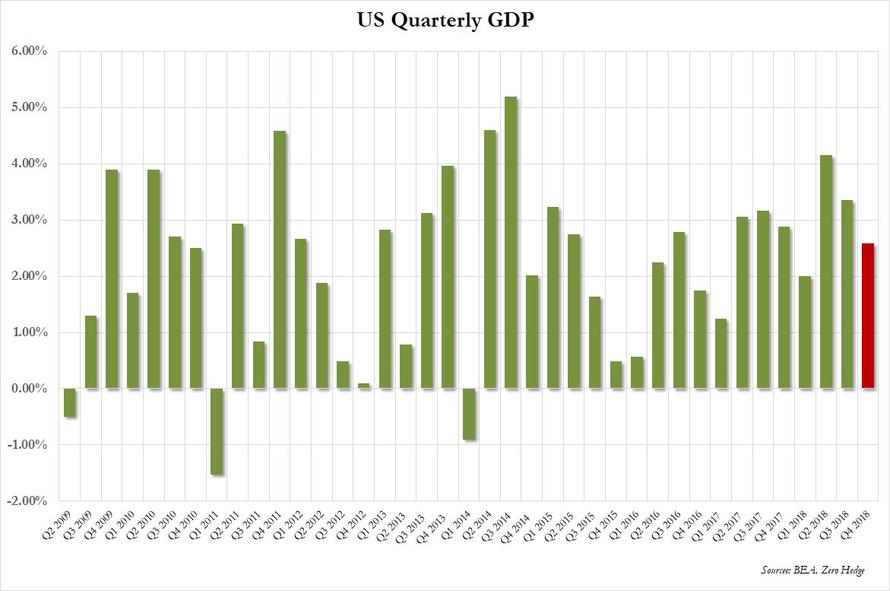

Following a one month delay due to the government shutdown in January, moments ago the BEA reported GDP for the fourth quarter combining both its first and second estimates, and while consensus was expecting a sharp slowdown in the last quarter of the year, from 3.4% in Q3 to 2.2%, the US economy surprised to the upside in Q4, when it grew a stronger than expected 2.6% (2.590% to be precise). As the BEA explained, “this initial report for the fourth quarter and annual GDP for 2018 replaces the release of the ‘advance’ estimate originally scheduled for January 30th and the ‘second’ estimate originally scheduled for February 28th.”

On a year over year basis, 2018 GDP rose 3.1%, the highest print since 2005, and another chance for Trump to claim an economic win, although as Joseph Lavorgna notes, “at present, we’re still looking for sub-2% growth in the current quarter” and adds that these data also have no bearing on #Fed policy which is comfortably on perma-hold.

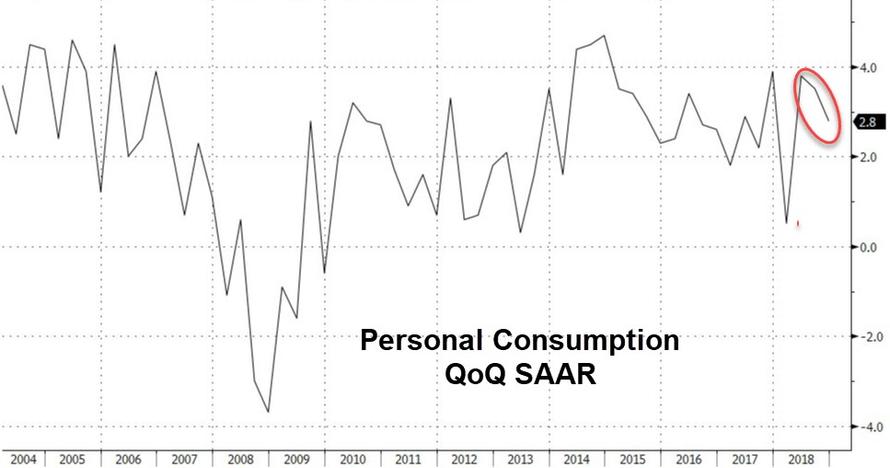

Yet despite the headline beat, personal consumption disappointed, and after rising at a 3.5% rate in Q3, in Q4 it rose just 2.8%, missing expectations of 3.0%.

Elsewhere, nonresidential fixed investment, or spending on equipment, structures and intellectual property jumped 6.2% in 4Q after rising 2.5% prior quarter. Don’t expect this surge to continue, however, in light of the recent weak durable and core capex numbers.

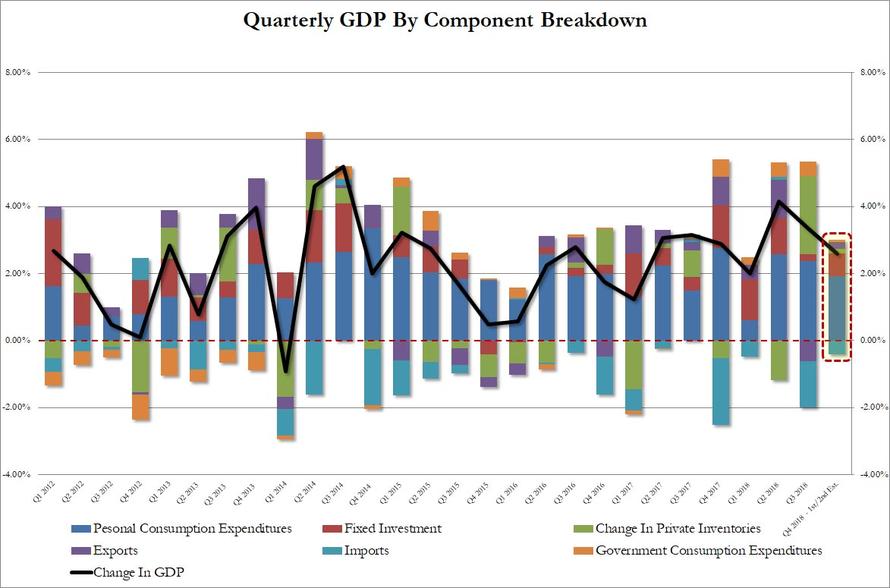

What were the components of Q4 GDP? Here is the breakdown to the bottom line:

- Personal consumption contributed 1.92% to the bottom line 2.59% number, down from 2.37% in Q3

- Fixed Investment rebounded from Q3’s 0.21% to 0.69% in Q4.

- Growth in private inventories, which drove much of the Q3 GDP jump, hit a pothole, rising just 0.13% in Q4 after the prior quarter’s 2.33% jump.

- Net Trade (exports less imports) was the biggest contributor to the rebound in Q4, and after this subtracted 2.0% in Q3, the trade impact in Q4 was only a -0.22% subtraction from GDP.

- Finally, Government consumption added a modest 0.07% to the bottom line GDP, following a 0.44% contribution in Q3.

As Renaissance Macro’s Neil Dutta notes, “research & development spending is exploding, advancing 13.5% annualized in Q4, climbing 9.9% over the last year. Private R&D spending now represents 2.3% of US GDP, an all-time record. R&D spending is usually a good sign for future productivity growth. If secular stagnation is a thing, U.S. firms are fighting like hell to avoid it.”

Visually:

Some more details from the report:

- Current-dollar personal income increased $225.1 billion in the fourth quarter, compared with an increase of $190.6 billion in the third quarter. The acceleration in personal income reflected an upturn in farm proprietors’ income and accelerations in personal dividend income and personal interest income. Compensation of employees decelerated.

- Disposable personal income increased $218.7 billion, or 5.7 percent, in the fourth quarter, compared with an increase of $160.9 billion, or 4.2 percent, in the third quarter. Real disposable personal income increased 4.2 percent, compared with an increase of 2.6 percent.

- Personal saving was $1.06 trillion in the fourth quarter, compared with $996.0 billion in the third quarter. The personal saving rate — personal saving as a percentage of disposable personal income — was 6.7 percent in the fourth quarter, compared with 6.4 percent in the third quarter.

Other details from today’s GDP report showed that the Fed’s “pause” may have been a tad premature, with core PCE rising 1.7% in Q4 after rising 1.6% prior quarter, and slightly beating expectations of a 1.6% print. The GDP price index also beat expectations, printing at 1.8% in Q4, above the 1.7% expected, and in line with last quarter. Lastly, final sales to private domestic purchasers q/q rose 3.1% in 4Q after rising 3.0% prior quarter

Following the strong and surprise beat, the 10Y yield jumped to 2.70% from 2.66% prior to the report, also helping the dollar move sharply higher as suddenly the reflation theme appears to be back again.

And while Q4 was clearly a stronger than expected print, the real question is what happens in Q1, when most banks and nowcasts expect GDP to print below 2%, in some cases concerningly so.

via ZeroHedge News https://ift.tt/2VupSW3 Tyler Durden