Was that it for China’s “Shanghai Accord 2.0”?

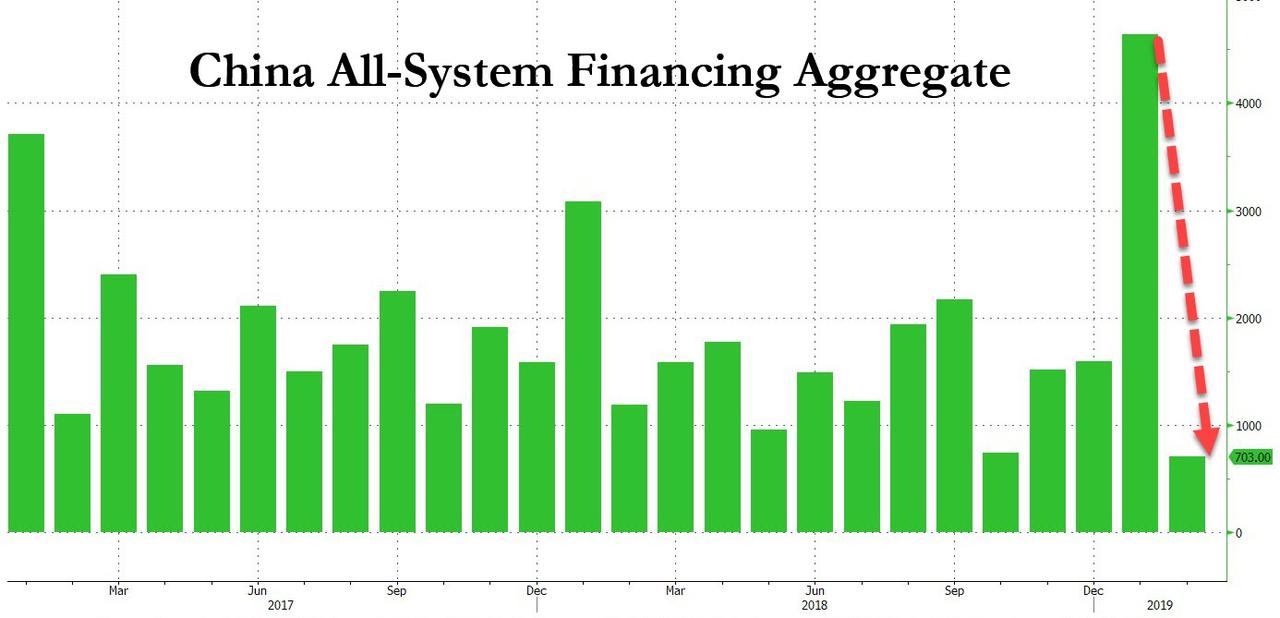

One month after the PBOC injected a gargantuan 4.64 trillion yuan ($685 billion) into the economy – more than the GDP of Saudi Arabia – in the month of January in the country’s broadest credit measure, the All-System Financing Aggregate, a credit injection that was so massive it even prompted the fury of China’s prime minister Li Keqiang who lashed out at the central bank for its unprecedented debt generosity in a time when China was still pretending to be on a deleveraging path, the PBOC once again shocked China-watchers, only this time to the downside, when overnight the Chinese central bank reported that in February, aggregate financing increased by a paltry 703 billion yuan, roughly half the expected 1.3 trillion…

… and the lowest print on record in the recently revised series.

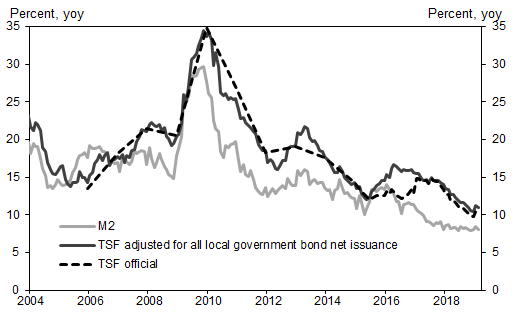

On a year-over-year basis, TSF stock growth (after adding local government special bond issuance) was 10.1% in February, vs 10.4% in January, according to Goldman calculates; if adding all local government bond net issuance to TSF flow data, adjusted TSF stock growth at 11.0% yoy in February, lower than 11.2% in January. The implied month-on-month growth of adjusted TSF was 11.9% SA ann, lower than 17.2% in January, all suggesting the January record outlier credit surge may have been just that.

In terms of the impacts of the liquidity supply on the economy, sequential growth of broadly defined TSF (which includes all local government bond issuance) was 11.9% month-over-month annualized after seasonal adjustment, still above its year-over-year growth of 11.0%. This is not particularly low, just not as high as its 17% growth pace in January.

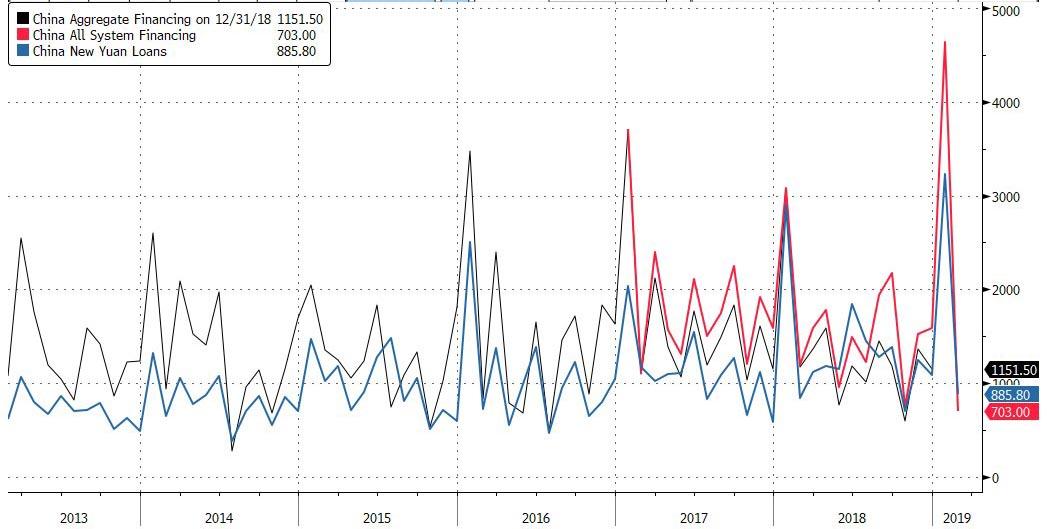

Curiously, new yuan loans increased by 886BN yuan in February (of which new loans to the real economy were 764BN) also below the 950BN consensus, and more notably, above the total system financial aggregate…

… which meant that after surging in January, when shadow banking added some 343BN yuan in new credit, the first positive print in one year, in February shadow banking reversed sharply, and posted a significant drop to the tune of 364.8BN as China’s shadow deleveraging appears to have returned with a bang, after the forceful political pushback against the re-emergence of shadow banking following the January print. Virtually all shadow banking components posted a drop in February, with trust and entrust loans down RMB 55bn (vs RMB -35bn in January; Jan-Feb average RMB -45bn), and bank acceptance bills were down RMB 310bn in February (vs an increase of RMB 379bn in January; Jan-Feb average RMB +34bn).

The sudden reversal in shadow credit follows Premier Li Keqiang urging last month that banks should supply more longer-term loans to the real economy after a surge in short-term bill financing. Even so, corporate bond net issuance slowed down sharply to just RMB 81BN in February, down from RMB 499bn in January.

Meanwhile, growth in China’s broad money supply, or M2, once again slumped and after a modest rebound in January, in February M2 Y/Y growth dropped back to 8.0%, the lowest print in series history.

The February collapse in credit creation following January’s extravagant print likely means that just like most other Chinese data in the pre-New Year period, this too was distorted by the Lunar New Year, and as a result the January surge, far from indicative of a major new reflationary boost may simply suggest that China will maintain a prudent approach to overall economic leverage, which however will be bad news for the stock market which in the second half of February went all in on bets that China has doubled-down on reflating both its, and the global economy.

So how did Chinese credit creation look like for the combined Jan-Feb period? While aggregate financing in the first two months was 5.31 trillion yuan, 1.05 trillion yuan higher than in the same period last year, the annual increase was far more tame than when comparing just January 2019 vs January 2018. At the same time, the shadow banking sector shrank 21.7 billion yuan for the two months:

- Entrusted loans (organized by a bank between borrowers and lenders) were down 120.8 billion yuan

- Trust loans (made by trust companies to finance infrastructure and real estate) rose 30.8 billion yuan

- Bankers’ acceptance (short-term credit issued by a company with a bank’s guarantee) up 68.3 billion yuan

Within February total social financing flows data, new RMB loans to the real economy were RMB 764bn vs Jan RMB 3.6 trillion; Jan-Feb average RMB 2.2 trillion), trust and entrust loans were down RMB 55bn in February (vs RMB -35bn in January; Jan-Feb average RMB -45bn), and bank acceptance bills were down RMB 310bn in February (vs an increase of RMB 379bn in January; Jan-Feb average RMB +34bn). Corporate bond net issuance was RMB 81bn in February (vs RMB 499bn in January; Jan-Feb average RMB 290bn).

Commeting on the disappointing February credit data, Goldman’s China analysts led by MK Tang said that they see the slowdown in credit growth as a result of a less supportive policy stance, which is in turn affected by

- a rapid rebound in the equity market which started to pose threat of a repeat of the 2015 boom and bust,

- positive developments on trade talks and better than expected January export data,

- signs of growth holding up into the new year (better export growth, better Caixin manufacturing PMI), which alleviated the concerns about further economic slowdown,

- criticism of January loosening in terms of overly loose overall amount and particularly the discount bill component.

Adding to the seasonality commentary, Goldman also noted that while there are technical reasons such as the timing of the Chinese New Year, if the government wanted they could have kept liquidity supply loose despite these reasons if the economy and markets were very weak and trade talks weren’t progressing well.

Another observation: contrary to tradition, where the monthly Chinese monetary data is released in the middle of the month, the February data was released relatively early as there was a press conference hosted by PBOC Governor Yi Gang and 4 deputy governors.

In the conference Governor Yi said January and February data should be viewed together and is clearly more than the same period last year. But this is still not free from the Chinese New Year effects, and January-March data will give a better view. This comment is important since the impact of the holiday on March data is usually limited but this was not the case last year because of the late timing of the festival. To Goldman, this may be a hint that March liquidity supply will once again be relatively ample, and a reversal of the February plunge.

Several other comments made by the governor are particularly worth noting:

- RRR level is no longer very high after the five cuts since early last year, though there is still room for further reduction. It is necessary to maintain an appropriate level for a developing country.

- The PBOC has “mostly exited” from the direct management of the FX rate. FX rate flexibility can serve as an automatic stabilizer of the economy and external account. China will not actively use FX as a policy tool to gain export competitiveness. There was no statement on currency stability as a part of the trade deal. Instead the governor said the two sides discussed the need to respect the right to make monetary policy independently and respect market forces in terms of how the FX rate is determined. Note the lack of direct intervention doesn’t mean there has been lack of indirect intervention and the fact that FX flexibility has advantages doesn’t mean the government will not intervene indirectly to maintain stability, with or without pressures from the US.

- Interest rate level is down, and the key to lower lending rate is to lower risk premium. These need to be addressed by making the rate setting mechanism more market-based and through structural reforms to lower transaction costs. For example improving the bankruptcy system and reinforcement of law.

- The PBOC reiterated that interest rate arbitrage activities related to discount bills existed but the amount was limited.

To Goldman, the PBOC’s comments suggest a reduced likelihood of further RRR and market interest rate cuts (the bank didn’t expect benchmark rate cuts to begin with). Credit supply in March (seasonally adjusted) is likely to be higher too, especially because bullish financial market sentiment was at least a partial contributor to regulatory tightening in February. Furthermore, given the equity market has already corrected slightly and these data may dampen sentiment even further, policy makers will be sure to watch against risks of shifting too quickly back toward tightening.

So while today’s data will likely lead to even more bearishness for China’s stock market, which as we noted on Friday plunged after state-owned broker CITIC downgraded a state-owned insurer which had become the poster child of the latest market euphoria, sending the Shanghai Composite tumbling almost 5% on Friday, what does all of this mean for Chinese economy? Here Goldman is slightly below market consensus forecasts in terms of January-February industrial activity growth though even with our forecast, the implied sequential growth would still be a little higher than the level in 4Q 2018. And so while January-February activity data together are still subject to slight downside Chinese New Year distortions on net, Goldman expects March data to be stronger on a year-over-year basis. What happens then will depend on whether Beijing once again open up the credit spigots, or if the current sharp slowdown in credit growth persists indefinitely, further depressing China’s already slowing economy.

via ZeroHedge News https://ift.tt/2VRnatP Tyler Durden