Authored by Koen Verbruggen of RaboBank

Summary

- The Commerce Department finished the report into whether automotive imports are a threat to the US national security

- Although the conclusion of the report has not been released yet, it is likely that Trump now has 90 days to decide on imposing tariffs

- We expect that Trump will wait with imposing tariffs and will use it as leverage in coming trade negotiations.

- The most important car exporters to the US are likely to receive exemptions based on progress of ongoing trade talks or earlier agreements about trade (USMCA)

- The economic impact from tariffs would be substantial for countries dependent on US car imports, such as Germany, Japan, Mexico and Canada

Very dangerous cars

Trump to proceed with car tariffs?

The Commerce Department concluded their investigation whether automotive imports are a threat to the US national security under Section 232 of the Trade Expansion Act. The Commerce Department did not release any details on the findings. The report could allow President Trump to restrict imports that threaten to “impair the national security”. He now has 90 days to decide about imposing tariffs, making his decision to be due by 18 May. We expect Trump to impose tariffs on car imports, but several countries will be given an exemption. Trump is likely to take some time and not impose the tariffs immediately. After the release of a similar report on aluminium and steel tariffs last year, which was made publicly available a month after completion, he took one additional month to announce the import tariffs on aluminium and steel.

The most important trading partners of the US are Mexico, Canada, Japan and the EU. Mexico, Canada and the United States have agreed on a new trade deal (USMCA) and should receive temporary exemptions, until USMCA is ratified and then avoid them altogether. Japan and the EU are looking to start trade talks and the possible exemption is likely to be conditional on the progress in these negotiations. The 232-report should therefore mainly be seen as a possibility to give the US more leverage during these talks.

Trade relationships: The global car industry

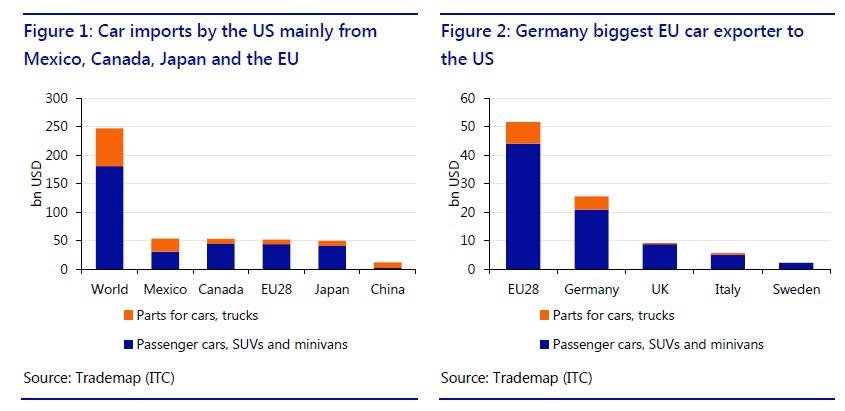

As we have noted before, the trade relationships regarding the automotive industry between the US and the rest of the world are highly intertwined. Depending on the precise category the US is going to target the value of car imports will be around USD 250bn. Figure 1 shows that the US imports cars mainly from the Mexico, Canada, the EU and Japan. The share of car imports from China is relatively small. Within the EU the most dependent country on US imports is clearly Germany.

By imposing tariffs on automotive imports Trump aims to protect the domestic automotive sector, boosting their domestic market share and creating more jobs. This line of reasoning misses two important points. The first one is that the US car industry is highly reliant on intermediate inputs, tariffs would raise the cost of these parts making the domestically produced cars more expensive and hence lowering demand both in the US and from abroad. The second one is that the tariffs are likely to be met with retaliation, lowering the demand for US cars abroad even more. Taken together we think the effect on the US economy will be ambiguous at best and likely negative in the long run.

If Trump decides to move ahead, it is expected that the tariffs will be in the range of 20-25%. This would indicate a 22.5 percent tariff increase for cars and could lead to a one-third reduction in car exports to the US from the rest of the World. For the EU this would mean a reduction in exports of USD 17 bn. Calculations by the IFO institute indicate that in the long-run German car exports to the US could even fall by almost 50%. The car exports from Japan to the US are worth almost USD 50bn, which is more than one-third of total exports to the US. A US import tariff on this category could therefore seriously hit the Japanese economy, reducing the estimated exports by around USD 16.2 bn. The total impact is likely to be larger given the integrated supply chains and interconnectedness between the car sector and other sectors in the economy.

Retaliation

The EU has already communicated to be prepared to target USD 22.7bn of US exports with import tariffs if Trump decides to impose tariffs on automotive imports. Since we expect that the US will give an exemption to the EU, it is likely that the retaliation will not take place in coming months. A further escalation of the trade war between the US and the EU will remain conditional on the progress of the coming trade talks. The same will hold for the trade tensions between Japan and the US. It still seems likely that the US and Japan will reach something like a deal later this year, where the expectation is that Japan will meet US demands in the field of agriculture and the automotive sector.

Conclusion

Although we do not expect that Trump will impose the tariffs immediately, they will increase uncertainty and could make firms hesitant to make investment decisions. This will be an additional downside risk for the already slowing Eurozone economy. Especially Germany, which saw its economy slowing down significantly in the 3rd and 4th quarter of 2018, is vulnerable to tariffs imposed on cars. It is fair to say that the tariffs come at an ill-timed moment for the Eurozone, which already has enough issues challenging the economy.

via ZeroHedge News http://bit.ly/2Ik1Db6 Tyler Durden