U.S. consumer sentiment unexpectedly fell from an initial February reading and remained near the prior month’s two-year low, signaling that Americans haven’t quite shaken off the government shutdown and trade war.

The University of Michigan’s final February sentiment index was 93.8, well below the preliminary reading of 95.5. Most notably, the measure of current conditions weakened from the earlier reading to the lowest since November 2016 while expectations were lower than in the initial report.

Following the dismal spending datya earlier today, UMich’s report showed 25 percent of all consumers reported worsening finances, the highest proportion recorded since Donald Trump was elected president

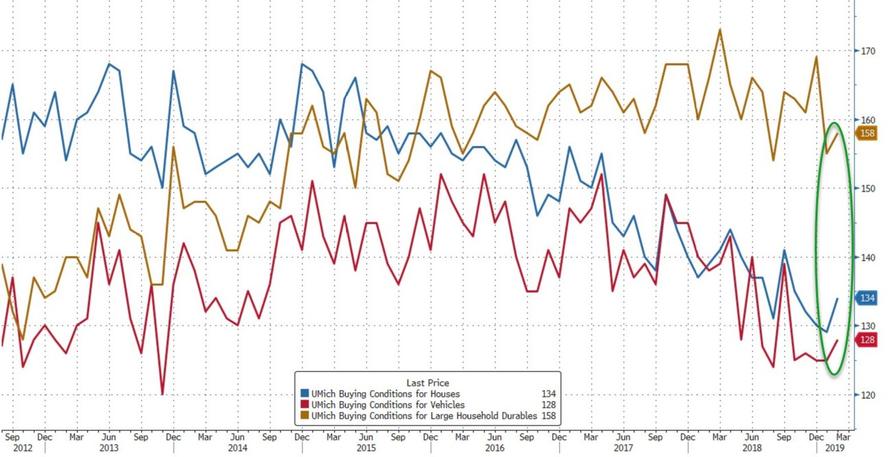

Buying Conditions rebounded in February…

The data contrast with other February sentiment readings that were more upbeat after the government shutdown ended and stocks rallied.

“The bounce-back from the end of the federal shutdown faded in late February,” Richard Curtin, director of the Michigan survey, said in a statement.

“While the overall level of confidence remains diminished, it is still quite positive.”

However, while upper- and middle-class income-earners’ confidence rebounded, low-income earners’ confidence slipped lower…

Upper-income households anticipated a 3 percent income gain, “well above those with incomes in the bottom two- thirds,” according to the report. Which leaves the question – why don’t the poor just pile all their hard-earned minimum wages into the stock market? Everything would be ‘equal’ then, right?

Finally, long-term inflation expectations reading of 2.3% matches record low…

via ZeroHedge News https://ift.tt/2GTDPcy Tyler Durden