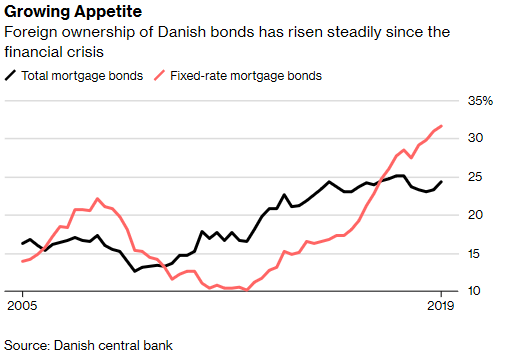

The share of foreigners who own Danish fixed-rate mortgages has peaked at an all-time high of 32%, three times what it was in 2012, reports Bloomberg.

As a result of the world’s largest mortgage-backed covered bond market being so attractive to outside buyers, Danish mortgages are incredibly low, as local home buyers can find a 30-year fixed rate loan of just 1.5 percent.

The primary buyers of Danish AAA-rated bonds are Japanese and German investors. The central bank, meanwhile, has warned that a “dependence on foreign investors can increase market fluctuations in times of crisis.”

Timothy Smal, head of fixed income at Silkeborg, Denmark-based Jyske Bank, says the risk of a sudden exit from the market is small, given that this is “not a homogeneous group.” –Bloomberg

“The fact that Denmark probably isn’t their main place for investing might make it easier for them to exit the market,” Smal told Bloomberg in a phone interview. That said, “at the moment there’s no sign of things heading that way.“

via ZeroHedge News https://ift.tt/2GTOXpT Tyler Durden