As the US battles with its OPEC+ rivals over the direction of global oil prices (Trump wants to keep oil prices subdued, while Saudi Arabia and Russia, reeling from years of prices too low to balance their budgets, are desperately hoping to push them higher with another round of production cuts), 12 supertankers sailing across the Atlantic can tell us a lot about the changing supply dynamics in the global oil market.

The tankers have been traveling a route spanning thousands of miles with no cargo other than some seawater needed for ballast. Of course, in normal times, the ships would be filled with heavy, high sulfur Middle East oil for delivery to refineries in places like Houston or New Orleans.

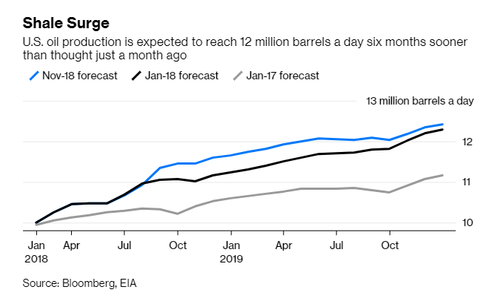

But these aren’t “normal” times. Following the OPE+ agreement to cut 1.5 mb/d, the ships are sailing cargo-less – forgoing profits on half of their journey – just so they can pick up the light crude that US shale producers – which briefly turned the US into a net-exporter of oil for the first time late last year – have been relentlessly pumping, according to Bloomberg.

That’s quite a sacrifice for the owners of the ships, which are traveling 21,000 with nothing to show for it.

The 12 vessels are making voyages of as much as 21,000 miles direct from Asia, all the way around South Africa, holding nothing but seawater for stability because Middle East producers are restricting supplies. Still, America’s booming volumes of light crude must still be exported, and there aren’t enough supertankers in the Atlantic Ocean for the job. So they’re coming empty.

“What’s driving this is a U.S. oil market that’s looking relatively bearish with domestic production estimates trending higher, and persistent crude oil builds we have seen for the last few weeks,” said Warren Patterson, head of commodities strategy at ING Bank NV in Amsterdam. “At the same time, OPEC cuts are supporting international grades like Brent, creating an export incentive.”

As OPEC+ supply declines, shippers are turning to the US for profit growth, analysts said.

Shippers are counting on the U.S. exports to help the tanker market withstand supply restrictions by the Organization of Petroleum Exporting Countries and allies including Russia. Industry analysts, who actually raised their estimates for what they think the ships will earn this year after the OPEC+ pact was announced in December, are citing rising American shipments as a contributing factor.

There are usually three or four empty supertankers – very large crude carriers in industry jargon – that would sail empty to the U.S. at any one time, according to shipbrokers.

The shift has produced knock-on effects around the shipping market. Daily earnings for the VLCCs, which can haul two million barrels of oil, on the benchmark Middle East-to-China route doubled since last week to $29,494, according to Baltic Exchange data.

“Following a fixing frenzy from the U.S. Gulf Coast late last week, most available tonnage in the Atlantic basin has been soaked up,” said Espen Fjermestad, an analyst at Fearnley Securities AS in Oslo. “With ships ballasting West, rates have shifted up also in the East.”

And with the spread between WTI and Brent crude widening back toward levels last reached during the October oil-price crash, OPEC+’s production cuts are increasingly looking like a Sophie’s choice: Either cut production and cede more market share to the US (shale crude also benefits because it’s easier to process into gasoline), or stop the cuts and accept that prices will remain low for the foreseeable future. While it’s unclear what OPEC+ will decide at its next meeting in Vienna (will OPEC+ members cave to Saudi and agree to a new alliance that includes Russia and its CIS allies as full partners?), one thing appears certain. Producers in the Permian are showing no signs of slowing down.

via ZeroHedge News https://ift.tt/2GK84mc Tyler Durden