But, but, but.. a deal was so close…

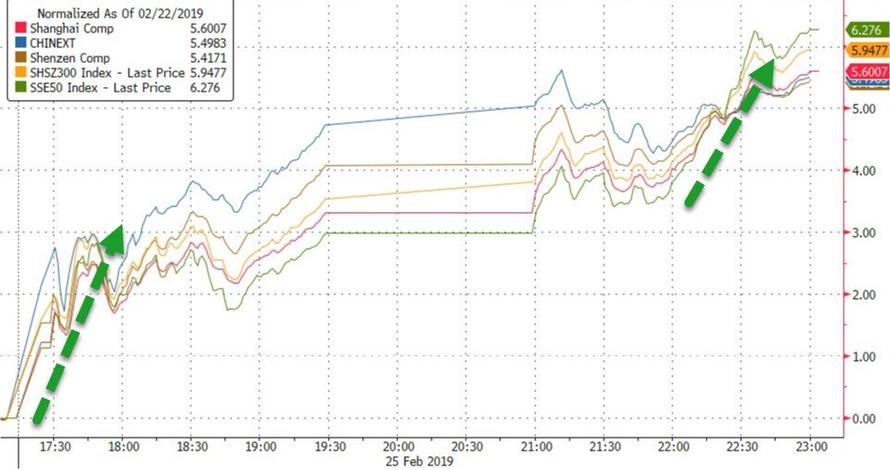

Chinese markets went to ’11’ overnight after positive tweets and headlines from both parties in the US-China trade talks (which were also talked back numerous other times). SHCOMP exploded 5.6%…

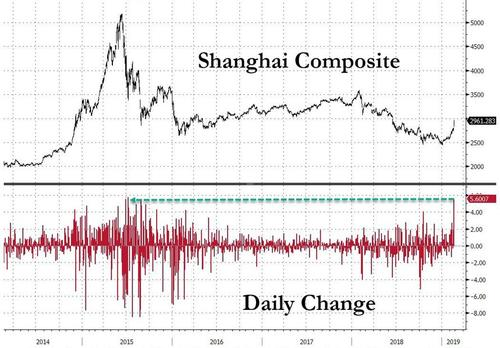

The biggest jump in 5 years as margin balances surge once again…

All major European markets extended gains on the back of China’s exuberance, led by Italy, but UK’s FTSE slipped to almost unch by the close…

US Futures opened excitedly amid trade hope but faded all daya long despite the best efforts of Trump et al. to jawbone stocks higher…

Trannies and Small Caps tumbled into the red in the last few minutes as the early-day gains evaporated across the market…

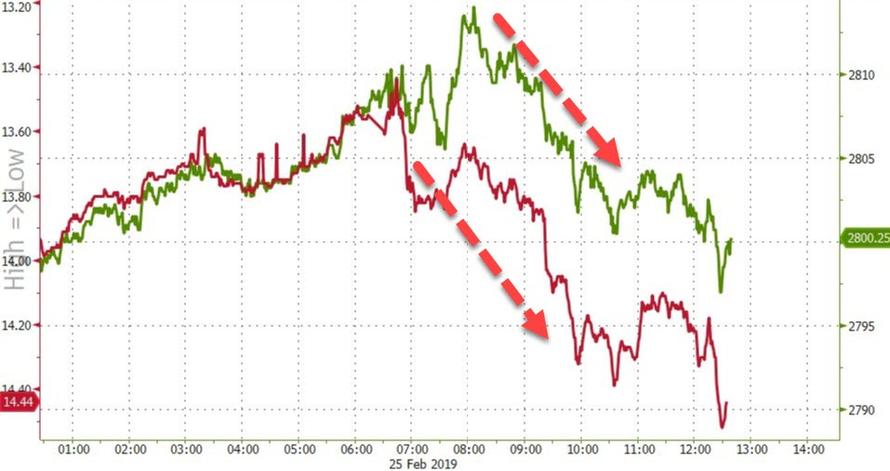

2800 was the level to watch for the S&P 500 and Trump did his best to tweet and keep the market above it…but it failed and close at LoD..

Is it really that easy?

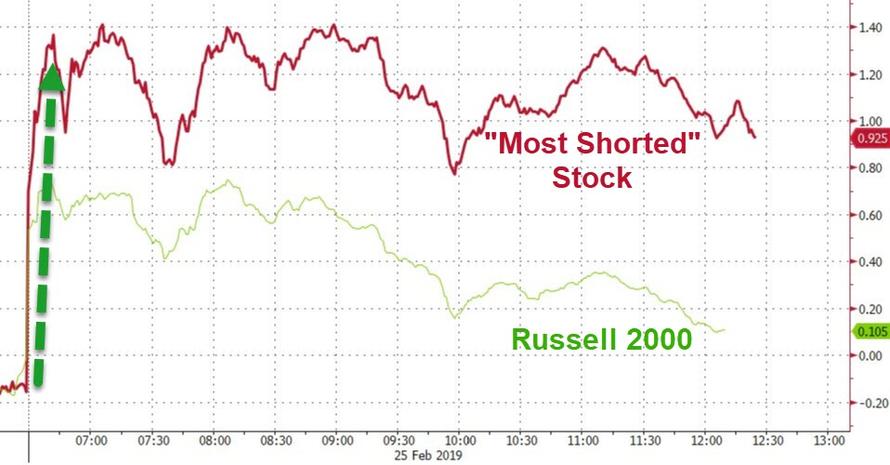

Another huge short-squeeze day all hit at the open…

Aided by another massive surge in buybacks at the open…

And then there was GE…

VIX was higher on the day alongside a higher stock market

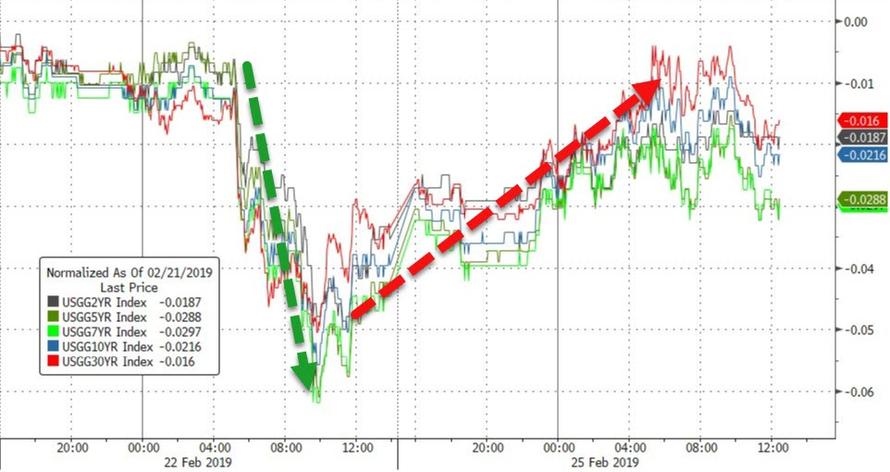

Treasury yields were higher on the day by 1-2bps – but were unable to erase Friday’s gains…

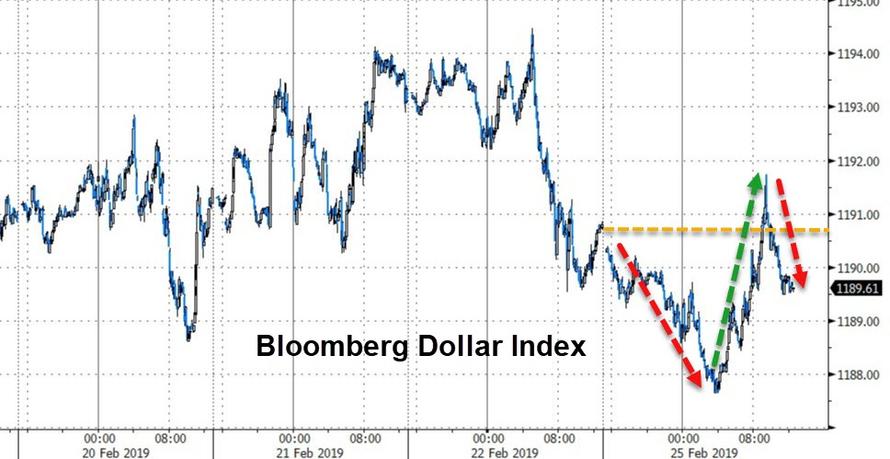

The Dollar ended the day lower after chopping around overnight…

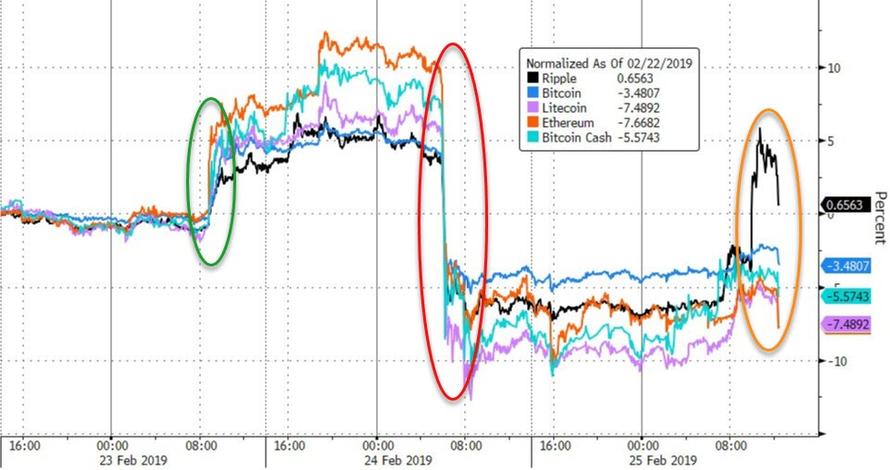

Cryptos have been wild since Friday…

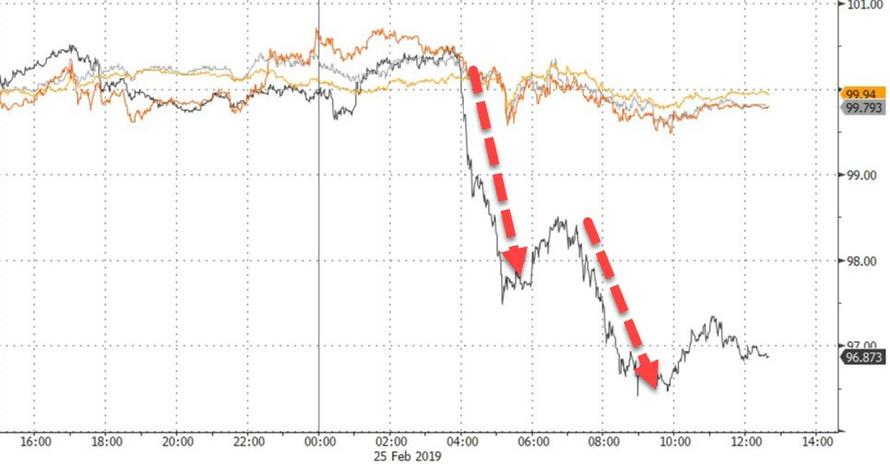

Commodities trod water basically on the day but oil plunged on Trump’s tweet…

Trump tweeted a shot across the bow at OPEC production cuts and that sent oil prices lower…

“You needed that spark and that spark was his tweet this morning slamming OPEC more or less,” said Bob Yawger, director of the futures division at Mizuho Securities USA.

Finally, we give Gluskin Sheff’s David Rosenberg the last word once again:

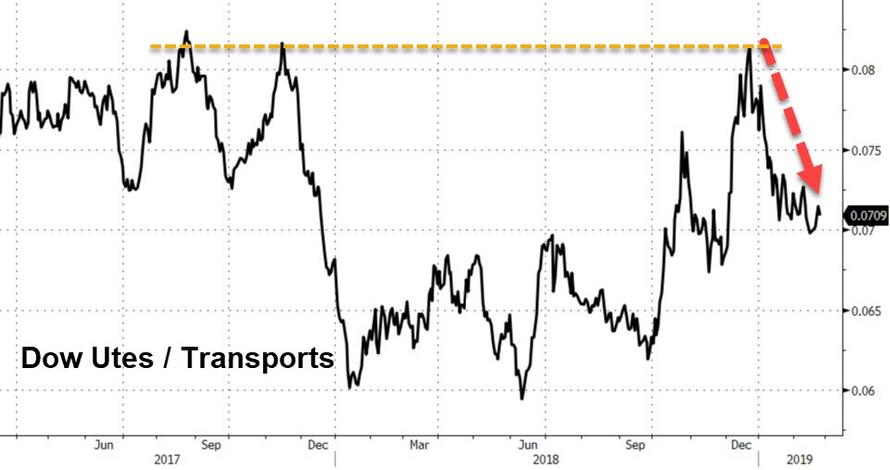

Question: What sort of bull market is this when the Dow Utilities are challenging the peaks, and yet the Transports are still 8.5% below their highs? It’s a fair question. Beneath the veneer, maybe the equity market isn’t pricing in any sort of growth rebound.

— David Rosenberg (@EconguyRosie) February 25, 2019

And then there is this silliness…

via ZeroHedge News https://ift.tt/2EvtJfz Tyler Durden