Submitted by Nomura strategist Bilal Hafeez

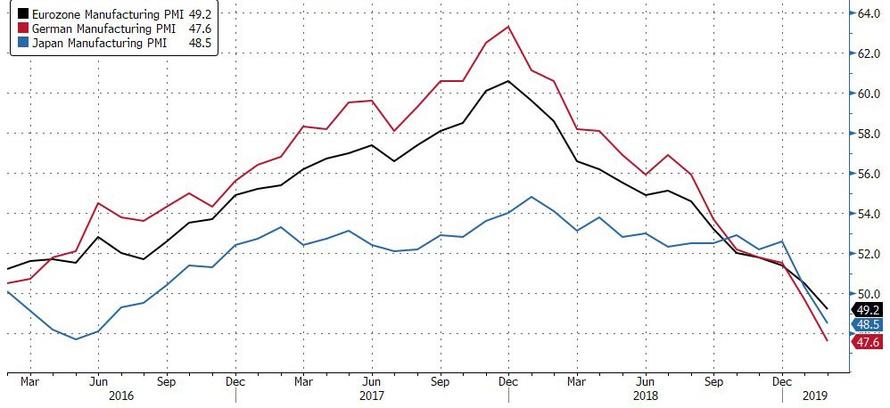

Today’s weak German and Japanese manufacturing PMIs suggest the global trade cycle remains under pressure.

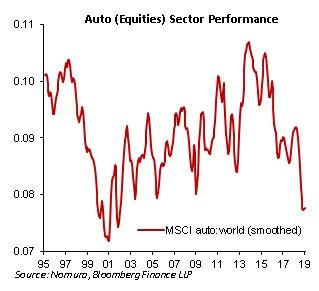

The fact that these two nations are major car manufacturers is also instructive. Indeed, an often neglected story of the past year has seen the collapse in the auto cycle.

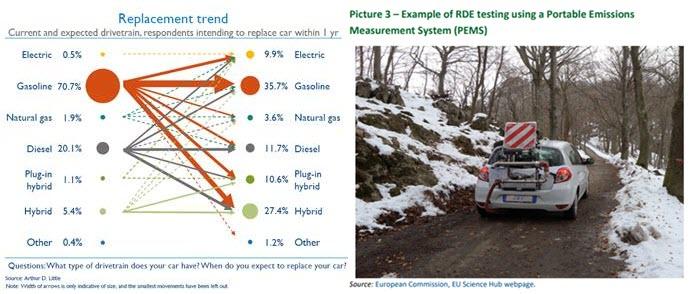

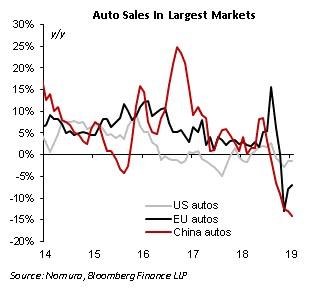

So while US-China trade talks are crucial for a revival in global manufacturing, another set of trade talks, that between the US-EU on car tariffs, are also important. And we shouldn’t forget the impact of Brexit on the European auto sector – both in terms of production and consumption. If that wasn’t enough, we also have the ongoing switch from diesel/petrol to electric/hybrid cars. Such an industry transformation has likely impacted the global auto sector, helped in part by governments at the national and local levels (especially in Europe) discouraging the purchase of diesel cars. Indeed, many surveys suggest consumers are holding off purchasing cars until a larger range of electric/hybrid cars are available (see picture).

Regional factors are also weighing on the auto sector. In Europe, we have new emission standards that have hurt EU sales. These new standards have forced car manufacturers to test almost all their model types in road conditions (the real-driving emissions test, RDE, see picture above right) rather than benchmark models in lab conditions. A backlog in getting the tests done has severely slowed auto sales. In China, we have seen the expiry of car tax breaks and ongoing deleveraging that have hurt China sales. These along with the global factors have seen sales in China and the EU plunge.

Therefore, a critical ingredient for a revival in global manufacturing will likely be a revival in the global auto sector. Several factors weighing on the sector appear to be temporary (emissions testing, trade deal), while others are more structural (move to electric). This year should clarify the balance between the two.

via ZeroHedge News https://ift.tt/2GCzaMf Tyler Durden