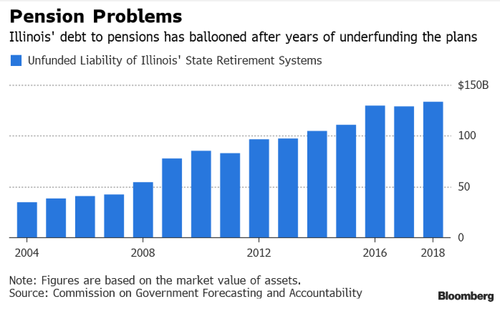

Back in December we noted that the lack of basic economic common sense by its politicians led the state of Illinois to a $134 pension shortfall. Now, the latest Democrat failing to understand simple math, and that the answer to fixing a debt problem is not more debt, is billionare Illinois governor J.B. Pritzker.

Pritzker is said to be preparing his first address on the state’s budget for Wednesday, where he will address his desire to issue $2 billion in bonds in order to raise cash for the state’s horrifically insolvent retirement system. This is the same tactic that the state tried in 2003 which, of course, failed miserably. All the while, in the years following 2003, Illinois’ credit rating has moved closer and closer to junk with the state just one notch above the embarrassing level.

Pritzker’s deputy governor, Dan Hynes, thinks that the bond sale might be a way for the government to shirk its annual contributions to the funds, which is what happened 16 years ago after Governor Rod Blagojevich’s $10 billion debt sale. After the 2003 debt sale, the state failed to make sufficient annual payments into pension funds from 2005 to 2008, which added nearly $12 billion to the state’s obligations.

The hilarious thing is that even while advocating for selling more debt, people involved are claiming to have “learned from their mistakes.” Robert Martwick, a state representative who chairs the House’s pension committee told Bloomberg: “This time you have people who understand the devastating effects of doing what he did.”

No, Bob. You don’t.

The borrowing is part of a new plan that includes – you guessed it – raising taxes, and other clinically insane and brutally useless ideas for addressing a $134 billion shortfall, like handing government assets, including office buildings, over to the retirement system. Hynes said that the $2 billion debt sale would supplement Illinois’ annual contribution and would be yet another wager on the stock market. He hopes that investment earnings will reduce the amount that the state owes.

Thus, the Ponzi-like house of cards continues to grow.

In 2010, a $3.5 billion bond was sold and used to cover the state’s pension contributions before a $3.7 billion bond issuance took place in 2011.

Thad Calabrese, a professor at New York University, tried to offer a reality check. “There’s going to have to be some actual sacrifice,” he said. While Calabrese is dancing around the issue a little, the facts are clear: more debt is simply not going to fix the problem and Illinois simply doesn’t seem to understand that.

A Bloomberg article uses the word “luck” in describing what’s necessary for Pritzker’s plan to work. This “luck” is nothing more than a gamble that the stock market is going to move higher, despite being near all-time highs right now.

Triet Nguyen, managing partner at Axios Advisors said: “All these gimmicks with the pension bonds and trying to transfer state assets into the pension funds — it seems more like an accounting gimmick than a true funding mechanism.”

Is it still any wonder the Fed bases monetary policy on day-to-day moves in the stock market, when all idiot politicians can do is kick the can and pray the Minsky moment won’t come crashing down on their heads?

via ZeroHedge News https://ift.tt/2SQIzGh Tyler Durden