been warning about since the beginning of the year – weaker growth.

“But the cracks are already starting to appear as underlying economic data is beginning to show weakness. While the economy ground higher over the last few quarters, it was more of the residual effects from the series of natural disasters in 2017 than ‘Trumponomics’ at work. The “pull forward” of demand is already beginning to fade as the frenzy of activity culminated in Q2 of 2018.

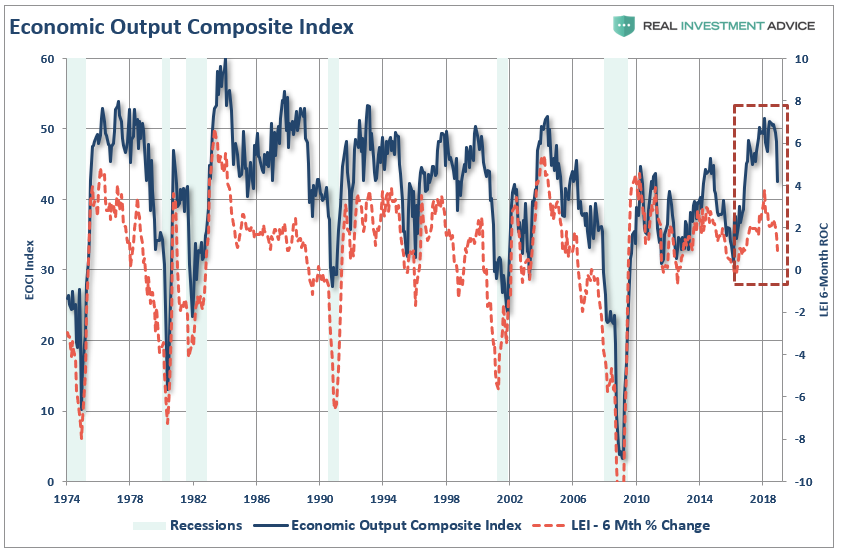

To see this more clearly we can look at our own RIA Economic Output Composite Index (EOCI). (The index is comprised of the CFNAI, Chicago PMI, ISM Composite, All Fed Manufacturing Surveys, Markit Composite, PMI Composite, NFIB, and LEI)

“As shown, over the last six months, the decline in the LEI has actually been sharper than originally anticipated. Importantly, there is a strong historical correlation between the 6-month rate of change in the LEI and the EOCI index. As shown, the downturn in the LEI predicted the current economic weakness and suggests the data is likely to continue to weaken in the months ahead.”

Not surprisingly, and to Bill’s point, the market turned lower as a host of pressures still remain.

-

Earnings estimates for 2019 have sharply collapsed as I previously stated they would and still have more to go.

-

Stock market targets for 2019 are way too high as well.

-

Trade wars are set to continue as talks with China will likely be fruitless.

-

The effect of the tax cut legislation has disappeared as year-over-year comparisons are reverting back to normalized growth rates.

-

Economic growth is slowing as previously stated.

-

Chinese economic has weakened further since our previous note.

-

European growth, already weak, will likely struggle as well.

-

Valuations remain expensive

Reserve Some For Me

Bill Dudley made a very interesting statement in relation to “excess reserves.”

“The new news here is simply that Fed sees greater demand for reserves than it expected a year ago.”

Why? What changed? Why do banks require more reserves, now?

The chart above shows excess reserves relative to the S&P 500. When bank reserves have previously declined, it was in the midst of market turmoil. It was then either the Federal Reserve, or global Central Banks, injected liquidity into the system.

The reason the banks need reserves, particularly during a market decline, is to ensure there is enough liquidity to meet demands for capital. This is also suggestive of why Steve Mnuchin, the Secretary of the Treasury, decided, just prior to Christmas as the market plunged, to call all the major banks to “assure them that liquidity was readily available.”

Given that it is highly unusual for the Treasury Secretary to call the heads of banks AND the “President’s Working Group On Financial Markets,” aka the “plunge protection team,” to try assuage market fears, it raises the question of what does the Treasury know that we don’t?

The One Thing

However, the one statement, which is arguably the most important for investors, is what Bill concluded about the size of the balance sheet and it’s use a a tool to stem the next decline.

“The balance sheet tool becomes relevant only if the economy falters badly and the Fed needs more ammunition.”

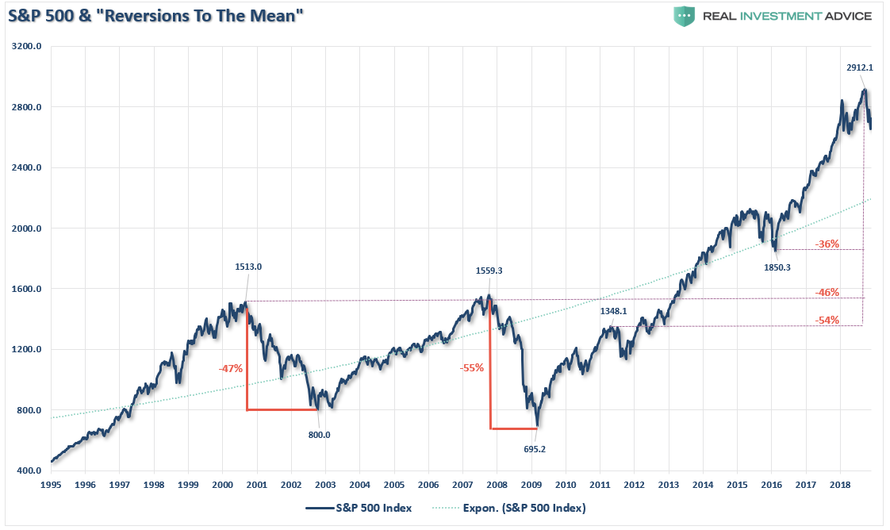

In other words, it will likely require a substantially larger correction than what we have just seen to bring “QE” back into the game. Unfortunately, as I laid out in “Why Another 50% Correction Is Possible,” the ingredients for a “mean-reverting” event are all in place.

“What causes the next correction is always unknown until after the fact. However, there are ample warnings that suggest the current cycle may be closer to its inevitable conclusion than many currently believe. There are many factors that can, and will, contribute to the eventual correction which will ‘feed’ on the unwinding of excessive exuberance, valuations, leverage, and deviations from long-term averages.

The biggest risk to investors currently is the magnitude of the next retracement. As shown below the range of potential reversions runs from 36% to more than 54%.”

“It’s happened twice before in the last 20 years and with less debt, less leverage, and better funded pension plans.

More importantly, notice all three previous corrections, including the 2015-2016 correction which was stopped short by Central Banks, all started from deviations above the long-term exponential trend line. The current deviation above that long-term trend is the largest in history which suggests that a mean reversion will be large as well.

It is unlikely that a 50-61.8% correction would happen outside of the onset of a recession. But considering we are already pushing the longest economic growth cycle in modern American history, such a risk which should not be ignored.”

While Bill makes the point that “QE” is available as a tool, it won’t likely be used until AFTER the Fed lowers interest rates back to the zero-bound. Which means that by the “QE” comes to the fore, the damage to investors will likely be much more severe than currently contemplated.

There is one important truth that is indisputable, irrefutable, and absolutely undeniable: “mean reversions” are the only constant in the financial markets over time. The problem is that the next “mean reverting” event will remove most, if not all, of the gains investors have made over the last five years.

This is why us “Financial Types” pay such close attention to the size of the Fed’s balance sheet.

via ZeroHedge News http://bit.ly/2DvV9An Tyler Durden