“off the lows” … or “off the highs” – it appears sell-the-news was the order of the day as yet another headline proclaiming a US-China trade deal is close sparked overnight gains, but met a wall of selling at the cash open…

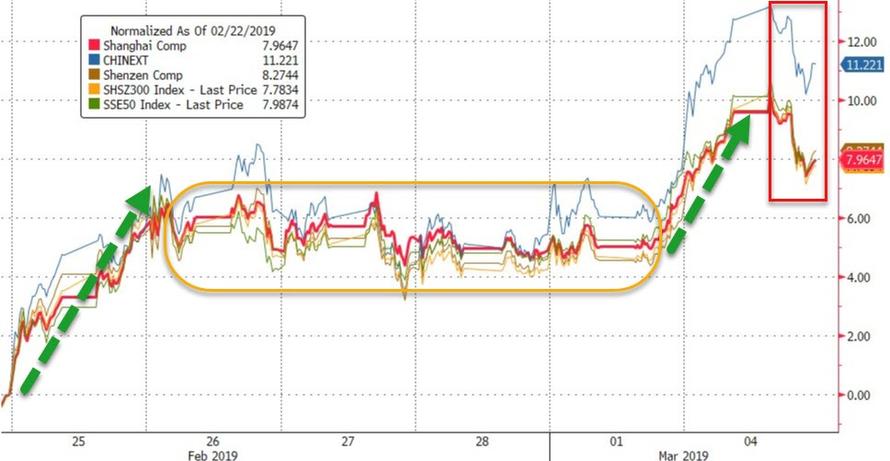

China was up once again overnight – with SHCOMP back above 3,000 – but the afternoon session was notable selling…

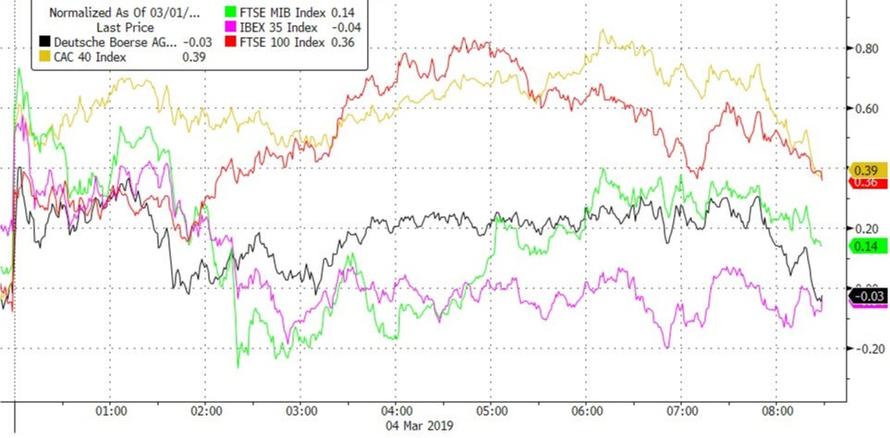

European markets opened gap higher but faded into the close with Span and Germany ended unch…

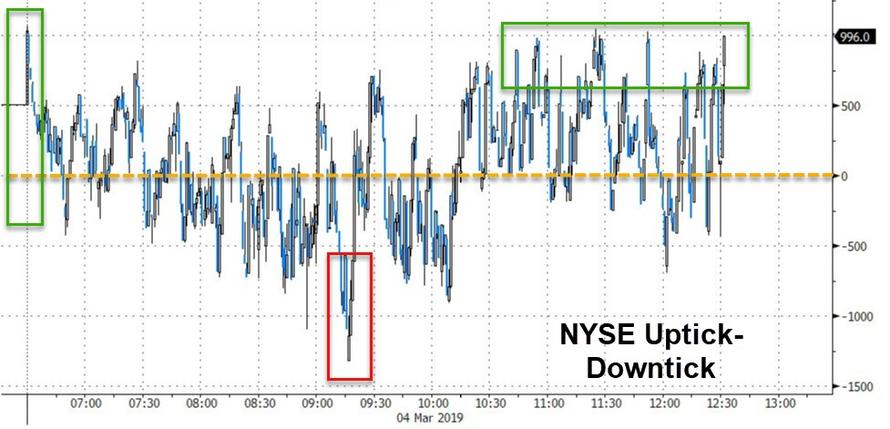

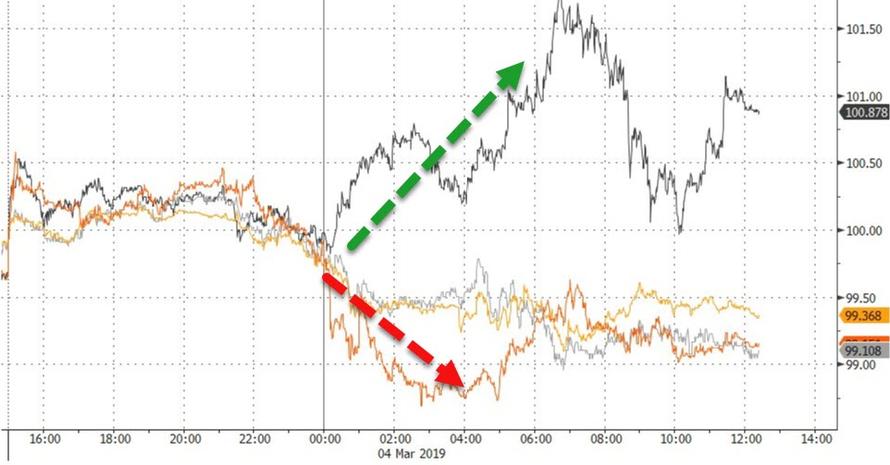

US Futures show the day’s actions best as stocks gapped open overnight after the WSJ trade headlines and then dumped at the cash open, not helped by construction spending and McConnell headlines…

Today was the worst day for the Dow since Jan 3rd before the panic bid lifted everything back…

Trannies are down 7 days in a row (longest losing streak since Nov 2017)

TICK showed the biggest selling pressure since Jan 28th hit around 1215ET, before stocks bounced on a series of buy programs…

S&P 2,800 confirmed the Quadruple Top…

The algos BTFD in a desperate attempt to get us back to 2800…

Nasdaq futures tested the 200DMA…

Tesla stocks hit a 5-mo low and caught down to bonds…

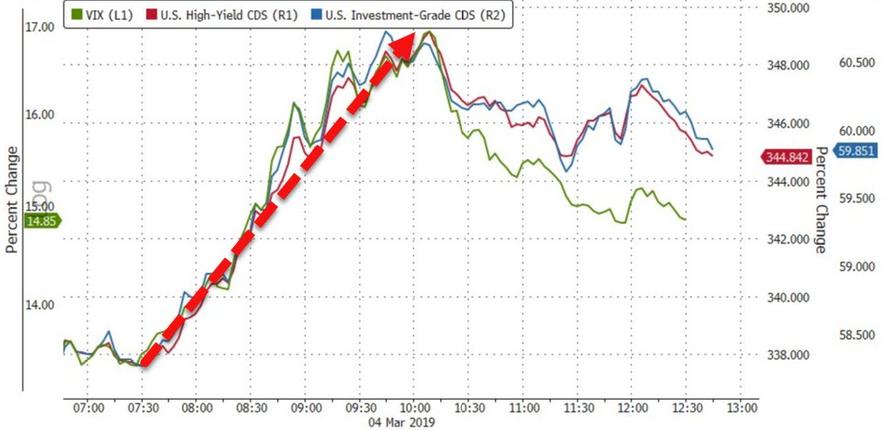

VIX topped 17 intraday, but compressed back as stocks bounced…

We note VIX broke above its 200DMA before pulling back…

Bonds and stocks decoupled as the latter rebounded…

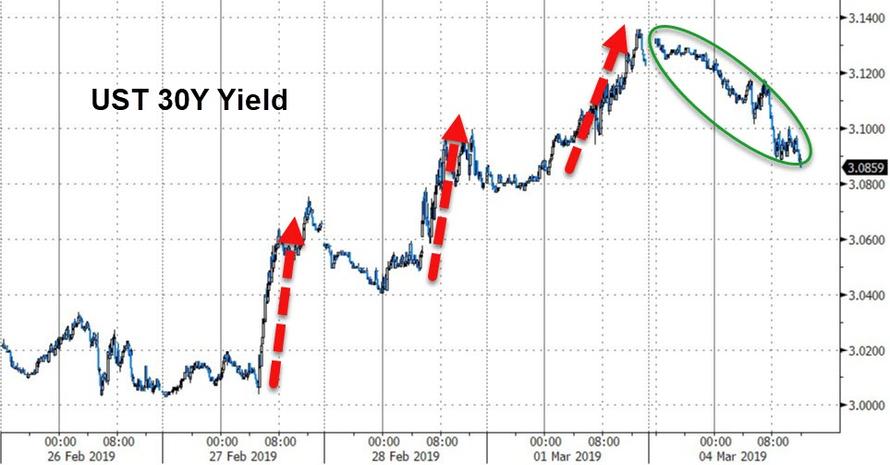

Treasury yields fell on the day – after 3 big up days – with the long-end outperforming…

30Y yields fell around 4bps…

The Dollar refused to be impacted by the weakness in stocks and continued to trend higher in a tight range…so much for Trump’s weak dollar call…

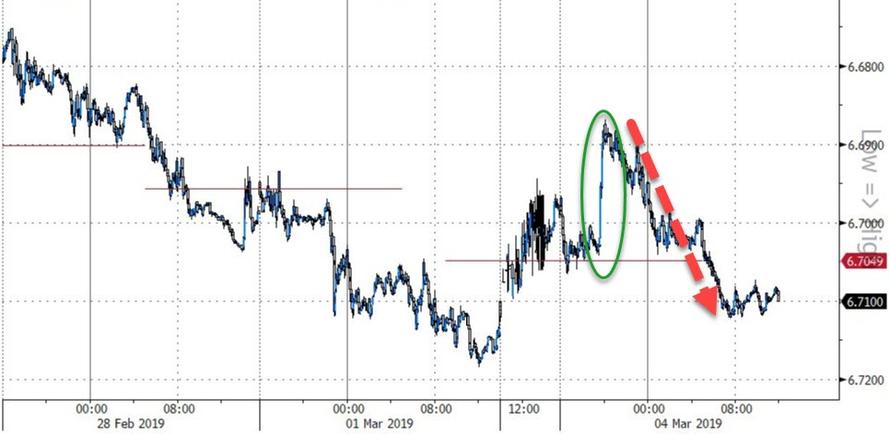

However, overnight strength in the yuan on the WSJ trade headlines, were erased…

Cryptos had another ugly day…

Despite dollar gains, WTI managed to rally as PMs and copper slipped lower…

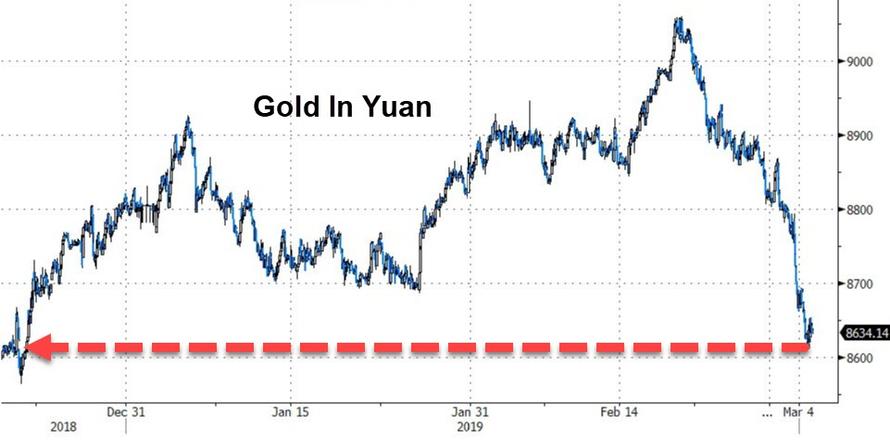

Gold extended its losses against the Yuan…

Coincidence?

What happens next?

via ZeroHedge News https://ift.tt/2EMGeng Tyler Durden