During its latest, quarterly meeting, the Treasury Borrowing Advisory Committee (aka the TBAC, which many years ago we dubbed the Supercommittee That Really Runs America, an assessment which 8 years later Bloomberg now generally agrees with), released minutes of its Jan. 29 meeting held at the Hay-Adams Hotel in conjunction with the U.S. government’s quarterly refunding announcement.

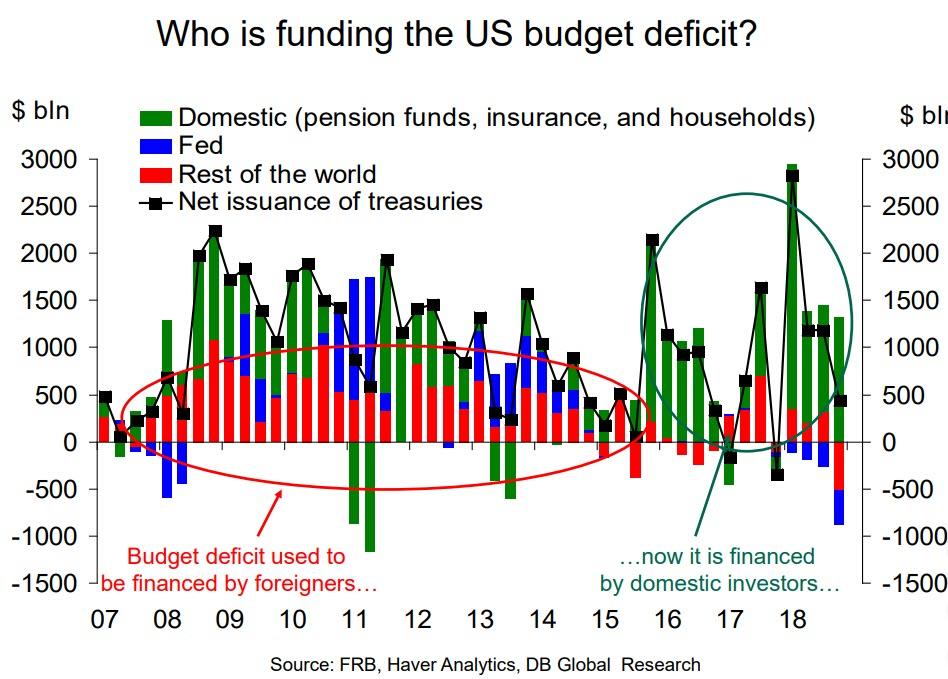

While there were many topics of discussion (discussed previously here), the TBAC highlighted two key areas of concern: i) the soaring US budget deficit, and specifically the possibility of significant financing gap over next 10 years amounting to over $12 trillion and the potential need for more domestic investor participation if foreign reserve growth slows; and tied to that ii) the worry that since “foreign investors already hold significant dollar debt“, and have been paring back substantially on their Treasury purchases in recent years, the US will have to increasingly rely on domestic savings to fund its future budget deficits.

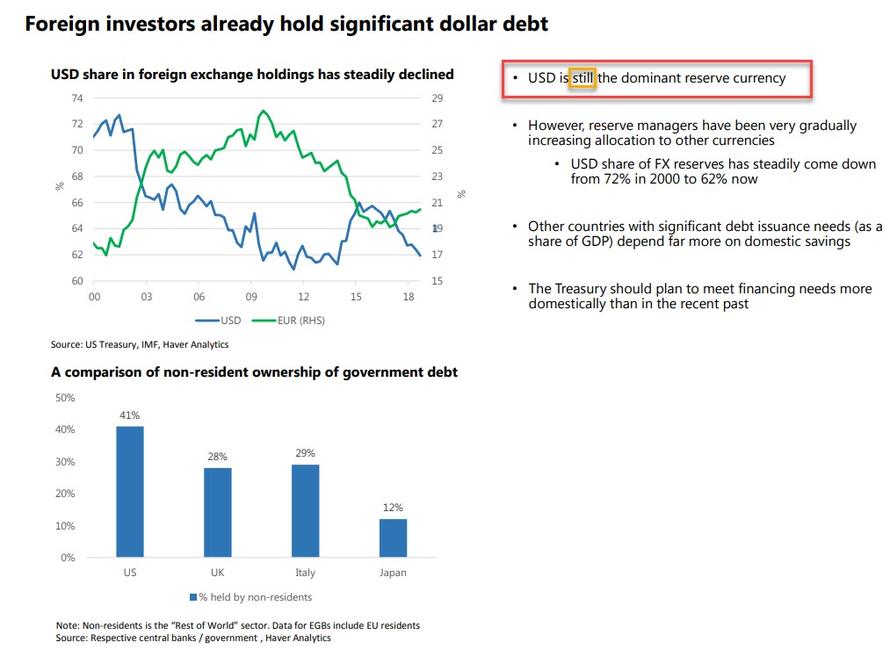

Of particular note, the TBAC said, tongue in cheek, that while the “USD is still the dominant reserve currency“, reserve managers have been very gradually increasing allocation to other currencies, and that the USD share of FX reserves has steadily come down from 72% in 2000 to 62% now. It also pointed out that other countries with significant debt issuance needs (as a share of GDP) depend far more on domestic savings. As a result, “the Treasury should plan to meet financing needs more domestically than in the recent past.”

Which brings up a key question: who is buying US Treasurys, and who will be buying US Treasurys for the foreseeable future.

To address just this question, on Friday Deutsche Bank’s team of economists and credit strategists led by Peter Hooper, Brett Ryan and Torsten Slok among other, published a presentation titled “Who is buying Treasuries, Mortgages, Credit and Munis” which seeks to address just the concern framed by the TBAC, and which will soon emerge as the most critical one for the US Treasury market (the biggest in the world), especially if public support for MMT (i.e. helicopter money to finance unlimited political promises) gains social traction.

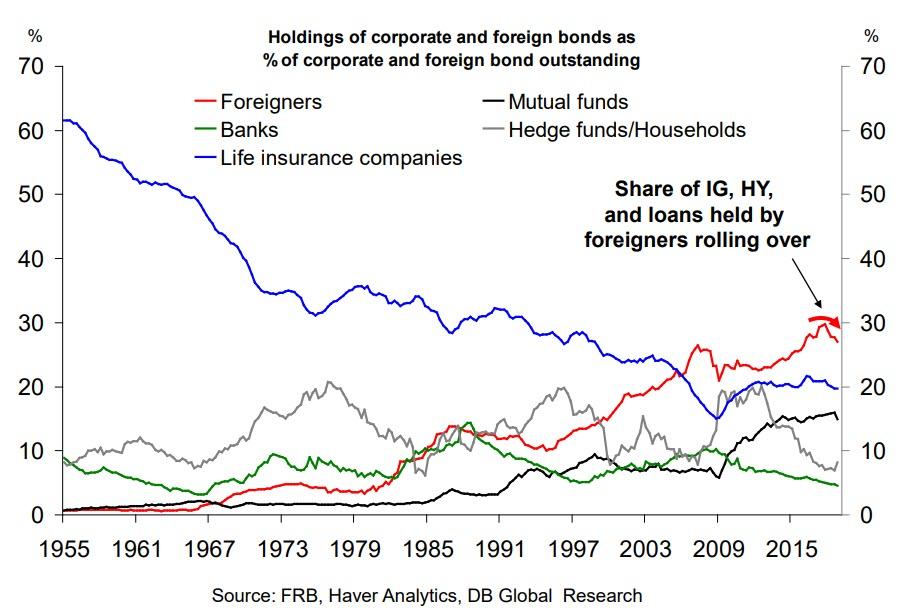

Below we excerpt some of the key charts from the presentation starting with the most obvious: foreign appetite for IG, HY and loans is rolling over.

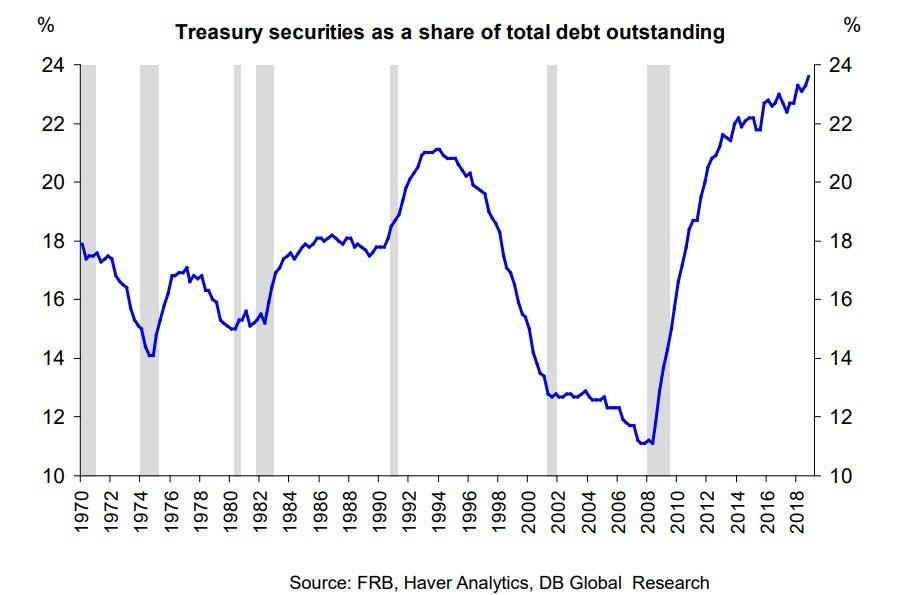

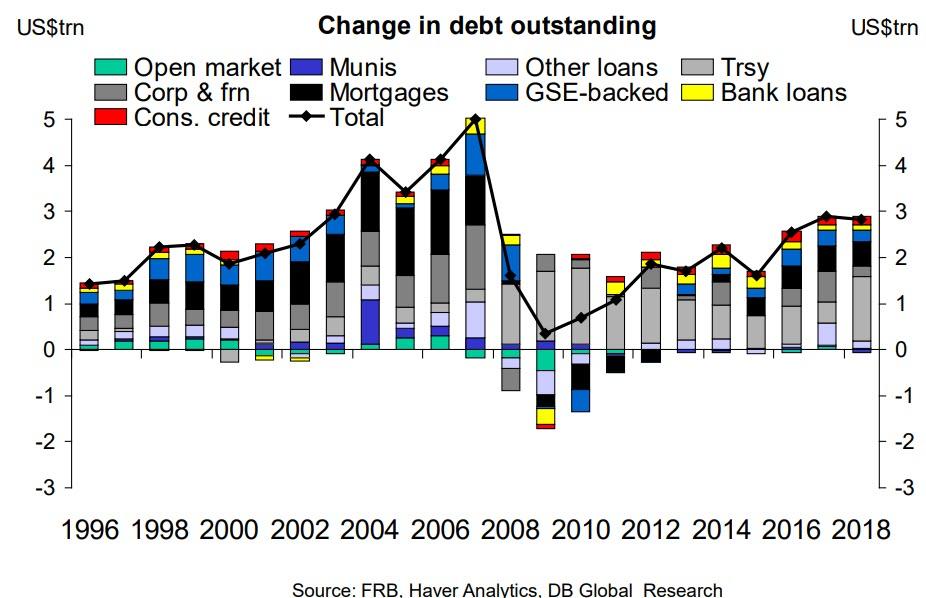

This is a growing problem just as the share of Treasuries as a share of total US debt outstanding is at an all time high…

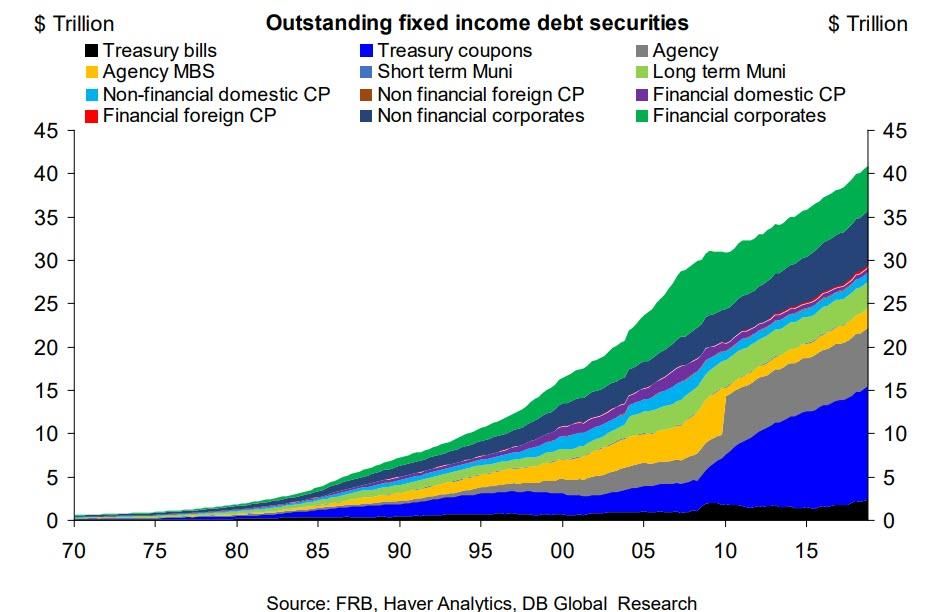

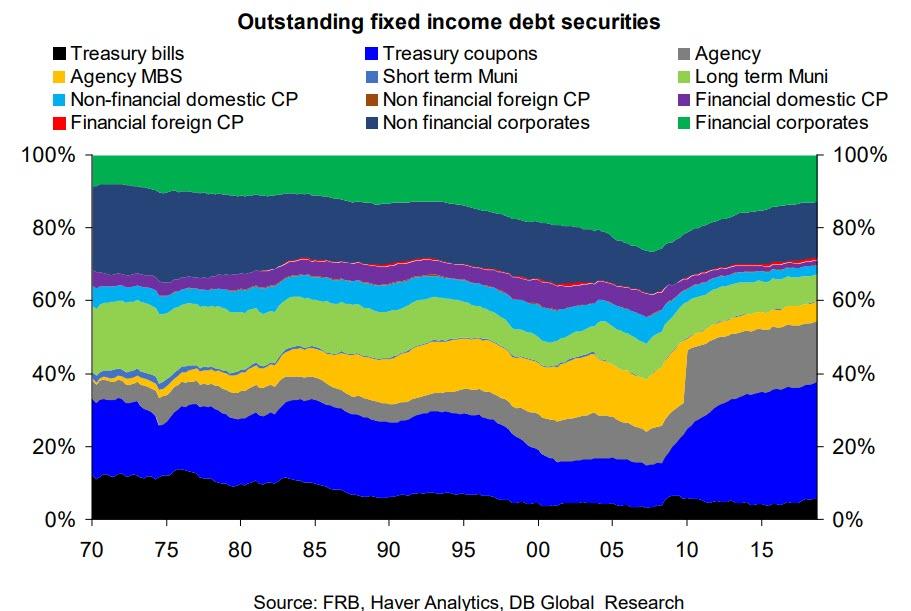

… and the total stock of US fixed income is now an all time high of $41 trillion…

… of which the total stock of Treasuries is now the highest on record and rising, with corporate debt (both financial and non-financial) and MBS debt in 2nd and 3rd spot.

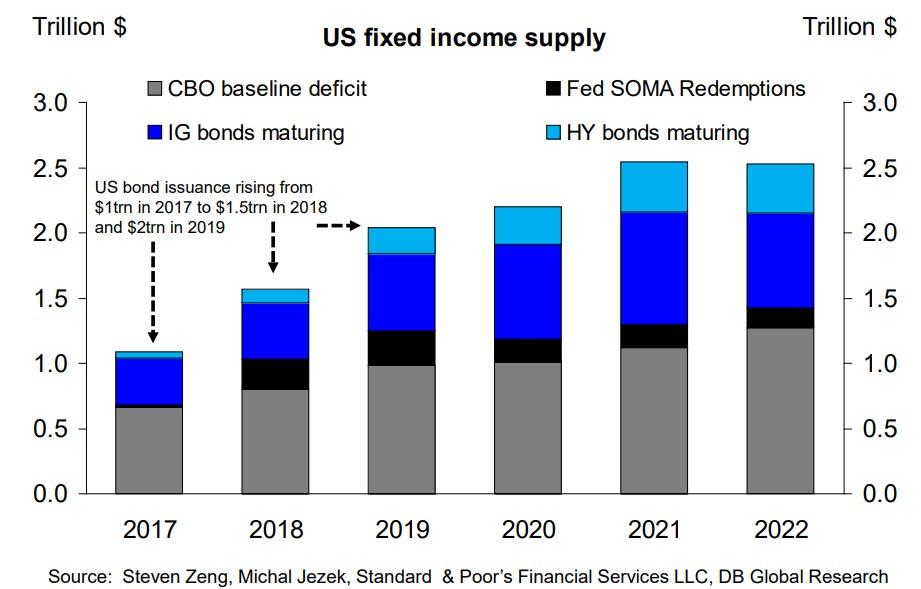

Don’t expect this dramatic increase in Treasuries to slow down any time soon. In fact, the explosion in US Treasury supply, much of which was needed to fund Trump’s tax cuts and the Fed balance sheet rundown (which may be ending as soon as September) will crowd out investment in equities and corporate debt, both IG and HY.

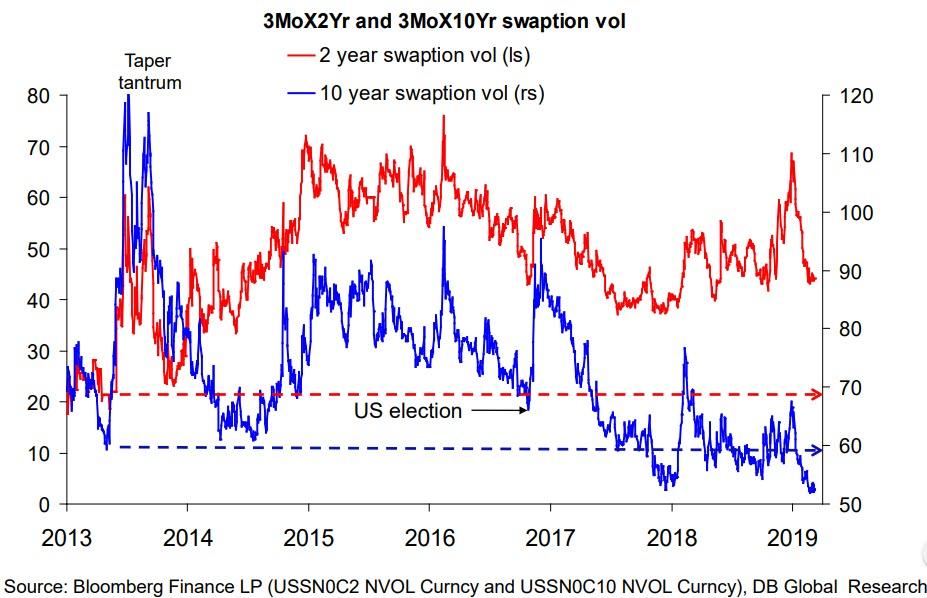

Yet despite – or rather permitting this surge in debt, is the fact that long-rate volatility has tumbled below pre-taper tantrum levels despite rising uncertainty about the US and global slowdown, Brexit and the ongoing trade war. In fact, as we discussed recently, Treasury volatility recently dropped to an all time low.

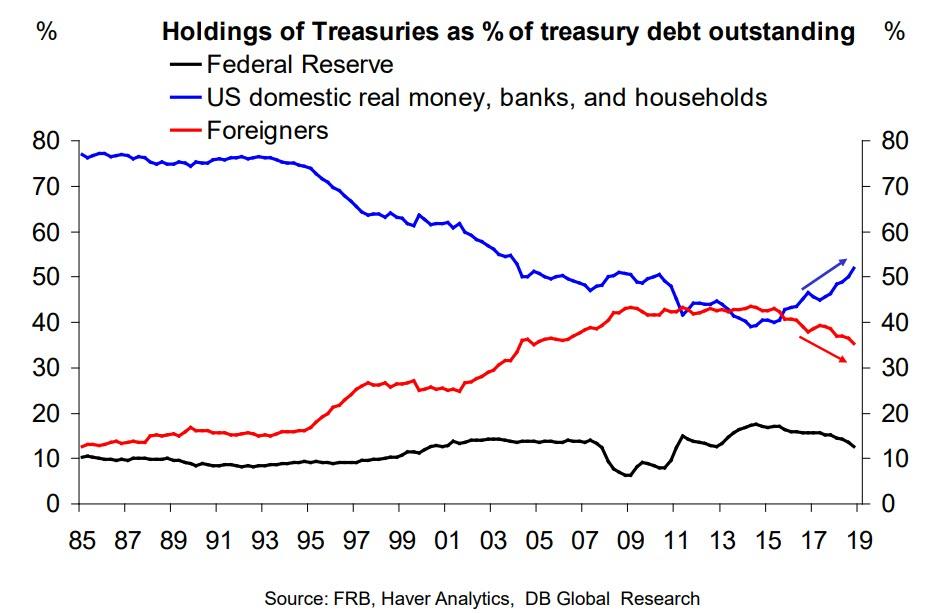

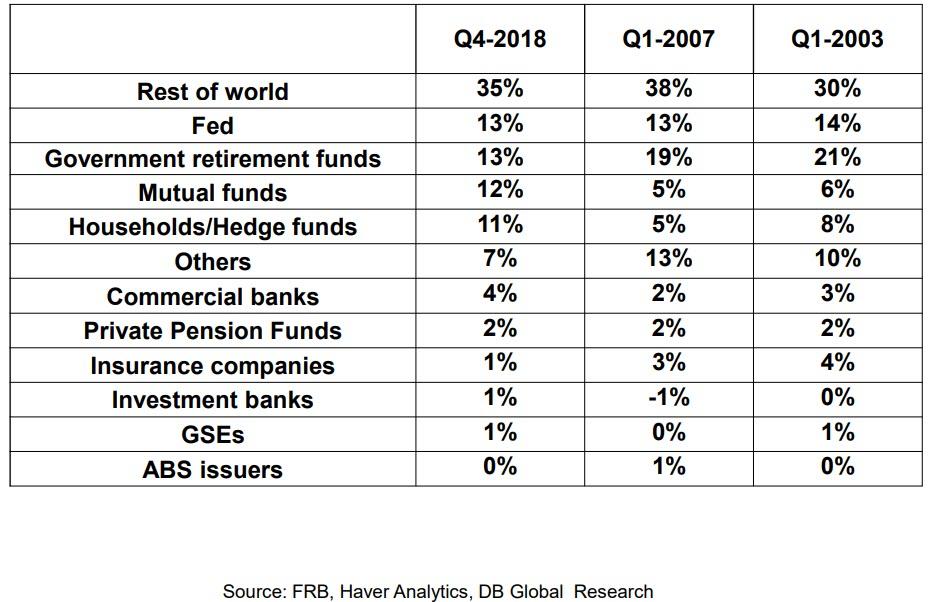

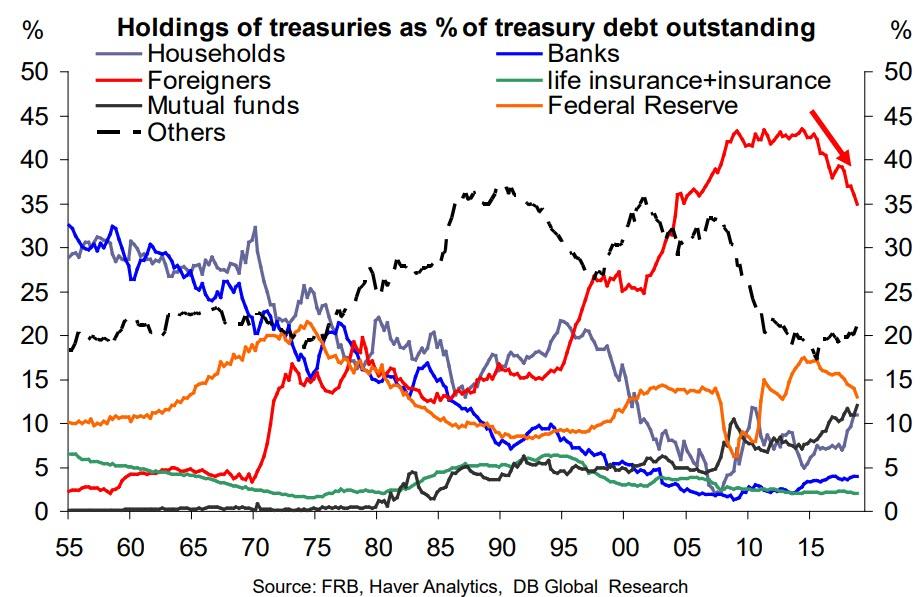

Which brings us to arguably the key chart which highlights the TBAC’s main concern: whereas the US budget used be financed by foreigners, it is now financed almost entirely by domestic investors, as some of the largest US creditors such as China are quietly exiting stage left.

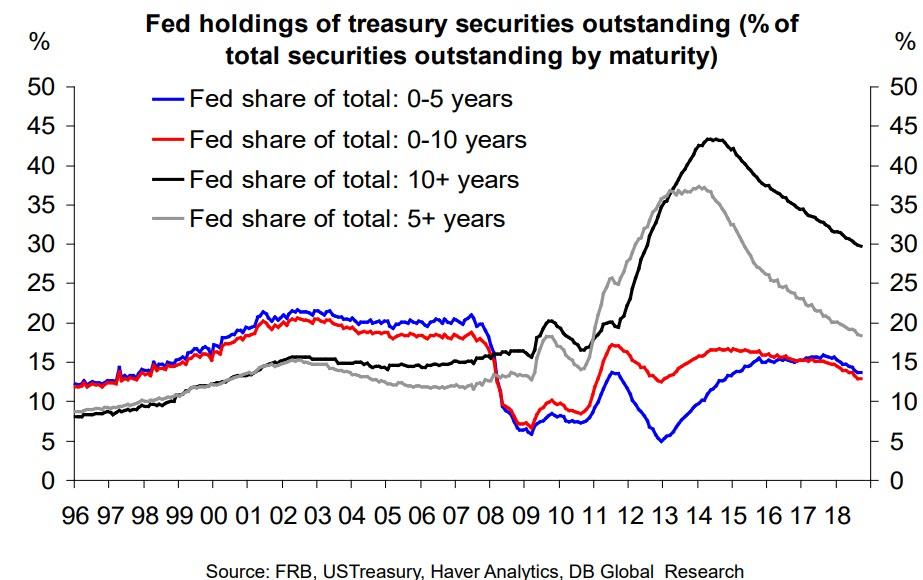

Meanwhile, as foreigners refuse to buy up any more US paper, in addition to the Fed rolloff, the relative share of Treasuries held by the Fed is declining, mainly due to the exploding Treasury supply.

And with the Fed selling alongside foreign investors, domestic sources of funds such as real money, banks and households (which is a plug in the Fed’s Flow of Funds report), have no choice but to buy Treasuries.

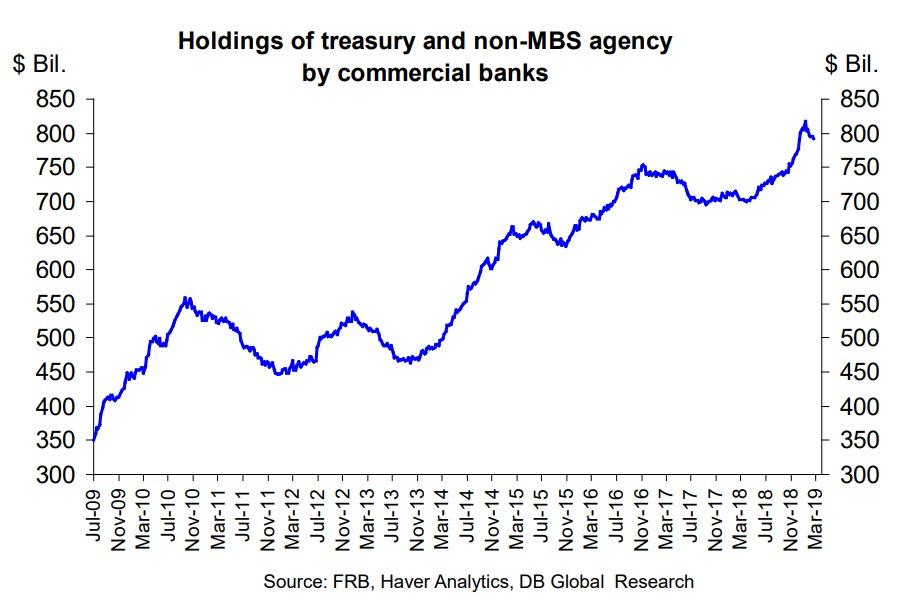

To be sure, there is one other persistent buyer – at least until the Fed returns with QE4 some time in the next 12 months – banks, which have been bidding up Treasuries and mortgages to the tune of $800 billion, as these serve as high quality liquid assets for regulatory purposes, and thus are effectively forced upon banks to buy.

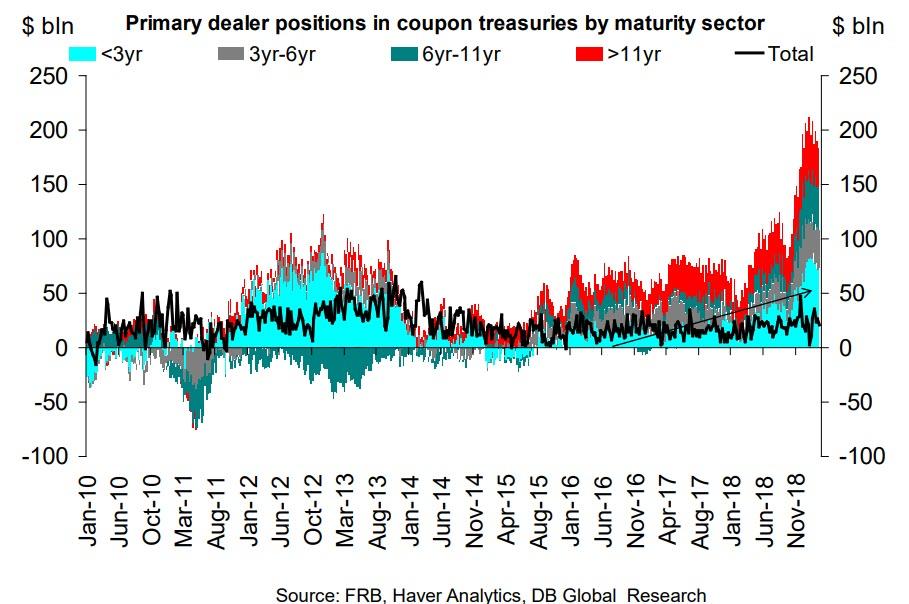

And of course, there are the primary dealers, who after having taken down their net holdings almost to zero several years ago, have seen their total exposure surge, and as recently as 1 month ago hit an all time high, perhaps because they had no choice as foreign buyers would chronically step back during key auctions.

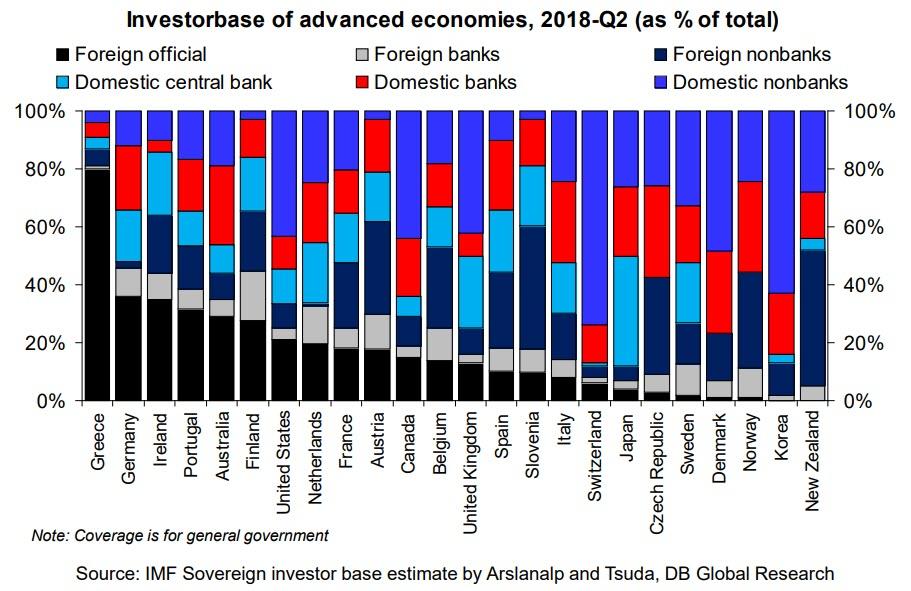

Here an interesting tangent: while US government debt is held mostly between domestic non-bank holders and foreign entities, who owns the rest of the world’s debt? Here is the visual answer courtesy of Deutsche Bank.

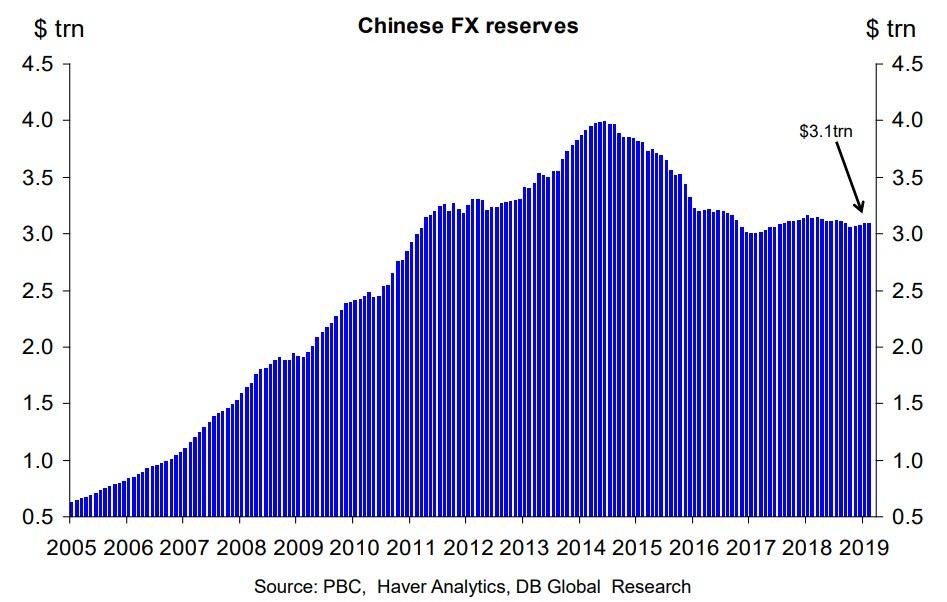

With that in mind, here is a look at what the biggest US foreign creditor, China, has been doing in recent years. What is notable is that after declining by $1 trillion from its all time high in 2014, China’s foreign reserves have stabilized around $3 trillion for the past three years.

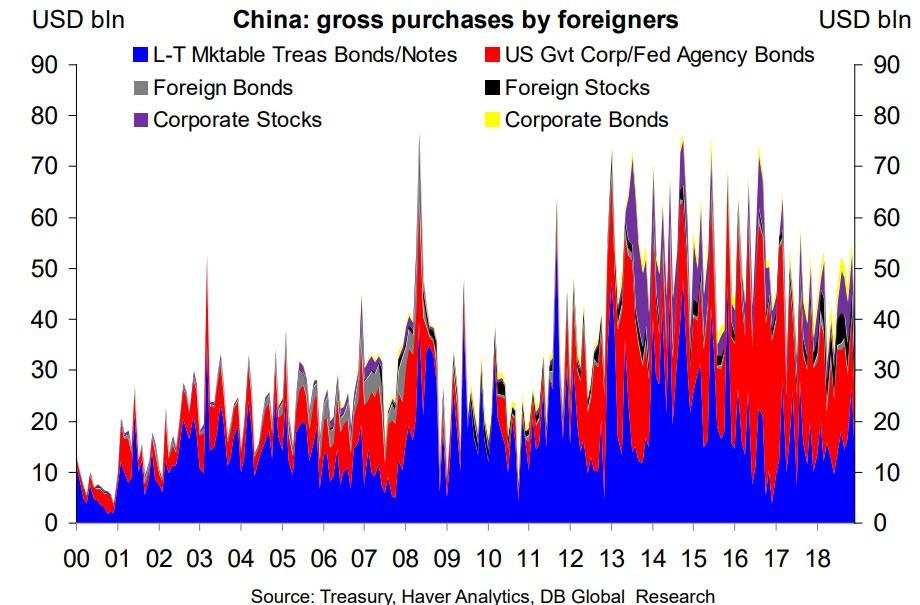

Despite that, Chinese gross buying of US assets has been declining in the past 4 years.

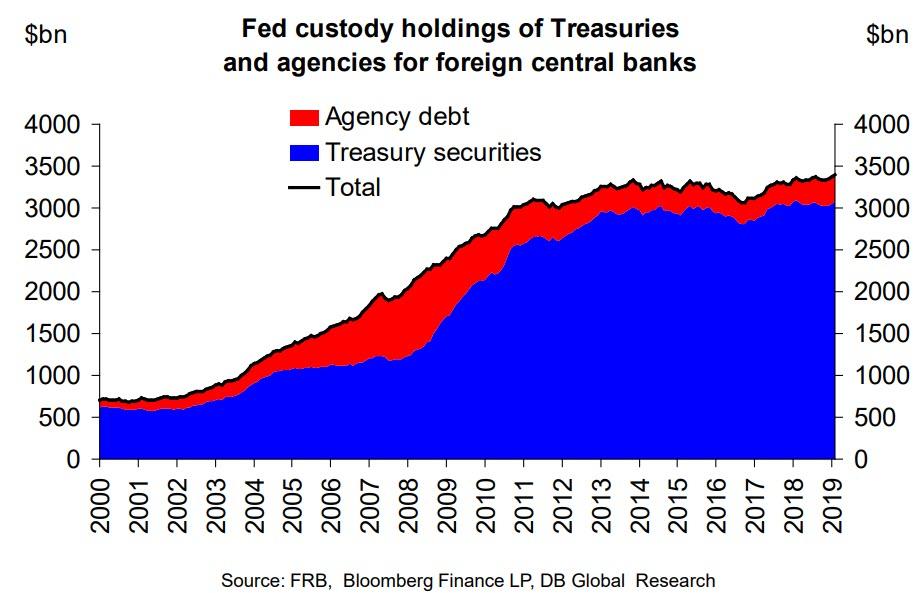

And while Chinese Treasury holdings have been declining according to TIC data, the Fed’s own account of custody holdings held at the central bank by foreign central banks has been increasing recently.

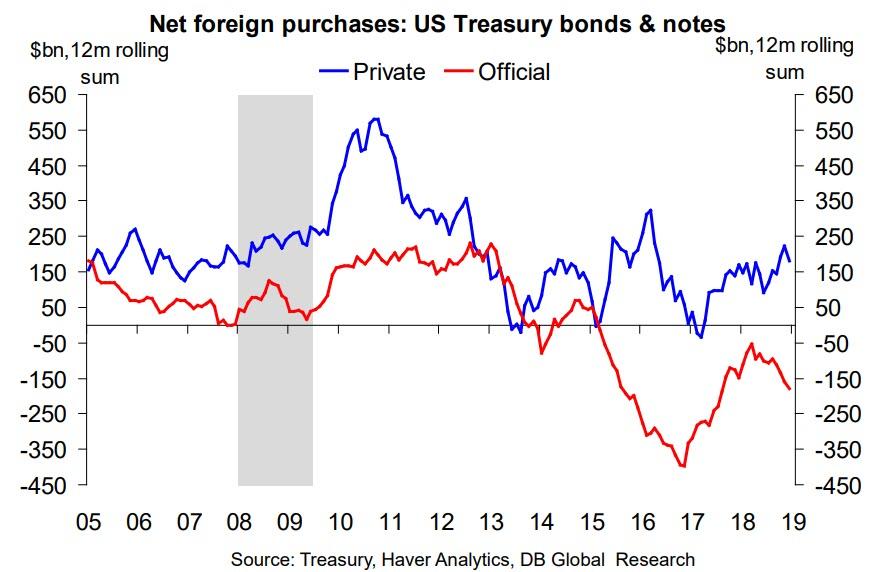

Yet while China may be sending conflicting signals, one thing is clear: foreign central banks have been dumping US Treasuries, selling on a 12 month rolling basis for the past 4 years, even as the private foreign sector has been buying.

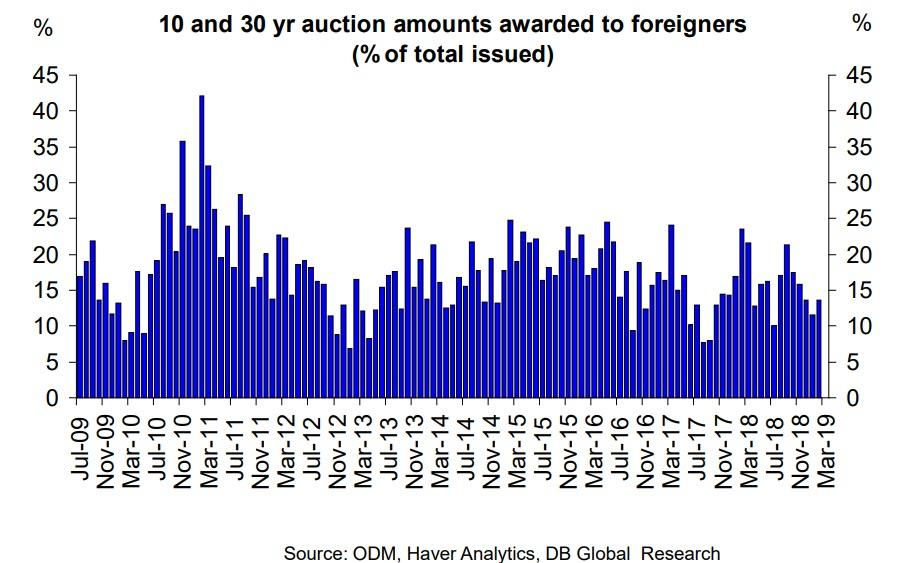

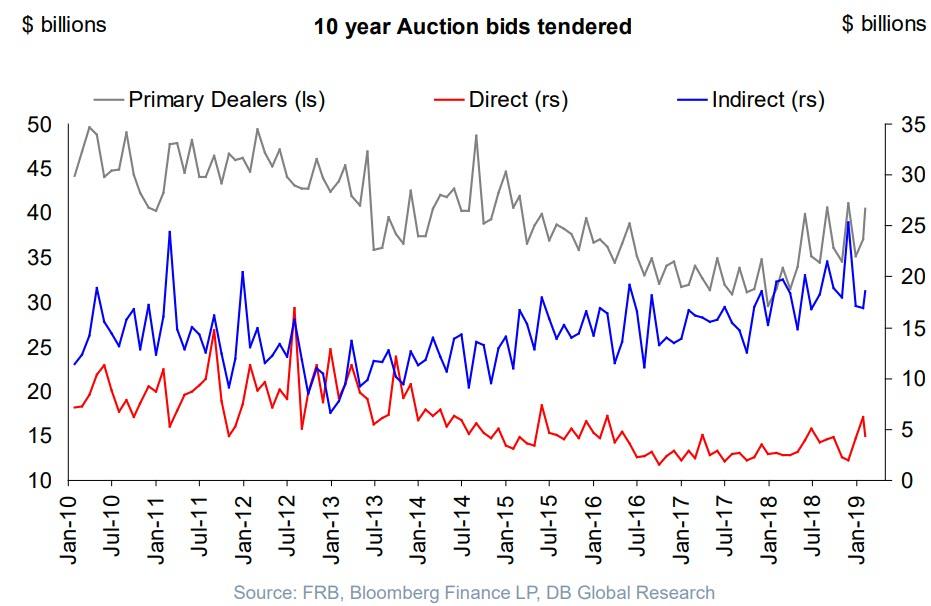

Next, looking at the Treasury issuance market reveals that while foreign participation for 10 and 30Y auctions have been relatively stable…

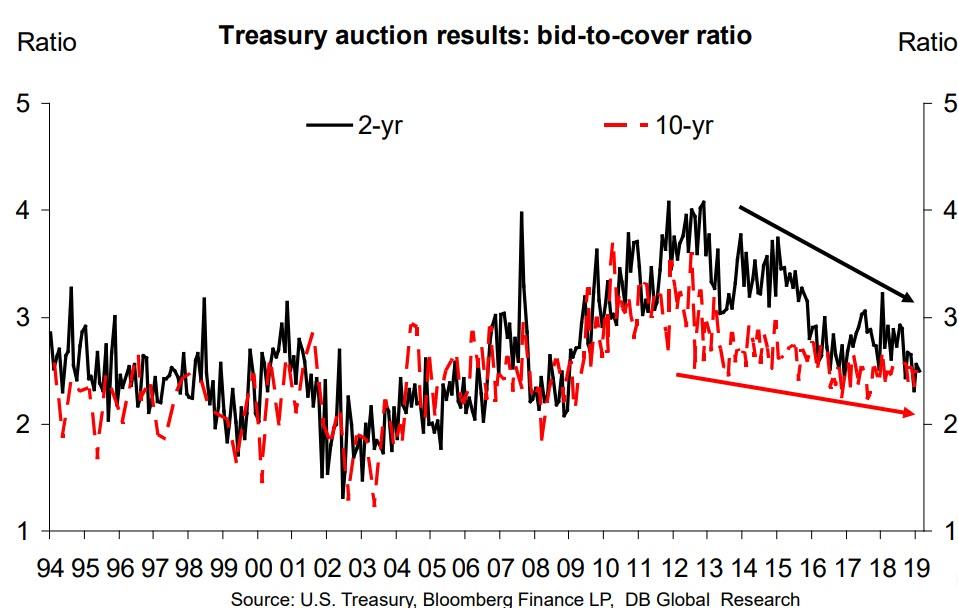

… the bid to cover ratios for both 2 and 10Y auctions have been declining steadily for the past 7 years.

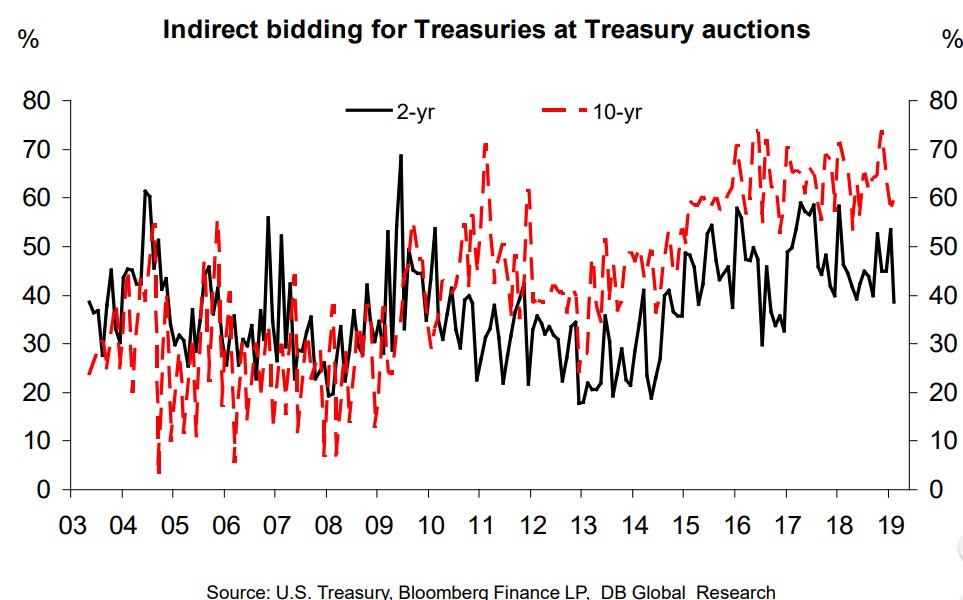

Yet sending a somewhat conflicting message, the Indirect – or foreign central bank – bid for 2s and 10s has gone largely nowhere in recent years.

The message gets even more confusing when looking at the distribution of takedowns between Dealers, Indirects and Direct bidders, as the Indirect trend is clearly increasing.

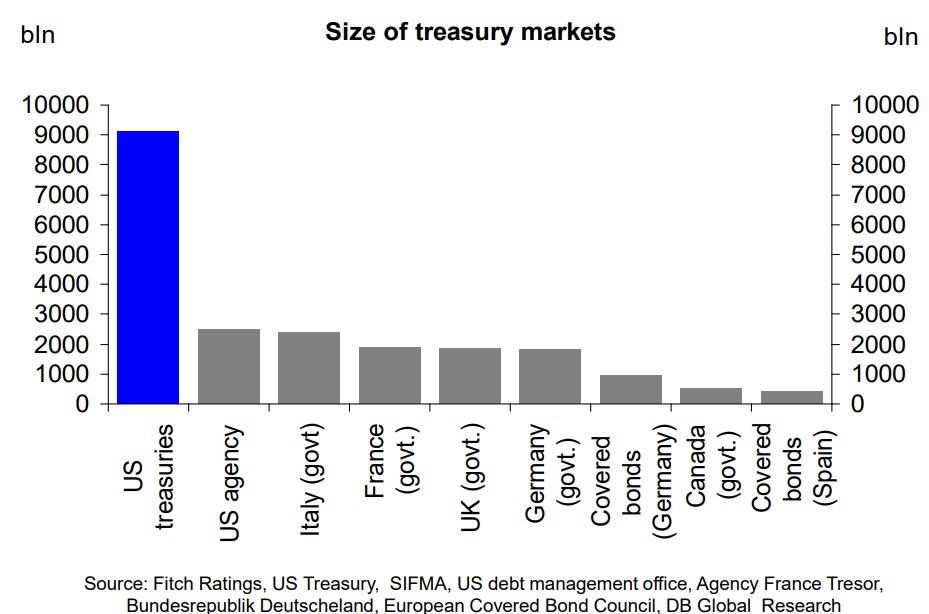

Here another tangent: why is the question of who is buying (and will buy) US Treasuries so important? Because, simply said, it is the largest fixed income market in the world (and why the Euro will have a very tough time if it ever hopes to become the reserve currency).

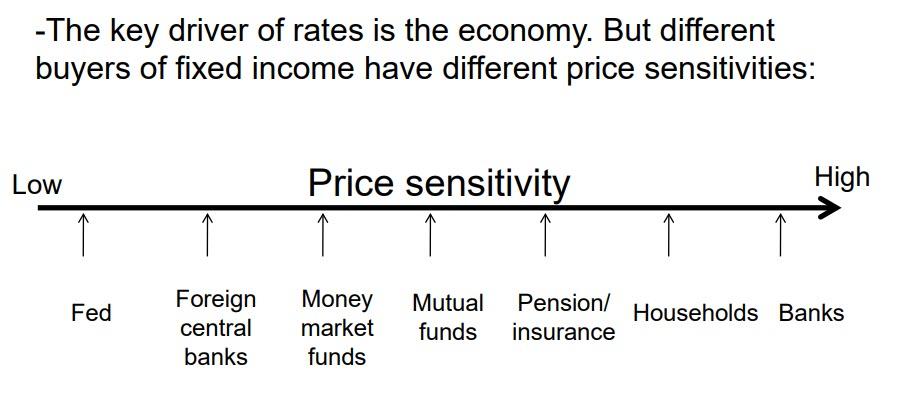

So once again going back to “who is buying Treasurys”, one notable observation is that various buyers have different motivations and price sensitivies, which is why the blanket response that if you just push yields high enough and the buyers will come, is dangerously inadequate.

And while mutual funds and households have clearly increased their holdings of Treasuries in the past decade…

… there has been a sharp drop in foreign appetite for US treasuries.

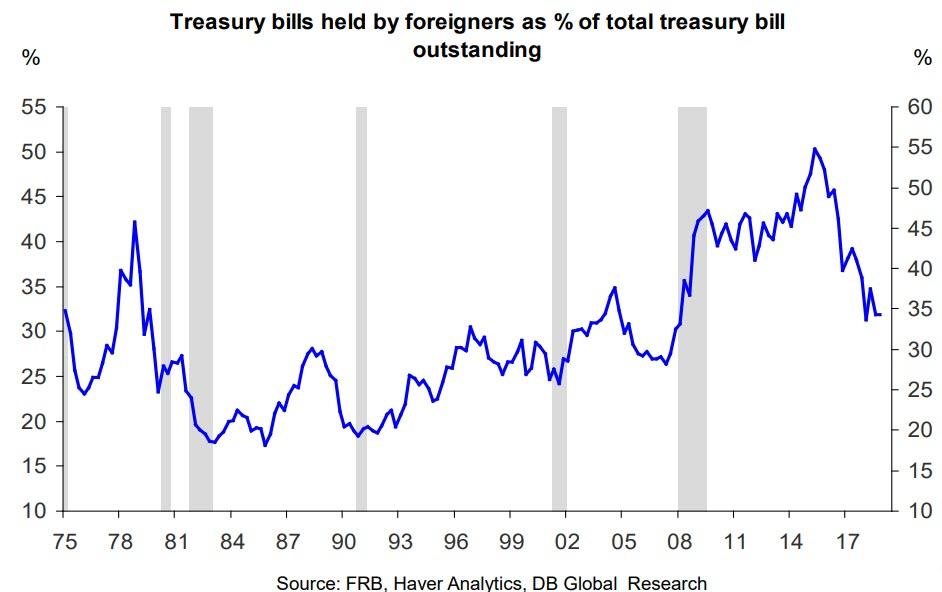

It’s not just coupon paper, but Bills as well:

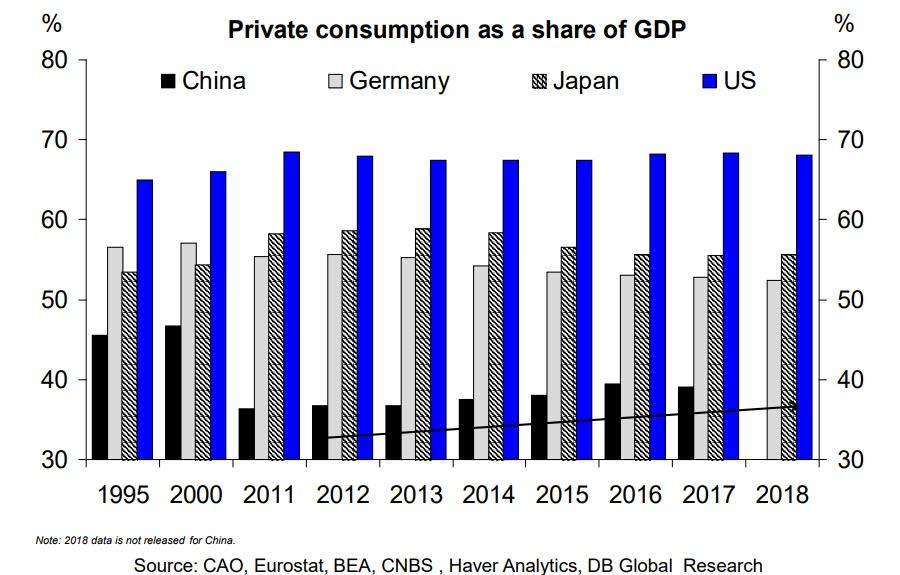

And with foreigners, and especially China trimming their purchases, if not outright treasury holdings, DB notes that a global rebalancing will be needed, one in which China will need far more domestic consumption (funded by outside capital), while the US will need less imports (alas the US just reported a record high trade deficit). Needless to say, this process will take many, many years and it won’t come without some notable market volatility.

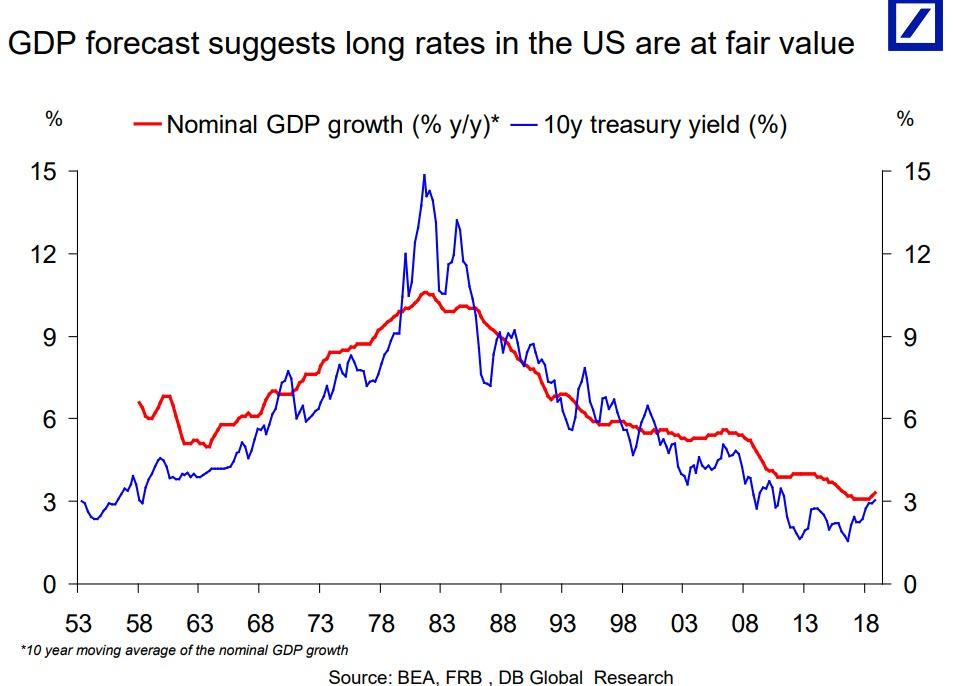

So with that in mind, what is the outlook? First, it is worth noting that if one relies on GDP as an indicator of treasury fair value, then the 10Y is indeed fairly valued right about now.

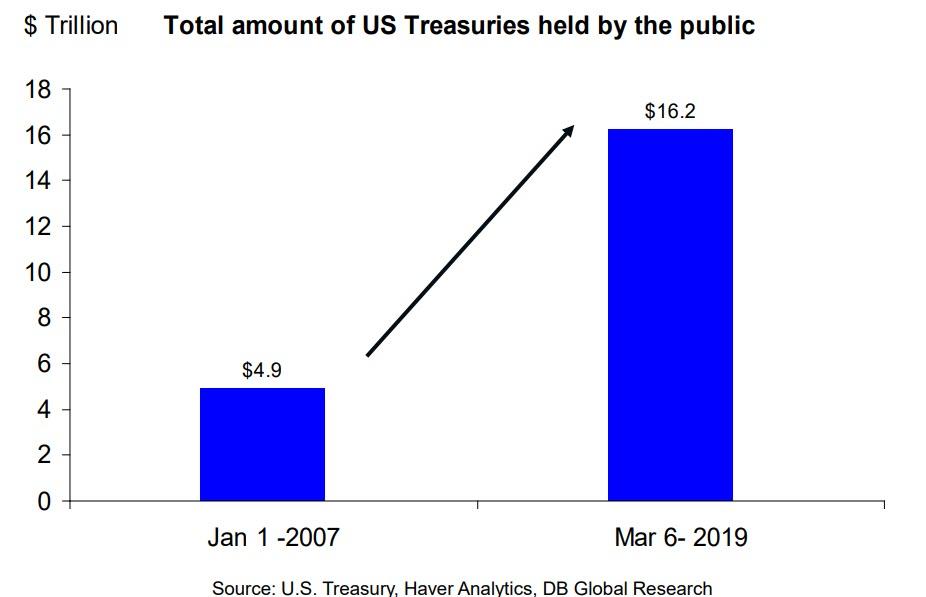

The question is whether these low rates will be sufficient to elicit continued demand for US paper in the future, especially since the total amount of US Treasuries held by the public has exploded more than three fold in just the past decade.

Meanwhile, treasury issuance is coming back as an ever greater share of total fixed income issuance.

And there it is: a long-form answer to a simple question – who is buying US Treasuries, even if the far more important answer of whether they will keep on buying these Treasuries, has yet to be answered.

So while there are no definitive answer to the very concerning questions brought up by the TBAC, keep a close eye on future TBAC presentations and especially any future reference by this all-important committee made up of the most important banks and hedge funds in the US…

… which appears to be increasingly concerned not only about how the US will fund its exploding debt deficits but also about the reserve currency status of the US Dollar.

via ZeroHedge News https://ift.tt/2TJjFYQ Tyler Durden