Russia is winning its war of attrition against aggressive U.S. sanctions policy. Diplomatically, Russia is winning on all fronts, finding positive solutions through its abundant energy reserves to open gaps in relationships hat have been frozen in geopolitical amber for two generations.

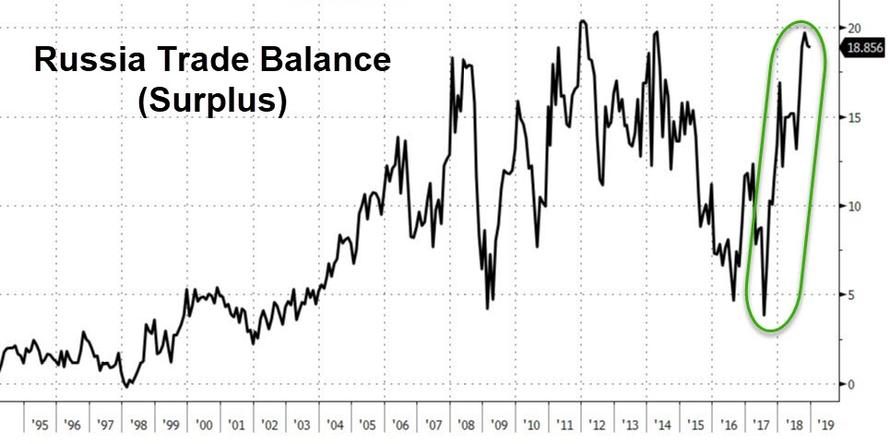

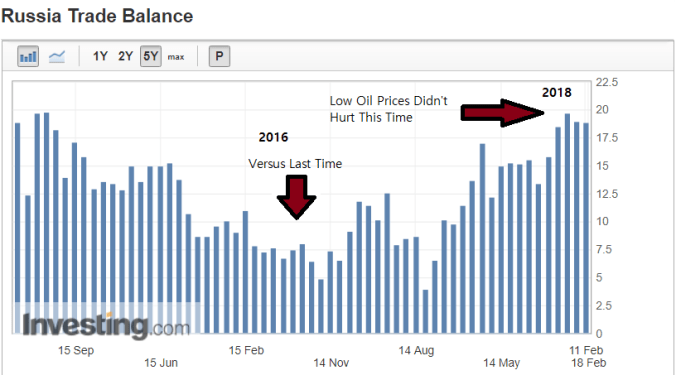

The latest balance of trade data from Rosstat tells the tale. Russia continues to run a massive trade surplus even though oil prices crashed in the fourth quarter and have only somewhat recovered.

I’ve covered the surprising stability of the Russian ruble over the past six months given the volatility in oil prices in the past. That stability is key to the future of central Asia as well as eastern Europe.

Putin is positioning Russia and the ruble as the glue which ties central Asia’s development together through the Eurasian Economic Union. So, it and Russia’s economy defying the best efforts of the U.S. to impede its growth is something to keep watch on.

Russia’s overall exports are governed by it’s oil production. With the U.S. threatening all manner of new sanctions throughout 2017, Russia turned on the oil spigots after Trump’s disastrous Aluminum tariffs and his exiting the JCPOA.

But, let’s do some math. From 10.5 million bbl/day to 11 million bbl/day is only an increase of around $1 billion per month assuming all of that oil is exported at an average price of $60/bbl and zero cost of production.

500,000 bbl/day X $60/bbl X 30 days/month equals $900,000,000.

So, the $5 billion / month increase in Russia’s trade balance can’t be covered by simply the production of more oil and gas. And since May of 2018 the Ruble has held in a pretty tight +/-3% band between RUB64 and RUB70 versus the dollar. So there’s no currency effects with respect to oil.

But beginning in November, Russia’s balance of trade numbers have hit record levels, jumping nearly $5 billion per month.

Balance of trade went from around $14-15 billion per month to $19-20 billion. Now, this is likely due to currency depreciation sparking exports with a six month time lag.

Before the sanctions the ruble was trading in the low to mid 50’s versus the dollar and then jumped 20% to the 60’s, where it has held ground ever since.

But, the ruble’s weakness was a market correction due to the U.S. trying to retard Russia’s growth through sanctions. Weaker oil prices, however, didn’t send the ruble and domestic inflation soaring. It’s back above 5% up from a low of 2.3% mostly due to rising food prices.

The takeaway here is that Russia’s export economy is showing signs of decoupling from oil.And they have the U.S.’s short-sighted use of sanctions to thank for it.

It’s also underscoring the strength of Russian/Chinese trade which grew another 30% to $107 billion in 2018 after nearly 21% growth in 2017.

Russia ran an $11.1 billion surplus with China last year. Maybe Donald Trump could ask Putin how he does that? Either way, Putin and Chinese Premier Xi Jinping are well ahead of their original goal of $100 billion in trade by 2020.

And with Power of Siberia nearly complete and should begin shipping gas by the end of the year, those numbers will increase dramatically again.

The ruble/yuan exchange rate has settled into a much tighter band as trade volume expands, so the potential effects of further sanctions on Russia seem muted at best.

2019 should be a mixed bag for the ruble with oil prices likely to stay where they but the dollar strengthening draining global liquidity.

But it has been Putin’s insistence on diplomacy that has assisted this export boom for his country. Japan is now making serious noises about signing a peace treaty to take advantage of Russia’s energy projects nearby.

Japan wants Russian gas. It’s currently buying it as LNG from Yamal and shipping it via the Arctic Sea Route.

Prime Minister Shinzo Abe reiterated this position this weekend after signing a major agreement with German Chancellor Angela Merkel. At some point there is only so long you can hold countries as vassals. Their best interests eventually come to dominate the relationship.

The U.S. is feeling that now with Japan and Germany and it all because of Russia’s vast energy reserves and their ability to craft win/win relationships with everyone.

That’s why Russia’s exports are booming and why in the long run Putin can wait for the U.S. to regain its senses and come to him. Or not. There are plenty of other potential partners.

* * *

Join my Patreon and subscribe to the Gold Goats ‘n Guns Newsletter for exclusive commentary and investment ideas.

via ZeroHedge News http://bit.ly/2WXoA7f Tyler Durden