While the broader market is suffering from one of its biggest selloffs of 2019, sparking worries that the “goldilocks rally” is finally over as Goldman warned over the weekend…

… Nomura’s Charlie McElligott once again focuses on the violent moves beneath the market’s surface, and finds that significant factor moves appear to be at the core of today’s broader Index-level selloff (which he describes as “GASP -75bps…yes, 2019 has been that absurd”), with the Nomura strategist’s favorite “Value” over “Growth” imbalance dynamic again looking like “patient zero” of today’s slump, as Monday’s performance behavior indicates potential “rebalancing” of risk exposures which in-turn may be causing general portfolio distress across L/S managers in particular (and likely behind some of the dynamic hedging in futures / ETFs)

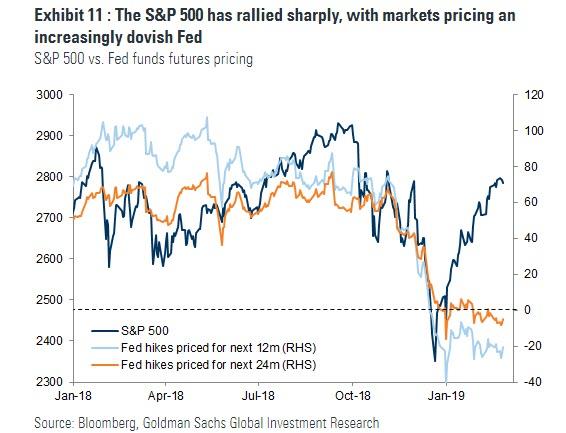

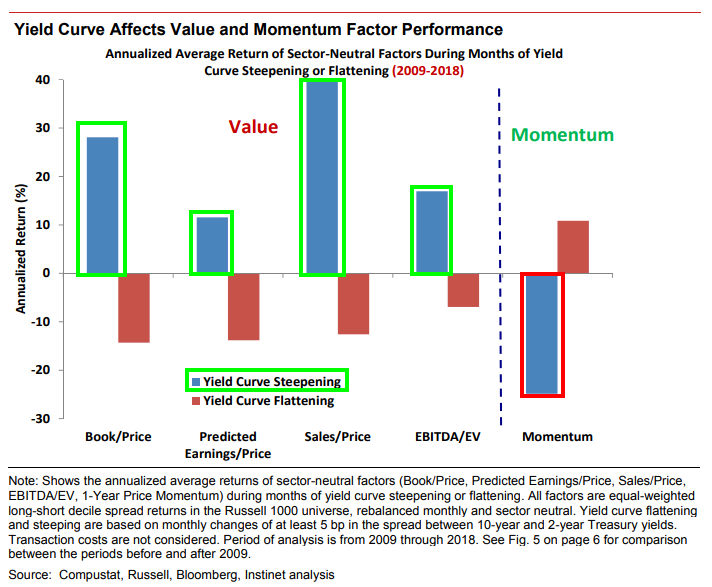

As McElligott – who recently correctly predicted the curve’s acute steepening – explains yet again, “Value” over “Growth” outperformance has become a standard pain-trade/de facto “Momentum” factor unwind of multi-year consensual “slow-flation” macro narrative positioning, this has worked flawlessly in conjunction with the Fed’s post-GFC efforts to flatten the US yield curve to maximize “easy” financial conditions (low rates, flat curves forever drive folks into stuff that can work “secularly” and doesn’t need a “hot” economic cycle).

In this vein, the “Long Growth, Short Value” consensual positioning dynamic of the past 5 years has been a critical performance driver for most equity funds over this period, with “Long Growth, Short Value” effectively becoming a market-neutral “Momentum” expression—which is why any catalyst for a resurgence in “Value” is a constant driver of fear for the majority of Equities players as it promptly leads to a broader market selloff as the equilibrium of the market gets tipped — which may also explain why such “reversal blasts” (and performance drawdowns) in recent years periods of “Value over Growth” have all been incredibly short-lived, “instead associated more with bouts of “Gross-Down” stress/book unwinds as opposed to any sort of macro regime change which could actually stick” according to the Nomura strategist.

However, as we have covered in recent months, at the core of McElligott’s 2019 trading view is the belief that “the catalysts are now largely in-place for a US yield curve STEEPENING over the coming 1Y + (featuring two very different but realistic scenarios for either a bull- or bear- steepening, based upon “end-of-cycle slowdown”- OR “reflation” / “cyclicals over defensives”- view)” which could also conspire against said legacy “Long Growth, Short Value” factor positioning in a much “stickier” long-term fashion… “because in this post-GFC regime, yield curve steepening has correlated with strong “Value” factor performance against “Growth”- and “Momentum” underperformance.“

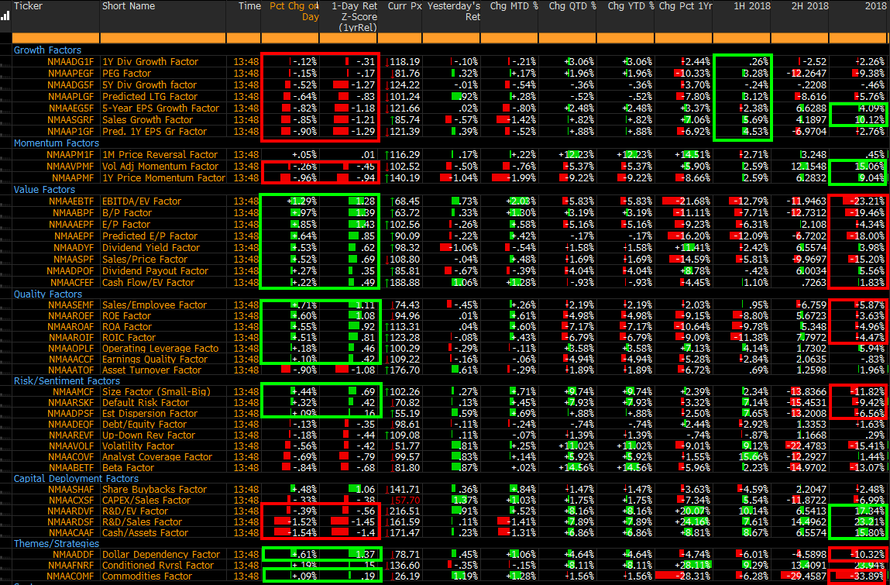

However, instead of being a representation of the “steepening”/macro regime change as the near-term driver though (despite the 5s30s more than doubling from +21bps in start Oct to the current +56bps), today’s behavior is most realistically related to the peak “Growth” factor LONG proxy that is the “Software & Services” space trading off ~2% (CRM earnings tonight as a huge input here, options pricing-in a 7.9% move), which is also why we see a bloodbath in some of the most popular trades, including the “Most Crowded” basket down -2.8%, “1Y Price Momentum Longs” -2.3%, “Cash / Assets (Growth) Longs” -2.6%, “Software 8x’s EV / Sales” basket -4.7% and “EBITDA / EV (Value) Shorts” -3.1% which as Charlie notes, “has a ~60% weighting between “Software & Services” along with addition “Growth Longs” proxy Biotech.”

To simplify his point, there are three things of note:

- Days when “Value” is outperfomring “Growth” /(i.e., long-short “Momentum”), like today, tend to be associated with negative broader stock performance, and today is just another expression of this

- This asymmetrical positioning dynamic with investors again crowded into “Growth” and short / underweight “Value” (as many view this current global CB “dovish pivot” as meaning that we are returning to a “low rates and flat curves in perpetuity” slowing-growth world) is now receiving a lot more attention though, because PMs, CIOs and other trigger-pullers are increasingly susceptible to this crowding risk; to this end, McElligott also writes that in over three months of client meetings, “the point of greatest concern/ interest has again centered around my view that the a longer-term US yield curve STEEPENING in 2019 will “knock-on” into the acceleration of this “VALUE” OVER “GROWTH” reversal dynamic within US Equities.”

- Today’s trade could be about mitigating this factor exposure risk looking-out further down the road (the structural “US YIELD CURVE STEEPENING” trade) via today’s possible rebalancing-type flows, “thus we see the ensuing damage in crowded Growth-overweights like “Tech Momentum Longs” (-2.7%), “Cash / Assets Longs” (-2.6%) and “R&D / Sales Longs” (-2.4%) factors or Biotech (-1.9%), all of which is leaning on the performance on “long” books—in turn forcing “unwindy” type flows on the “short” side, with “Value” outperforming as it remains broadly underweighted / shorted.”

Charlie’s appropriate conclusion:

“Factor exposures always seem to matter more on the drawdown days”—Every Equities PM ever

via ZeroHedge News https://ift.tt/2HfwALu Tyler Durden