As Deutsche Bank’s Jim Reid writes overnight, for those in the capital markets who have had enough of politics “I suggest you go on holiday for a few days as this topic should dominate proceedings.” To wit: we have continued US-China trade discussions but with the March 1st tariff deadline pushed back overnight, a second summit between Trump and Kim Jong Un (Weds/Thurs), another Brexit parliament vote (Weds), Michael Cohen (Mr Trump’s ex-lawyer) giving two days of congressional testimony, including an open session on Wednesday, and the Mueller Russia investigation may be completed even if the results aren’t expected this week. We’ve got Powell’s semi-annual testimonies to Congress (Tues/Weds), US Q4 GDP (Thurs) and PCE data (Fri), European inflation data (Thurs/Fri) and final PMIs (Friday), and PMIs due out in China (Thurs).

While the week will be extremely busy by all counts, as Bloomberg quips, Wednesday will be especially challenging for TV producers managing the split screens. On that day:

- The U.S. president and the North Korean leader begin their second summit in Hanoi.

- Michael Cohen, Trump’s former lawyer, testifies at an open Congressional hearing on what he knows about the 2016 campaign.

- U.S. Trade Representative Robert Lighthizer gives an update on trade talks with China to the House Ways and Mean Committee.

- U.S. Federal Reserve Chairman Powell will address the House Financial Services Committee, his second of two days of testimony.

A closer look at the key developments:

Trade

Friday was the original deadline that the US and China set to negotiate an agreement before US tariffs on $200bn of Chinese imports rise from 10% to 25%. However Trump tweeted just before futures opened on Sunday night that “I will be delaying the U.S. increase in tariffs now scheduled for March 1,” citing productive talks with China while adding, “the U.S. has made substantial progress in our trade talks with China on important structural issues including intellectual property protection, technology transfer, agriculture, services, currency, and many other issues.” He also said that if both sides make further headway in negotiations then he will meet China’s Xi Jinping at his Mar-a-Lago resort in Florida to conclude an agreement, though he didn’t offer any details on the timing of the meeting or how long he expects the tariff extension to last. However, Mnuchin had said last week that the meeting between Trump and Xi is being tentatively planned for late March. The news unleashed the biggest rally for Chinese stocks since the summer of 2015, even as China’s state-run Xinhua news agency published a commentary on trade talks overnight saying that talks will be harder at the final stage. We should note that Lighthizer is due to testify to the House Ways and Means Committee on Wednesday which should shed some light on where things stand although the media are picking up on disagreements between Trump and Lighthizer.

Trump in Nam

Staying with Trump, expect there to be some focus on Wednesday’s second summit between the President and North Korea’s Kim Jong Un. The summit is due to take place in Vietnam over two days and a joint statement is expected following the summit. As Bloomberg notes, the regional implications could be huge for allies such as South Korea, where 30,000 U.S. troops are based, and Japan. There’s concern that Trump will give up too much if Kim makes some kind of sweet-sounding offer, a U.S. official said. Trump tweeted Sunday that he has a “great relationship” with the North Korean communist leader. They’re expected to meet one-on-one at some point during the Feb. 27-28 summit. Kim headed to Vietnam by train.

Brexit

The Brexit Parliament vote is scheduled for Wednesday with UK PM May updating the House of Commons the day prior. In all likelihood, given recent developments, the vote won’t be on a new withdrawal agreement and so therefore remains to be seen what PM May can offer MPs to stave off a Boles/ Cooper revolt which would extend Article 50. Expect a delicate few days of negotiations ahead before MPs go into that vote. Playing for time, May on Sunday promised a binding vote on her divorce deal by March 12. But she’s promised to give Parliament a general vote on Wednesday, which members are threatening to use to delay Brexit. Also keep an eye out for comments by Emmanuel Macron and Angela Merkel in Paris.

Mueller Probe

There’s a chance that the US Justice Department will announce the completion of Mueller’s Russia investigation. At this stage, it’s not known if the findings will be made public with a story on Bloomberg this week suggesting Democrats were seeking to potentially subpoena Mueller if the results aren’t publically released. One to potentially keep an eye on.

Cohen Testimony

Whether or not Mueller completes his report, attention will turn to Michael Cohen, Trump’s former fixer sentenced to three years in prison in December. He’ll be giving two days of congressional testimony, including an open session on Wednesday. As Bloomberg notes, it’s a chance for Democrats to explore topics such as pre-election hush money paid to women who alleged they had affairs with Trump, and what Cohen knows about Russian influence in the 2016 presidential campaign. What’s more, federal prosecutors in New York are still looking into Trump’s company, presidential campaign and inaugural committee.

Lighthizer Testimony

US Trade Rep Lighthizer testifies on Wednesday, and may give a sense of how likely the U.S. is to impose tariffs on auto imports. The European Union is threatening to hit back. U.S. fourth-quarter gross domestic product, due Thursday, is expected to show 2.5 percent expansion last year, short of the Trump administration’s ambitious goal.

Powell

The main focus for Fed watchers this week will be Fed Chair Powell’s testimony to the Senate Banking Committee on Tuesday and House Financial Services Committee on Wednesday where he will deliver the Fed’s semi-annual monetary policy report. Expect the focus to be on the balance sheet, the current thinking on inflation and also how Powell now views the economic outlook, particularly.

US Economy

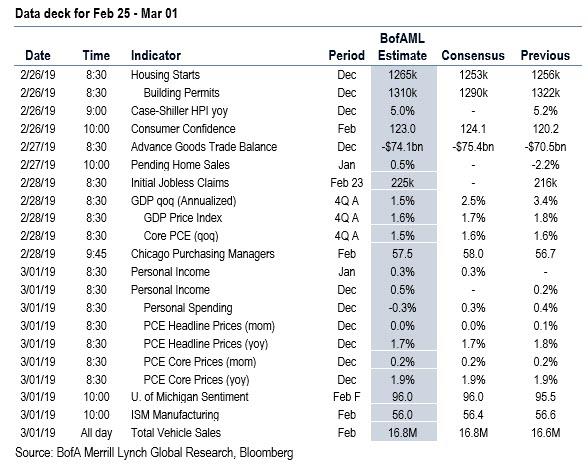

In terms of economic data, the main highlights are at the back end with a first look at Q4 GDP on Thursday and then the December PCE reading due on Friday. Expectations for Q4 GDP are for a +2.5% qoq annualized reading which would be down from +3.4% in Q3, while core PCE is expected to rise +0.2% mom which would be enough to hold the annual rate at +1.9% yoy and therefore more or less in line with the Fed’s target. Other data worth highlighting in the US next week include December housing starts, building permits and consumer confidence on Tuesday, the December advance goods trade balance on Wednesday, and February ISM manufacturing on Friday.

European Economy

In Europe the main highlights next week are the preliminary February CPI readings in France and Germany on Thursday and the Euro Area on Friday, as well as the final February manufacturing PMIs, including a first look at the non-core. China’s February PMIs on Thursday is likely to be the main highlight in Asia. We should also note that China’s NPC Standing Committee is due to meet for two days from Tuesday ahead of the annual NPC which begins the week after. Finally, it’s another busy week for central bank speakers. Away from Powell we’re due to hear from Clarida on Monday and Thursday as well as Bostic, Harker and Kaplan on Thursday. Powell then speaks again on Friday along with Mester and Bostic. Over at the ECB, Lane, Coeure and Mersch are due to speak on Tuesday.

Fed Speakers

Away from Powell we’re due to hear from Clarida on Monday and Thursday as well as Bostic, Harker and Kaplan on Thursday. Powell then speaks again on Friday along with Mester and Bostic. Over at the ECB, Lane, Coeure and Mersch are due to speak on Tuesday

Below is a summary of key events in the week ahead sorted by day:

- Monday: A quiet day for data with the releases focused in the US where we get the January Chicago Fed national activity index, December wholesale inventories and trade sales and February Dallas Fed manufacturing activity index. Away from that, the BoE’s Carney and Fed’s Clarida are due to speak.

- Tuesday: The main focus will be Fed Chair Powell’s testimony on the semiannual monetary policy report in front of the Senate. As for data, in Europe we get consumer confidence readings in Germany and France as well as the UK’s January finance loans for housing. In the US, we get December housing starts and building permits, Q4 house price index, December FHFA house price index, February Richmond Fed manufacturing index and February consumer confidence. Meanwhile, the BoE’s Carney, Ramsden, Vlieghe and Haskel will all speak at a Parliamentary committee hearing while the ECB’s Mersch and Coeure are also due to speak. UK PM May will address the House of Commons while German Chancellor Merkel is also set to addresses a Federation of German Industries. Finally, China’s NPC Standing Committee is due to meet for two days ahead of the annual NPC which begins the week after.

- Wednesday: The scheduled UK parliament Brexit vote will likely be the main focus, along with Powell’s testimony to the House panel and a second summit between President Trump and North Korea’s Kim Jong Un. As for data, overnight we will get the UK’s February BRC shop price index followed by the release of Euro Area January M3 money supply and February confidence indicators. In the US, we get the latest weekly MBA mortgage applications, December advance goods trade balance and retail inventories, January pending home sales and December factory orders along with the final December capital and durable goods orders. Late evening, we will get Japan’s preliminary January industrial production and retail sales. Elsewhere, the BoJ’s Kataoka is due to speak. US Trade Representative Lighthizer is also due to testify to the House Ways and Means Committee on where trade talks between the US and China stand.

- Thursday: The main data highlight is a first look at Q4 GDP in the US and preliminary February CPI readings in Europe for France, Germany, Italy and Spain. Prior to that, we will get China’s official February PMIs overnight and in Europe, we will get France’s January PPI and consumer spending along with preliminary Q4 GDP. In the US, we get the latest weekly initial jobless and continuing claims readings along with the February Chicago PMI and Kansas City Fed manufacturing activity index. Away from the data, the BoJ’s Suzuki and Fed’s Clarida, Bostic, Harker and Kaplan are all due to speak.

- Friday: The final February manufacturing PMIs in Europe, US, Japan and China should be the main data highlight on Friday. Away from that, we will also get the UK’s January money and credit aggregates data and the Euro Area’s advance February CPI and January unemployment rate readings. In the US, we get January personal income and December personal spending data along with December core PCE, February manufacturing ISM, vehicle sales and final University of Michigan survey results. Elsewhere, the Fed’s Bostic is due to speak.

Finally, here is Goldman looking only at key events in the US, where the key economic data releases this week are the initial Q4 GDP estimate on Thursday and the core PCE report and ISM manufacturing report on Friday. There are several scheduled speaking engagements by Fed officials this week, including Chairman Powell’s semiannual testimony to Congress on Tuesday and Wednesday.

Monday, February 25

- 10:00 AM Wholesale inventories, December preliminary (consensus +0.4%, last +0.3%)

- 10:30 AM Dallas Fed Manufacturing index, January (consensus +4.8, last +1.0)

- 11:00 AM Fed Vice Chairman Clarida (FOMC voter) speaks: Fed Vice Chairman Richard Clarida will speak at a Fed Listens event, followed by a moderated discussion with Dallas Fed President Robert Kaplan.

Tuesday, February 26

- 08:30 AM Housing starts, December (GS +1.5%, consensus -0.5%, last +3.2%); Building permits, December (consensus -2.8%, last +5.0%): We estimate housing starts rose 1.5% in December, reflecting a moderate boost from mild winter weather.

- 09:00 AM FHFA house price index, December (consensus +0.4%, last +0.4%)

- 09:00 AM S&P/Case-Shiller 20-city home price index, December (GS +0.4%, consensus +0.3%, last +0.3%): We estimate the S&P/Case-Shiller 20-city home price index increased 0.4% in December, following a 0.3% increase in November. Our forecast of a solid increase largely reflects the appreciation in other home prices indices such as the CoreLogic house price index in December. We continue to look for slower home price growth in the coming months.

- 10:00 AM Richmond Fed manufacturing index, February (consensus +6, last -2)

- 10:00 AM Conference Board consumer confidence, February (GS 124.5, consensus 124.0, last 120.2): We estimate that the Conference Board consumer confidence index increased by 4.3pt to 124.5 in February, reflecting higher equity prices and some reversal of the government shutdown impact.

- 10:00 AM Fed Chairman Powell appears before the Senate Banking Committee: Federal Reserve Chairman Jerome Powell will appear before the Senate Banking Committee to deliver the Fed’s semi-annual Monetary Policy Report to Congress and answer questions from lawmakers.

Wednesday, February 27

- 08:30 AM U.S. Census Bureau Report on Advance Economic Indicators; Advance goods trade balance, December (GS -$74.7bn, consensus -$74.3bn, last -$71.6bn); Wholesale inventories, December (consensus +0.4%, last +0.3%): We estimate that the goods trade deficit rebounded to -$74.7bn in December, reflecting a rebound in inbound container traffic. The goods trade deficit fell sharply in November, as imports and exports of goods both declined.

- 10:00 AM Pending home sales, January (GS flat, consensus +0.8%, last -2.2%): We estimate that pending home sales remained unchanged in January based on mixed regional home sales data, following a 2.2% decline in December. We have found pending home sales to be a useful leading indicator of existing home sales with a one- to two-month lag.

- 10:00 AM Factory Orders, December (GS -0.6%, consensus +0.9%, last -0.6%); Durable goods orders, December final (last +1.2%); Durable goods orders ex-transportation, December final (last +0.1%); Core capital goods orders, December final (last -0.7%); Core capital goods shipments, December final (last +0.5%): We estimate factory orders decreased 0.6% in December following a 0.6% decline in November, primarily due to large declines in the price of oil in prior months.

- 10:00 AM Fed Chairman Powell appears before the House Financial Services Committee: Federal Reserve Chairman Jerome Powell will appear before the House Financial Services Committee to deliver the Fed’s semi-annual Monetary Policy Report to Congress and answer questions from lawmakers.

- 10:00 AM USTR Ambassador Lighthizer speaks: US Trade Representative Ambassador Robert Lighthizer will testify before the House of Representatives Ways and Means Committee on US-China trade issues in advance of the March 1 deadline to reach an agreement before the tariff rate on $200bn of imports from China steps up on March 2. The hearing will be streamed on the Ways and Means Committee website.

Thursday, February 28

- 08:00 AM Fed Vice Chairman Clarida (FOMC voter) speaks: Fed Vice Chairman Richard Clarida will speak at the annual NABE conference in Washington.

- 08:30 AM GDP, Q4 initial/second (GS +1.9%, consensus +2.4%, last +3.4%); Personal consumption, Q4 initial/second (GS +2.3%, consensus +3.5%, last +3.5%): We estimate a 1.9% increase in the initial release of Q4 GDP (qoq ar). We expect the composition of the report to reflect deceleration in personal consumption (+2.3%), but a pickup in business fixed investment (+4.2%) alongside a significant boost from federal government spending (+4.0%). We expect a significant slowdown in housing investment (-6.0%).

- 08:30 AM Initial jobless claims, week ended February 23 (GS 220k, consensus 224k, last 216k); Continuing jobless claims, week ended February 16 (last 1,725k): We estimate jobless claims increased 4k to 220k in the week ended February 23. The claims reports of recent weeks suggest that the pace of layoffs remains low, though it probably remains somewhat higher than in early fall.

- 08:50 AM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic takes part in a panel discussion on the economic and housing landscape at the Atlanta Fed. Audience Q&A is expected.

- 09:45 AM Chicago PMI, February (GS 56.7, consensus 57.6, last 56.7): We estimate that the Chicago PMI remained unchanged at 56.7pt in February, following a 7.1pt decline in January. The continued slowdown in global manufacturing may weigh on business sentiment in this report.

- 11:00 AM Kansas City Fed manufacturing index, February (last +5)

- 11:00 AM Philadelphia Fed President Harker (FOMC non-voter) speaks: Philadelphia Fed President Patrick Harker will discuss the economic outlook. Prepared text is expected.

- 1:00 PM Dallas Fed President Kaplan (FOMC non-voter) speaks: Dallas Fed President Robert Kaplan will speak in a moderated Q&A in San Antonio. Media Q&A is expected.

- 7:00 PM Cleveland Fed President Mester (FOMC non-voter) speaks: Cleveland Fed President Loretta Mester will speak on women in economics in a moderated Q&A at the Second Annual Women in Economics Symposium at the Federal Reserve Bank of St. Louis. Prepared text and audience Q&A are expected.

- 8:15 PM Fed Chairman Powell (FOMC voter) speaks: Fed Chairman Jerome Powell will discuss “Recent Economic Developments and Longer-Term Challenges” at a Citizens Budget Commission conference in New York. Prepared text is expected.

Friday, March 1

- 08:30 AM Personal income, January (GS +0.3%, consensus +0.3%); Personal income, December (GS +0.6%, consensus +0.5%, last +0.2%); Personal spending, December (GS -0.4%, consensus -0.1%, last +0.4%); PCE price index, December (GS +0.04%, consensus flat, last +0.06%); Core PCE price index, December (GS +0.20%, consensus +0.2%, last +0.15%); PCE price index (yoy), December (GS +1.74%, consensus +1.7%, last +1.84%); Core PCE price index (yoy), December (GS +1.91%, consensus +1.9%, last +1.88%): Based on details in the PPI, CPI, and import price reports, we forecast that the core PCE price index rose 0.20% month-over-month in December, or 1.91% from a year ago. Additionally, we expect that the headline PCE price index increased 0.04% in December, or 1.74% from a year earlier. We expect a 0.6% increase in personal income and a 0.4% decline in personal spending in December following the weak retail sales report, and a 0.3% increase in January personal income.

- 09:45 AM Markit Flash US manufacturing PMI, February final (consensus 54.9, last 53.7)

- 10:00 AM ISM manufacturing index, February (GS 55.3, consensus 55.6, last 56.6): Our manufacturing survey tracker – which is scaled to the ISM index – declined by 1.1pt to 53.0, reflecting mixed-to-weak manufacturing surveys so far in February. Following a 2.3pt rise in January, we expect the ISM manufacturing index to decline by 1.3pt to 55.3 in February.

- 10:00 AM University of Michigan consumer sentiment, February final (GS 95.8, consensus 95.8, last 95.5): We expect the University of Michigan consumer sentiment index to edge up 0.3pt from the preliminary estimate for February. The report’s measure of 5- to 10-year inflation expectations declined by three tenths to 2.3% in the preliminary report for February.

- 1:15 PM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will speak on the economic outlook and monetary policy at a NABE conference in Washington. Audience Q&A is expected.

- 5:00 PM Lightweight Motor Vehicle Sales, February (consensus 16.8m, last 16.6m)

Source: BofA, DB, Bloomberg, Goldman

via ZeroHedge News https://ift.tt/2H1S2Dz Tyler Durden