Authored by Sven Henrich via NorthmanTrader.com,

In last week’s Weekly Market Brief I made the case for a coming $VIX spike: “With a $VIX now at 13.5 and a big open gap at 24+ the $VIX is setting up for a rebellion”. Indeed $VIX rebelled this week with a move from 13.5 to above 18 a move of 33%. The first real volatility spike and directional change in $VIX since the beginning of the year.

While all this may simply be a reaction of overbought conditions following a 10 week uninterrupted rally the context of the when, where, and why may suggest otherwise. “I’m the one who knocks” Walter White famously exclaimed in Breaking Bad.

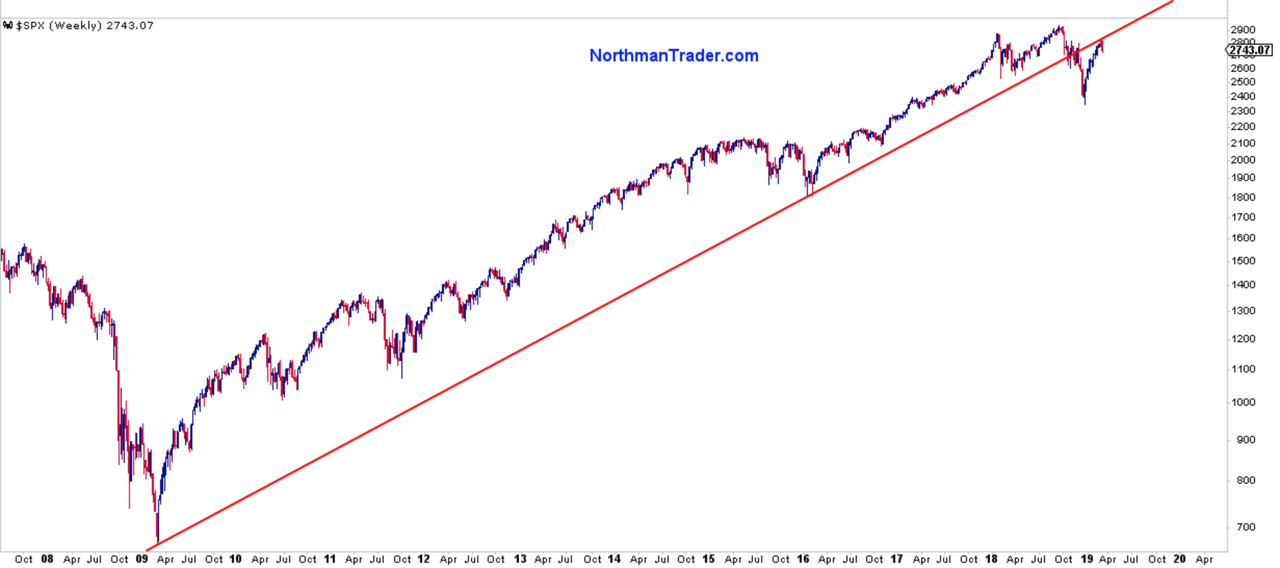

Markets just knocked on a key trend line and broke badly away from it with a weekly outside reversal candle (bearish engulfing):

I’ve been vocal about stating that the bull or bear cases for 2019 remain very much unproven. We’ve had a very aggressive rally from deep oversold conditions at the end of December. This rally has become very overbought and was due for a pullback/breather.

However I’ve been pointing to larger structural charts that leave room for the possibility of this having been a bear market rally if a larger bear market is to unfold. I can’t overstate how important these structural charts are.

The biggest challenge for most people (myself included) is patience, waiting for structures to build and ultimately unfold. The daily noise gets in the way, the back and forth can take nauseatingly long and extremes can become more extreme, gnawing on psychology and letting everyone lose sight of the bigger picture.

In “Curb Your Enthusiasm” I outlined specific factors to keep a close eye on the weeks ahead. For me the biggest risk factors that pose the danger new lows include: Technical structural patterns, the fact that the rally has been driven by “jawboning” and buybacks as opposed to improving fundamentals, the lack of confirmation from the bond market, vast technical divergences, and a pervasive bullish sentiment that places 100% faith in central bankers reversing policy being sufficient in keep an aging business cycle at bay yet again.

In light of the price action last week I wanted to take a closer look at these structural charts, their context and their potential relevance as indices broke their 2019 trends again last week. In light of the detail I’ve decided it’d be best to give this a voiceover hence the video below whereI’m outlining the risk factors, but also a potential bullish path forward:

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

via ZeroHedge News https://ift.tt/2SV2dMv Tyler Durden