Authored by Bryce Coward via Knowledge Leaders Capital blog,

With US stocks up 11% YTD and nearly 19% since the Christmas Eve low, one could surmise that the economic slowdown that occurred in the back half of 2018 both globally and in the United States was a thing of the past, or at least would be over soon.

After all, the Fed is no longer tightening policy, China has been easing for over a year and expectations for an ECB rate hike keep getting punted further down the line.

Yet, we shouldn’t forget that the Fed has done nothing more than alter forward guidance, China’s stimulus appears to be not working as well as it did in the past, and the ECB has few conventional or even semi-conventional policy arrows left in the quiver.

Furthermore, and more importantly, the tightening of financial conditions that occurred in 2018 has yet to fully feed through to economic conditions and still has a long way to run. After all, changes in financial conditions are like hangovers in that they only start to be felt by the body (real economy) long after the intoxicant (easing of financial conditions) stops being ingested. Therefore, it’s the changes in financial conditions that happened in the previous 1 to 2 years that we should be paying attention to to get an accurate read on where the economy is headed in the months and quarters ahead. And by changes in financial conditions we simply mean changes in interest rates and measures of credit creation.

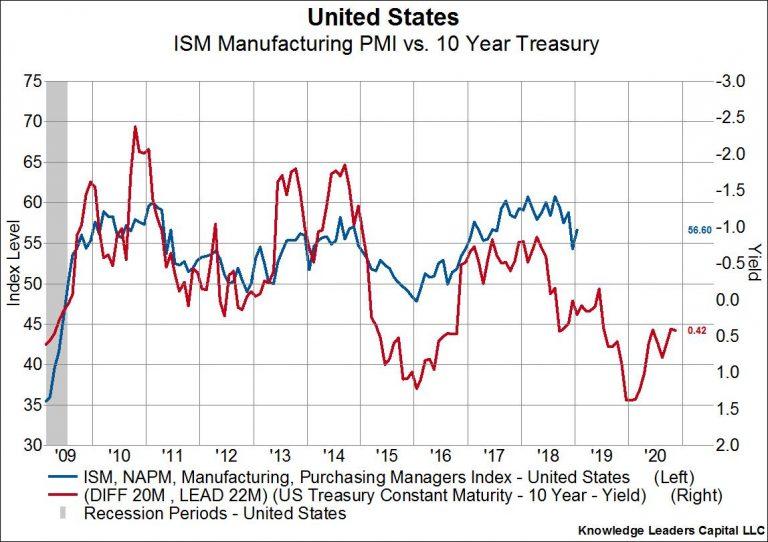

For example, in the first chart below we plot the United States ISM manufacturing PMI (a gauge of economic activity) against the 20 month difference in the 10 year treasury bond yield, and we advance the treasury bond series by about 2 years. We see that changes in interest rates that happened 20 months ago impact economic activity today. In this case, it’s the increase in interest rates that we saw from 2016-2018 that are now having a slowing impact on economic growth now, and it looks like that baked-in tightening will continue through the end of 2019. In other words, the slight uptick we have witnessed in the PMI should be overlooked as the longer-term trend appears to be lower for the next 11 months.

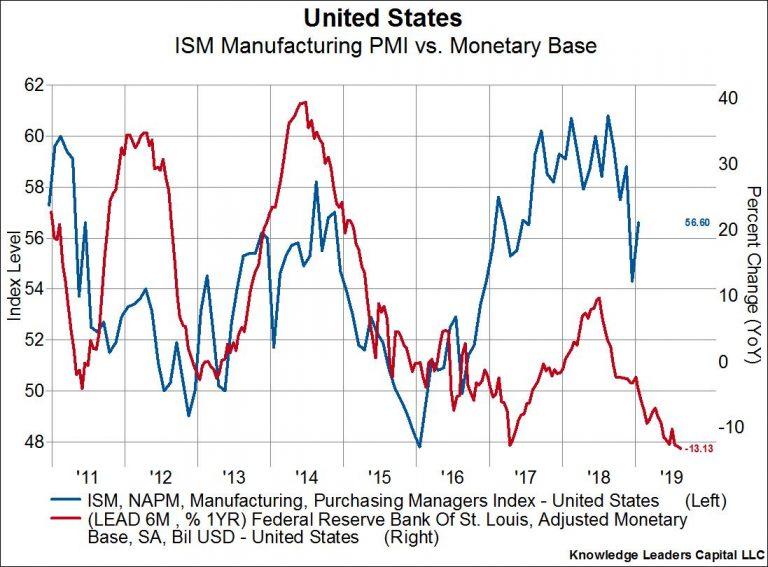

Changes in the money supply are painting a similar picture. Here we plot the YoY percent change in the money supply and advance it by 6 months before overlaying the ISM manufacturing PMI. The tightness in the money supply (thank you Fed) that is still occurring looks like it will have a material impact on economic conditions through the summer of 2019 at least.

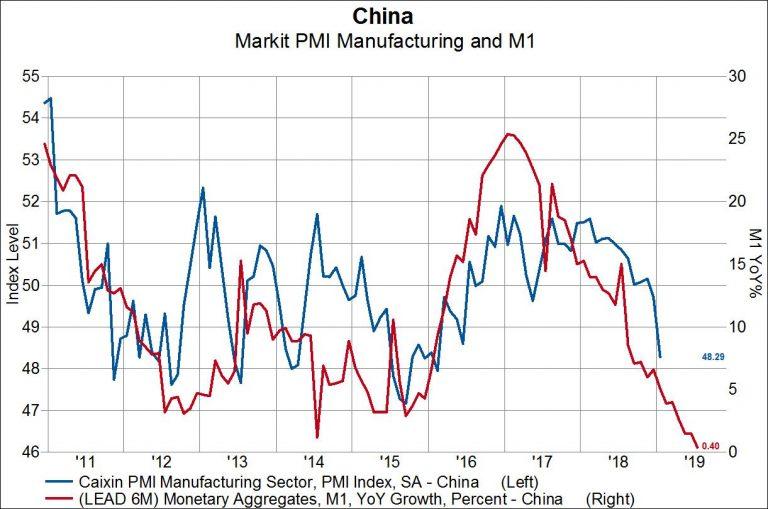

The phenomenon of changes in financial conditions leading economic growth is a global one. For example, despite all the easing measures enacted by the Chinese authorities, the Chinese money supply is growing at the slowest pace on record at only .4% YoY. The slowdown of the money supply portends a lower Chinese manufacturing PMI through the summer of 2019, a trend that was reinforced just today with the weaker than expected PMI reading out of China. It does appear as though the advertised easing in China has been rather ineffective in boosting credit creation as it did from 2015-2016.

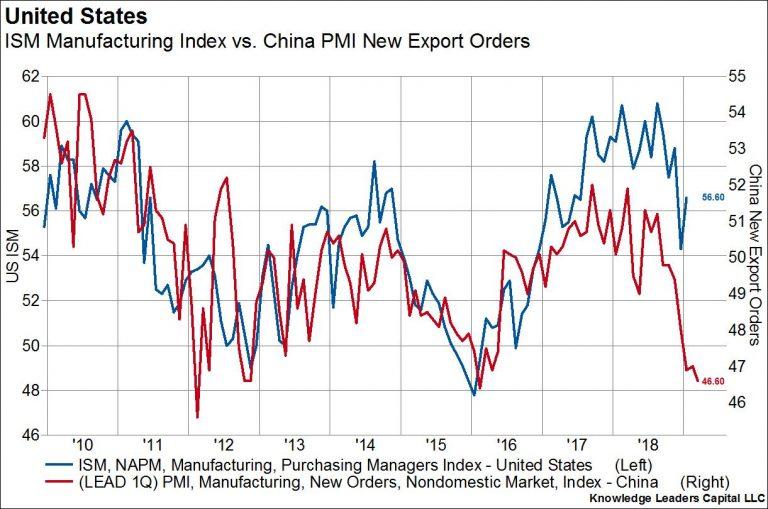

One could of course look past these indicators showing a further global slowdown and assume stocks know better this time or that the Fed’s forward guidance will overwhelm these relationships. Even in that situation though, we are faced with the prospect of a further US slowdown thanks to the weak China data reported today. Because China is close to the beginning of the global supply chain and the US is close to the end, there is a tight relationship between new orders of Chinese products and US economic growth.

New orders of Chinese products lead US economic growth by about a quarter, and those new orders just hit a 3 year low.

via ZeroHedge News https://ift.tt/2NA2d3A Tyler Durden