Commenting on the market’s latest meltup, Nomura’s Charlie McElligott generally skips the primary catalyst for today’s action, namely Trump’s decision to extend the March 1 trade tariff deadline with China, and instead focuses on the Fed’s “breathtaking” policy pivot which as noted during the barrage of Fed speakers on Friday, now also includes the “double-whammy” of both 1) a “Reverse Operation Twist” shift to alter the composition of the balance-sheet (shrinking the weighted average duration of the UST portfolio via directing reinvestments into the front-end, while allowing for MBS to continue “running off”) alongside a hint of 2) a new framework to increase inflation expectations (either through ‘averaging’ or ‘targeting’ to allow for “overshoot”) which “will have a profound thematic impact on investor behavior over the coming months.”

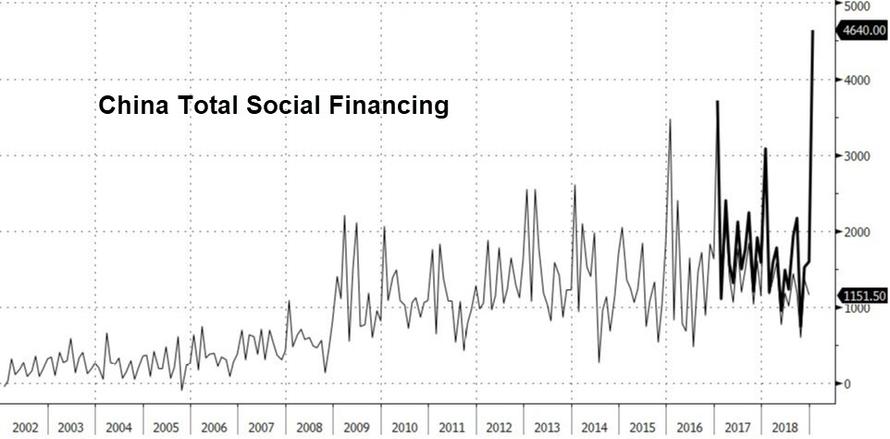

Meanwhile, McEliggott also notes the ongoing gargantuan Chinese liquidity- and credit-creation “binge”…

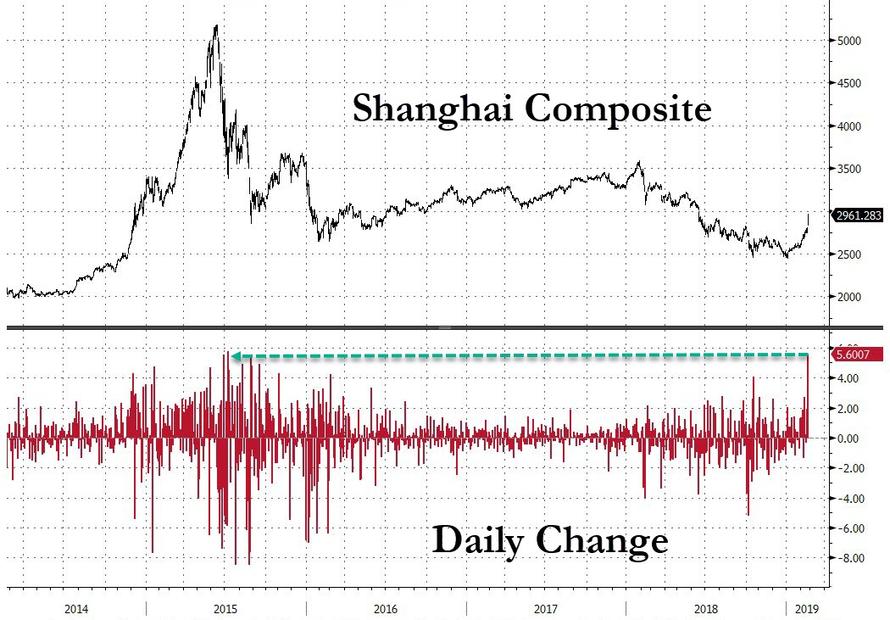

… which despite vocal complaints from China’s prime minister urging to tame the massive credit expansion, shows no-signs of letting-up following Friday’s Politburo “official statement”, which now downplays “the prior baseline importance of preventing financial risks, vs now instead signaling greater focus on stimulating growth (as well as further seeking to liberalize the Securities industry) and driving a “speculative mania” back into stocks again”, which as we noted earlier today saw Chinese stocks re-enter a bull market, with the CSI 300 soaring +6.0%, alongside the SHCOMP’s 5.6% surge – its biggest one day gain since the summer of 2015 – with a “cyclical” lean (Brokers +10.6%, Diversified Financials +10.0%, Banks +6.3%, Materials +5.6%, Industrials +5.2%).

To the Nomura strategist, this latest “reflation” impulse is critical from a macro-factor perspective to maintain the “goldilocks” narrative, as (subdued) inflation matters most to SPX, with “Metals” and “Inflation Expectations” making up four of the top five largest sensitivities (Iron Ore, Copper, 2Y Inflation Expectations and 5Y Inflation Expectations), and as seen as evidence that “global Growth” may be stirring even as the Fed’s new inflation framework allows for higher inflation without concerns of Fed “policy error/overtightening.” In other words, we are back to the QE days when “bad news is good news, and good news is great news.”

And yet, as some other asset classes clearly indicate most notably bonds where the 10Y stubbornly refuses to move higher, this “reflation” view is seen as tactical, as the “end-of-cycle” investor skepticism mentality too remains firmly in-place among investors and traders, with most voicing a desire to only “rent” these themes against a rapidly-aging business cycle which Nomura sees correctly as being propped-up by central bank “dovish” spasms and capitulation, coupled with China’s massive liquidity-injections and credit-pumping after admitting defeat on their failed two year “deleveraging.”

To this “late-cycle investor pessimism” fear, Charlie also points to the Bloomberg US Economic Surprise Index, which is now -1.5 Standard Deviations below its lifetime range, for the first time since the global growth scare of early ’16, ironically prior to the “Shanghai Accord”/Yellen “Weak Dollar” pivot.

Incidentally, according to Nomura calculations, when the US Econ surprise index is trading below its current “trigger” at -0.51 for the first time in at least 3 months, making it a “new low”, over the following month median returns for the SPX is -6.7%, RTY -7.3% while Growth/Tech get smoked relative to Value.

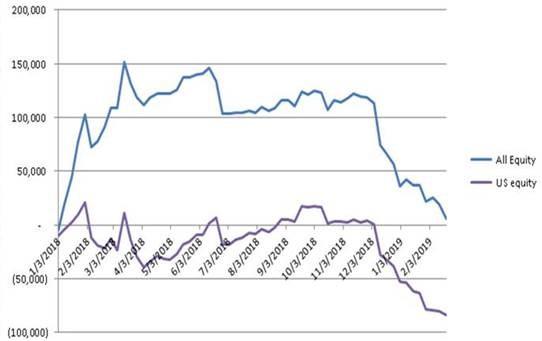

This then likely explains the continued skepticism of investors who as we noted last Friday, have been pulling money from US equity funds for the past 12 weeks, as the US Economic data meltdown is a large part as to why there is so much simplistic disdain for owning anything “US Cyclical” here at this point in the game, versus the muscle-memory investor “safety blanket” of “Secular Growth.”

And yet… with the S&P now above 2810 and nearly 500 points higher in exactly two months, someone clearly is buying stocks.

Which brings us to the question du jour: what has driven the US Equities price action? According to Nomura’s cross-asset strategist, the answer is four-fold:

- US Corp stock repurchases,

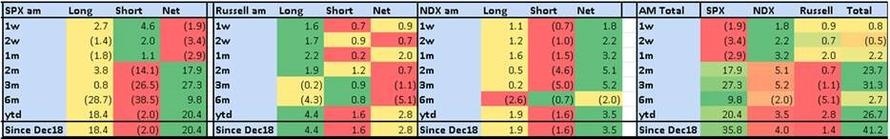

- Short-Covering (Cash, Futs and ETFs),

- Asset Manager Futures buying and

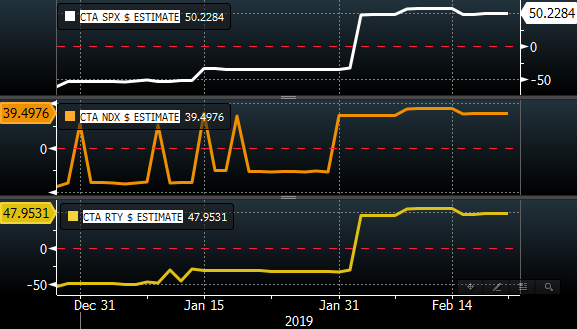

- CTA Trend pivot from “Max Short” to “Max Long”

As a reminder, last week we noted that according to BofA client flows, YTD 2019 stock buybacks are running nearly 100% higher than the same period in 2018. So making a conservative assumption of buybacks at a similar pace as 1Q18 at $189B and ‘day-counting’ from mid-Dec through past Friday (47 days), this assumes $3B of purchases / day (or $5B / day adjusted for blackout) which equates to ~ $143B of Corp buyback purchases YTD thus far.

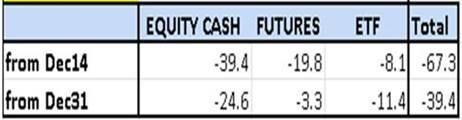

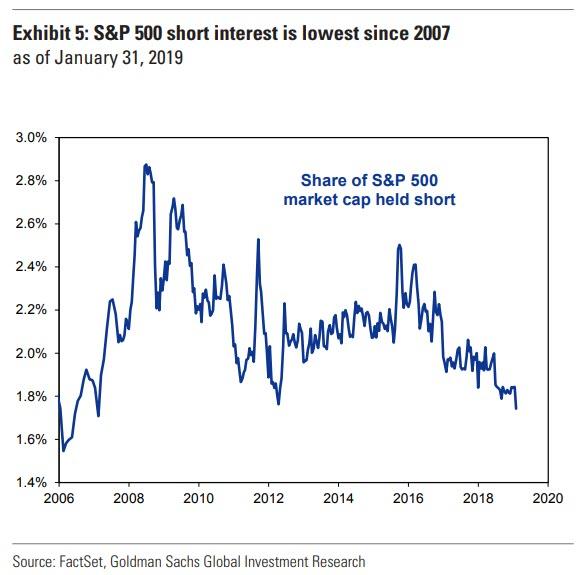

Next, picking up on our Friday report that S&P500 Short Interest has tumbled To a 12 Year Low, McElligott notes that using the same mid-Dec 14th date through Jan 31st 2019, we have seen $39.4B of Cash Equities covering; $19.8B of Futures covering; and $8.1B of ETF covering for a total of $67.3B of notional short-squeeze (YTD, is $39.4B across Cash $24.6 / Futs $3.3B / ETF $11.4B).

As a reminder, Goldman calculates that the share of S&P 500 market cap held short is now at the lowest level since 2007, and as shown in the chart below, after peaking at 2.5% in 2015, just ahead of the Jan 2017 Shanghai Accord, short interest as a share of S&P 500 market cap has continued to slide lower and now equals just 1.7%.

Meanwhile, even as investors have been avoiding cash equities and ETFs, equity futures positioning for Asset Managers show that “real money” has been scooping since mid-Dec as well, with a cumulative +$41.2B of purchases across SPX, NDX and Russell ($35.8B / $4.0B / $1.4B, respectively).

Finally, there are the algos, which were so quickly blamed for the market waterfall in December yet which nobody has anything bad to say about now. Looking at Nomura’s assumptions from the company’s QIS Trend model, McElligott estimates that CTAs were -$65B “Max Short” in S&P by mid-Dec, and upon the cover and flip to “Max Long” are now ~+$50.2B notional net long for a cumulative +$115B of demand.

Meanwhile, and still refusing to validate the equity move higher, global money flows are clearly “defensive” in nature, with McElligott showing that Global Bonds leading inflows (+$39.2B over the past month) while Global Equities continue to be purged (-$30.9B for the last month), and as we reported last Friday, US Equities outflows in particular continue to evidence the skepticism of the rally, with Institutional outflows (-$2.6B on the wk, and -$14B for the past month), Retail outflows (-$1.7B last wk, -$8.8B for the past month), Active outflows (-$3.1B on the wk, -$9.5B over the past month) and Passive outflows (-$1.2B wk, -$13.5B past month).

via ZeroHedge News https://ift.tt/2U2zlDz Tyler Durden