Submitted by Michael Every of Rabobank

In 1929, the liberal world order looked stable. It then suffered the Wall Street Crash, the Great Depression, the collapse of the global trading and monetary architecture, and then wild political extremism leading to the horrors of WW2. The cause and effect was clear, as shown here:

In 2008-09 the global economy again experienced a shock on par with 1929. A decade of lopsided recovery later, the liberal world order again looks unstable: the US is populist; the UK is flirting with Hard Brexit; 25% of EU voters backed populist parties in 2018, with 170m EU citizens living in a country with at least one populist in government vs. 13m back in 1998; Turkey is populist; Mexico is populist; and Brazil is too. So is history repeating itself?

Of course, it would be facile to compare the economic suffering of the 1930s with what was experienced in 2008-09 and subsequently. At present unemployment in many Western economies is at a record low; asset prices are at or are close to record highs; and interest rates are still either close to or at record lows. Moreover, we have welfare states to ensure that we never again experience hardships like the 1930s – for exactly the reason history shows us. Globalisation has also lifted hundreds of millions out of poverty, and created untold wealth and new technology.

Nonetheless, we still have populism – and if one scratches beneath the surface it is not a surprise why: we have an echo of the 1930’s today politically because we have echoes of that era’s problems socio-economically.

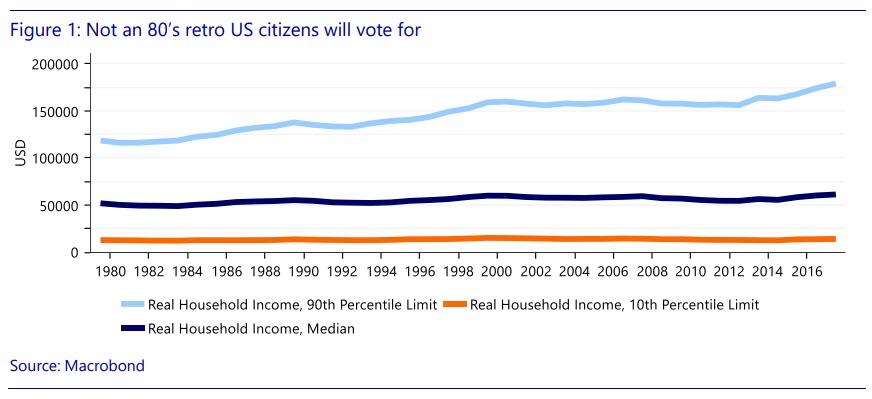

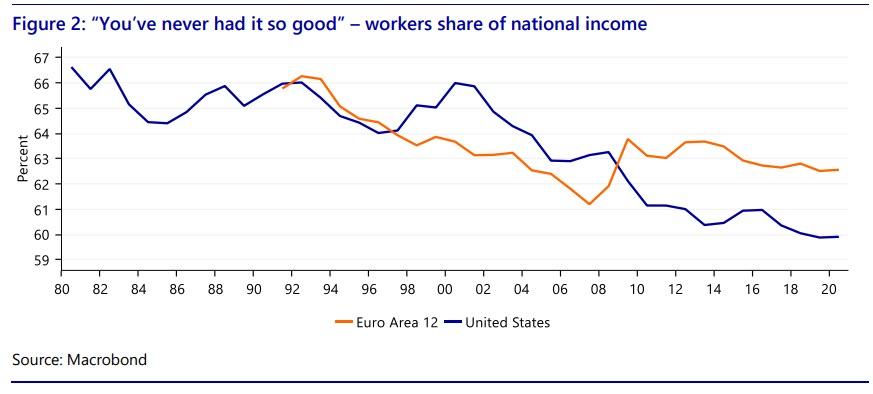

While Western unemployment is low, the quality of employment is often poor, and/or insecurity is pervasive – (“Will my job/industry be around in five years?”). That matters hugely. At the same time, Western median real wages have stagnated for years, and in the case of US men, for decades. On top of that, austerity in many economies has seen welfare pared back, and public services are often straining at the seams. Moreover, low interest rates punish prudent savers, while high house prices mean that homes are unaffordable for many, leaving them frustrated and without assets as others gain wealth effortlessly. Large-scale immigration is then added on top of that combustible mixture, bringing rapid social change in many places and increased job competition. (Another historical echo: Hannah Arendt argued “stateless persons” –similar to today’s refugees– accounted for 10% of the French population prior to WW2, for example).”

There is now institutional recognition that such a state of affairs is dangerous and unsustainable.

The World Inequality Report 2018 states: “Economic inequality is widespread and to some extent inevitable. It is our belief, however, that if rising inequality is not properly monitored and addressed, it can lead to various sorts of political, economic, and social catastrophes.” President Macron of France –holding a round of “town-hall ”meetings to try to get back in touch with his frustrated citizens– has admitted that there has been a “clear breakdown in equality” between the poor banlieues and wealthy suburbs, and that the state must now “guarantee social justice”. And Fed Chair Powell has stated that inequality is the largest challenge that the US will face over the next decade, adding “We want prosperity to be widely shared. We need policies to make that happen,” and that on declining social mobility: That’s not our self-image as a country, nor is it where we want to be”.

The 2019 World Economic Forum was also aware of this worrying threat to the globalisation they have championed. Ahead of this year’s meeting its Executive Chairman Klaus Schwab argued in a personal manifesto:

“We need a new framework for global cooperation in order to preserve peace and accelerate sustainable progress. After the Second World War, leaders from across the globe came together to design a new set of institutional structures to enable the post-war world to collaborate towards building a shared future. The world has changed, and as a matter of urgency, we must undertake this process again.

This time, however, the change is not merely geopolitical, nor economic. Rather, we are experiencing a change to the very fabric of how individuals and society relate to one another and to the world at large. We are living in the age of the 4th Industrial Revolution (4IR). Economies, businesses, societies, and politics are not just changing – they are fundamentally transforming.

Reforming our existing processes and institutions will not be enough. Rather, we need to redesign them to anticipate the forces of change and shape strategies that leverage the abundance of new opportunities, while avoiding the great risks inherent in such disruptive periods. If we wait, or just apply a “quick fix” to repair the deficiencies of outdated systems, the forces of change will naturally develop their own momentum and rules, and thus limit our ability to shape a positive trajectory and outcome.”

The need for action was immediate as in Schwab’s view “Manufacturing will be revolutionized by automation, localization, and customization, replacing traditional supply chains. Employment and income patterns will be transformed as large parts of employment are substituted by intelligent automation. Traditional labour income will be extensively replaced by accrued returns from creative tasks, venture capital, and first-mover advantage…[with] government policies continuously lagging behind.”

In other words, Schwab is expecting massive future unemployment and downwards pressure on wages due to Artificial Intelligence and automation, while “creative” workers and venture capitalists will be rewarded as governments fail to act in time. Given where populism already is today, that smells strongly like a recipe for something closer to the 1930s ahead.

Indeed, we should not take these threats of social catastrophe lightly. History shows that liberal world orders are more fragile than they look. The 1929 version swept aside in the 1930s and by WW2 was itself the second iteration of international liberalism, with the first UK-centric version having been crushed by the protectionism, imperialism, and then militarism that ended up in WW1 (an historical and structural theme we explored in detail back in April 2016’s Thinnest Ice).

As economic historian Adam Tooze underlines, our current liberal world order is only 25 years old rather than dating back to 1945 as imagined: after WW2, the Cold War sealed much of the global economy off from any form of liberalism; it was the collapse of the post-1945 Bretton Woods system in 1971 that led to our current USD-based system; and it was only with the fall of the Berlin Wall that our new era of globalisation truly began. Indeed, the WTO was born as recently as 1995; inflation targeting for the Bank of England only began in 1997; and the Euro is only 20 years old. As such, institutions that look like they have always been with us are new and ‘how we do things’ is also new, while a less globalised world economy has far deeper roots.

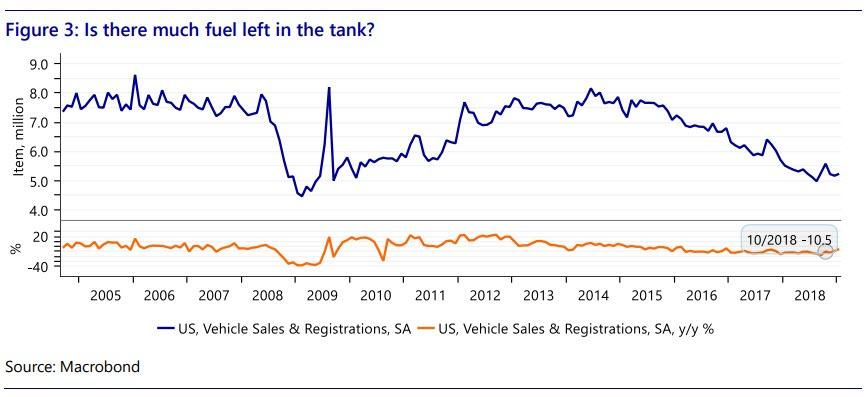

Moreover, if populism is the backdrop to a global recovery, how will populations react when we experience the next global recession?

Rabobank now sees a 69% chance of a US recession in 2020, while Europe may already close to technical recession. Furthermore, the IMF warns of a looming global economic storm for which we are unprepared.

The threat of a major Chinese currency devaluation is also a potential breaking-point for the global system analogous to the UK’s exit from the gold standard in 1931. It was the refusal of Germany to follow the UK’s devaluation that saw it embrace “pro-competitive” wage deflation, leading to the rise of the Nazi party: how would the US or Europe, or any other economy cope with a Chinese currency suddenly 20, 30, or 40% lower than today? Even if the US were to instead force China into a Japan-style Plaza Accord as part of a trade deal, how would a debt-laden, slowing Chinese economy cope with a currency that is 20% stronger? (Indeed, there is emerging evidence that China itself is already stuck in a ‘new normal ’of slowing growth.)

Deflation and populism looms either way for somebody.

via ZeroHedge News https://ift.tt/2Uc8kOh Tyler Durden