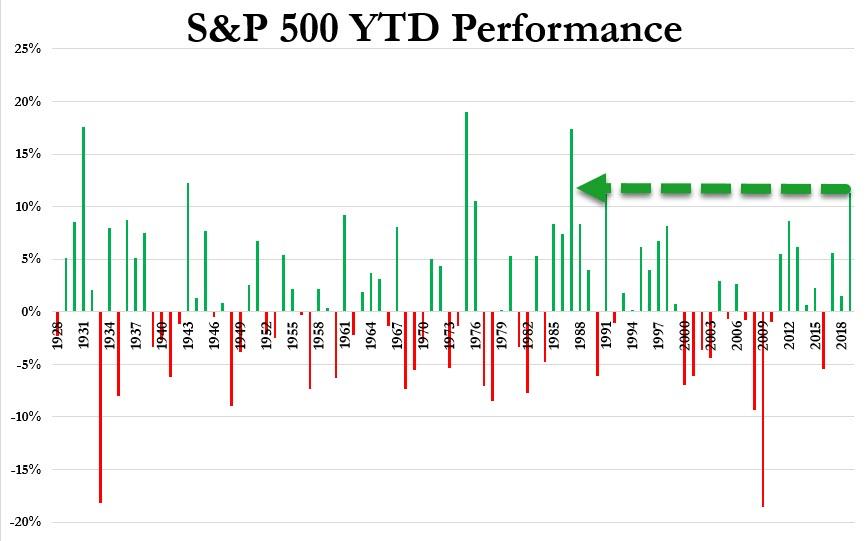

The S&P 500 continues its strongest start to a year since 1987…

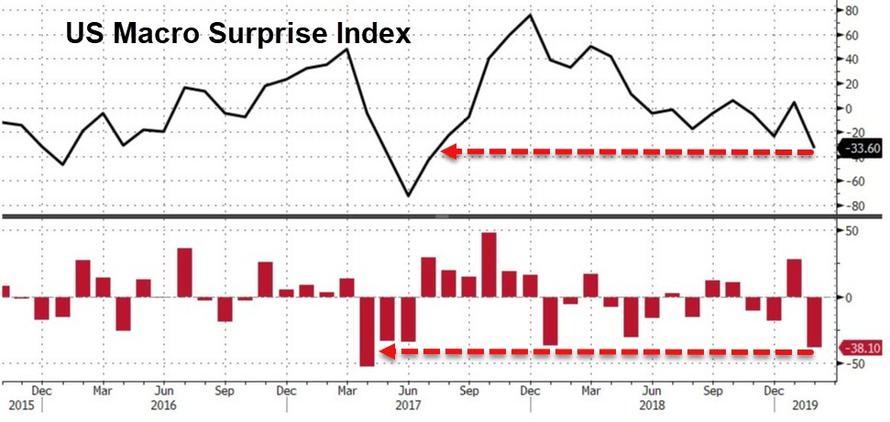

Despite the worst monthly drop in US Macro data in two years…

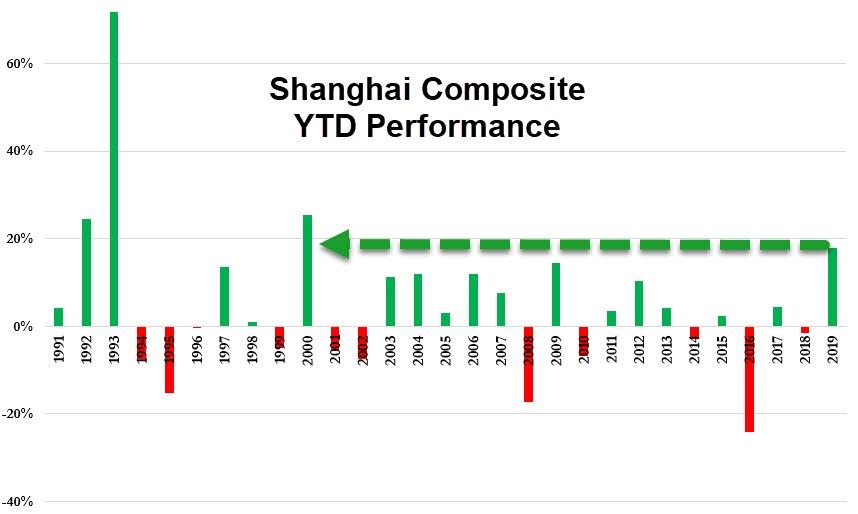

This is also China’s best start to a year since 2000…

As China macro data collapses…

And European stocks soared despite crashing economic data…

The reason is simple… who cares about fundamentals when global money supply (and bank balance sheets) have suddenly reversed course and exploded higher…

Notably, China massively outperformed US and European markets in February…

Summing February up thus…

* * *

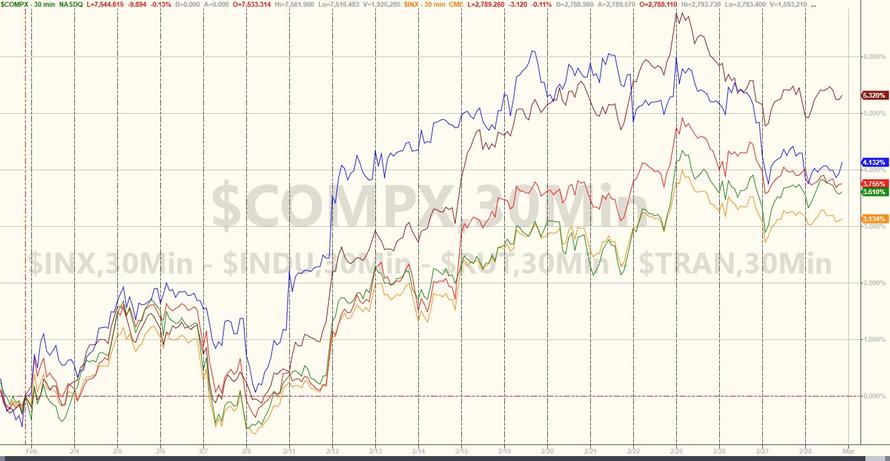

US equities ended the month weaker… with The S&P down for 3 straight days for the first time since Mid-December… this is also the 4th weak close in a row..

US Small Caps outperformed in February…

S&P was unable to maintain 2,800 once again…

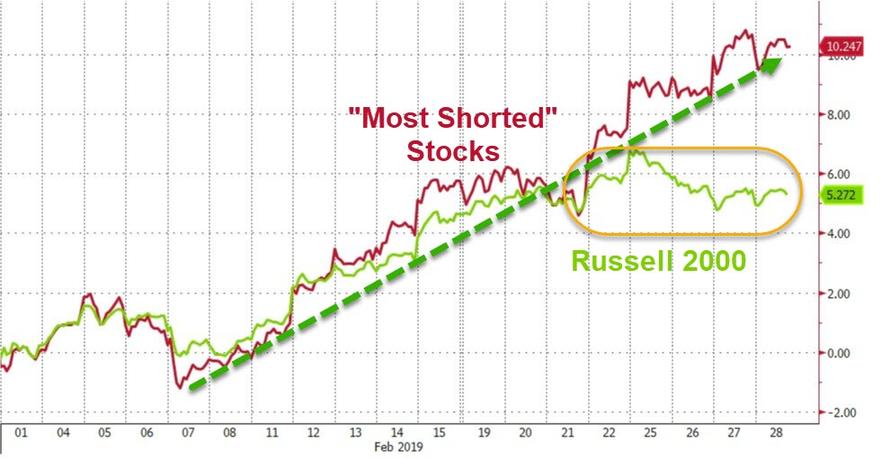

For a little context, February has seen a non-stop short-squeeze…

2019 has seen the biggest short-squeeze since the March 2009 lows…

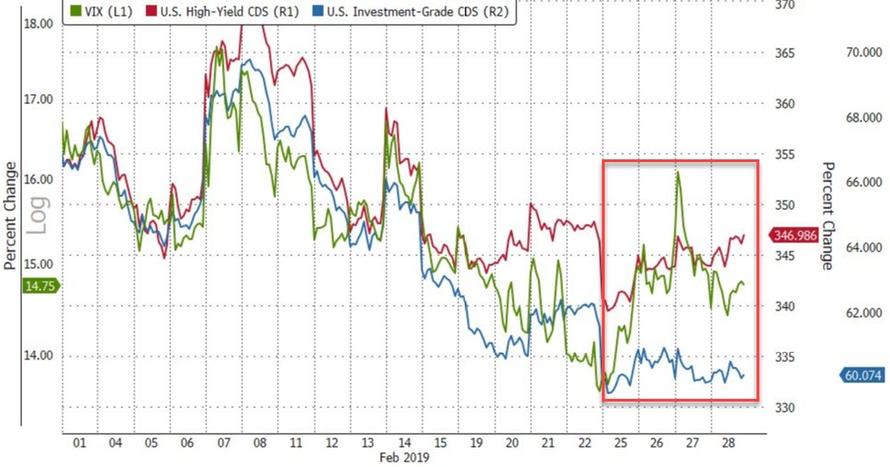

Equity (VIX) and Credit (IGCDX and HYCDX) protection costs collapsed in February along with all sense of risk…

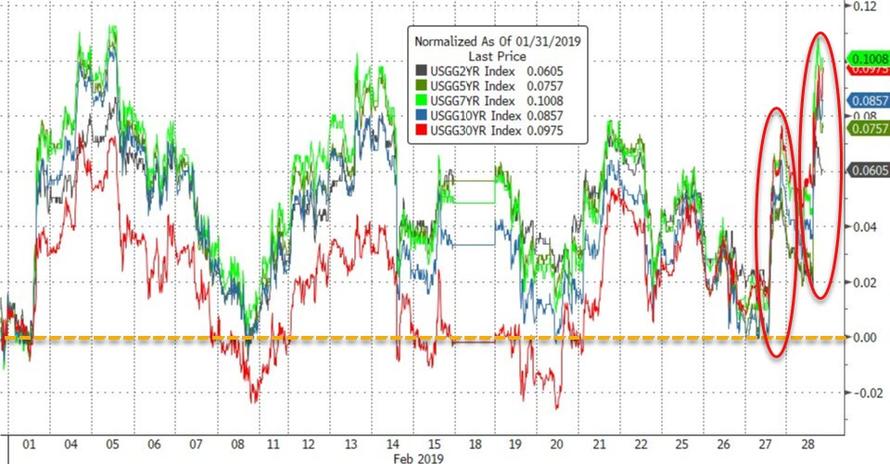

The surge in the last two days (among the biggest yield spikes in 2019) pushed yields to the highs of the month (up between 7 and 10bps across the curve)…

This is the 10Y yield’s biggest monthly yield spike since Sept 2018.

And 10Y Yields broke out of their recent descending triangle pattern…

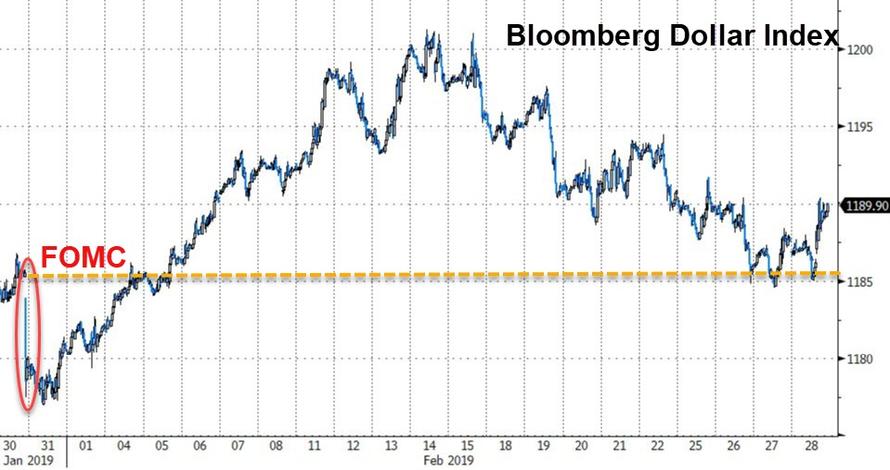

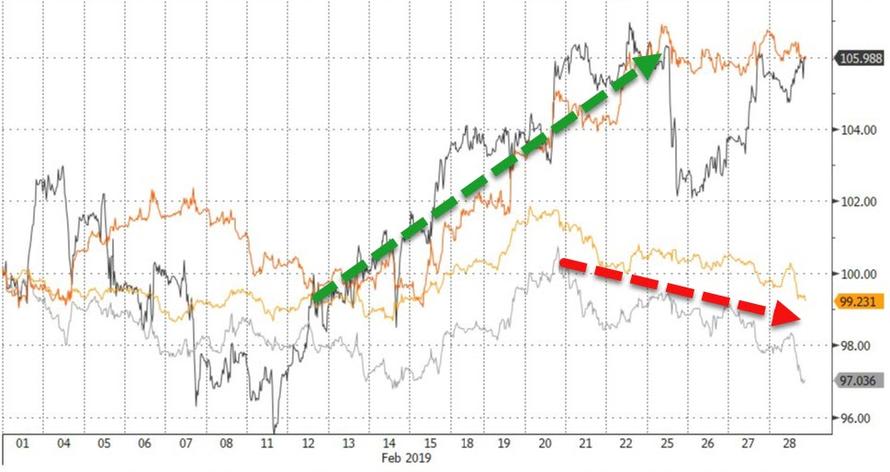

The dollar index rose in February (first monthly gain since Oct 2018)…

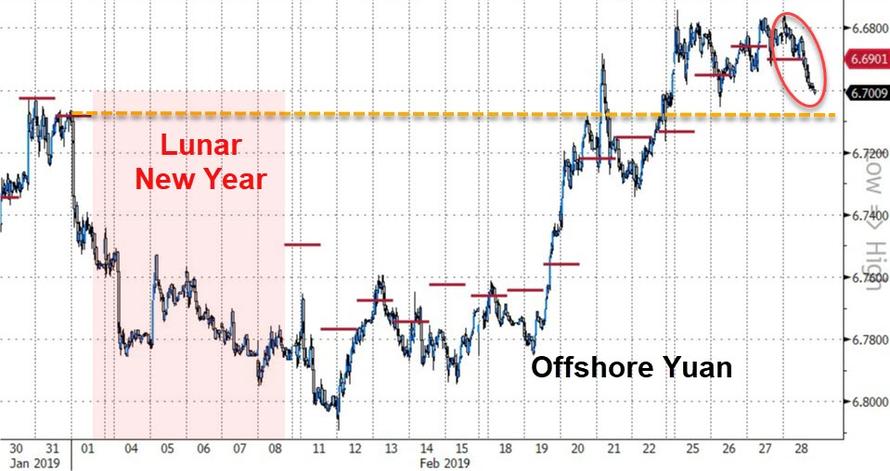

Yuan fell back to almost unchanged on the month after weak macro data overnight…

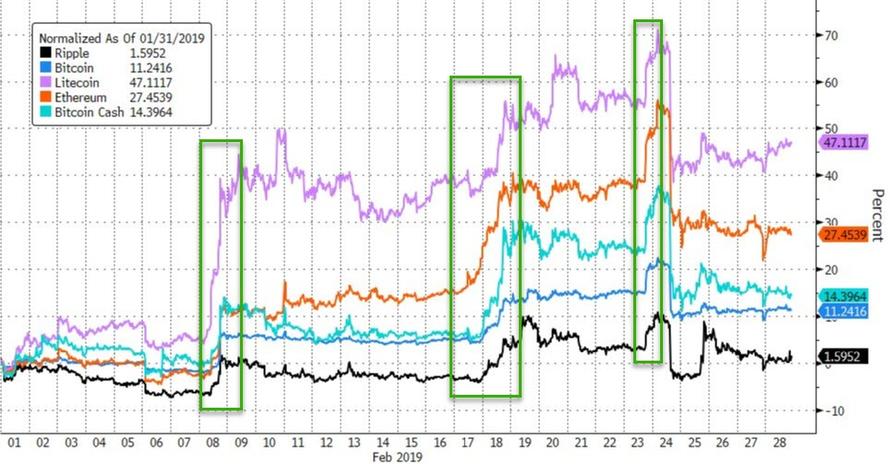

Cryptos ended February in the green thanks to early and mid-month spikes…this is the first monthly rise for Bitcoin since July 2018

Copper & Crude surged in Feb, PMs limped lower…

Gold continues to hold YTD gains through February – for the 6th year in a row – but overnight strength gave way quickly to weakness which pushed the precious metal red for Feb and ended the 4-month win streak…

WTI appears to find $57.50 as notable resistance for now…

Finally, as February comes to an end, we wonder, when does reality break back into the market’s perception?

And pop the bear-market-bounce bubble…

#Time’sUp?

via ZeroHedge News https://ift.tt/2IIyZRs Tyler Durden