Authored by Ben Hunt via EpsilonTheory.com,

Let’s take a walk down memory lane, shall we?

“My relations with the Fed,” Nixon said, “will be different than they were with [previous Federal Reserve chairman] Bill Martin there. He was always six months too late doing anything. I’m counting on you, Arthur, to keep us out of a recession.”

“Yes, Mr. President,” Burns said, lighting his pipe.

“I don’t like to be late.” Nixon continued. “The Fed and the money supply are more important than anything the Bureau of the Budget does.” Burns nodded. “Arthur, I want you to come over and see me privately anytime . . .”

“Thank you, Mr. President,” Burns said.

“I know there’s the myth of the autonomous Fed . . .” Nixon barked a quick laugh. “. . . and when you go up for confirmation some Senator may ask you about your friendship with the President. Appearances are going to be important, so you can call Ehrlichman to get messages to me, and he’ll call you.”

January, 1970 (John Ehrlichman, “Witness to Power”)

Nixon: [If I’m not re-elected] this will be the last Conservative administration in Washington.

Burns: Yes, Mr. President.

Nixon: This liquidity problem is just bullshit.

October 10, 1971 (Secret Nixon Tape No. 607-11)

Burns: I wanted you to know that we lowered the discount rate . . . got it down to 4.5 percent.

Nixon: Good, good, good.

Burns: I put them [the FOMC] on notice that through this action that I want more aggressive steps taken by that committee on next Tuesday.

Nixon: Great. Great. You can lead ‘em. You can lead ‘em. You always have, now. Just kick ‘em in the rump a little.

December 10, 1971 (Secret Nixon Tape No. 16-82)

Shultz: Money supply is beginning to move. The economy has to be good, strong expanding economy this year. So much at stake on that. He [Burns] recognizes that and he needs to do everything that he can do. Why worry about interest rates going down? . . . We want low interest rates. What’s the problem there? So, we don’t have a return flow of money from Europe? So what? Keep the money supply going up!

Nixon: Another defense he’s building up for not raising the money supply . . . I’d rather he weren’t so optimistic. … This is the last time I want to see him [garbled] or get the hell out of here. War is going to be declared if he doesn’t come around some. … He’s talking with the Jewish press.

February 14, 1972 (Secret Nixon Tape 670-5)

In 1971, Richard Nixon had a problem. The US economy was pretty strong and the Fed wanted to tighten. But Nixon had an election to win in 18 months, and he needed loose monetary policy to do that. Also, the global economy wasn’t that strong, and the rest of the world needed an expanding supply of dollars and an expanding US trade deficit to keep its motor running. Nixon didn’t really care about that, but a lot of his oligarch cronies did.

So Nixon alternately bullied and cajoled and threatened and rewarded his hand-picked Federal Reserve Chair, Arthur Burns, to do the right thing and keep the money spigot open … wide open. Complaints about too much liquidity sloshing around were “bullshit”, and so what if they were running the economy hot? Good lord, man, imagine who would take over the White House in 1972 if he were defeated! Imagine the insane fiscal spending policies that those Democrats would push on the country if he lost!

Donald Trump has EXACTLY the same problem.

Donald Trump has found EXACTLY the same solution.

Jay Powell is the Arthur Burns of our day.

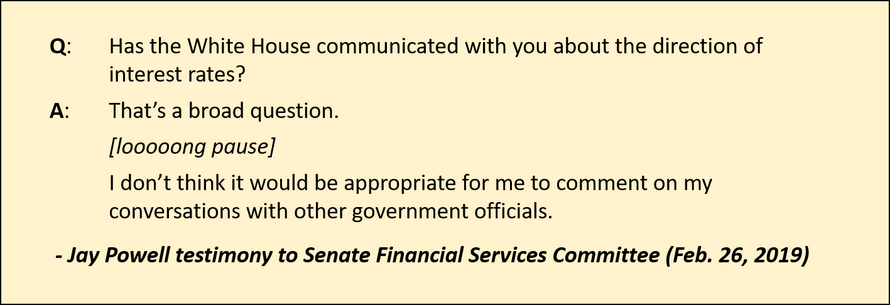

The only difference is that Nixon did all of his bullying and cajoling and threatening and rewarding in private, and Burns wouldn’t dream of saying out loud what Powell is shouting about the “important signal” of financial market “volatility” on monetary policy decisions.

They’re not even pretending anymore.

via ZeroHedge News https://ift.tt/2TazgBh Tyler Durden