Global stocks rose to the highest level in five months and the dollar dipped on Monday as traders ignored a SCMP report that the April meeting between presidents Xi and Trump had been delayed to June, and glossed over the latest slide in Boeing stock following a WSJ report of a grand jury subpoena into the 737 MAX’s development, as they once again priced in the dovish stance from the Fed at its policy meeting this week, a process which has been going on since December.

MSCI’s World index was up 0.3% on the day, sitting at a five-month high, hitting its highest since October 10.

European markets were broadly in the green, led by miners and banks, helped by a jump in shares in German lenders Deutsche Bank and Commerzbank after they confirmed over the weekend they were in talks to merge, a process which is far from certain will end with a merger despite the German government’s backing. The STOXX Europe 600 index rose 0.3%, hitting a five-month high, before trimming gains in half.

Britain’s FTSE 100 outperformed its European peers with a 0.3 percent gain, the main beneficiary from the surge in base metal prices with heavyweight miners all sitting comfortably at the top of the index (Rio Tinto +2.2%, Anglo American +2.1%, Antofagasta +1.8%, Glencore +1.7%); gains were boosted by prospects of parliament voting for a third time on Prime Minister Theresa May’s Brexit plan after ruling out a near-term no-deal exit.

European material names initially outperformed but were later overtaken by financial names ahead of a plethora of central bank rate decision including FOMC and BOE. Financial names may also feel support from the Deutschebank (+3.9%)/Commerzbank (+6.6%) saga, with the latest reports confirming merger talks between the two banks after the German government approved the tie-up, although, German union Verdi warned that merger could put up to 30k jobs at risk, to which the government replied that jobs at stake are being examined.

Earlier in the session, Asian stocks began the week mostly higher after last Friday’s tech-led upside on Wall St, but with early cautiousness amid reports the Trump-Xi summit was said to be pushed back to June. In related news, a source reportedly suggested that there was a divergence within the Trump administration regarding the deal with China. ASX 200 (+0.3%) eked marginal gains as underperformance in telecoms and financials offset some of the commodity-driven strength in the Australian bourse, while the Nikkei 225 (+0.6%) was underpinned by a weaker currency following weaker than expected data in which Trade Surplus topped estimates but both Exports and Imports contracted more than expected. Elsewhere, Hang Seng (+1.4%) and Shanghai Comp. (+2.5%) were both positive after the PBoC increased its liquidity efforts and as mainland China shrugged off an early whimsical tone caused by uncertainty from the delay of the Trump-Xi summit.

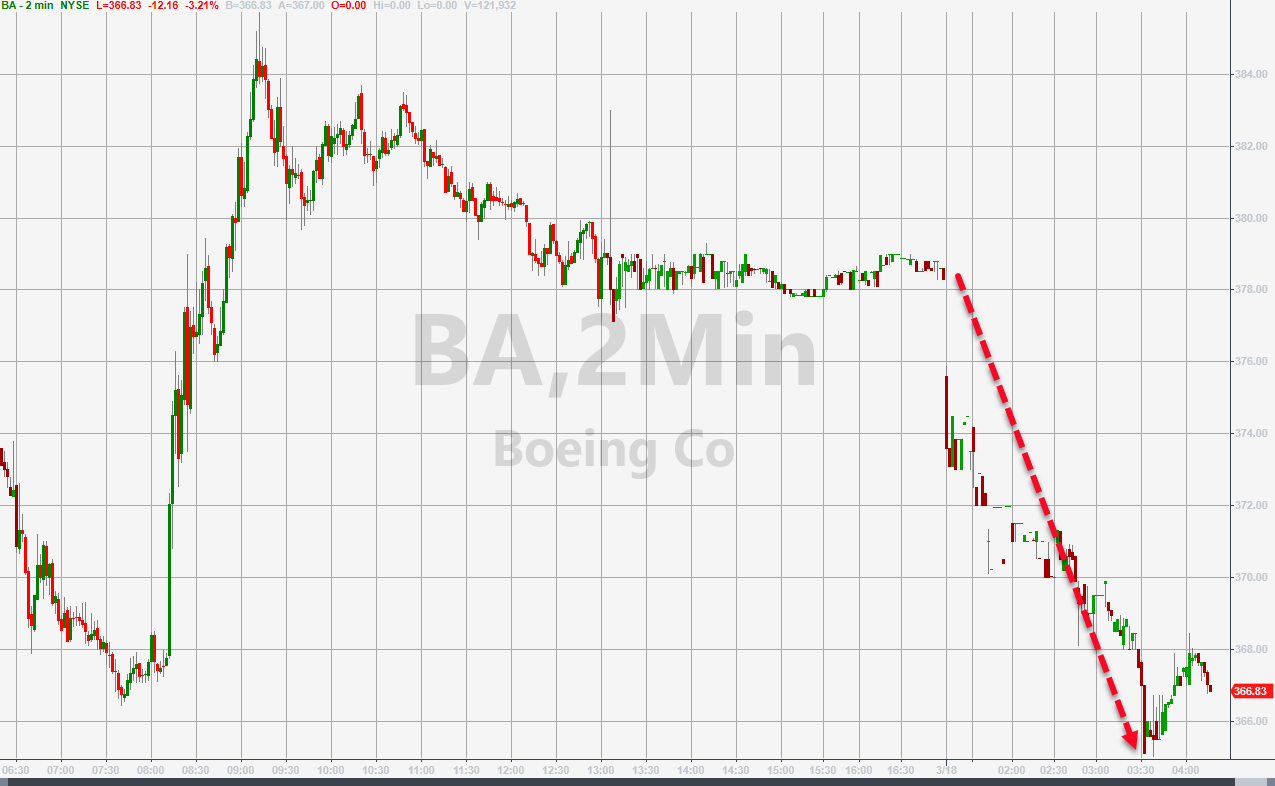

U.S. equity indexes were flat, with the Dow in the red, dragged lower by the latest drop in Boeing stock which tumbled following a WSJ report that the US Transportation Department are reportedly probing FAA approval of the 737 Max.

Still,the generally positive mood remains ahead of a week filled with potentially significant catalysts from central bank meetings, geopolitical developments and economic data.

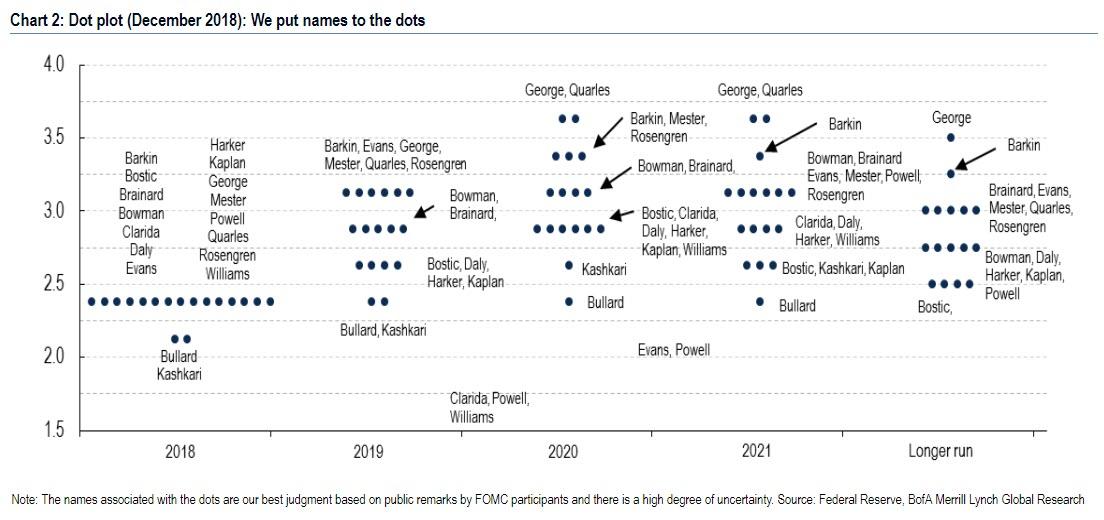

With a signs of global economic growth slowing, and with “bad news once again good news”, traders were focused on the Federal Reserve, which meets on Wednesday for further cues about the path of U.S. interest rates. In particular focus will be the whether policymakers will have sufficiently lowered their interest rate forecasts to more closely align their “dot plot.”

“The market is probably expecting some down-shift in the ‘dot plots’ (which currently see two hikes in 2019 and one in 2020), plus some more discussion on the end of quantitative tightening – i.e. stopping its balance sheet reduction. This should maintain a positive environment for risk,” ING analysts said.

Also expected is more detail on a plan to stop cutting the Fed’s holdings of nearly $3.8 trillion in bonds. The two-day meeting ends with a news conference on Wednesday.

Treasuries were little changed and most European bonds climbed: yields on three and five-year Treasuries are dead in line with the effective Fed funds rate, while futures imply a better-than-even chance of a rate cut by year end. In European bonds, no news proved the most important news in euro zone bonds on Monday after ratings agency Moody’s decided not to downgrade Italy’s credit rating, prompting investors to buy Italian government bonds.

Italy’s 10-year government bond yield fell as much as four basis points on the day to 2.46 percent, its lowest since May 2018. Its spread over higher-rated Germany briefly narrowed to its tightest since September 2018.

Elsewhere, in the latest Brexit developments, UK PM May received backing by some staunch Brexiteers after she personally lobbied MPs but still remained significantly short of the number she needs to win a vote this week. Furthermore, it was separately reported that 40 Tory rebels told PM May they would only support her deal if she quits as PM. Various UK ministers suggested PM May could cancel this week’s 3rd Brexit vote if there is not enough support. In related news, former UK Foreign Minister Johnson called for a delay in the 3rd Brexit vote and said it is not too late to get a real change regarding backstop. The DUP reportedly want a seat in trade negotiations with the EU in exchange for supporting PM May and there were also reports citing senior DUP figures that they held constructive Brexit talks with ministers, while sources close to the DUP also said that the regulatory alignment offer may have won over the DUP.

In currencies, the dollar slipped versus most of its G10 peers and the euro strenghtened ahead of a Federal Reserve policy announcement Wednesday where the central bank is seen striking a dovish tone. The pound fell as Prime Minister Theresa May continued to face opposition to her Brexit plans, pushing up U.K.

May has only three days to win approval for her deal to leave the European Union if she wants to go to a summit with the bloc’s leaders on Thursday with something to offer them in return for more time. “Should May hold another vote tomorrow that would constitute a signal that she considers it possible that her deal will be accepted,” said Ulrich Leuchtmann, a currency strategist at Commerzbank. “It should no doubt have a moderately positive effect on the British currency,” he added.

The Australian and New Zealand currencies both rallied, as stocks traded in the green and Treasuries edged up.

Expected data include NAHB Housing Market Index. HealthEquity, StoneCo, Syneos Health, and Tilray are among companies reporting earnings.

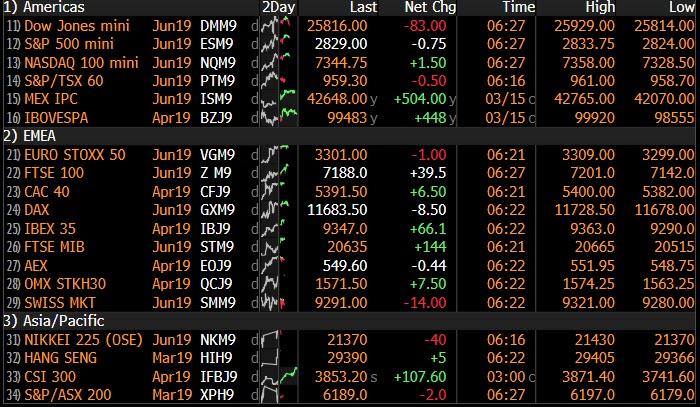

Market Snapshot

- S&P 500 futures little changed at 2,831.25

- STOXX Europe 600 up 0.2% to 381.98

- MXAP up 0.9% to 160.30

- MXAPJ up 1% to 529.77

- Nikkei up 0.6% to 21,584.50

- Topix up 0.7% to 1,613.68

- Hang Seng Index up 1.4% to 29,409.01

- Shanghai Composite up 2.5% to 3,096.42

- Sensex up 0.07% to 38,050.16

- Australia S&P/ASX 200 up 0.3% to 6,190.53

- Kospi up 0.2% to 2,179.49

- German 10Y yield unchanged at 0.083%

- Euro up 0.2% to $1.1343

- Italian 10Y yield fell 0.5 bps to 2.142%

- Spanish 10Y yield fell 0.5 bps to 1.184%

- Brent futures down 0.4% to $66.90/bbl

- Gold spot up 0.2% to $1,304.47

- U.S. Dollar Index down 0.1% to 96.47

Top Overnight News

- Theresa May is threatening to give up trying to get Brexit done any time soon unless euroskeptics in her Conservative party back down and promise to vote for her deal this week. The British prime minister is still working to win support for her divorce agreement but she won’t bother putting it to another vote in Parliament as planned on Tuesday unless there is a strong chance it will be approved, ministers said

- The Federal Reserve will bring the current cycle of interest-rate increases to an end after one more hike later this year, according to a Bloomberg survey of economists

- OPEC and its allies have much work ahead to balance global oil markets and are prepared to do what’s necessary in the second half, Saudi Energy Minister Khalid Al- Falih said

- Asked about the possibility of Japanese Prime Minister Shinzo Abe running for a fourth term as leader of the ruling Liberal Democratic Party, 59.3% of respondents said they oppose it and 31.1% were in support in an FNN poll conducted over the weekend.

- Asking prices for London homes fell this month as buyers hesitated on closing deals amid political turmoil over Brexit. Average values declined in March, slumping 1.1 percent from February to 607,557 pounds ($806,000), property-website Rightmove said in a report Monday

- The proportion of Japan bond transactions made by overseas funds climbed to 14.57 trillion yen ($131 billion) in January, or 11.9 percent of the total, a record in data from the Japan Securities Dealers Association starting in 2004

- Deutsche Bank and Commerzbank have confirmed they are in merger talks, bowing to officials’ desire to forge a durable German lender with global reach out of two troubled firms

- Credit stress in China is deepening with another local conglomerate, backed by a state-owned giant, struggling under the weight of its debts

- Italy’s Finance Minister Giovanni Tria is working on a new plan of incentives that would allow the country to avoid a budget adjustment, according to newspaper Corriere della Sera

Asian stocks began the week mostly higher after last Friday’s tech-led upside on Wall St, but with early cautiousness observed ahead of the week’s plethora of central bank activity and amid uncertainty with the Trump-Xi summit said to be pushed back to June. ASX 200 (+0.3%) eked marginal gains as underperformance in telecoms and financials offset some of the commodity-driven strength in the Australian bourse, while the Nikkei 225 (+0.6%) was underpinned by a weaker currency following mixed data in which Trade Surplus topped estimates but both Exports and Imports contracted more than expected. Elsewhere, Hang Seng (+1.4%) and Shanghai Comp. (+2.5%) were both positive after the PBoC increased its liquidity efforts and as mainland China shrugged off an early whimsical tone caused by uncertainty from the delay of the Trump-Xi summit. Finally, 10yr JGBs were relatively unchanged with demand dampened by the gains in riskier assets and with downside also restricted by the BoJ’s presence in the market. A summit between US President Donald Trump and Chinese counterpart Xi Jinping could be delayed to June according to sources who noted they will not be able to finalise an agreement by April. In related news, a source reportedly suggested thatthere was a divergence within the Trump administration regarding the deal with China. Chinese President Xi is set to visit Europe this week in efforts to bolster trade relationships. The Chinese President will travel to France, Italy and Monaco from March 21st to 26th; according to Chinese Foreign Ministry Spokesman Lu Kang.

Top Asian News

- Hong Kong Train Collision Marks Latest Mishap for City Metro

- Some at BOJ Are Said to See Price Goal Out of Reach Through 2021

- Takeda Is Said to Plan Sale of Tachosil in Shire Divestments

- Sensex, Nifty Pare Gains After Five-Day Rally to Six- Month Highs

- India Seeks Higher Weighting in MSCI Equity Indexes, Report Says

Mixed start to the week for major European indices [Stoxx 600 +0.1%] following a relatively optimistic lead from Asia where China outperformed amid liquidity efforts by the PBoC coupled with the Chinese government’s steps to enhance the country’s economy. UK’s FTSE 100 (+0.6%) is the marked outperformer and major beneficiary from the surge in base metal prices with heavyweight miners all sitting comfortably at the top of the index (Rio Tinto +2.5%, Anglo American +2.3%, Antofagasta +2.1%, Glencore +1.8%). Sector-wise, material names initially outperformed (for the aforementioned reason) but was later overtaken by financial names ahead of a plethora of central bank rate decision including FOMC and BOE. Financial names may also feel support from the Deutschebank (+3.1%)/Commerzbank (+5.8%) saga, with the latest reports confirming merger talks between the two banks after the German government approved the tie-up, although, German union Verdi warned that merger could put up to 30k jobs at risk, to which the government replied that jobs at stake are being examined. On a broader front for European banks, GS notes that the sector has been amongst the weakest performers in the Stoxx 600 YTD as the banks continue to battle with concerns over long term growth. In terms of strategy, GS noted that Japanese banks trades at an even lower multiple than the European, but the latest TLTRO move (although positive for sector liquidity) “further erodes the competitive advantage of European banks”. GS is taking a neutral stance on the European equity market over the next three months.

Top European News

- Italy’s Nexi Files for IPO in Milan, to Begin Offer in April

- Domino’s Pizza Group Says Talks With Franchisees Continuing

- After Danske, Next Dirty Money Risk Is Examined in Denmark

- Leoni Falls After Cutting 2,000 Jobs, Guidance on Autos Slowdown

In FX, both AUD/NZD are off overnight highs, but the Aussie and Kiwi remain elevated and ahead of their G10 counterparts on a combination of renewed risk appetite, short covering and for the former also a supply-related rise in iron ore prices following further production problems for Brazil’s Vale. Aud/Usd has extended its rebound to 0.7100+ and Nzd/Usd to around 0.6875 as the Aud/Nzd cross pivots 1.0350 ahead of Westpac’s NZ Q1 consumer survey later today and Q4 GDP on Wednesday. In terms of options, large expiries in Nzd/Usd run off later, including 1 bn at 0.6825 and 1.5 bn at 0.6925.

- GBP – In contrast to the outperformance down under noted above, the Pound has handed back gains vs a generally soft Dollar and weakened relative to the Euro amidst ongoing Brexit uncertainty after last week’s string of UK Parliamentary votes, as PM May strives to drum up DUP support for the current Withdrawal Agreement in the hope that this may entice enough of the ERG to back the deal in time for a pre-EU Summit 3rd MV. Cable has backed off from another 1.3300 venture to sub-1.3250 and Eur/Gbp has bounced to around 0.8570 vs circa 0.8510 at one stage, with a hefty 1.7 bn option expiry at the 0.8500 strike now looking pretty safe.

- EUR – Aside from benefiting from Sterling’s Brexit angst, the single currency has taken advantage of the aforementioned Greenback weakness post-recent soft if not quite downbeat US data and pre-FOMC. Indeed, the headline pair has rebounded further from early March lows (in wake of the dovish ECB) to establish a firmer footing above 1.1300 and briefly touched 1.1350, with the next bullish targets at 1.1367 and 1.1373 (100 DMA and 50% Fib of the 1.1570-1.1177 move respectively).

- CHF/CAD/JPY – All narrowly mixed vs the Greenback, as the Franc attempts to break resistance at the psychological parity level in the run up to the SNB and FOMC, but holds steady vs the Eur on the 1.1350 pivot, while the Loonie sits midway between 1.3300-50 ahead of Canadian securities data for January and the Jpy straddles 111.50 in wake of mixed Japanese trade figures and reports suggesting that some BoJ members are not even sure if the 2% inflation target is attainable by 2021. Note also, decent option expiry interest could be influential given 1.1 bn rolling off from 111.55-60 today.

In commodities, WTI (-0.4%) and Brent (-0.2%) futures are marginally lower as participants digest the latest from the meeting of the OPEC cartel in Baku, although there seems to be some discrepancy as to when the next JMMC meeting will take place. Energy futures saw a marginal leg lower, with WTI losing more ground below its 100 WMA (USD 58.46/bbl) after sources stated that the JMMC panel recommended no meeting in April, but the Kazakh Energy Minister said nothing was set in stone. Furthermore, the Iraqi Energy Minister reportedly confirmed that the next JMMC meeting will take place in June, however sources later came out with a May meeting in Riyadh. Prices were little affected by developments over the weekend wherein the Saudi Energy Minister stated that the Kingdom’s March and April output is to drop to around 9.8mln BPD vs. February level of 10.09mln BPD (January 10.24mln BPD). Recalling some comments from last week, a Saudi official stated that March an April output is to be “well below” 10mln BPD. Saudi did however mention that OPEC’s job from rebalancing is far from over whilst signalling that output curbs need to be extended to H2 2019. Elsewhere, the metals complex is bolstered by a pullback in the Greenback with gold reclaiming the USD 1300/oz level and breaching its 50 DMA to the upside at 1304.10 whilst copper prices benefit from the overall risk appetite. Finally, Dalian iron ore futures surged over 3% on supply concerns after a Brazilian court ordered Vale halts operations at another mine and as the miner suggested a 12mln ton decline in annual output due to dam suspensions.

US Event Calendar

- 10am: NAHB Housing Market Index, est. 63, prior 62

DB’s Jim Reid concludes the overnight wrap

I hope you had a good weekend and if around Northern Europe that you survived the gales that played havoc with my golf ball on Saturday. Yesterday, I thought myself very clever for taking the family to a miniature steam railway as all three children are currently obsessed with trains. As fun as it was it was a little embarrassing as the event seemed to be predominantly aimed at steam engine enthusiasts rather than children. So a lot of older men with big bushy beards, flat caps and notebooks! I’d imagine their first note was that those three children make a lot of noise!

Talking of noise, it’s possible that Brexit muffles will amplify to a crescendo this week as Mrs May will more than likely try to bring her twice defeated Withdrawal Agreement back to the House of Commons tomorrow. We’ll find out today and much will depend on whether the DUP agree to back it after talks continue today. The UK’s Chancellor of the Exchequer Philip Hammond said in a weekend interview with BBC TV that PM May will only put her WA to another vote if there is a strong chance that it will be approved while adding that otherwise PM May will head to the EU summit on Thursday possibly seeking a long delay to Brexit. The magnitude of her task is best explained by the fact that the first and second attempt were the largest and fourth largest defeats in the whole history of the House of Commons with the second and third being the same bill on the same day in 1924. The likelihood is that the vote will be pretty tight if the DUP agree to vote for it as they will bring tens of Tory MP’s along with them. However, there are a hardline group of Brexiteers (possibly 15-25 depending on reports) who dislike the deal so much that very little would change their mind even though a softer (or no) Brexit is the likely outcome if the WA doesn’t pass very soon. So best case scenario is that Mrs May probably needs to secure over 10 opposition Labour MPs to get over the line. She only had three last time. If she doesn’t get it over the line it will be over to the EU at their council summit on Thursday and Friday to decide what length of extension they offer the UK to Article 50 and what the conditions will be. The direction of travel seems to be towards a lengthy one of at least a year if the WA doesn’t pass or a quick alternative plan is not reached. In the offer of such a lengthy delay, the EU would hope to either focus the minds of the Brexiteers voting against the current deal or leave time for the UK to change its mind or commit to a softer Brexit. Remember the government has committed to indicative votes (probably early April) but we may still see a fourth attempt to pass the WA before that.

Outside of Brexit, we have both a BoE (Thursday) and Fed meeting (Wednesday) this week as well as the aforementioned EU council meeting on Thursday/Friday. As for data, the undoubted highlights are the flash global PMIs on Friday.

Briefly previewing the Fed, no change in policy is expected and the meeting should reinforce the message that the Fed will remain patient for now. That being said, our economists believe that there are two key topics that market participants should focus on. The first is any signals about the timeline for ending the Fed’s balance sheet unwind and the second is any insights into the conditions needed to drop their patient guidance and possibly raise rates again later in 2019. On the former, while an announcement of the date for stabilising the SOMA portfolio is possible next week, we now think it is more likely at the May FOMC meeting. On the latter, Powell should maintain significant flexibility while likely reiterating that a dissipation of the crosscurrents, evidence of continued above-potential growth, and higher inflation are all likely preconditions for another rate increase this cycle.

As for the flash March PMIs around the globe, a reminder that last month in Europe we saw the manufacturing print slide below 50 for the first time in nearly 6 years to 49.3 for the Euro Area. That also confirmed declines in 13 out of the last 14 months after peaking at 60.6 in December 2017. The consensus expects another below 50 print at 49.5, albeit one which would at least signal that we’ve potentially hit the lows. In contrast, the services sector picked up last month with the Euro Area reading up from 51.2 to 52.8. The consensus expects a small pullback to 52.5. So expect there to be a continued focus on the services versus manufacturing divergence. In the US, the consensus expects the manufacturing PMI to jump 1pt to 54.0 and the services PMI to jump 0.5pts to 56.5.

Asian markets have started the week on a firm footing with China’s bourses leading the advance. The Shanghai Comp (+1.36%), CSI (+1.71%) and Shenzhen Comp (+1.47%) are all up along with the Nikkei (+0.59%), Hang Seng (+0.81%) and Kospi (-0.02%). Elsewhere, futures on the S&P 500 (+0.04%) are trading flattish. Overnight, we saw Japan’s February trade stats indicating that exports (at -1.2% yoy vs. -0.6% yoy expected) have now fallen for three months in a row while imports also declined larger than expectations (at -6.7% yoy vs. -6.4% yoy expected) bringing the trade balance to JPY 339.0bn (vs. JPY 305.1bn expected).

In other news, Saudi Arabia’s Energy Minister Khalid Al-Falih said, ahead of the planned OPEC+ meeting beginning today, that OPEC and its allies have much work ahead to balance global oil markets and are prepared to do what’s necessary in the second half. He said that OPEC+ needs to “stay the course” until June as its job is “nowhere near complete” in terms of restoring oil-market fundamentals. However, Russian Energy Minister Alexander Novak said at the same briefing that uncertainties arising from production in Venezuela and Iran make it difficult for the coalition to determine its next step before May or June. This indicates that we might not get any output cut extensions at today’s meeting. Oil prices (Brent -0.24% and WTI -0.41%) are trading weaker this morning.

Let’s recap last week’s market activity. US equities had their best weekly performance of the year last week, with the S&P 500 advancing +2.89% (+0.50% Friday) and the NASDAQ gaining +3.78% (+0.76% Friday). The DOW – up +1.57% on the week (+0.54% Friday) – lagged as Boeing underperformed sharply after its 737 Max plane was broadly grounded. European equities also had a strong week, with the Stoxx 600 advancing +2.84% (+0.68% Friday). Banks outperformed, with the Stoxx bank index gaining +5.16% (+1.12% Friday).

In fixed income, 10yr treasury yields fell -4.0bps (-4.1bps Friday), after the first economic data for March printed soft, as the Empire manufacturing survey unexpectedly fell to a 22-month low. 10yr US yields have only been lower on one day (Jan 3rd this year) over the last 14 months. In Europe, bund yields rose +1.5bps (-0.2bps Friday) but are still as low as 0.084%. The tightening spread between the two though helped the euro advance +0.83% (+0.21% Friday) versus the dollar, its biggest weekly rally since September. Meanwhile, the dollar index dropped -0.76% (-0.22% Friday) for its worst performance of the year. Credit markets rallied further, with HY spreads tightening -11bps and -19bps in the US and Europe, respectively (+1bps and -1bps on Friday, respectively).

Looking ahead, it is a quiet start to the week with the only data due being January industrial production in Japan, the January trade balance for the Euro Area and the March NAHB housing market index reading in the US.

via ZeroHedge News https://ift.tt/2U0QIrP Tyler Durden