Echoing the v-shaped recovery in the stock market – despite plummeting earnings and macro data – US ‘soft’ survey data has staged a dramatic recovery with China purchasing managers the latest to suggest exuberance is back.

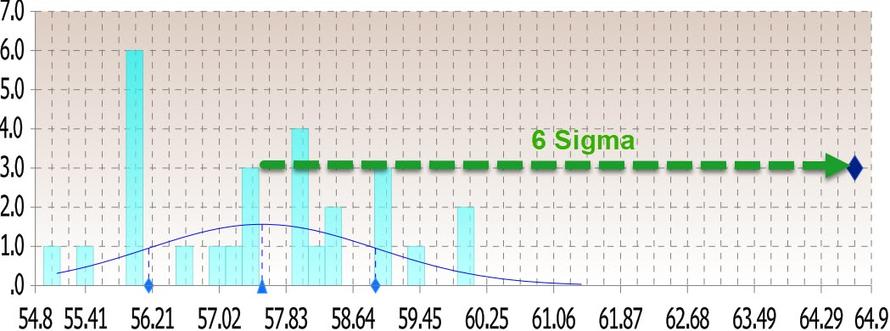

Against expectations of a modest rebound to 57.5, Chicago PMI surged back to its highest since Dec 2017 at 64.7…

This is six standard deviations above expectations…

Under the hoods:

-

Prices paid rose at a faster pace, signaling expansion

-

New orders rose at a faster pace, signaling expansion

-

Employment rose at a faster pace, signaling expansion

-

Inventories fell and the direction reversed, signaling contraction

-

Supplier deliveries rose at a slower pace, signaling expansion

-

Production rose at a faster pace, signaling expansion

-

Order backlogs rose at a faster pace, signaling expansion

All of which is evident in the following chart as ‘real hard’ economic data contonues to disappoint but ‘soft survey’ data rebounds dramatically…

Is this putting Powell further in the corner?

via ZeroHedge News https://ift.tt/2IFWuud Tyler Durden