Last week, Mark Orsley observed that the most critical resistance for the S&P is 2800, a key number because the trend line connecting that point failed three times in Oct, Nov, and Dec and “would also coincide nicely with my Elliott Wave “5 count” that would speak of an “ABC” correction.”

And now thank to the latest “trade talk optimism” after president Trump said – 15 minutes before futures opened for trading – that he will delay the March 1 deadline for higher U.S. tariffs on $200 billion of Chinese goods, risk assets received a fresh boost, as algos first bought the rumor and then also bought the news, lifting Japan and South Korean shares higher, but all eyes are on S&P futures, which not only took out Thursday’s, and 2019 highs…

… but more importantly are right at the key resistance level that successfully ended the last three bounces in October, November and December.

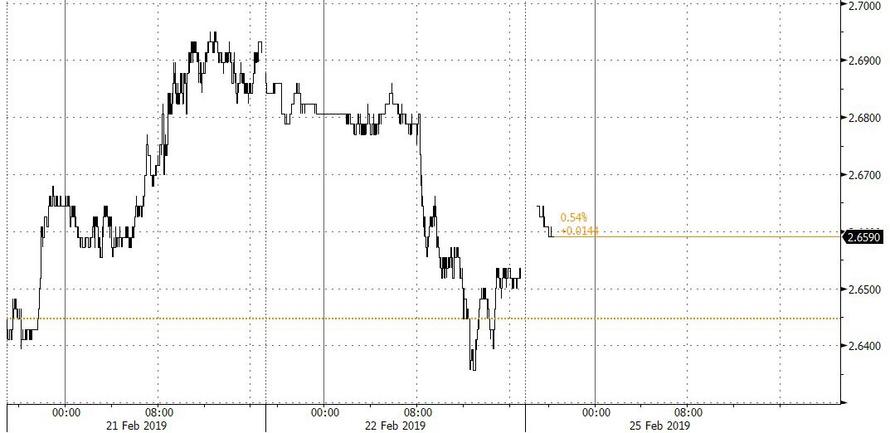

Yet while algos are eager to keep rising on both rumors and news, Treasurys are far more subdued, with the 10Y yield barely rising, and last trading just under 2.66%, largely unchanged from its Friday level.

Finally, siding with the more subdued take on today’s trade news, JPMorgan’s chief market strategist for Asia Pac, Tai Hui, said on Bloomberg TV that “the extension of the trade truce between the U.S. and China may not offer a significant boost to stocks, JPMorgan says, as the market has been moving toward this view in recent weeks.” Still, the extension “helps to underpin positive investor sentiment in what could be a testing week if February PMI numbers continue to show softening of the global economy.”

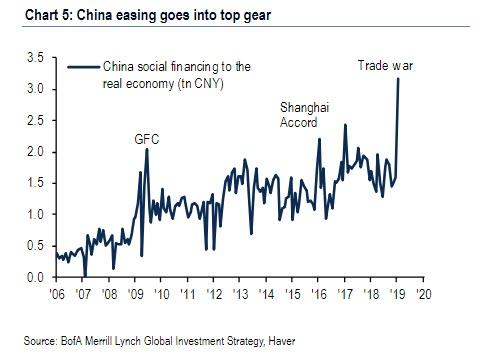

Of course, with the trade deal now effectively under wraps barring some unexpected development, and this week’s testimony by Chair Powell in which he will likely be just as dovish, it is quite likely that any bad news will be seen as good news for markets, especially as traders still digest China’s gargantuan January credit injection which was substantially greater than what China did to unleash the global market rally following the Shanghai Accord.

That said, with trader euphoria prevalent, keep in mind the following caution from Mark Orsley: the S&P future has only been this overbought to its 50-day moving average only two times: both times saw significant corrections of ~10% shortly thereafter.

via ZeroHedge News https://ift.tt/2T3u1Uc Tyler Durden