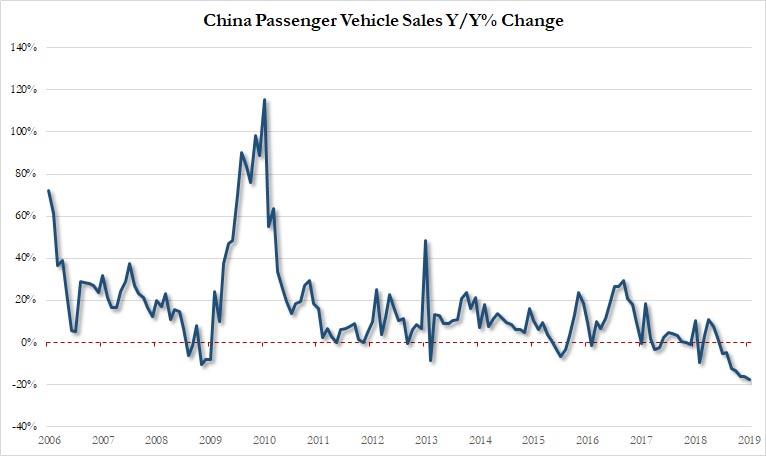

Car sales in China continued their relentless descent in January, falling 17.7%, as we recently expected would happen when discussing Europe’s tumbling January auto sales. This follows the country’s first full year slump (2018) in more than two decades and it puts further pressure on the state of the global automotive market.

The drop marked the eighth monthly retail sales decline in a row and was the biggest one-month drop in seven years.

Gu Yatao, a Beijing-based auto analyst with Roland Berger, confirmed to Bloomberg that the “downward pressure is still there. The government isn’t adopting stimulating policies to give the market a shot in the arm.”

The contraction in China comes at the same time that auto markets in Europe and North America continue to shrink as a result of car sharing services and slowing economies. As we have been reporting for months, the slowdown in China continues to be a result of the country’s slowing economy, coupled with the lagging trade war with the United States. Even discounts for the Chinese New Year, which traditionally can help spur sales, weren’t enough to keep consumers in showrooms early this year.

It’s a “historic slump” for China: the wholesale decline in January, to 2.02 million units, accelerated from December’s 15.8% slump. For 2018, the drop was 4.1%, marking the first decrease since the early 1990s.

John Zeng, managing director of LMC Automotive Shanghai, told Bloomberg he expects the first half of 2019 will “continue to see downward pressure” as a result of a purchase tax cut from 2016 and 2017 that pulled vehicle sales forward. At the same time, manufacturers continue to watch their spending carefully and rein in sales forecasts. According to Bloomberg:

- Geely Automobile Holdings targets sales of 1.51 million cars this year, up only 0.7%

- Volkswagen is expecting further growth this year, but believes that the Chinese market will shrink overall in 1H 2019

- Jaguar Land Rover was recently forced to take a $3.9 billion writedown this month as a result of the market slowdown

- Daimler and BMW reduced forecasts last year due to the U.S.-China trade war

- Hyundai said last month it’s moving forward with layoffs as it re-evaluates its long term plans for China

CAAM predicts that China’s car market will be “little changed in 2019”, but global cues have so far painted a picture of pessimism for the industry worldwide.

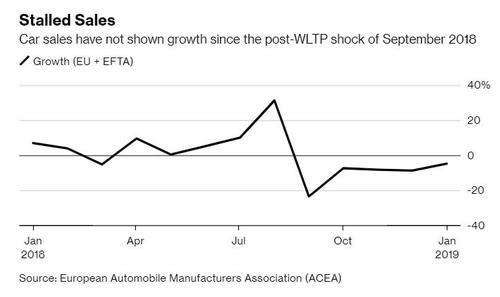

For instance, we just reported that the latest EU/EFTA vehicle registration data showed that passenger car registrations dropped 4.6% year over year to start 2019. Additionally, sales declined in all of the largest markets in Germany, France, the U.K., Italy and Spain.

Last year, emissions testing was the generic excuse used by most manufacturers to explain the sharp drop in EU auto sales. However, with poor data continuing into 2019, it’s becoming clear that the problem is likely to instead be the result of a broader global slowdown, with China continuing to lead the charge.

via ZeroHedge News http://bit.ly/2Im9W6w Tyler Durden