One week after PIMCO’s chief investment officer of global credit, Mark Kiesel, told Bloomberg that now is the time to start selling risk as “the market has priced in a lot of good news right now” and with all major asset classes overbought, the Pimco CIO “would be tilting the portfolio towards high quality Treasuries, agencies, investment-grade corporate bonds, owning less high-yield and owning less levered companies” adding that “this has been a situation where the rising tide has lifted all boats”, another financial icon has echoed this call. In its latest Global Perspectives note, private equity giant KKR, has issued a similar warning on publicly traded stocks: It’s time to sell the rally.

One month after KKR’s bullish turn paid off handsomely, with the firm turning tactically overweight US equities just in time to catch the best rally in the S&P since 1987, the private equity giant is now turning more cautious, saying equities are no longer cheap and investors should hold the same amount of U.S. stocks as suggested by benchmarks.

Commenting on his abrupt change in sentiment just one month after he turned bullish, Henry McVey, KKR’s head of global macro and asset allocation, wrote that “we are not bearish, but we do not think that public markets will continue to appreciate in a straight line from current levels if earnings growth continues to disappoint”. And, as McVey reminds, the equity upgrade in January was “based on our belief that investors were already pricing in a recession, ” he said. Now, “We think that fear is no longer being discounted in global equity prices, U.S. ones in particular.”

Here is the key excerpt from the firm’s extended monthly report:

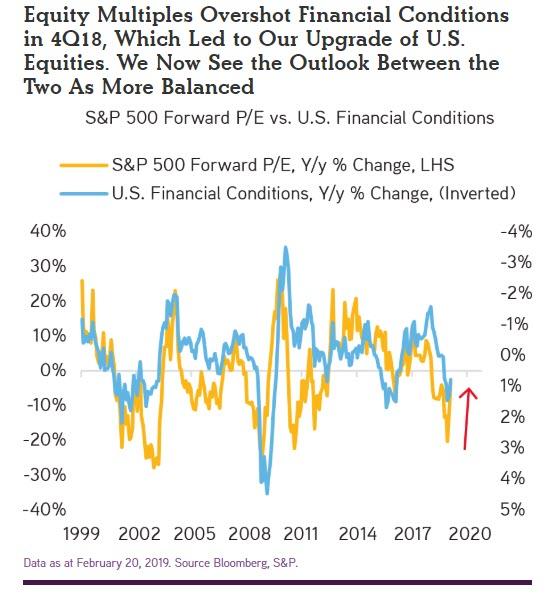

Looking at the big picture, our macro framework suggests that risk asset prices are now more appropriately valued on an absolute basis as well as relative to financial conditions. One can see this in Exhibit 1. As such, we are downgrading our tactical overweight to U.S. Equities back towards an equal weight position. With the proceeds, we take our Cash position to an equal weight position relative to our benchmark of two percent versus our January 2019 allocation of one percent. To review, we had upgraded U.S. Equities from 300 basis points underweight in 2018 relative to our benchmark to a 100 basis point overweight position in January 2019 based on our belief that investors were already pricing in a recession (whether or not one actually occurred). Today, after a solid 10% move up in the S&P 500 since January 1, 2019, we think that fear is no longer being discounted in global equity prices, U.S. ones in particular. We are not bearish, but we do not think that public markets will continue to appreciate in a straight line from current levels if earnings growth continues to disappoint.

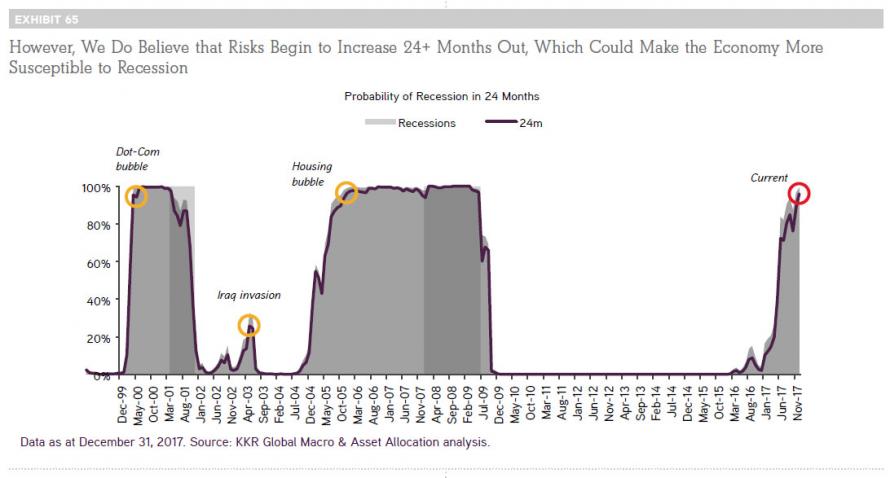

Looking at the bigger picture, McVey writes that overall, “the environment for many risk assets seems fairly balanced” as on the one hand, “economic growth trends are quite weak, and our forecasting models continue to point towards a notable deceleration during 2019.” As a reminder, in January 2018, KKR’s model predicted that a recession would hit by the end of 2019 with 100% certainty.

On the other hand, McVey counters that “central banks are now – without question – more dovish than most anyone in the investment community was thinking coming into this year.” More importantly, inflation – at least as measured by the BLS’ faulty methodology and then hedonically adjusted – remains low, which KKR believes now provides many global central bankers with some much needed “air cover” to be patient amidst record low unemployment rates in countries like the United States, Germany, and the United Kingdom.

KKR’s bearish call echoes not only Pimco but also strategists from Goldman who recently warned the equity rally is set to stall as concerns over a recession and Federal Reserve monetary tightening have evaporated, while all the good news have been priced in even as earnings growth remains scarce.

In addition to the firm’s reversal on equities, KKR made the following big picture observations on the global macro landscape:

- In Terms of Ongoing Trade Tensions, Our Macro Work Underscores That China Has Been Preparing for This Type of Trade Slowdown for Some Time. To be sure, the current trade tariffs are creating some notable headwinds in China, but they pale in comparison to what the effect could have been a decade ago.

- A Recent Trip to Europe Reinforces Our Strong Belief That Private Equity Will Meaningfully Outperform Public Equities During the Next Few Years. Our work shows that European public equity indices are structurally underrepresented in key growth markets like Technology and Business Services. At the same time, however, they are overweight cyclical industries such as Natural Resources and Financials, both areas that we believe face some significant long-term challenges in the years ahead. As such, despite heightened concern about Europe’s many challenges from our client base, we actually feel pretty good about the opportunity set for Private Equity to arbitrage these compositional shortcomings to the benefit of its investor base.

- Portfolio Construction 101: Buy Shorter Duration Cash Flowing Assets Linked to Nominal GDP and Trim Positions in Longer Duration Sovereign Debt. Given the sizeable debt loads that many governments now carry amidst rising deficits, we think that there is a growing risk of a “crowding out effect” towards other asset classes, including U.S. stocks and credit securities. Of interest to us right now is that U.S. savers are being asked to step up and replace global central banks and international investors as more meaningful owners of U.S. Treasury Bonds — thereby reducing the availability of capital for individual investors to own other financial assets.

- Given Where We Think the World Is Headed, We Believe Now Is the Time to Increase – Not Decrease – Flexibility Across Mandates. Importantly, we have the highest conviction about a more flexible approach in Liquid Credit. As many of our readers know, we did downgrade our tactical overweight to Levered Loans in our 2019 target asset allocation in January; however, we want to be clear: We were not making a major negative near-term call on the creditworthiness of Levered Loans, or we certainly would not have upgraded U.S. Equities at the same time. At the risk of stating the obvious, Public Equities actually sit below Levered Loans in a corporation’s capital structure.

For much more, read the full monthly report here.

via ZeroHedge News https://ift.tt/2ECWWp8 Tyler Durden